Whale Faces $3.7 Million Loss After Going Long on LIT.

- Whale Address Closure: The whale address "0xf39" has closed its entire position after holding it for approximately 34 days.

- Financial Loss: This transaction resulted in a loss of around $3.7 million.

Trade with 70% Backtested Accuracy

Analyst Views on LIT

About the author

Whale Trader's Recent Activity: The trader known as "Whale Trader" closed a 1x leverage short position of 242,356 MEGA, resulting in a profit of $17,800.

Previous Trades: Before this position, the trader had shorted MON, LIT, and FOGO, accumulating a total profit of $41,600 from those trades.

- Strategic Collaboration: Rockwell Automation has deepened its collaboration with Lucid Group to support Saudi Arabia's first vehicle manufacturing plant, marking a significant milestone in the Kingdom's industrial development under Vision 2030.

- Production Efficiency Enhancement: Lucid will implement Rockwell's FactoryTalk manufacturing execution system (MES) to optimize production processes, ensuring real-time visibility and traceability, thereby enhancing operational efficiency and quality.

- Local Training Initiative: Rockwell will provide local training programs in Saudi Arabia aimed at developing domestic talent in electric vehicle manufacturing, supporting long-term industrial growth and enhancing local manufacturing capabilities.

- Technological Innovation Application: Lucid has also announced a partnership with Trimble to supply advanced positioning technology for its upcoming Gravity electric SUV, improving navigation and driver assistance reliability, with implementation expected in January 2026 for new models.

Lithium Price Outlook: Fitch predicts that lithium prices will remain weak until 2026, with a potential recovery in late 2025, while the market is expected to stay oversupplied unless significant production cuts occur.

Market Dynamics: The lithium market faces challenges from evolving battery technologies and alternative materials, which could impact demand, while China continues to dominate both demand and processing.

Capital Management Strategies: Lithium producers are focusing on financial resilience, with companies like Albemarle and SQM adjusting their capital expenditures and debt strategies to navigate the current market volatility.

M&A Opportunities: The difficult market conditions are creating opportunities for well-capitalized miners, such as Rio Tinto, to pursue acquisitions and diversify their portfolios in the lithium sector.

Canadian Solar's New Contract: Canadian Solar Inc. is enhancing its presence in Australia's energy storage market with a contract to supply a 408 megawatt-hour battery system for the Tailem Bend 3 project in South Australia, set to begin operations in 2027.

Grid Stability and Renewable Energy: The battery installation will support grid stability in South Australia, which relies on renewable energy sources, by balancing supply and demand as these sources increase.

Service Agreement: Canadian Solar's e-STORAGE division will maintain the battery system under a five-year service agreement, ensuring reliable performance post-commissioning.

Investor Interest: The company's stock has seen a surge, attributed to its focus on battery storage projects, which are viewed as a significant growth opportunity alongside competitors like Tesla and NextEra Energy.

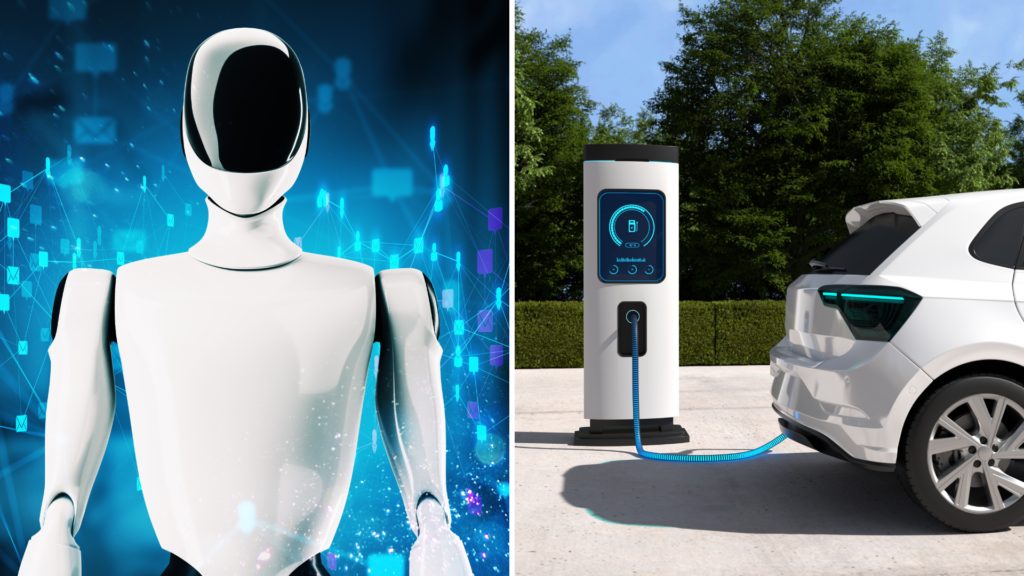

Robotics Investment Trends: The robotics sector is gaining political support in the U.S., with potential executive orders and initiatives from the Department of Commerce aimed at promoting the industry, leading to increased interest in robotics ETFs like ROBO and BOTZ.

Electric Vehicle ETF Dynamics: In contrast, electric vehicle (EV) ETFs are influenced by car sales, battery prices, and consumer demand, making them more volatile and cyclical compared to the steadier robotics investments.

Government Support for Robotics: The U.S. government views robotics and advanced manufacturing as essential for domestic production, with discussions around a national robotics commission and the potential for robotics to help address national debt.

Investment Strategy Outlook: Robotics ETFs are seen as a long-term, stable investment supported by government policy, while EV ETFs are characterized by higher risk and potential for significant price swings based on market conditions.