MakeMyTrip (MMYT) Shares Rise 5.2%: Is Further Growth Ahead?

Stock Performance: MakeMyTrip (MMYT) shares rose 5.2% to $82.6, driven by increased trading volume and a 3.2% gain over the past month, reflecting optimism in the travel sector despite seasonal disruptions.

Earnings Expectations: The company is projected to report quarterly earnings of $0.43 per share, a 10.3% increase year-over-year, with revenues expected to reach $313.62 million, up 17.3% from the previous year.

Earnings Estimate Trends: The consensus EPS estimate for MMYT has remained stable over the last 30 days, indicating that stock price movements may be influenced by future earnings estimate revisions.

Industry Comparison: QuinStreet (QNST), another company in the same industry, has also maintained its EPS estimate at $0.21, with a Zacks Rank of #3 (Hold), highlighting a similar market sentiment.

Trade with 70% Backtested Accuracy

Analyst Views on MMYT

About MMYT

About the author

- AI Capability Enhancement: MakeMyTrip announced a collaboration with OpenAI to integrate its APIs into the app, aiming to enhance user travel discovery and streamline the transition from inspiration to booking, which is expected to significantly boost user engagement, particularly in Tier-2 and smaller cities.

- Increased User Interaction: The Myra interface processes over 50,000 multilingual conversations daily, indicating MakeMyTrip's leadership in AI-driven travel planning and its improved ability to respond to evolving travel intents.

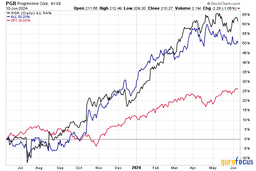

- Weak Stock Performance: Currently, MMYT shares are trading 9.1% below the 20-day simple moving average and 28.9% below the 100-day average, indicating a bearish trend in the short term, with a 44.15% decline over the past 12 months, nearing its 52-week low.

- Financial Outlook: MakeMyTrip is set to release its financial update on May 13, 2026, with an EPS estimate of 38 cents and revenue forecasted at $278.66 million, despite a high P/E ratio of 109.2, reflecting its premium valuation status.

- AI-Driven Travel Planning: MakeMyTrip's collaboration with OpenAI leverages its APIs to introduce new AI features in the app, enabling travelers to seamlessly transition from conversational inspiration to booking, enhancing user experience and strengthening market competitiveness.

- Dynamic Response to Travel Intent: By integrating OpenAI's technology, MakeMyTrip can more flexibly respond to evolving travel demands, providing structured, transaction-ready options across flights, hotels, and ancillary services, driving business growth.

- Multilingual Support with Smart Assistant: MakeMyTrip's GenAI Trip Planning Assistant, Myra, facilitates over 50,000 conversations daily in multiple languages, with significant increases in voice interactions from Tier-2 and smaller cities, broadening its user base.

- Global Expansion and Compliance: Since its inception in 2000, MakeMyTrip has served over 87 million users, expanding its operations to over 150 countries, and entering the UAE and Saudi Arabia in 2021, showcasing its global strategy and compliance capabilities.

- AI-Driven Travel Discovery: MakeMyTrip's collaboration with OpenAI integrates APIs that allow users to seamlessly transition from conversational inspiration to booking within the Myra interface, significantly enhancing user experience and strengthening market competitiveness.

- Enhanced Dynamic Response Capability: This integration enables MakeMyTrip to dynamically respond to evolving travel intents, delivering structured, transaction-ready options across flights, hotels, and ancillary services, thereby driving business growth.

- Multilingual Support Expansion: The Myra assistant facilitates over 50,000 conversations daily in multiple languages, with over 45% of queries coming from Tier-2 and smaller cities, highlighting the strategic significance of expanding the user base in underserved markets.

- Global Market Expansion: Since its inception in 2000, MakeMyTrip has served over 87 million users and expanded into the UAE in 2021 and recently Saudi Arabia, further solidifying its position in the global travel market and showcasing strong international capabilities.

- Significant Profit Decline: MakeMyTrip's Q3 profit plummeted by 73.1% to $7.3 million, or $0.07 per share, primarily due to soaring net finance costs that surged to $27.7 million from $4.8 million last year, indicating substantial financial pressure on the company.

- Adjusted Net Profit Improvement: Despite the overall profit decline, adjusted net profit rose to $50.7 million, or $0.52 per share, up $4.7 million from $46.0 million, or $0.39 per share, last year, showcasing enhanced profitability in specific areas of the business.

- Revenue Growth: Q3 revenue increased by 10.6% to $295.7 million, driven by strong travel demand in India for both domestic and international outbound travel, indicating potential market recovery and the company's competitive position in the travel sector.

- Stock Price Volatility: Following the earnings announcement, MakeMyTrip's stock fell 5.65% to $62.60, but slightly rebounded to $62.66 in pre-market trading, reflecting market caution regarding the company's future performance.

- Price Target Adjustment: Citi has cut MakeMyTrip's price target from $108 to $96 while maintaining a 'Buy' rating, indicating confidence in the company's future growth despite a cautious outlook on current performance.

- Revenue Miss: MakeMyTrip reported quarterly revenue of $295.7 million, falling short of analyst expectations of $310 million, suggesting weak market demand that could impact future investor confidence.

- Earnings Improvement: Despite the revenue miss, the company reported earnings per share of $0.07, exceeding the expected $0.01, indicating some success in cost control that may lay the groundwork for future profit growth.

- Market Reaction: MakeMyTrip's shares fell over 12% on Wednesday in response to the price target cuts, with a cumulative decline of over 34% in the past year, reflecting investor concerns about its long-term prospects.

- Oversold Signal: MakeMyTrip Ltd. (MMYT) shares have dropped to $65.53, with an RSI of 27.1, indicating that the recent heavy selling may be nearing exhaustion, prompting bullish investors to seek buying opportunities.

- Market Comparison: Compared to the S&P 500 ETF (SPY) with an RSI of 48.4, MMYT's oversold condition suggests potential for price rebound, warranting investor attention to shifts in market sentiment.

- Historical Performance: MMYT's 52-week low is $65.53 and high is $120.725, with the current trading price at $65.54, indicating the stock is hovering near its low, which may attract value investors.

- Investor Strategy: Given the current oversold condition, investors might consider buying MMYT shares as they rebound, capitalizing on potential gains from market fluctuations.