Reasons to Reconsider Consumer Staples ETFs Now

Economic Uncertainty and Consumer Confidence

- Rising Inflation Expectations: In August, consumers' 12-month inflation expectations rose to 4.9% from 4.5%, while long-term expectations increased to 3.9% from 3.4%. The Conference Board reported a similar trend, with average expectations climbing to 6.2% from 5.7%.

- Consumer Sentiment Decline: The University of Michigan's Consumer Sentiment Index fell to 58.6 in August from 61.7 in July. The Conference Board's Consumer Confidence Index also dropped to 97.4 from 98.7, indicating growing concerns about a potential U.S. recession.

Market Reactions and Investment Strategies

- Investor Caution: Fed Chair Jerome Powell's comments at the Jackson Hole Symposium heightened inflation concerns, leading to increased investor caution and anxiety about stagflation risks.

- Defensive Investment Approach: Given the economic landscape, investors are encouraged to increase exposure to consumer staples, which can provide stability and protection during market downturns. The S&P 500 Consumer Staples Index has gained 3.28% year-to-date.

Consumer Staples Investment Options

- Top ETFs for Consumer Staples: Recommended funds include the Consumer Staples Select Sector SPDR Fund (XLP), Vanguard Consumer Staples ETF (VDC), and iShares U.S. Consumer Staples ETF (IYK). XLP is noted for its liquidity with an average trading volume of 16.08 million shares and an asset base of $15.79 billion.

- Performance and Fees: While VDC has shown strong performance over the past year with a 6.66% gain, FSTA and XLP are the most cost-effective options for long-term investors, charging only 0.08% in annual fees.

Economic Outlook

- Projected Economic Slowdown: The Conference Board anticipates a slowdown in the economy in the second half of 2025, with real GDP growth expected to moderate from 1.6% this year to 1.3% next year. This outlook reinforces the need for investors to adopt a more defensive strategy.

Trade with 70% Backtested Accuracy

Analyst Views on XLP

About the author

- Market Concerns: The article discusses the current market anxieties related to the escalating conflict in the Middle East, tariffs, and advancements in artificial intelligence.

- Investment Strategy: It suggests that consumer-staples stocks may provide a safe haven for income investors during these turbulent times.

- Impact on Supply Chains: The Iran conflict may disrupt global supply chains, leading to logistical challenges for businesses.

- Rising Costs: Increased energy and freight costs are anticipated as a result of the conflict, affecting various industries.

- Consumer Demand Pressure: The situation could weaken consumer demand, particularly impacting U.S. consumer staples companies.

- Economic Implications: Overall, the conflict poses significant economic risks that could ripple through multiple sectors.

Current State of AI Trade: The AI trade is experiencing fluctuations, with some sectors showing growth while others face challenges, leading to debates about its viability.

Market Dynamics: Factors such as technological advancements, regulatory changes, and competition are influencing the AI market, impacting investment and development strategies.

Future Prospects: Experts are divided on the future of AI trade, with some predicting a resurgence driven by innovation, while others caution about potential market saturation.

Investment Trends: There is a noticeable shift in investment patterns, with a focus on sustainable and ethical AI solutions, reflecting changing consumer and regulatory expectations.

- Investment Opportunities: The current market conditions favor dividend stocks, providing opportunities for income-seeking investors.

- Strategies for Investors: There are various strategies available for investors to capitalize on the potential growth of dividend stocks.

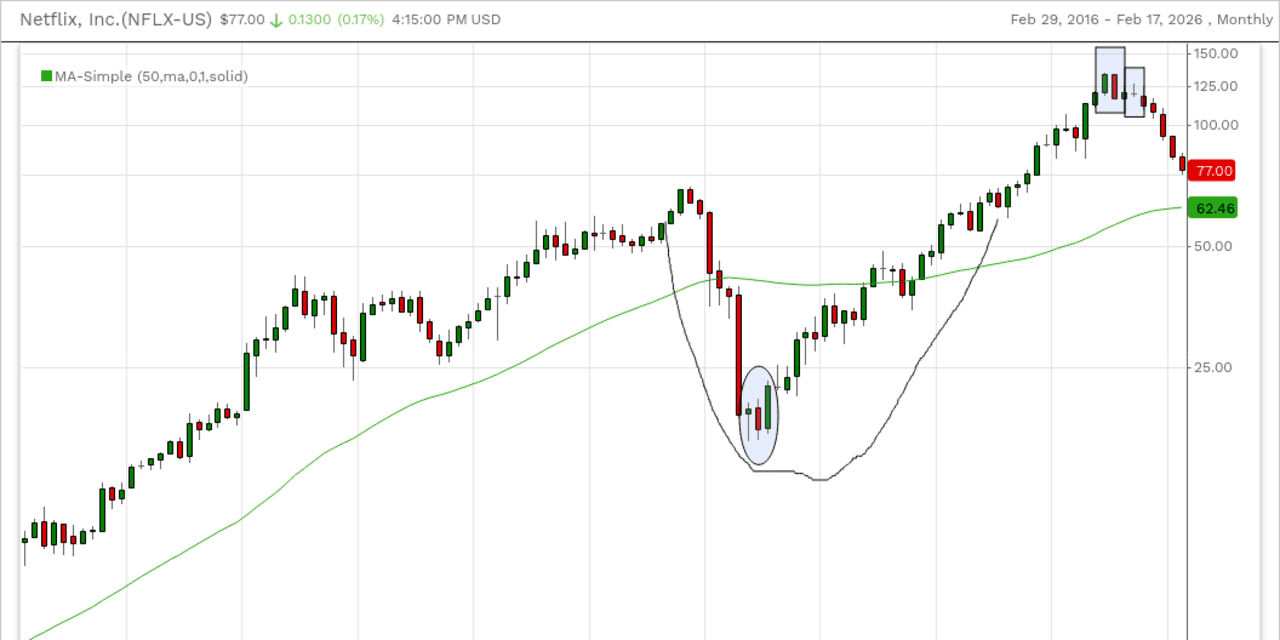

Market Cycles: Markets operate in cycles, indicating that trends and leadership positions are temporary.

Leadership Rotation: Leadership within markets rotates, consolidates, and eventually reemerges over time.

Market Performance: Consumer staples stocks have experienced a significant rally in 2026, indicating strong market performance in this sector.

Investment Opportunities: Despite the rally making it challenging to find undervalued stocks, there are still investment opportunities available for those willing to search.