Significant Withdrawals Observed in ETF for SPMD, COHR, LITE, UTHR

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 05 2025

0mins

Should l Buy LITE?

Source: NASDAQ.COM

SPMD Share Price Analysis: SPMD's share price is currently at $58.49, with a 52-week low of $43.99 and a high of $58.90, indicating a stable position within its trading range.

Understanding ETFs: Exchange traded funds (ETFs) function like stocks, where investors buy and sell "units" that can be created or destroyed based on demand, affecting the underlying assets.

Monitoring ETF Flows: Weekly analysis of shares outstanding helps identify ETFs with significant inflows (new units created) or outflows (units destroyed), which can influence the individual components of the ETFs.

Disclaimer on Views: The opinions expressed in the article are those of the author and do not necessarily represent the views of Nasdaq, Inc.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy LITE?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on LITE

Wall Street analysts forecast LITE stock price to fall

14 Analyst Rating

9 Buy

5 Hold

0 Sell

Moderate Buy

Current: 694.430

Low

147.00

Averages

303.36

High

470.00

Current: 694.430

Low

147.00

Averages

303.36

High

470.00

About LITE

Lumentum Holdings Inc. is a designer and manufacturer of optical and photonic products enabling optical networking and laser applications worldwide. Its segments include Cloud & Networking and Industrial Tech. The Cloud & Networking segment products include a comprehensive portfolio of optical and photonic components, modules, and subsystems supplied to cloud and communications network operators and network equipment manufacturers building cloud data center infrastructure, including products for artificial intelligence and machine learning (AI/ML) and data center interconnect (DCI) applications, and communications service provider networks, including products for access (local), metro (intracity), long-haul (city-to-city and worldwide), and submarine (undersea) network infrastructure. The Industrial Tech segment products include solid-state lasers, kilowatt-class fiber lasers, diode lasers, ultrafast lasers, and gas lasers, which address applications in numerous end-markets.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Market Rally: Wall Street experienced a relief rally on Wednesday, driven by optimism surrounding potential US-Iran diplomatic talks, with the Nasdaq 100 gaining 1.5% to 25,100, indicating investor confidence in future economic stability.

- Oil Price Decline: Following two consecutive days of gains, Brent crude fell 0.5% to $81.00 per barrel and WTI crude slipped 0.8% to $74.07, reflecting the impact of diplomatic optimism on the energy market.

- Volatility Index Drop: The CBOE Volatility Index plunged 11.6% to 20.84, indicating a rise in market risk appetite and a decrease in demand for safe-haven assets, further fueling the stock market's upward momentum.

- Stable Treasury Yields: The 10-year U.S. Treasury yield held steady at 4.07%, suggesting that as risk appetite increases, demand for safe assets is capped, reflecting a positive outlook on economic prospects.

See More

- Put Option Appeal: The current bid for the $680.00 put option is $302.00, and if an investor sells-to-open this option, they commit to buying the stock at $680.00, effectively lowering their cost basis to $378.00, which is approximately a 1% discount to the current price of $684.58, making it attractive for potential LITE buyers.

- Yield Potential Analysis: Should the put option expire worthless, it would yield a 44.41% return on the cash commitment, or an annualized yield of 19.41%, referred to as YieldBoost, highlighting the option's potential attractiveness.

- Call Option Returns: The $740.00 call option has a current bid of $316.00, and if an investor buys LITE shares at $684.58 and sells this call option, they could achieve a total return of 54.26% if the stock is called away at the June 2028 expiration, indicating strong profit potential.

- Risk-Reward Tradeoff: The $740.00 call option represents an approximate 8% premium to the current stock price, with a 26% chance of expiring worthless according to current analytics, allowing investors to retain both their shares and the premium, further enhancing their investment returns.

See More

- Acquisition Details: Semtech has acquired HieFo for $34 million in cash, aiming to enhance its data center portfolio and strengthen U.S. technology supply chains, particularly in the AI sector.

- Financial Impact: The acquisition of HieFo is expected to be accretive to adjusted diluted earnings per share within the first year, reflecting Semtech's confidence in its future profitability.

- Technology Integration: Semtech plans to combine HieFo's proven InP technology with its industry-leading TIAs and laser drivers to offer comprehensive solutions for next-generation optical platforms, thereby solidifying its leadership in high-bandwidth, low-power networking solutions.

- Market Sentiment: Despite Semtech's shares gaining over 153% in the past year, retail sentiment on Stocktwits remains neutral, indicating a cautious market reaction to the acquisition.

See More

- Oil Price Surge: The escalating conflict between the U.S., Israel, and Iran has driven West Texas Intermediate crude oil prices up by 6.4% to $75.8 per barrel, marking the largest two-day rally since March 2022, indicating heightened market concerns over energy supply disruptions.

- Market Panic Intensifies: The CBOE Volatility Index surged by 6% to 22.74, reflecting increased investor fear regarding short-term market volatility, with all 11 S&P 500 sectors trading in the red, showcasing widespread market pressure.

- Fed Policy Expectations Shift: Amid rising inflation fears, the 10-year Treasury yield climbed from 3.97% last Friday to approximately 4.06%, leading traders to reprice expectations for Fed rate cuts, now anticipating fewer chances of cuts in 2026.

- Strong Dollar Impact: The U.S. dollar index is on track for its largest two-day gain since February 2023, resulting in significant declines in gold and silver prices, with spot gold falling 4.6% to around $5,080 per ounce and silver plummeting 7.8% to $82 per ounce, highlighting the dollar's pressure on commodity markets.

See More

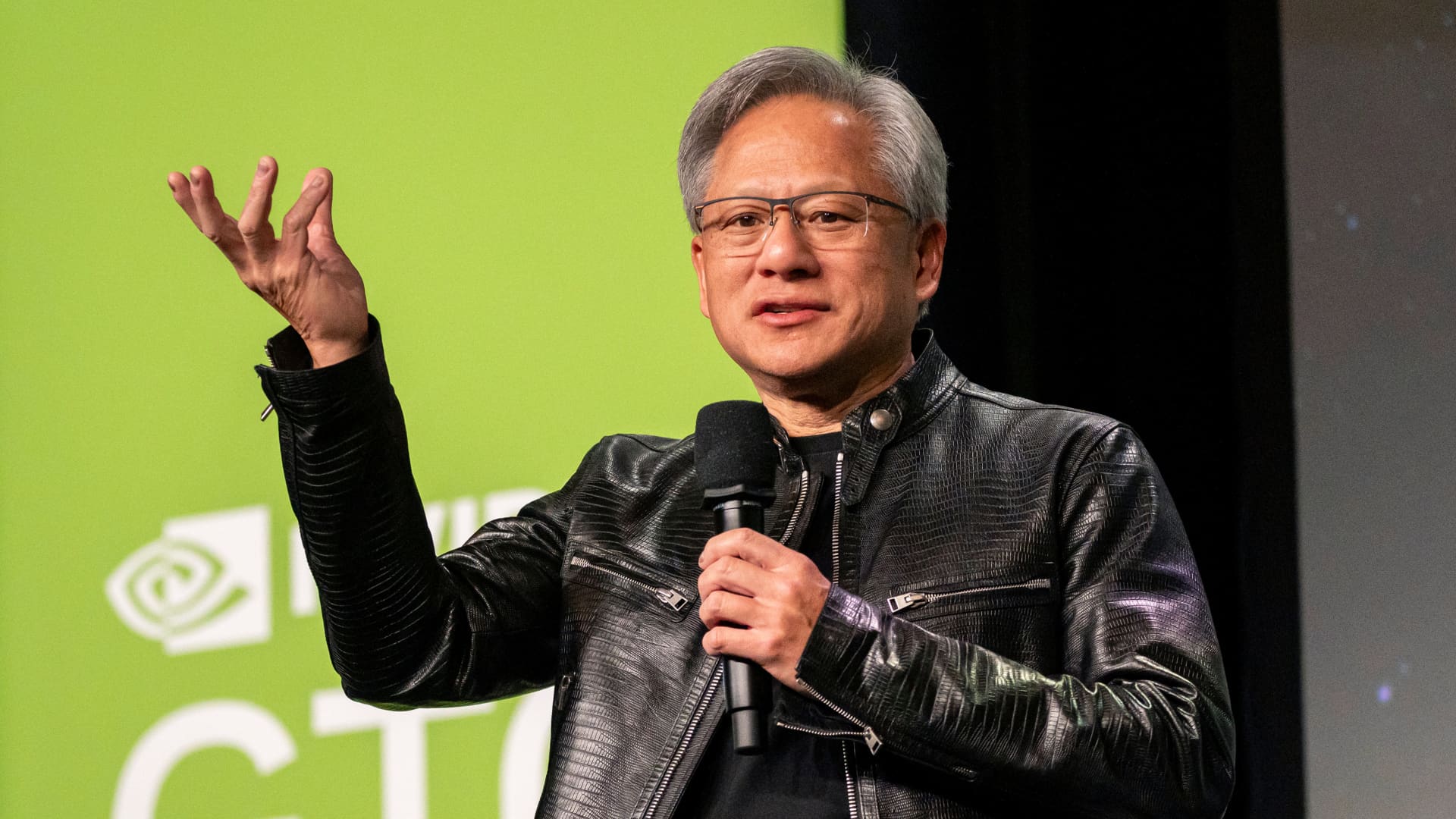

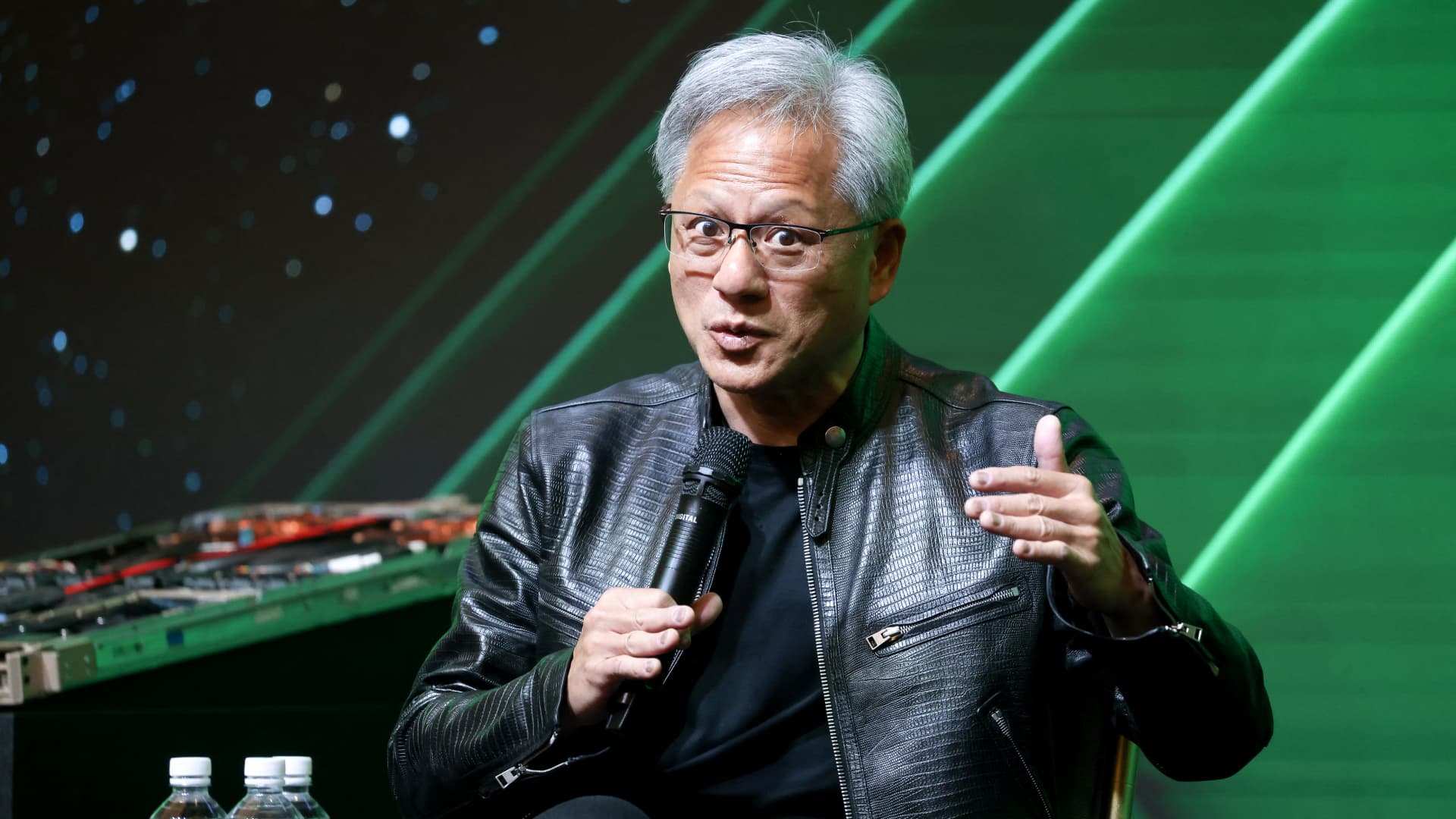

- Significant Investment: Nvidia announced a $4 billion investment, allocating $2 billion each to Coherent and Lumentum, aimed at advancing innovation in optical technologies, thereby enhancing its competitive position in the photonics sector.

- Analyst Price Target Increases: Rosenblatt's Mike Genovese raised the price target for Lumentum from $580 to $900 and for Coherent from $300 to $375, indicating strong confidence in both companies and likely attracting more investor interest.

- Potential S&P 500 Inclusion: Boutique research firm Gordon Haskett believes that Lumentum and Coherent could be included in the S&P 500 this year, reflecting their leading positions among mid-cap peers and potentially increasing their market visibility and investment appeal.

- Positive Retail Sentiment: On Stocktwits, retail sentiment for COHR stock was in the 'extremely bullish' territory over the past 24 hours, while LITE stock was in the 'bullish' territory, indicating growing investor confidence in both stocks.

See More