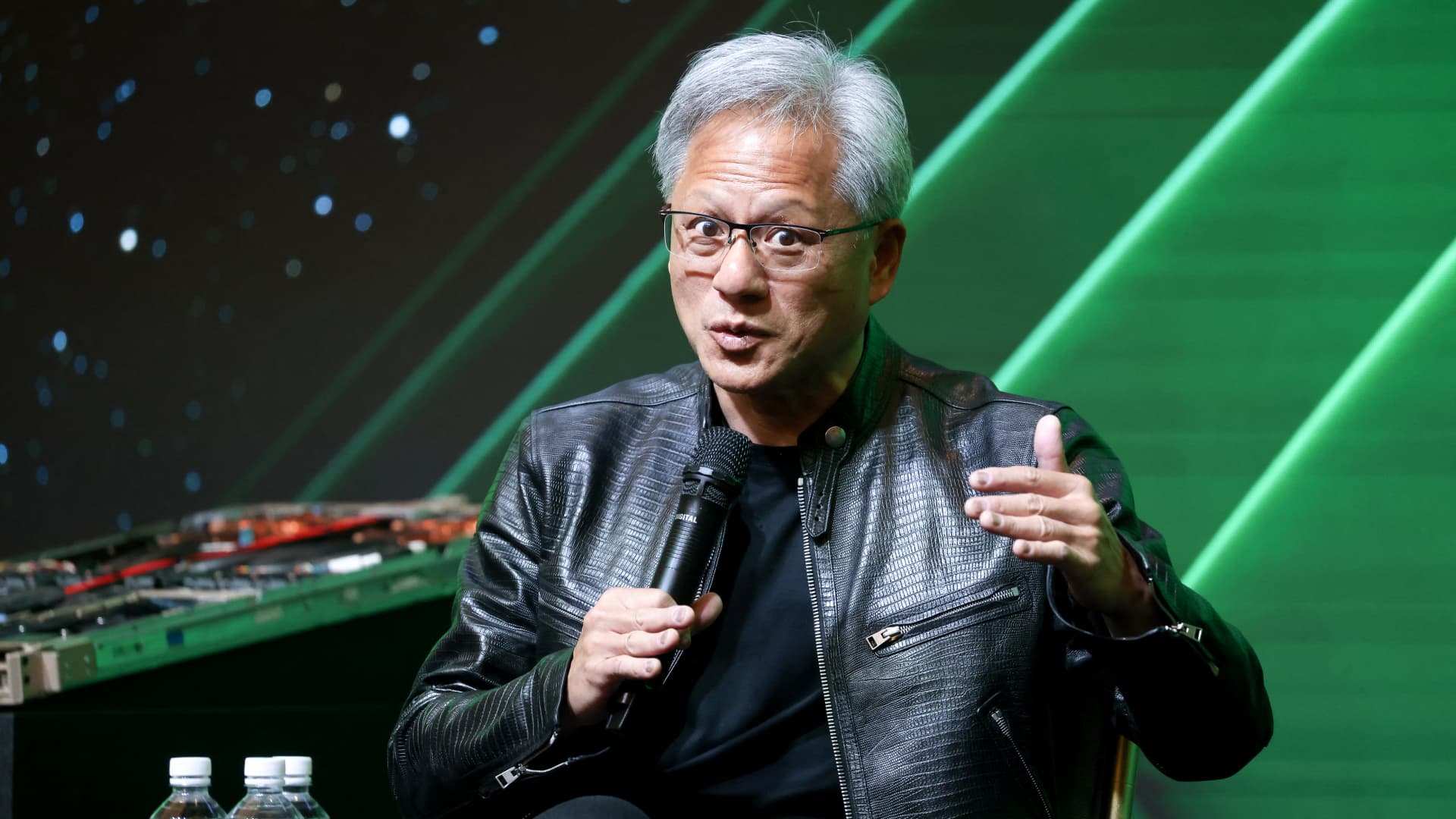

U.S. Commerce Department Says Nvidia Must Comply with Licensing Terms for China Chip Sales

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Feb 10 2026

0mins

Should l Buy NVDA?

Nvidia "must live with" the licensing terms on sales of its second most advanced AI chip to China, Commerce Department Secretary Howard Lutnick said at a hearing, Reuters' David Lawder and Alexandra Alper report. "The license terms are very detailed. They've been worked out together with the State Department, and those terms Nvidia must live with," he said. Reuters reported last week that Nvidia has not agreed to proposed conditions for use of its chips in China, including the Know-Your-Customer requirement, which ensures China's military does not access the chips.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy NVDA?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on NVDA

Wall Street analysts forecast NVDA stock price to rise

41 Analyst Rating

39 Buy

1 Hold

1 Sell

Strong Buy

Current: 180.050

Low

200.00

Averages

264.97

High

352.00

Current: 180.050

Low

200.00

Averages

264.97

High

352.00

About NVDA

NVIDIA Corporation is a full-stack computing infrastructure company. The Company is engaged in accelerated computing to help solve the challenging computational problems. The Company’s segments include Compute & Networking and Graphics. The Compute & Networking segment includes its Data Center accelerated computing platforms and artificial intelligence (AI) solutions and software; networking; automotive platforms and autonomous and electric vehicle solutions; Jetson for robotics and other embedded platforms, and DGX Cloud computing services. The Graphics segment includes GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems, and Omniverse Enterprise software for building and operating industrial AI and digital twin applications.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Earnings Growth: Nvidia's latest earnings report reveals a revenue of $68.1 billion for the quarter ending January 25, reflecting an impressive growth rate of 73%, which is exceptionally rare among tech companies, indicating robust market demand and business performance.

- Stock Price Volatility: Despite strong performance, Nvidia's stock price has declined following the earnings release, currently trading at a P/E ratio of 37, which drops to 23 based on expected earnings, highlighting market concerns over its high valuation.

- Market Position Consolidation: As the world's most valuable company with a market cap of $4.4 trillion, Nvidia maintains a strong investment appeal despite overall bearish sentiment in tech, thanks to its leadership in the AI chip sector.

- Cautious Investor Sentiment: Analysts suggest that investors should approach Nvidia with caution in the current market environment, as while its business remains strong, the likelihood of the stock doubling in value in the short term is low, necessitating realistic expectations.

See More

- Core Investment: The Vanguard Total Stock Market ETF (VTI) tracks the entire U.S. stock market and owns over 3,500 stocks, providing investors with the convenience of investing in thousands of stocks with a single click, making it ideal for those looking to simplify their investments.

- Cost Advantage: With an expense ratio of just 0.03%, investing $10,000 incurs only $3 in annual fees, significantly lowering investment costs and enhancing long-term return potential for investors.

- Long-Term Return Potential: Since its inception in 2001, the ETF has averaged a 9.2% annual total return, meaning a $10,000 investment would be worth over $90,000 today, demonstrating its effectiveness as a wealth-building tool.

- Concentration Risk and Lack of Diversification: Despite holding many stocks, the ETF's performance is heavily reliant on the top 10 companies, presenting significant concentration risk, while lacking exposure to international stocks and fixed-income assets, which may hinder portfolio diversification.

See More

- Strong Earnings Report: Adobe reported $6.2 billion in revenue for Q4, reflecting a 10.5% year-over-year increase, and total revenue for fiscal 2025 reached $23.8 billion, growing 11%, showcasing robust performance in the digital media sector despite a 38% decline in stock price over the past year.

- Robust Cash Flow: The company generated over $10 billion in operating cash flow in fiscal 2025, nearly all of which was used for share buybacks, indicating management's optimistic view on the undervaluation of its stock while reducing the share count by over 6%.

- Accelerated AI Integration: Adobe is aggressively integrating its proprietary AI model, Firefly, into its flagship applications, driving customers to upgrade to higher-tier subscriptions, with first-quarter fiscal 2026 revenue projected at $6.3 billion, translating to approximately 9.9% year-over-year growth.

- Attractive Valuation: Despite facing competitive risks from AI, Adobe's stock is currently trading at about 16 times earnings, suggesting that the market may be overly pessimistic about its future growth; given its strong customer base and cash-generating capabilities, the current valuation may present a compelling buying opportunity for investors.

See More

- Stock Price Fluctuation: IREN shares fell about 5% in Wednesday's after-market session after rising nearly 13% during regular trading, indicating market divergence regarding its future performance.

- AI Cloud Revenue Forecast: The company forecasts an annualized revenue of $3.7 billion from its AI Cloud segment this year, bolstered by the purchase of 50,000 advanced gaming processing units (GPUs) from Nvidia, increasing total capacity to 150,000 units and solidifying its market position.

- Impact of Financing Plans: IREN plans to raise up to $6 billion through an at-the-market stock offering to fund its expansion, which has pressured the stock price; however, retail investors remain optimistic about the company's growth prospects.

- Retail Investor Sentiment Shift: On Stocktwits, retail investor sentiment flipped from 'bearish' to 'bullish', as traders believe the company's expansion efforts will lead to explosive growth, reflecting confidence in its investments in AI infrastructure.

See More

- Strong Earnings Report: Broadcom's fiscal Q1 2026 revenue reached $19.31 billion, surpassing the $19.18 billion consensus forecast with a 29% year-over-year increase, indicating robust growth potential in the AI chip sector.

- Improved Profitability: Adjusted earnings per share (EPS) rose 28% to $2.05, exceeding expectations of $2.03, while adjusted EBITDA grew 30% to $13.13 billion, further boosting investor confidence.

- Optimistic Future Outlook: Broadcom projects AI chip revenue to exceed $100 billion by 2027, having secured the necessary supply chain, reflecting strong confidence in future demand, particularly with a positive relationship with OpenAI.

- Shareholder Return Plan: The company announced a newly authorized $10 billion share repurchase program, which, combined with strong financial performance and an optimistic outlook, enhances market confidence in Broadcom's stock.

See More

- Market Share Comparison: Nvidia commands an impressive 86% market share in AI data center revenue, compared to AMD's mere 7%, highlighting Nvidia's dominant position in the data center processor market, which is likely to attract more customers in the future.

- Major Deal Impact: AMD's agreement with Meta to supply up to 6 gigawatts of AI data center processing, valued at over $100 billion, represents a significant win for AMD; however, its high stock valuation raises concerns among investors.

- Financial Performance Divergence: Nvidia's recent Q4 fiscal 2026 results revealed a 65% increase in sales to nearly $216 billion, with adjusted earnings rising 60% to $4.77 per share, indicating strong growth momentum in the AI sector.

- Valuation Comparison: Nvidia's P/E ratio stands at 53, which, while above the tech sector average, is significantly lower than AMD's 101, making Nvidia a more attractive investment in the AI stock landscape given its robust financial performance.

See More