Schrodinger Partners with Eli Lilly to Launch AI Drug Design Platform TuneLab

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 09 2026

0mins

Should l Buy LLY?

Source: Newsfilter

- Collaborative Innovation: Schrodinger's partnership with Eli Lilly integrates Lilly's AI platform TuneLab into its LiveDesign software, enabling biotech companies to directly access this advanced tool, thereby accelerating drug development processes.

- Technological Advantage: By incorporating TuneLab into LiveDesign, chemists can more effectively design compounds and predict drug behavior in the body, enhancing the efficiency and accuracy of drug research and development.

- Market Demand: With the FDA pushing to reduce animal testing, the increasing adoption of AI by drug developers is expected to meet the urgent market demand for faster and more cost-effective drug discovery, making this collaboration timely.

- Client Expansion: Existing LiveDesign clients will gain access to TuneLab in Q1 of this year, while new users will start using it in Q2, which is anticipated to attract more biotech companies and drive diversity and speed in drug development.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy LLY?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on LLY

Wall Street analysts forecast LLY stock price to rise

20 Analyst Rating

18 Buy

2 Hold

0 Sell

Strong Buy

Current: 1007.730

Low

950.00

Averages

1192

High

1500

Current: 1007.730

Low

950.00

Averages

1192

High

1500

About LLY

Eli Lilly and Company is a medicine company, which discovers, develops, manufactures, markets, and sells pharmaceutical products worldwide. Its cardiometabolic health products include Basaglar; Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, and others; Humulin, Humulin 70/30, and others; Jardiance; Mounjaro; Trulicity; Zepbound; VERVE-102; VERVE-201, and VERVE-301. Its oncology products include Cyramza, Erbitux, Tyvyt, and Verzenio. Its immunology products include Ebglyss, Olumiant, Omvoh, and Taltz. Its neuroscience products include Emgality and Kisunla. The Company is also engaged in radiopharmaceutical discovery, development, and manufacturing efforts, and clinical and pre-clinical radioligand therapies in development for the treatment of cancer. It is also developing an oral small molecule inhibitor of a4b7 integrin for inflammatory bowel disease (IBD). It is evaluating its novel gene therapy candidate, ixoberogene soroparvovec.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Price Target Analysis: Analysts currently project Eli Lilly's price target to be just under $1,230, indicating approximately 17% upside from its current price of $1,031.79, which presents a potential return opportunity for investors.

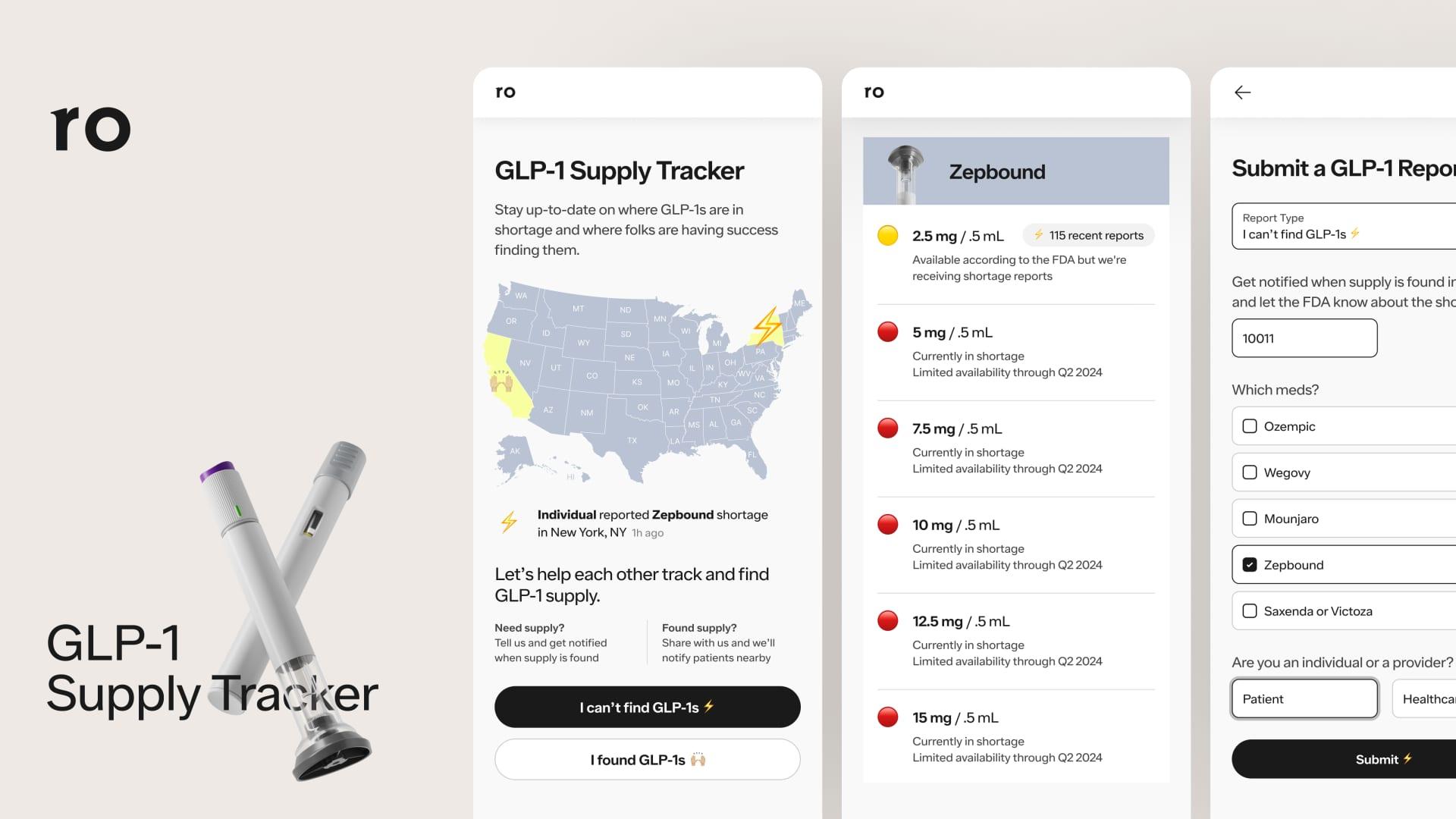

- Growth Drivers: The strong growth of Eli Lilly's GLP-1 drugs, Zepbound and Mounjaro, has fueled bullish sentiment, as investors grow confident in the company's potential to dominate the anti-obesity drug market, thereby continuing to drive the stock's rally.

- Valuation Considerations: Despite Eli Lilly's market cap nearing $1 trillion, its price-to-earnings ratio stands at 46, significantly higher than the S&P 500 average of 25, suggesting that much of the future growth is already priced in, which could lead to correction risks if expectations are not met.

- Long-term Investment Advice: For long-term investors, Eli Lilly remains a solid investment option, but it is crucial to temper expectations to avoid overestimating future gains, especially given the current high valuation context.

See More

- Eli Lilly's Growth Momentum: Eli Lilly has demonstrated revenue growth rates exceeding mid-double digits in recent quarters, significantly outperforming large pharmaceutical companies, showcasing its leadership in the anti-obesity drug market, with new drug launches expected to further solidify its market share.

- Leader in Anti-Obesity Market: Eli Lilly's tirzepatide became the world's best-selling drug last year, with the anticipated launch of the oral GLP-1 drug forglipron this year and additional approvals expected in the coming years, enhancing the diversity of its product pipeline.

- Veeva Systems' Market Opportunity: Veeva Systems provides cloud solutions to life science companies, boasting over 1,500 customers, with a goal to double its annual revenue by 2030, indicating a compound annual growth rate of nearly 18%, reflecting its strong competitive position in a rapidly growing market.

- Growth Potential in Cloud Market: Veeva Systems estimates an addressable market of $20 billion, significantly higher than its trailing 12-month revenue of $3.1 billion, indicating substantial growth opportunities ahead, prompting investors to consider buying at current low levels.

See More

- Strong Growth for Eli Lilly: Eli Lilly has achieved mid-double-digit revenue growth rates in recent quarters, significantly exceeding the pharmaceutical industry average, demonstrating its robust competitive position and future growth potential.

- Leader in Anti-Obesity Market: Eli Lilly's tirzepatide became the world's best-selling drug last year, and the anticipated launch of the oral GLP-1 drug forglipron this year will further solidify its leadership in the rapidly growing anti-obesity market.

- Market Opportunities for Veeva Systems: Veeva Systems provides cloud solutions to life science companies, boasting over 1,500 customers, and aims to double its annual revenue by 2030, indicating a compound annual growth rate of nearly 18%, showcasing its strong competitive edge in the large cloud market.

- Optimistic Industry Outlook: Despite intensified competition, Veeva Systems' high switching costs and unique market positioning provide ample growth opportunities, with an addressable market estimated at $20 billion, significantly surpassing its current revenue of $3.1 billion.

See More

- Market Size Growth: According to analysis, the chronic kidney disease (CKD) market size was approximately $4.8 billion in 2024 and is expected to grow further by 2034, reflecting increased demand for new therapies and an expanding patient base.

- Rising Patient Numbers: In 2024, there were about 82 million prevalent cases of CKD across the 7 major markets (7MM), with projections indicating continued growth from 2025 to 2034, primarily driven by an aging population and the rising prevalence of diabetes and hypertension.

- Launch of New Therapies: The introduction of emerging therapies such as AstraZeneca's Zibotentan/Dapagliflozin and Boehringer Ingelheim's Vicadrostat + Empagliflozin is expected to significantly boost market growth and improve treatment outcomes for patients.

- Advancements in Biomarkers: Progress in biomarkers like KIM-1 and NGAL enables more precise early detection of CKD, thereby enhancing the potential for timely interventions and improving overall patient prognosis.

See More

- Sales Growth Dependency: Eli Lilly's Mounjaro and Zepbound drugs achieved impressive sales growth of 99% and 175% in 2025, respectively, yet these two drugs account for nearly 45% of the company's total sales, raising concerns about the sustainability of such growth.

- Overvaluation Concerns: Despite the strong performance of Eli Lilly's drugs, its stock price has surged to a price-to-earnings ratio of 44, with a meager dividend yield of 0.6%, indicating that the market's expectations for future growth may be overly optimistic.

- Competitors' Opportunities: GLP-1 competitors Novo Nordisk and Pfizer offer more attractive investment profiles with dividend yields of 4.57% and 6.31%, respectively, and price-to-earnings ratios of 10 and 20, especially as Eli Lilly faces risks from patent expirations.

- Intensifying Industry Competition: While Eli Lilly's success in the GLP-1 space is notable, it may overshadow the risks it faces; as competition intensifies, the strong historical performance of Novo Nordisk and Pfizer could enable them to rebound in the market, presenting new opportunities for investors.

See More

- Significant Sales Growth: Eli Lilly's Mounjaro and Zepbound drugs achieved sales increases of 99% and 175% respectively in 2025; however, such growth may not be sustainable, introducing uncertainty into the company's future performance.

- Market Share Risk: These two GLP-1 drugs account for 56% of Eli Lilly's total revenue, and with patent protections set to expire, the company may face a substantial revenue gap that could impact its long-term financial health.

- Competitor Dynamics: While Novo Nordisk and Pfizer lag in the GLP-1 market, Novo Nordisk recently launched an oral GLP-1 medication, and its dividend yield stands at 4.9%, indicating its ongoing competitiveness in the market.

- Investor Sentiment Analysis: Despite Eli Lilly's stock price surging due to market enthusiasm, resulting in a high P/E ratio of 44 and a meager dividend yield of 0.6%, analysts suggest that investors consider competitors like Novo Nordisk and Pfizer for potentially better returns.

See More