Corning announces Q3 core EPS of 67 cents, surpassing consensus estimate of 66 cents.

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Oct 28 2025

0mins

Should l Buy GLW?

Q3 Financial Performance: The company reported Q3 core revenue of $4.27 billion, exceeding the consensus estimate of $4.24 billion.

Year-over-Year Growth: Core sales increased by 14% compared to the previous year, while core earnings per share (EPS) rose by 24% to $0.67.

Springboard Initiative Success: The Springboard plan has added $4 billion to the annualized sales run rate and significantly improved profitability.

Future Projections: The company anticipates an operating margin of 20% in the fourth quarter, achieving this goal a year ahead of schedule.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GLW?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GLW

Wall Street analysts forecast GLW stock price to fall

10 Analyst Rating

8 Buy

2 Hold

0 Sell

Strong Buy

Current: 136.220

Low

83.00

Averages

99.00

High

110.00

Current: 136.220

Low

83.00

Averages

99.00

High

110.00

About GLW

Corning Incorporated operates as an innovator in materials science. Its segments include Optical Communications, Display Technologies, Specialty Materials, Environmental Technologies, and Life Sciences. Its Optical Communications segment manufactures carrier network and enterprise network components for the telecommunications industry. Its Display Technologies segment manufactures glass substrates for flat-panel displays, including liquid crystal displays and organic light-emitting diodes. Its Specialty Materials segment manufactures products that provide material formulations for glass, glass ceramics and fluoride crystals for customer needs. Its Environmental Technologies segment manufactures ceramic substrates and filters for emission control systems in mobile applications. Its Life Sciences segment develops, manufactures and supplies laboratory products, including labware, equipment, media, serum and reagents, enabling workflow solutions for drug discovery and bioproduction.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

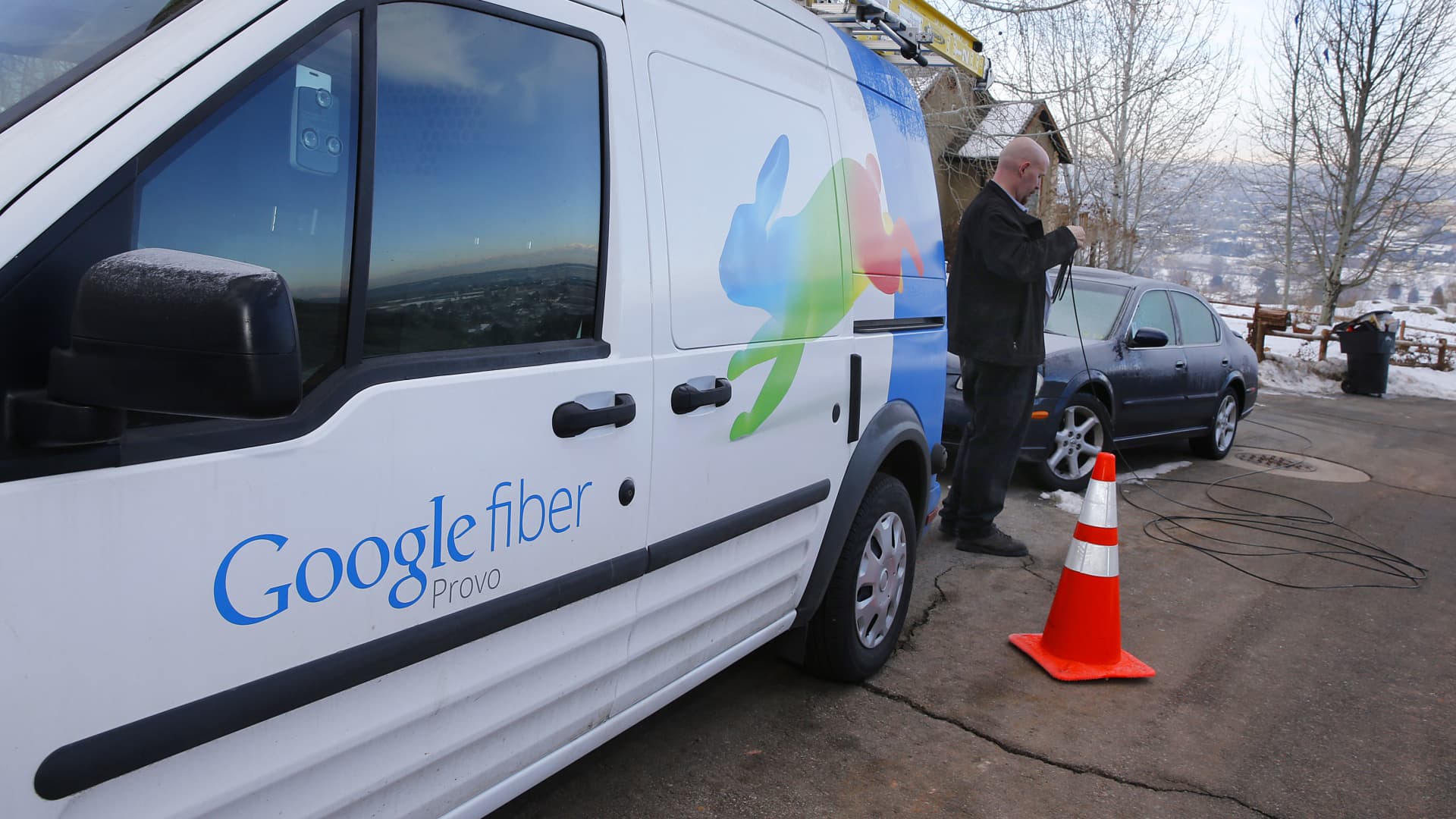

- Formation of New Company: Google Fiber is merging with Astound Broadband to create an independent internet service provider, with Google remaining a minority shareholder, and the transaction is expected to close in Q4, marking a strategic shift amid growing demand for high-capacity networks.

- Management Team Continuity: The new company will be led by the existing Google Fiber executive team, leveraging their expertise in high-speed fiber innovation to manage the combined network footprint, aiming to enhance service quality and market competitiveness.

- Path to Financial Independence: This spinout positions Google Fiber for financial independence, with external capital facilitating nationwide expansion to meet the rising demand for artificial intelligence services, reflecting a strategic emphasis on high-capacity network infrastructure.

- Market Context Analysis: Since its launch in 2010, Google Fiber has faced multiple canceled expansion plans, yet the increasing demand for fiber infrastructure driven by cloud computing, streaming, and emerging AI services has prompted the company to reassess its market strategy.

See More

- Strategic Collaboration: Corning has partnered with US Conec to license PRIZM® TMT optical ferrule technology, aimed at enhancing fiber density and connectivity efficiency in data centers to meet the growing demands of AI infrastructure.

- Market Demand: As AI chips and cluster sizes expand, data center customers require connections for an increasing number of accelerators, with traditional short-reach copper links being replaced by optical connections, leading to thousands of fibers per server and switch rack.

- Technological Advantages: The PRIZM® TMT ferrule utilizes precision-aligned microlenses to provide faster and more reliable installations, greater contamination resistance, and reduced total cost of ownership, all critical in high-density AI data center deployments.

- Industry Exhibition: Corning will showcase the PRIZM® TMT technology at the 2026 Optical Fiber Communication Conference (OFC), where attendees can learn about its role in supporting emerging data center connectivity strategies at Corning's booth (#1739).

See More

- Surging Market Demand: Corning's optical communications business generated $6.2 billion in revenue in 2025, reflecting a 35% year-over-year increase driven by data center operators' urgent need for fiber optics, highlighting the critical role of high-speed data transmission in AI development.

- Profitability Boost: The optical communications segment achieved a record $1 billion profit in 2025, up 71% from the previous year, showcasing strong market demand and granting the company significant pricing power, thereby reinforcing its leadership position in the industry.

- Future Growth Potential: CEO Wendell Weeks predicts that the market for data center optical fiber could triple in size over the long term, indicating that the ongoing evolution of AI technology will sustain rising demand for fiber optics, further propelling the company's performance.

- Investment Value Analysis: Although Corning's P/E ratio stands at 48.9, significantly higher than the Nasdaq-100's 31.8, analysts project earnings per share to grow to $3.11 in 2026 and $3.87 in 2027, suggesting potential investment opportunities as future earnings forecasts may be revised upward.

See More

- Surging Market Demand: Driven by the artificial intelligence sector, Corning anticipates a tripling of the data center optical fiber market, reflecting strong demand for its fiber products and further solidifying the company's leadership in high-speed data transmission.

- Significant Revenue Growth: In 2025, Corning reported core revenue of $16.4 billion, a 13% increase year-over-year, with its optical communications segment contributing $6.2 billion, growing at an impressive 35%, showcasing the company's robust performance in the fiber market.

- Enhanced Profitability: The optical communications business achieved a record profit of $1 billion in 2025, up 71% from the previous year, which not only boosts the company's overall profitability but also provides funding for future investments and expansions.

- Valuation Analysis: Despite Corning's P/E ratio of 48.9, significantly higher than the Nasdaq-100's 31.8, analysts project its earnings per share will rise to $3.11 in 2026, indicating that holding the stock long-term could yield substantial returns.

See More

- Positive Performance of Renewable-Energy Stocks: Despite negative political headlines, the past year has been highly favorable for renewable-energy stock funds.

- Contrast with Political Climate: The strong performance of these funds contrasts sharply with the prevailing negative political environment, highlighting a disconnect between market trends and political narratives.

- Investor Sentiment: Investors may be increasingly optimistic about the future of renewable energy, leading to significant gains in this sector.

- Market Trends: The success of renewable-energy stocks suggests a growing trend towards sustainable investments, regardless of external political factors.

See More

- Market Rebound: Stocks opened lower on Tuesday but quickly rebounded after President Trump's comments hinted at a potential end to the Iran conflict, with West Texas Intermediate crude falling 10.5% to around $85 per barrel, reflecting the market's sensitivity to geopolitical risks.

- Nvidia Hardware Launch Expectations: Ahead of its annual GPU Tech Conference, Nvidia shares rose 1.6%, with analysts anticipating the launch of new hardware, particularly a new chip for training AI models, which could serve as a positive catalyst for the stock.

- Corning Stock Surge: Corning's shares jumped 7.6% following AT&T's announcement of a $250 billion investment over the next five years to build high-speed networks, positioning Corning favorably due to its leadership in optical fiber and cable manufacturing.

- Investor Caution Advised: Jim Cramer cautioned investors to be aware of market volatility, particularly how presidential comments could significantly impact the market, suggesting a need for caution in the short term to navigate potential uncertainties.

See More