U.S. IPO Market Set for Significant Wave in 2026

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Feb 09 2026

0mins

Should l Buy AMZN?

Source: Benzinga

- Surge in IPO Proceeds: Goldman Sachs projects that U.S. IPO proceeds will reach a record $160 billion in 2026, quadrupling from 2025, indicating strong economic recovery and robust equity markets.

- Doubling of IPO Count: The number of IPOs is expected to double to 120 in 2026, driven by a recovering economy, rising equity prices, and favorable financial conditions, with software and healthcare sectors leading the charge.

- Large Company Listings: Goldman Sachs notes that 2026 IPOs will be dominated by large private company listings, with proceeds estimated between $80 billion and $200 billion, although recent selloffs in software stocks highlight valuation risks.

- Signs of Market Activity: Approximately $5 billion has already been raised through IPOs in 2026, including notable companies like AI equipment manufacturer Forgent Power and biopharmaceutical firm Eikon Therapeutics, reflecting a strong market rebound.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AMZN?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AMZN

Wall Street analysts forecast AMZN stock price to rise

44 Analyst Rating

41 Buy

3 Hold

0 Sell

Strong Buy

Current: 208.390

Low

175.00

Averages

280.01

High

325.00

Current: 208.390

Low

175.00

Averages

280.01

High

325.00

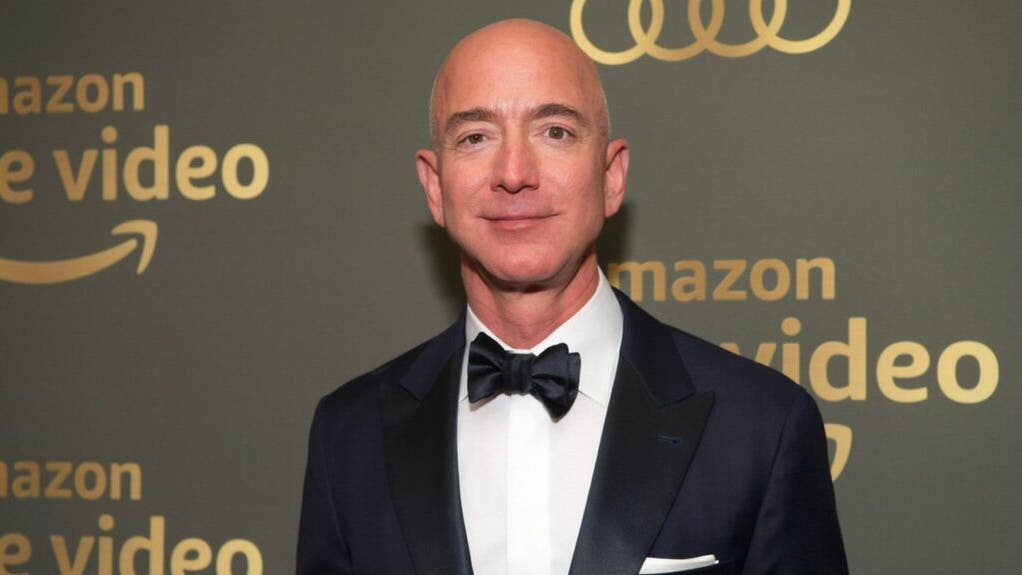

About AMZN

Amazon.com, Inc. provides a range of products and services to customers. The products offered through its stores include merchandise and content it has purchased for resale and products offered by third-party sellers. The Company’s segments include North America, International and Amazon Web Services (AWS). It serves consumers through its online and physical stores and focuses on selection, price, and convenience. Customers access its offerings through its websites, mobile apps, Alexa, devices, streaming, and physically visiting its stores. It also manufactures and sells electronic devices, including Kindle, Fire tablet, Fire TV, Echo, Ring, Blink, and eero, and develops and produces media content. It serves developers and enterprises of all sizes, including start-ups, government agencies, and academic institutions, through AWS, which offers a set of on-demand technology services, including compute, storage, database, analytics, and machine learning, and other services.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Sales Growth: In 2025, Amazon's net sales increased by 12%, up from 11% in 2024, indicating resilience in its e-commerce business despite stock price declines, which may attract more investor interest moving forward.

- Cloud Business Performance: Amazon Web Services (AWS) is growing significantly faster than its e-commerce segment, driven by the expanding AI market that encourages more companies to invest in cloud infrastructure, thereby enhancing Amazon's profitability and market competitiveness.

- Investment Impact: Amazon plans to invest up to $200 billion in its cloud and AI infrastructure, a substantial investment that may pressure stock prices in the short term but is expected to strengthen its market position and profitability in the long run.

- Future Outlook: Analysts project Amazon's revenue and EPS to grow at CAGRs of 12% and 18% from 2025 to 2028, and if the stock trades at a 25 P/E ratio by 2028, it could rise 40% over the next two years, highlighting its long-term investment potential.

See More

Acquisition Announcement: Amazon has announced the acquisition of the George Washington University Virginia campus for $427 million.

Strategic Move: This acquisition is part of Amazon's strategy to expand its presence in the education and technology sectors.

See More

- Investment Expansion: Amazon has increased its total investment in Spain to €33.7 billion ($39.8 billion), adding €17 billion to enhance the number of data centers and advance its artificial intelligence initiatives, demonstrating a long-term commitment to the Spanish market.

- Job Creation: This investment is expected to support approximately 29,900 full-time jobs, with 6,700 positions directly created by Amazon, directly boosting local economic growth and enhancing community employment levels.

- Infrastructure Development: The new investment will support the development of Amazon Web Services (AWS) in the Aragón region of Spain, strengthening local digital infrastructure and enabling businesses and organizations to innovate and grow in cloud computing and AI.

- Sustainability Commitment: Amazon stated that this investment focuses not only on economic benefits but also on promoting water stewardship and carbon-free energy projects, reflecting the company's strategic goals in environmental sustainability.

See More

- Market Reaction: Stocks opened significantly lower, indicating a shift away from the previous "ignore geopolitics" mindset.

- Recovery Trend: By late morning, there was a noticeable recovery in stock prices, suggesting some stabilization in the market.

See More

- Significant Revenue Growth: CrowdStrike reported a 23% year-over-year revenue increase in Q4 FY2024, reaching $1.305 billion, surpassing the market expectation of $1.297 billion, indicating strong performance in the cybersecurity sector.

- Adjusted EPS Beat: The adjusted earnings per share (EPS) for the quarter was $1.12, exceeding the analyst estimate of $1.10, reflecting the company's sustained profitability, although shares dipped slightly in after-hours trading.

- Annual Recurring Revenue Surge: The net new annual recurring revenue totaled $331 million, above the analyst forecast of $304 million, representing a 47% year-over-year growth, marking a successful expansion in customer relationships and revenue stability.

- Optimistic Outlook: Management forecasts revenue for FY2027 to be between $5.87 billion and $5.93 billion, exceeding the FactSet consensus estimate of $5.86 billion, showcasing confidence in future growth driven by AI technology demand.

See More

- Employee Safety Priority: Nvidia's CEO Jensen Huang confirmed that the safety of approximately 6,000 employees in Israel is secured despite the temporary closure of Dubai offices, emphasizing the company's commitment to employee welfare amid escalating regional tensions.

- Mass Flight Cancellations: Over 11,000 flights across the Middle East have been canceled since the U.S.-Israeli strikes on Iran, leaving many Google employees stranded in Dubai after a sales conference, highlighting the significant disruption to business operations caused by the conflict.

- Amazon Operational Adjustments: Amazon has instructed all corporate employees in the Middle East to work remotely and follow local government guidelines, demonstrating the company's prioritization of employee safety while also impacting its regional business operations amid ongoing instability.

- Data Center Damage: Two Amazon data centers in the UAE were directly struck by drones, resulting in structural damage and service outages, prompting AWS to advise customers to back up their data or consider migrating workloads, underscoring the direct threat the conflict poses to technological infrastructure.

See More