MPLY vs MOAT: How the Latest Monopoly ETF is Outperforming Established Competitors

Monopoly ETFs Overview: The rise of monopoly-themed ETFs, such as the newly launched Strategy Shares Monopoly ETF (MPLY), reflects investor interest in companies with dominant market positions and strong pricing power, which often leads to higher margins and economic rents.

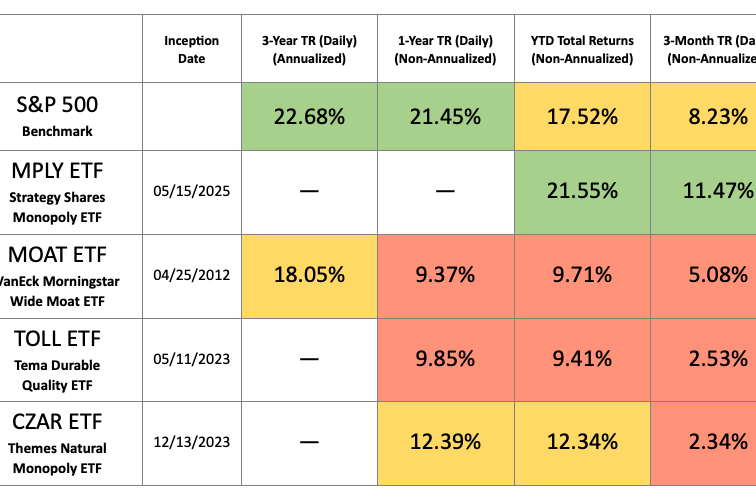

Performance Comparison: MPLY has outperformed the S&P 500 with a YTD return of +21.55% since its launch in May 2025, while the older VanEck Morningstar Wide Moat ETF (MOAT) has struggled, underperforming the S&P 500 with a 10-year annualized return of 14.47%.

Investment Strategies: MPLY focuses on large-cap stocks with monopolistic attributes without the constraints of a value strategy, while MOAT attempts to prioritize value, which has led to missed opportunities in high-performing stocks like Nvidia and Apple.

Market Dynamics: The changing stock market landscape, particularly the dominance of the "Magnificent 7" tech stocks, has rendered MOAT's value-focused approach less effective, highlighting the potential advantages of MPLY's more straightforward monopoly investment strategy.

Trade with 70% Backtested Accuracy

Analyst Views on SCHG

About the author

Overview of Featured ETFs: The article discusses ETFs that invest in top growth stocks, primarily from the tech sector, highlighting their volatility and expense ratios ranging from 0.04% to 0.2%.

Top Performing ETFs: The Invesco QQQ Trust, Vanguard Information Technology Index Fund, and Schwab US Large-Cap Growth ETF have shown significant returns, with the Vanguard fund being the top performer at 133% over three years.

Investment Risks and Diversification: While these ETFs offer strong growth potential, they also come with risks, particularly due to their heavy exposure to the tech sector, which can lead to greater volatility during market downturns.

Stock Advisor Recommendations: The article mentions that the Motley Fool's Stock Advisor has identified other stocks that may offer better returns than the featured ETFs, emphasizing the importance of considering various investment options.

Vanguard Growth ETF Performance: The Vanguard Growth ETF has shown strong average annual returns of approximately 17.4% over the past decade, focusing on large U.S. companies, particularly in technology and consumer cyclical sectors, with a low expense ratio of 0.04%.

Invesco QQQ Trust Overview: The Invesco QQQ Trust, which tracks the Nasdaq-100 index, has significantly outperformed the S&P 500 with total returns of around 456% over the last decade, driven by its heavy weighting in technology and innovative sectors, and has an expense ratio of 0.20%.

Schwab U.S. Large-Cap Growth ETF Details: The Schwab U.S. Large-Cap Growth ETF tracks the Dow Jones U.S. Large-Cap Growth Total Stock Market Index, has a low expense ratio of 0.04%, and boasts a 10-year annualized return of 18.18%, with major holdings in megacap stocks like Nvidia and Microsoft.

Investment Recommendations: The Motley Fool's Stock Advisor team has identified 10 top stocks for investment, suggesting that while growth ETFs like the Vanguard Growth ETF are solid options, there may be other stocks with higher potential returns that investors should consider.

Significant Outflows in ETFs: The Schwab U.S. Large-Cap Growth ETF experienced the largest outflow with a decrease of 27.1 million units, a 1.7% drop from the previous week, while Nvidia and Apple showed mixed performance in morning trading.

Percentage Decline in Units: The Defiance Daily Target 2X Short SMCI ETF saw the most significant percentage decline, losing 1.29 million units, which equates to a 39.9% decrease in outstanding units compared to the prior week.

Recent 13F Filings: The latest 13F filings for the 09/30/2025 reporting period show that Schwab U.S. Large-cap Growth ETF (SCHG) was held by 10 hedge funds, indicating a potential trend among fund managers.

Limitations of 13F Filings: It's important to note that 13F filings only disclose long positions, which may not fully represent a fund's overall strategy, as short positions are not required to be reported.

Changes in SCHG Holdings: From 06/30/2025 to 09/30/2025, three funds increased their SCHG positions while three decreased them, with an overall increase in aggregate holdings by approximately 6.62%, totaling 343,189,693 shares.

Future Insights: The article emphasizes the value of analyzing groups of 13F filings over time to uncover stock ideas worth further research, particularly in the context of hedge fund activities.

Investor Sentiment: Despite the Federal Reserve's cautious tone regarding rate cuts, investors showed strong optimism by pouring $37.6 billion into U.S.-listed ETFs during the week ending October 31.

Top Performing ETFs: The SPDR S&P 500 ETF Trust (SPY) led the inflows with $4.4 billion, followed closely by the Vanguard S&P 500 ETF (VOO) with $4.3 billion, indicating a strong preference for large-cap growth funds.

Tech Sector Dominance: Technology-focused ETFs, such as the Vanguard Information Technology ETF (VGT) and Invesco NASDAQ 100 ETF (QQQM), attracted significant inflows, driven by major players like Nvidia and Amazon, highlighting continued investor interest in AI-driven growth.

Market Dynamics: Despite Powell's attempts to temper market enthusiasm, investors remained focused on momentum, leading to outflows in small caps and defensive assets, while large-cap growth stocks continued to dominate the market landscape.

Monopoly ETFs Overview: The rise of monopoly-themed ETFs, such as the newly launched Strategy Shares Monopoly ETF (MPLY), reflects investor interest in companies with dominant market positions and strong pricing power, which often leads to higher margins and economic rents.

Performance Comparison: MPLY has outperformed the S&P 500 with a YTD return of +21.55% since its launch in May 2025, while the older VanEck Morningstar Wide Moat ETF (MOAT) has struggled, underperforming the S&P 500 with a 10-year annualized return of 14.47%.

Investment Strategies: MPLY focuses on large-cap stocks with monopolistic attributes without the constraints of a value strategy, while MOAT attempts to prioritize value, which has led to missed opportunities in high-performing stocks like Nvidia and Apple.

Market Dynamics: The changing stock market landscape, particularly the dominance of the "Magnificent 7" tech stocks, has rendered MOAT's value-focused approach less effective, highlighting the potential advantages of MPLY's more straightforward monopoly investment strategy.