Why Leggett & Platt Shares Are Trading Higher By Around 15%; Here Are 20 Stocks Moving Premarket

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Apr 29 2025

0mins

Should l Buy UCTT?

Source: Benzinga

Leggett & Platt Earnings Report: Leggett & Platt's shares surged 14.8% in pre-market trading after the company reported a first-quarter EPS of 24 cents, exceeding expectations, and raised its FY25 EPS guidance.

Market Movements: Several stocks experienced significant changes in pre-market trading, with notable gainers including Wearable Devices Ltd. (+55%) and LogicMark, Inc. (+46.5%), while Incannex Healthcare Inc. saw a sharp decline of 65.8%.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy UCTT?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

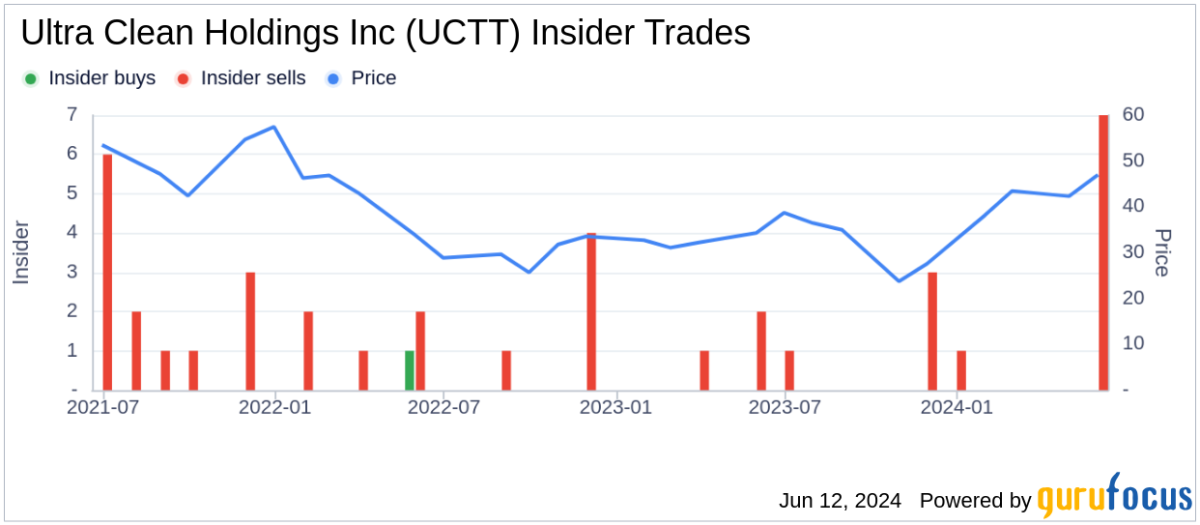

Analyst Views on UCTT

Wall Street analysts forecast UCTT stock price to fall

2 Analyst Rating

2 Buy

0 Hold

0 Sell

Moderate Buy

Current: 63.220

Low

50.00

Averages

50.00

High

50.00

Current: 63.220

Low

50.00

Averages

50.00

High

50.00

About UCTT

Ultra Clean Holdings, Inc. is a developer and supplier of critical subsystems, components, parts, and ultra-high purity cleaning and analytical services, primarily for the semiconductor industry. It offers its customers an integrated outsourced solution for major subassemblies, design-to-delivery cycle times, design for manufacturability, and prototyping. The Company’s segments are Products and Services. The Products segment primarily designs, engineers, and manufactures production tools, components, parts, and modules and subsystems. The Products segment includes chemical delivery modules, frame assemblies, gas delivery systems, fluid delivery systems, precision robotics and process modules as well as other high-level assemblies. The Services segment provides ultra-high purity parts cleaning, process tool part recoating, surface encapsulation and high sensitivity micro contamination analysis primarily for the semiconductor device makers and wafer fabrication equipment (WFE) markets.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Earnings Decline: Yatsen Holding Ltd reported adjusted earnings of 7 cents per share for Q4, down from 14 cents in the previous year, indicating a significant decline in profitability that could undermine investor confidence.

- Sales Growth: Despite the drop in earnings, Yatsen's sales increased from $157.347 million to $197.258 million, suggesting that the company still has growth potential in market demand, which may lay the groundwork for future recovery.

- Stock Price Volatility: Yatsen's shares fell 10.1% to $4.00 in pre-market trading, reflecting a negative market reaction to its earnings report, which could lead to increased selling pressure from investors in the short term.

- Market Trends: U.S. stock futures were generally lower, with Dow futures falling around 1%, indicating a broader market sentiment that may have a ripple effect on Yatsen and other stocks' performance.

See More

- Significant Revenue Growth: AMTD Digital Inc reported a staggering 565.7% year-over-year increase in FY25 revenue, reaching $136.1 million, which significantly enhances the company's financial performance and indicates strong market demand for its services.

- Stock Price Surge: Following the positive earnings report, AMTD Digital's shares jumped 24.4% to $2.18 in pre-market trading, reflecting investor optimism regarding the company's future growth potential and profitability.

- Positive Market Reaction: The robust financial results have garnered widespread attention in the market, potentially attracting more investors and further driving up the stock price while bolstering overall market confidence in the company.

- Strategic Implications: The revenue growth not only strengthens AMTD Digital's market position but also provides financial resources for future expansion and investments, enhancing its competitiveness in the digital finance sector.

See More

- Increased Offering Size: Ultra Clean Holdings has raised the size of its convertible senior notes offering from $400 million to $525 million, with settlement scheduled for March 3, 2026, indicating strong market demand for its financing needs.

- Clear Use of Net Proceeds: The company expects to net approximately $511.1 million from the offering, with about $21.9 million allocated for capped call transactions, $40 million for repurchasing 672,608 shares of common stock, and the remainder for working capital and loan repayment, reflecting a strategic approach to capital structure optimization.

- Attractive Conversion Terms: The initial conversion price of approximately $84.75 per share represents a 42.5% premium over the latest stock price of $59.47, which may entice investors to convert their notes in the future, thereby enhancing long-term shareholder value.

- Risk Management Measures: Ultra Clean has entered into capped call transactions with initial purchasers to mitigate potential dilution risks, as exceeding the cap price of $104.0725 could lead to dilution, demonstrating the company's proactive approach to capital management.

See More

- Increased Offering Size: Ultra Clean Holdings has raised the size of its convertible senior notes offering from $400 million to $525 million, reflecting strong market demand and is expected to yield approximately $511.1 million in net proceeds, enhancing the company's financial flexibility.

- Attractive Conversion Terms: The initial conversion price of approximately $84.75 per share represents a 42.5% premium over the last closing price of $59.47 on February 26, 2026, which not only attracts investors but may also elevate the company's stock price in the future, enhancing shareholder value.

- Share Repurchase Plan: Ultra Clean intends to utilize about $40 million of the net proceeds to repurchase its own shares, which is expected to boost earnings per share and potentially increase market demand for its stock, further supporting stock price performance.

- Risk Management Strategy: The company has entered into capped call transactions with initial purchasers to mitigate potential dilution risks, ensuring minimal impact on shareholders during note conversions, demonstrating Ultra Clean's commitment to protecting shareholder interests.

See More

- Convertible Notes Offering: Ultra Clean announced plans to privately place $400 million in convertible senior notes due 2031, with an option for initial purchasers to buy an additional $60 million within 13 days of issuance, enhancing the company's capital structure and financing flexibility.

- Diverse Use of Proceeds: The net proceeds from this offering will be partially allocated to fund capped call transactions, while also planning to repurchase up to $40 million of common stock, thereby enhancing shareholder value and optimizing capital allocation.

- Debt Repayment and Working Capital: Remaining funds will support working capital needs, facilitate partial prepayment of outstanding term loans, and cover other general corporate purposes, ensuring financial stability and enhancing operational capacity.

- Positive Market Reaction: Ultra Clean's stock surged significantly after reporting fourth-quarter results, reflecting market confidence in its future growth potential, particularly against the backdrop of accelerating AI-driven semiconductor demand.

See More

- Offering Size: Ultra Clean Holdings intends to offer $400 million in convertible senior notes, which is expected to provide the company with capital for future operations and shareholder returns, reflecting a proactive financial strategy.

- Use of Proceeds: The net proceeds from the offering will be allocated to capped call transactions, repurchasing up to $40 million of common stock, and for working capital and loan repayment, indicating a focus on optimizing capital structure.

- Redemption Terms: The notes will mature in 2031, allowing holders to convert into cash or common stock under certain conditions, while the company retains the option to redeem the notes before maturity, enhancing debt flexibility.

- Market Impact: By repurchasing shares and issuing convertible notes, Ultra Clean aims to enhance shareholder value, which could positively influence the company's stock price, reflecting confidence in future growth prospects.

See More