VistaShares Launches QUSA ETF, Targeting 15% Annual Yield With Quality U.S. Stocks, Options Overlay

New ETF Launch: VistaShares has introduced the Target 15 USA Quality Income ETF (QUSA), an actively managed fund aiming for a 15% annual income through a combination of high-quality U.S. equities and an options overlay, with monthly payouts of 1.25%.

Investment Strategy: QUSA focuses on a portfolio of 20 to 50 U.S. equities selected based on quality metrics, while also employing an options strategy to enhance yield, positioning itself as a hybrid investment option between fixed income and dividend-heavy equities.

Trade with 70% Backtested Accuracy

Analyst Views on OMAH

About the author

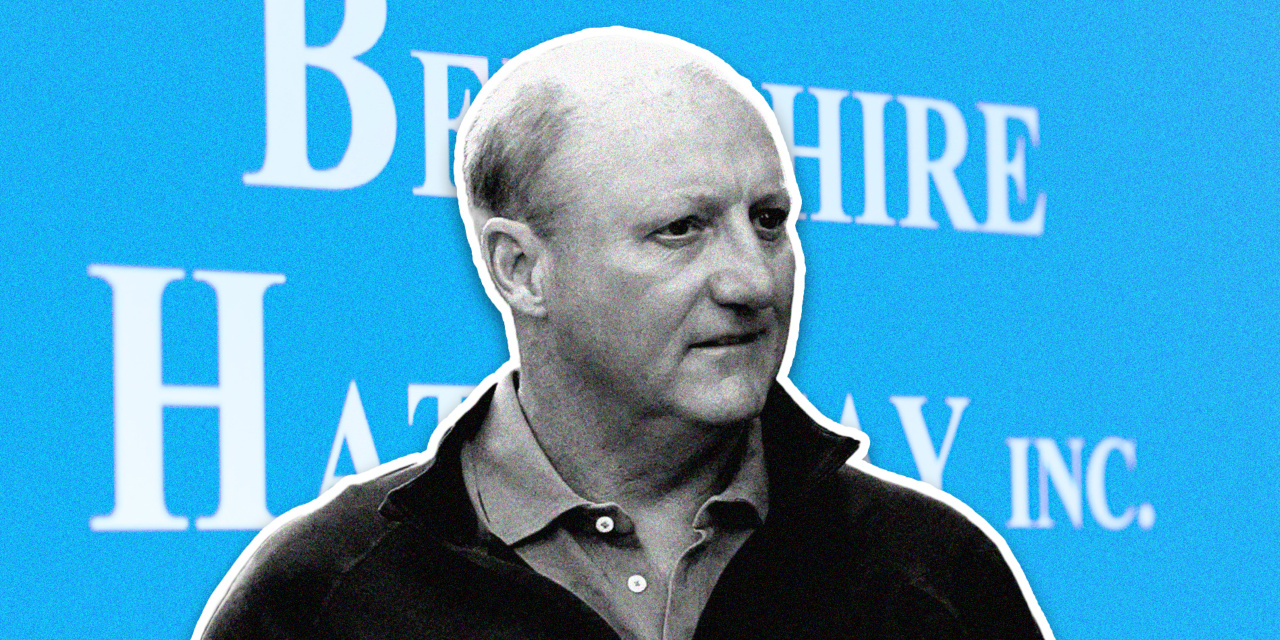

Executive Turnover: Berkshire Hathaway is experiencing significant executive turnover as Warren Buffett prepares to step down, with key figures like Todd Combs leaving for JPMorgan Chase and CFO Marc Hamburg also set to depart.

Stock Premium Concerns: The company faces challenges related to a narrowing premium on its stock that has been associated with Buffett's leadership, raising concerns about its future performance.

ETF Performance: The VistaShares Target 15 Berkshire Select Income ETF is underperforming, down approximately 1.3% in Monday afternoon trading.

Weakest Components: Key contributors to the ETF's decline include Kroger, which fell by about 2.2%, and Coca-Cola, which decreased by around 1.4%.

Market Context: The article highlights the performance of specific ETFs and their components during the trading day.

Author's Perspective: The views expressed in the article are those of the author and do not necessarily represent Nasdaq, Inc.

Emergence of Personality-Based ETFs: A new trend in the ETF market is the creation of funds modeled after renowned money managers, such as Warren Buffett and Bill Ackman, aimed at democratizing investment strategies previously inaccessible to average investors.

Unique Investment Approach: The VistaShares Target 15 ACKtivist Distribution ETF (ACKY) combines high-conviction long-term holdings with a disciplined income strategy, offering a sustainable investment option that balances risk and return, while also providing exposure to diverse sectors beyond large-cap tech.

New ETF Launch: VistaShares has introduced the Target 15 ACKtivist Distribution ETF (ACKY), which aims to replicate Bill Ackman's Pershing Square Capital Management holdings while targeting a 15% annual income paid monthly.

Innovative Investment Strategy: ACKY utilizes an options-based overlay to generate monthly cash income, appealing to income-focused investors who want equity exposure without sacrificing yield, reflecting a broader trend in ETF innovation.

Emergence of Celebrity ETFs: A new trend in Exchange-Traded Funds (ETFs) is emerging, where funds aim to replicate the investment strategies of renowned investors like Warren Buffett and Cathie Wood, either through direct involvement or by tracking their publicly disclosed trades.

Challenges and Investor Interest: Despite initial successes, these "copycat" ETFs face challenges such as time lags and high fees that may affect long-term performance, while the impending departure of Buffett from Berkshire Hathaway has heightened investor interest in alternative investment strategies.

Fund Performance and Strategy: VistaShares' Target 15™ Berkshire Select Income ETF (OMAH) has surpassed $250 million in assets within four months of trading, aiming for a 15% annual income through an equity portfolio reflecting Berkshire Hathaway's investments and an actively managed options overlay.

Investor Engagement and Future Plans: The fund has successfully distributed monthly income since inception, with the next distribution set for June 20. VistaShares aims to educate investors on integrating this innovative approach into their portfolios.