New Found Gold Issues Stock Options and Restricted Share Units

Stock Options and RSUs Granted: New Found Gold Corp. has granted 809,167 stock options and 2,053,000 restricted share units to directors and officers, with specific vesting provisions and an exercise price of $2.97 for the options.

Project Expansion and Recent Developments: The company is focused on growth, having entered agreements to acquire additional shares and mineral claims that could increase the size of its Queensway project by up to 33%, while continuing to report new discoveries from ongoing drilling.

Trade with 70% Backtested Accuracy

Analyst Views on NFGC

About NFGC

About the author

- Earnings Disappointment: PennyMac Financial Services reported quarterly earnings of $1.96 per share, significantly missing the analyst consensus estimate of $3.24, indicating a notable decline in profitability that could undermine investor confidence.

- Sales Miss: The company's quarterly sales totaled $538.005 million, falling short of the analyst consensus estimate of $642.528 million, reflecting weak market demand that may pressure future performance.

- Stock Price Volatility: Following the earnings report, PennyMac's shares plummeted 21.8% to $117.00 in pre-market trading, highlighting investor concerns over financial health that could trigger broader market reactions.

- Market Sentiment Impact: Despite a 0.1% gain in Dow futures, PennyMac's negative earnings report may influence other financial stocks, affecting investor risk appetite amid overall market instability.

- Drill Program Launch: New Found Gold has initiated its 2026 drill program at the 100%-owned Queensway Gold Project, with four rigs currently active focusing on resource conversion drilling to support the mine plan outlined in the 2025 preliminary economic assessment.

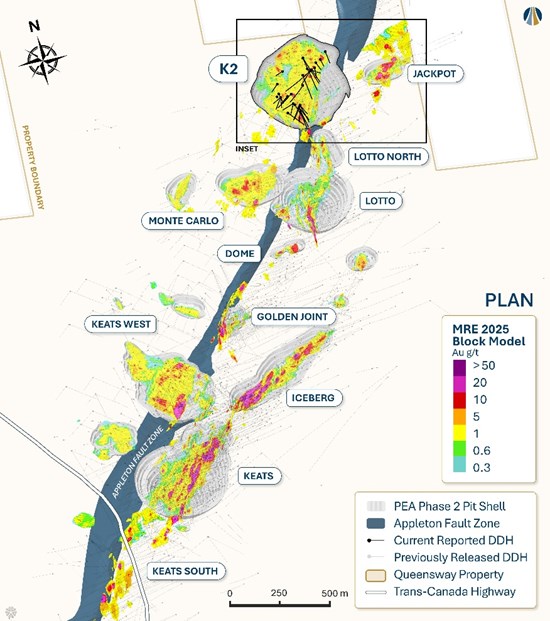

- K2 Zone Mineralization Results: The infill drilling results from the K2 zone in 2025 demonstrate consistent and continuous gold mineralization, with a peak of 18.9 g/t, indicating significant resource growth potential that may impact future resource updates.

- Drilling Depth and Scope: Gold mineralization at K2 has been defined to a maximum vertical depth of 250 meters, with multiple areas intersecting beyond the initial mineral resource model, showcasing the project's expansion potential.

- Regional Exploration Progress: In addition to drilling, regional exploration is underway, with soil sampling programs advancing to generate new trenching and drilling targets, expected to further develop in 2026 and beyond.

- Acquisition Proposal: Cintas Corporation has proposed to acquire UniFirst for $275 per share in cash, valuing the company at approximately $5.2 billion, which represents a 64% premium over its 90-day average closing price, indicating strong market confidence in UniFirst's growth potential.

- Stock Reaction: Following the announcement, UniFirst's stock surged 21.8% to $207.50, reflecting investor optimism regarding the acquisition and enhancing the company's market position within the industry.

- Market Impact: This acquisition proposal could not only alter UniFirst's strategic direction but also trigger further M&A activity among competitors, intensifying market competition.

- Financial Outlook: Cintas's intent to acquire signals confidence in UniFirst's financial health and market performance, potentially providing UniFirst with stronger resource support and opportunities for market expansion.

U.S. Stock Market Performance: U.S. stocks declined, with the Dow Jones dropping approximately 250 points on Monday.

Leggett & Platt Acquisition Proposal: Leggett & Platt Inc shares surged 13.4% to $11.64 after receiving a proposal from Somnigroup International Inc for an all-stock acquisition valued at $12.00 per share.

Notable Stock Gains: Several stocks experienced significant gains, including Coincheck Group NV (+45.4%), GDEV Inc (+33.3%), and New Fortress Energy Inc (+18%) following positive news regarding a liquefied natural gas contract.

Other Rising Stocks: Additional companies like Bausch Health Companies Inc (+15.3%) and Jyong Biotech Ltd (+14%) also saw notable increases in their stock prices.

Gold Market Dynamics: The current macroeconomic environment, characterized by high sovereign debt, central bank accumulation, and persistent inflation, has created a favorable backdrop for gold, pushing it into a structural bull market. Junior gold explorers can potentially offer significant leverage during this cycle, but success hinges on selecting the right companies with strong management and capital discipline.

Toogood Gold's Success: Toogood Gold has demonstrated remarkable exploration success since its public listing in July 2025, achieving a 100% hit rate in drilling at its Newfoundland project, with high-grade gold intercepts indicating a skilled exploration team. The company's approach emphasizes geological rigor and a proven strategy, distinguishing it from less disciplined junior mining ventures.

Newfoundland's Mining Potential: Newfoundland and Labrador have emerged as a prime location for gold mining, boasting a wealth of critical minerals and a supportive regulatory environment. The region has seen significant investments and consolidations, with companies like New Found Gold and Maritime Resources leading the charge in expanding production capabilities.

Investment Strategy: Investors are encouraged to focus on junior gold companies backed by experienced teams with a history of successful discoveries and disciplined strategies. The performance of Toogood Gold, along with the broader trend of junior miners in a bull market, highlights the potential for substantial returns when investing in well-managed exploration projects in favorable jurisdictions.