Target's Struggles Benefit TJX: These ETFs Are Placing Holiday Bets on the Successor

Target's Struggles: Target Corp has cut its profit guidance and reported declining discretionary sales, leading to a 35% drop in its stock this year, while facing challenges from rising costs and cautious consumer spending.

TJX's Success: In contrast, TJX Companies Inc has raised its annual profit outlook due to strong store traffic and demand for discounted goods, resulting in a 21% increase in its stock year-to-date.

ETF Performance Divergence: The performance of retail sector ETFs reflects this divergence, with TJX having a more significant impact on fund performance compared to Target, which has minimal weightings in most ETFs.

Consumer Trends and Future Outlook: As consumers shift towards value-oriented shopping, TJX benefits from this trend while Target's incoming CEO aims to revitalize the brand amidst ongoing challenges, indicating a potential long-term struggle for Target.

Trade with 70% Backtested Accuracy

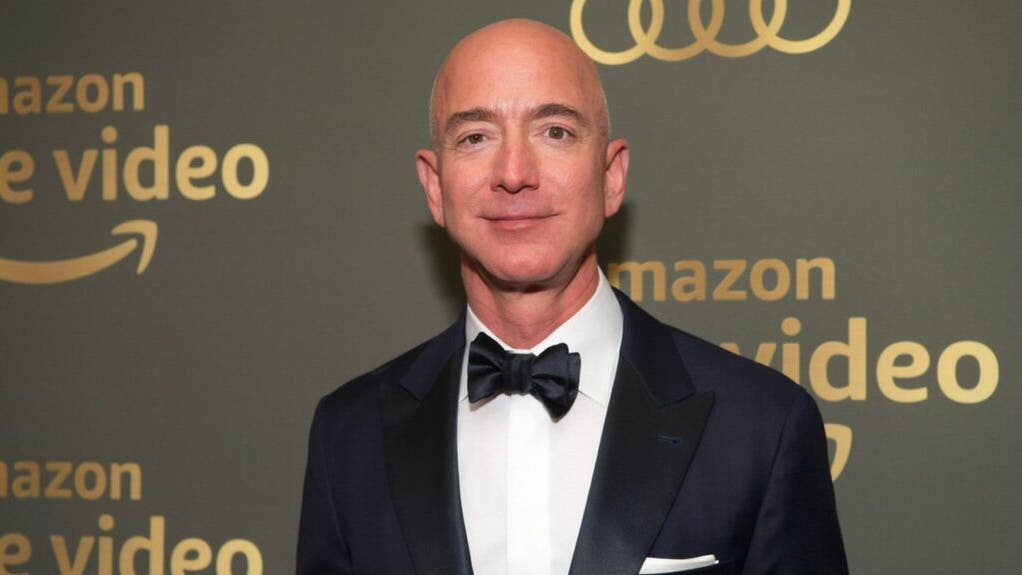

Analyst Views on AMZN

About AMZN

About the author

- Sales Growth: In 2025, Amazon's net sales increased by 12%, up from 11% in 2024, indicating resilience in its e-commerce business despite stock price declines, which may attract more investor interest moving forward.

- Cloud Business Performance: Amazon Web Services (AWS) is growing significantly faster than its e-commerce segment, driven by the expanding AI market that encourages more companies to invest in cloud infrastructure, thereby enhancing Amazon's profitability and market competitiveness.

- Investment Impact: Amazon plans to invest up to $200 billion in its cloud and AI infrastructure, a substantial investment that may pressure stock prices in the short term but is expected to strengthen its market position and profitability in the long run.

- Future Outlook: Analysts project Amazon's revenue and EPS to grow at CAGRs of 12% and 18% from 2025 to 2028, and if the stock trades at a 25 P/E ratio by 2028, it could rise 40% over the next two years, highlighting its long-term investment potential.

Acquisition Announcement: Amazon has announced the acquisition of the George Washington University Virginia campus for $427 million.

Strategic Move: This acquisition is part of Amazon's strategy to expand its presence in the education and technology sectors.

- Investment Expansion: Amazon has increased its total investment in Spain to €33.7 billion ($39.8 billion), adding €17 billion to enhance the number of data centers and advance its artificial intelligence initiatives, demonstrating a long-term commitment to the Spanish market.

- Job Creation: This investment is expected to support approximately 29,900 full-time jobs, with 6,700 positions directly created by Amazon, directly boosting local economic growth and enhancing community employment levels.

- Infrastructure Development: The new investment will support the development of Amazon Web Services (AWS) in the Aragón region of Spain, strengthening local digital infrastructure and enabling businesses and organizations to innovate and grow in cloud computing and AI.

- Sustainability Commitment: Amazon stated that this investment focuses not only on economic benefits but also on promoting water stewardship and carbon-free energy projects, reflecting the company's strategic goals in environmental sustainability.

- Iran Withdrawal Resolution Fails: The U.S. Senate's failure to pass a resolution demanding President Trump withdraw from military actions in Iran highlights significant congressional divisions over current military policy, despite the resolution's largely symbolic nature.

- Major Update to French Nuclear Policy: French President Macron's announcement to increase the number of nuclear warheads and enhance cooperation with European allies is viewed as the most significant update to France's nuclear deterrence policy in 30 years, potentially reshaping the European security landscape.

- Impact on Indian Remittance Flows: A Citi report indicates that the Indian diaspora in Gulf countries contributes nearly 38% of total remittance inflows, with a total of $135.4 billion in FY 2025, of which $51.4 billion comes from Gulf nations, suggesting that prolonged Middle Eastern conflict could negatively impact India's economy.

- China Sets Record Low GDP Growth Target: The Chinese government has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, reflecting the challenges Beijing faces amid persistent deflationary pressures and trade tensions with the U.S.

- Investment Scale Shift: NVIDIA's latest $30 billion investment represents a significant pivot from the previously proposed $100 billion investment outlined in a non-binding letter of intent from September, indicating the company's focus on OpenAI's impending IPO.

- Market Valuation: This investment occurs at a time when OpenAI is raising funds at a pre-money valuation of $730 billion, demonstrating NVIDIA's ongoing confidence in the AI sector and laying a foundation for future business growth.

- Stable Client Relationship: OpenAI CEO Sam Altman reassured that the company will remain a 'gigantic customer' of NVIDIA, highlighting the strong technological and market ties between the two firms.

- Criticism of Financing: Critics argue that investments from NVIDIA and Amazon into OpenAI are essentially disguised vendor financing, suggesting that such arrangements could challenge OpenAI's independence and strategic direction.

- Platinum Card Benefits: Robinhood has launched a Platinum card with a $695 annual fee, promising up to $3,000 in annual benefits to attract users to its financial services.

- Travel and Dining Incentives: Cardholders can receive up to $120 every four years for Global Entry or TSA PreCheck application fees, and enjoy $250 in dining credits at over 15,000 restaurants annually, enhancing user experience.

- Hotel and Travel Rewards: Users can earn up to $500 in hotel booking credits through Robinhood's travel portal and receive 5% cash back on flight bookings, increasing the appeal of travel-related services.

- Health Tracking and Membership Services: The Platinum card also offers a one-year membership to the Oura Ring, encouraging health awareness, along with a Priority Pass Select membership for unlimited airport lounge access, enhancing travel convenience.