Pharma ETF (FTXH) Reaches Record 52-Week Peak

ETF Performance: The First Trust NASDAQ Pharmaceuticals ETF (FTXH) has reached a 52-week high, increasing 37.2% from its low of $23.29/share, attracting investor interest for potential momentum.

Market Drivers: The pharmaceutical sector is experiencing a resurgence due to favorable regulatory changes, improved funding conditions from Fed rate cuts, and the growing integration of AI in healthcare.

ETF Ranking and Outlook: FTXH holds a Zacks ETF Rank #3 (Hold) and shows a positive weighted alpha of 21.53, suggesting the possibility of continued strong performance in the near term.

Additional Resources: Zacks Investment Research offers a free newsletter with actionable insights and top-performing ETFs, along with a report on the "7 Best Stocks for the Next 30 Days."

Trade with 70% Backtested Accuracy

Analyst Views on FTXH

About the author

ETF Performance: The First Trust NASDAQ Pharmaceuticals ETF (FTXH) has reached a 52-week high, increasing 37.2% from its low of $23.29/share, attracting investor interest for potential momentum.

Market Drivers: The pharmaceutical sector is experiencing a resurgence due to favorable regulatory changes, improved funding conditions from Fed rate cuts, and the growing integration of AI in healthcare.

ETF Ranking and Outlook: FTXH holds a Zacks ETF Rank #3 (Hold) and shows a positive weighted alpha of 21.53, suggesting the possibility of continued strong performance in the near term.

Additional Resources: Zacks Investment Research offers a free newsletter with actionable insights and top-performing ETFs, along with a report on the "7 Best Stocks for the Next 30 Days."

Eli Lilly's Influence on Healthcare ETFs: Eli Lilly has become a significant driver in the pharmaceutical ETF market, with around 15 ETFs allocating double-digit weights to the company, making it a key player in healthcare fund performance.

Strong Q3 Performance: In Q3, Eli Lilly reported a 54% year-over-year revenue increase, surpassing Wall Street expectations, and raised its full-year sales and EPS guidance, solidifying its status as a growth engine in the sector.

Major ETF Allocations: Leading ETFs like iShares US Pharmaceuticals ETF and VanEck Pharmaceutical ETF have substantial allocations to Lilly, with weights of 26.9% and 24.1% respectively, indicating a strong reliance on the stock for performance.

Concerns Over Concentration: While Eli Lilly's growth is beneficial for investors, there are concerns about the potential over-dependence of ETFs on a single stock, as Lilly's performance continues to significantly impact the broader pharmaceutical ETF market.

Third-Quarter Earnings Performance: The medical sector, particularly large-cap pharmaceutical companies, reported strong third-quarter results with over 82% of participants showing 4.3% earnings growth and 10.7% revenue growth, alongside high earnings and revenue beat ratios of 91.8% and 83.7%, respectively.

Notable Company Performances: Major pharmaceutical companies like Johnson & Johnson, Eli Lilly, and Merck exceeded earnings expectations, with Eli Lilly showing a remarkable 54% revenue increase year-over-year, while Pfizer's earnings declined but still beat estimates.

Pharmaceutical ETFs Performance: Several major pharmaceutical ETFs, including iShares U.S. Pharmaceuticals ETF and VanEck Vectors Pharmaceutical ETF, experienced positive performance over the past month, with gains ranging from 3.5% to 8.7%.

Outlook and Guidance Adjustments: Companies like Bristol-Myers Squibb and AbbVie raised their revenue guidance for 2025, while others like Pfizer and Merck adjusted their earnings forecasts, reflecting a generally optimistic outlook for the sector despite some year-over-year declines.

Critique of Pharmacy Benefit Managers: Eli Lilly CEO Dave Ricks criticized pharmacy benefit managers (PBMs) for inflating insulin prices, claiming they profit from the difference between high list prices and low net prices, which harms uninsured patients.

Response to Price Inflation: Ricks noted that despite Lilly's efforts to introduce a low-cost insulin option, PBMs resisted these changes, prompting the company to create LillyDirect, a direct-to-consumer platform to bypass the PBM system.

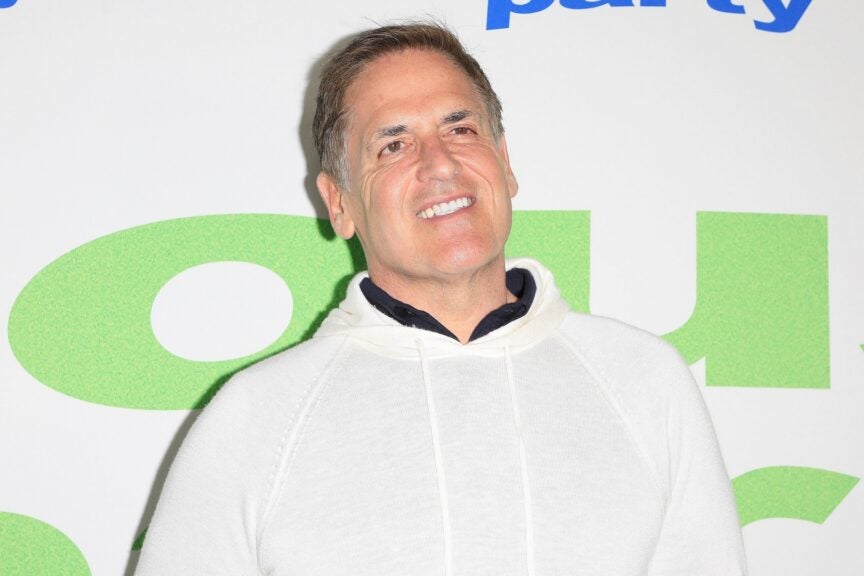

Industry Support Against PBMs: Ricks' views align with those of industry disruptors like Mark Cuban, who also condemned PBMs for their role in escalating healthcare costs, indicating a growing challenge to the PBM business model.

Eli Lilly's Stock Performance: Following these developments, Eli Lilly's stock has shown positive performance, closing higher and reflecting a strong price trend over the year, despite a poor value ranking.

Impact of Proposed Tariffs: Economist Justin Wolfers argues that President Trump's proposed 100% tariffs on foreign pharmaceuticals will ultimately increase costs for American patients and insurers, particularly for patented drugs with no competition.

Criticism from the Pharmaceutical Industry: The Pharmaceutical Research and Manufacturers of America (PhRMA) warns that the tariffs will divert funds away from American manufacturing and the development of new treatments, despite the potential for a surge in domestic manufacturing investment.

Burden on Vulnerable Patients: While generic drugs are exempt from the tariffs, those relying on specialized, foreign-made brand-name medications are expected to face significant price increases, leading to a "meaningful commercial hit" for U.S. consumers.

Market Reactions: Despite the proposed tariffs, major pharmaceutical companies like Eli Lilly and Pfizer may benefit from the policy shift, while broader market indices such as the S&P 500 and Nasdaq 100 have shown positive performance.

Mark Cuban's Critique of the Drug Industry: Mark Cuban criticized the U.S. prescription drug industry on social media, accusing wholesalers and Pharmacy Benefit Managers (PBMs) of manipulating prices through anti-competitive practices that inflate costs for consumers.

Opaque Pricing Mechanisms: Cuban explained how pharmacies are coerced into exclusive purchasing agreements with wholesalers, leading to artificially inflated prices and complicated rebate schemes that ultimately disadvantage patients and make the system difficult to navigate.