Three Tech and Telecom Stocks Poised for Growth This September

Oversold Stocks Opportunity: The communication services sector has several oversold stocks, presenting potential buying opportunities for undervalued companies, particularly those with an RSI below 30.

Array Digital Infrastructure Inc: This stock has an RSI of 21.4, a recent price drop of 11%, and closed at $47.97, indicating it may be undervalued.

DoubleVerify Holdings Inc: With an RSI of 24.7 and a 27% decline in stock price, it closed at $11.89 despite reporting strong year-over-year growth.

Amber International Holding Ltd: This stock has an RSI of 29, a recent 16% drop, and closed at $3.44, highlighting its potential as an undervalued investment following positive sales results.

Trade with 70% Backtested Accuracy

Analyst Views on RSI

About RSI

About the author

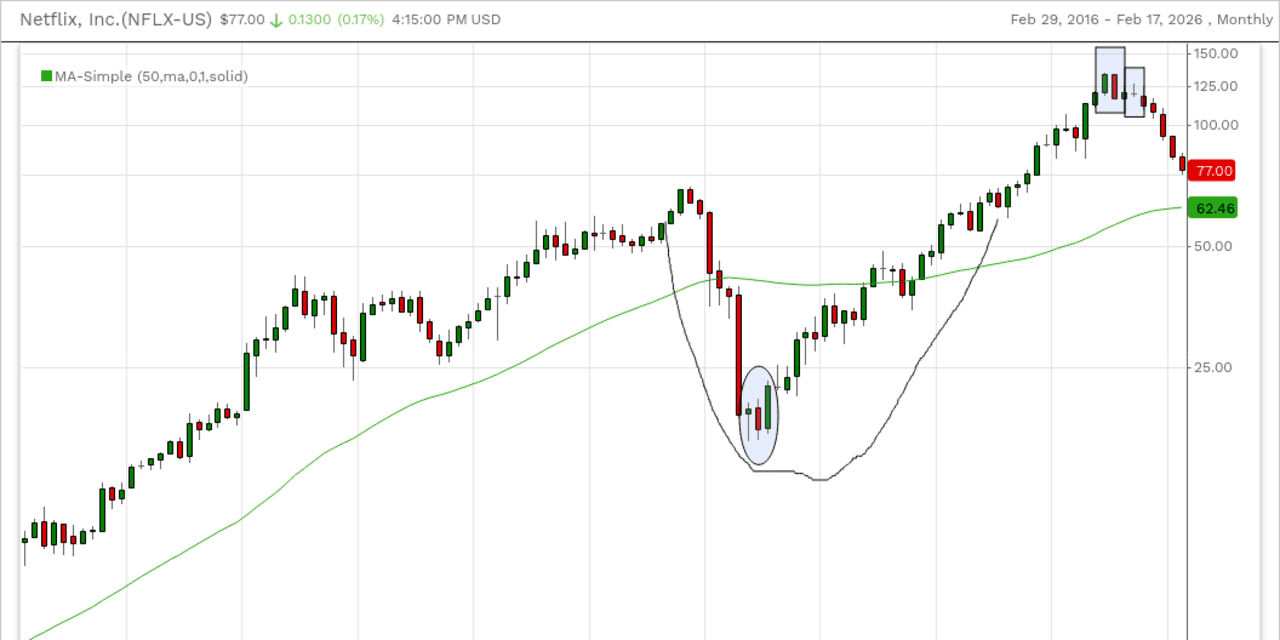

- Market Observation: There are indications that software stocks have reached a bottom in their decline.

- Investor Sentiment: The current situation is drawing significant attention from investors and analysts in the software sector.

Market Cycles: Markets operate in cycles, indicating that trends and leadership positions are temporary.

Leadership Rotation: Leadership within markets rotates, consolidates, and eventually reemerges over time.

Stock Performance: Rush Street Interactive shares increased by 7% following a positive earnings report.

Revenue Results: The company's Q4 revenue exceeded analysts' expectations, contributing to the stock surge.

- Amazon Remains a Top Pick: Morgan Stanley reiterates Amazon as overweight, highlighting its underappreciated potential in AWS and retail, with expectations for AWS to grow over 30% in 2026/27, showcasing strong market competitiveness.

- Weak Demand for Crocs: Williams Trading downgrades Crocs from hold to sell, raising the price target to $84, reflecting ongoing declines in U.S. demand and challenges in expanding its global DTC business.

- Rush Street Interactive Upgrade: Citizens upgrades Rush Street Interactive to market outperform, citing its durable business model in online gaming, which indicates strong growth potential driven by favorable market conditions.

- Optimistic Outlook for Nvidia: Wells Fargo reiterates Nvidia as overweight, advising investors to buy ahead of next week's earnings report, anticipating strong demand and GPU spending dominance to drive stock price increases.

- Analyst Optimism: Jefferies analyst David Katz raised the price target for Rush Street Interactive by $1 to $30, indicating strong bullish sentiment with a projected 77% upside, reflecting market confidence in the company's future growth.

- Earnings Beat: Rush Street reported a fourth-quarter revenue beat and provided robust full-year earnings guidance, showcasing its competitive edge in the digital gaming sector and reinforcing its status as an 'easy-to-own' investment choice.

- Revenue Growth Expectations: Katz anticipates continued revenue growth at a mid-high teens rate, with a solid flow-through of over 1.5X despite rising G&A costs, demonstrating resilience in profitability.

- Market Opportunity Analysis: The company shows significant growth potential in the LATAM market, particularly in Mexico, with a 100% year-over-year growth rate for three consecutive quarters, indicating a promising outlook despite its modest current business share.

- Earnings Surprise: Pitney Bowes reported an adjusted EPS of 45 cents for Q4, surpassing the analyst consensus of 38 cents, indicating strong profitability and boosting investor confidence.

- Sales Miss: The quarterly sales of $478 million fell short of the expected $486.68 million, highlighting some market demand challenges that could impact future revenue growth.

- Stock Surge: The company's shares jumped 7.9% to $11.05 in pre-market trading, reflecting optimistic market sentiment regarding its future prospects and potentially attracting more investor interest.

- Positive Guidance: Pitney Bowes issued FY26 adjusted EPS guidance with a midpoint above estimates, further strengthening market confidence in its long-term growth potential.