Lakeland Financial (LKFN) Announces 4% Increase in Quarterly Cash Dividend to $0.52 per Share

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 13 2026

0mins

Should l Buy LKFN?

Source: Globenewswire

- Dividend Increase: Lakeland Financial announces a quarterly cash dividend of $0.52 per share for Q1 2026, reflecting a 4% increase from the $0.50 per share paid in 2025, showcasing the company's strong capital foundation and disciplined financial management strategy.

- Payment Schedule: The dividend will be payable on February 5, 2026, to shareholders of record as of January 25, 2026, ensuring timely returns for investors and bolstering shareholder confidence.

- Company Background: Lake City Bank, a wholly-owned subsidiary of Lakeland Financial, boasts $6.9 billion in assets and has been serving Central and Northern Indiana communities since 1872, reinforcing its market position through community banking.

- Tech-Driven Services: With 55 branches and a robust digital banking platform, the bank prioritizes building long-term relationships with customers while delivering technology-forward solutions, enhancing customer satisfaction and competitive edge in the market.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy LKFN?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on LKFN

Wall Street analysts forecast LKFN stock price to rise

3 Analyst Rating

0 Buy

3 Hold

0 Sell

Hold

Current: 58.670

Low

66.00

Averages

66.50

High

67.00

Current: 58.670

Low

66.00

Averages

66.50

High

67.00

About LKFN

Lakeland Financial Corporation is a bank holding company, which provides, through its subsidiary Lake City Bank (the Bank), a range of financial products and services throughout its Northern and Central Indiana markets. It offers commercial and consumer banking services, and trust and wealth management, brokerage, and treasury management commercial services. It serves a diverse customer base, including commercial customers across a wide variety of industries, including commercial real estate, manufacturing, agriculture, construction, retail, wholesale, finance and insurance, accommodation and food services, and healthcare. The Bank serves Central and Northern Indiana communities with 54 branch offices in 15 counties and a robust digital banking platform. The Bank’s deposits are insured by the Federal Deposit Insurance Corporation (the FDIC) to the maximum extent provided under federal law and FDIC regulations. It also provides credit card services to retail and commercial customers.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

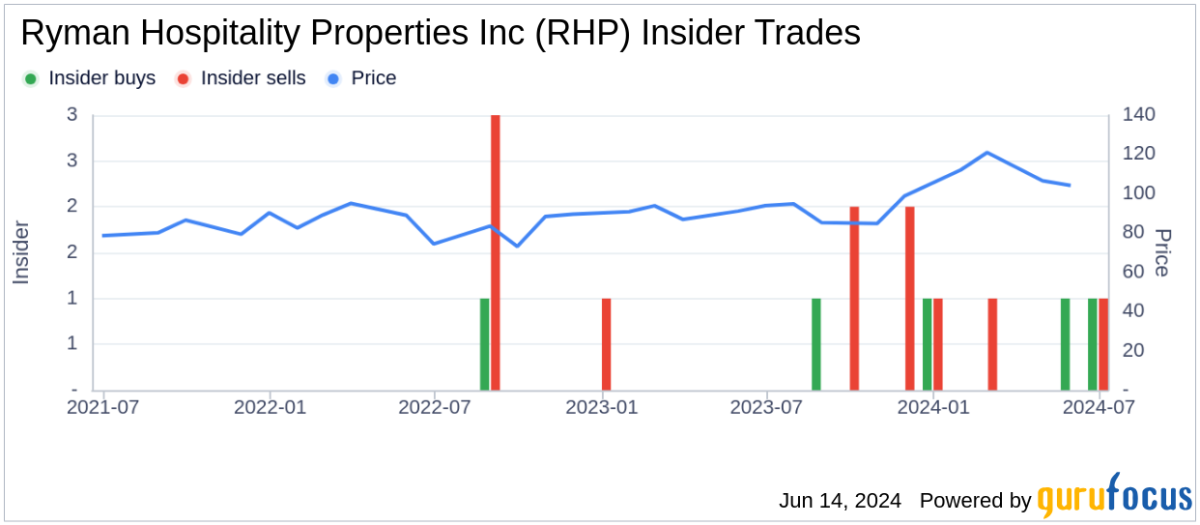

- RHP Stock Purchase: Colin V. Reed, Executive Chairman of Ryman Hospitality Properties, purchased 7,800 shares at $100.67 each on Friday, totaling $785,226, indicating strong confidence in the company's future prospects.

- Market Reaction: Despite Reed's purchase price being higher than Monday's trading low of $97.41, which is 3.2% below his purchase price, RHP's stock still rose about 0.3% on Monday, reflecting market recognition of its fundamentals.

- Welch's LKFN Purchase: M. Scott Welch, Director of Lakeland Financial, bought 10,000 shares at $57.95 each on Friday, totaling $579,500, demonstrating his optimism about the company's outlook.

- Historical Buying Activity: Prior to this latest purchase, Welch had invested a total of $920,374 in LKFN over the past year, with an average price of $61.36 per share, indicating his sustained belief in the company's long-term value.

See More

- Executive Purchase: M Scott Welch, a director at Lakeland Fin, executed a purchase of 10,000 shares on February 27, 2026, indicating his confidence in the company's future, which may enhance investor trust.

- Market Reaction: Such executive purchases are typically viewed as positive signals, potentially leading to a short-term positive impact on Lakeland Fin's stock price and attracting more investor interest.

- Investor Confidence: The purchase behavior of executives often reflects an optimistic outlook on the company's financial health, which could elevate the overall market perception of Lakeland Fin.

- Strategic Implications: By increasing his stake, Welch not only demonstrates confidence in the company's growth prospects but may also play a more active role in corporate governance, thereby driving the achievement of the company's strategic objectives.

See More

- Earnings Beat: Lakeland Financial reported a Q4 GAAP EPS of $1.16, exceeding expectations by $0.10, which underscores the company's robust profitability and boosts investor confidence.

- Significant Revenue Growth: The company achieved revenues of $69.8 million, a 9.8% year-over-year increase, surpassing market expectations by $0.25 million, indicating sustained strong demand and business expansion.

- Improved Return Metrics: Return on average equity improved to 15.59% from 13.87% year-over-year, reflecting effective capital management and enhanced profitability.

- Loan Growth and Margin Improvement: Average loans increased by $185.1 million, or 4%, to $5.27 billion, while net interest margin improved by 23 basis points to 3.48%, demonstrating the company's competitive edge in the lending market and enhanced profitability.

See More

- Quarterly Net Income Growth: Lakeland Financial achieved a record net income of $29.9 million in Q4 2025, representing a $5.7 million increase or 24% compared to Q4 2024, showcasing the company's strong profitability and market competitiveness.

- Earnings Per Share Increase: Diluted earnings per share rose to $1.16, up $0.22 or 23% from Q4 2024, reflecting the company's commitment to enhancing shareholder returns.

- Robust Annual Performance: The company reported an annual net income of $103.4 million for 2025, an 11% increase from $93.5 million in 2024, indicating sustained profitability and stable financial performance.

- Improved Capital Ratios: As of December 31, 2025, the common equity tier 1 capital ratio improved to 14.77%, up from 14.64% in 2024, demonstrating the company's strength in capital management and risk control.

See More

- Executive Promotion: Lake City Bank announces the promotion of Senior Vice President Donald J. Robinson-Gay to Executive Vice President and Chief Credit Officer, leveraging his extensive experience in the commercial lending process to enhance credit management efficiency.

- Credit Management Expertise: Robinson-Gay has served as Chief Credit Officer since 2023, previously holding key credit management positions within the bank, particularly excelling in the Fort Wayne and Warsaw markets.

- Strategic Role: As Chief Credit Officer, Robinson-Gay will oversee the bank's loan portfolio, ensuring a balance between credit quality and risk management, thereby driving sustainable loan growth and enhancing the bank's competitive position.

- Educational Background: Robinson-Gay holds an MBA from Marquette University and a bachelor's degree from Miami University, providing a solid academic foundation for his success in credit management.

See More

- Dividend Increase: Lakeland Financial announces a quarterly cash dividend of $0.52 per share for Q1 2026, reflecting a 4% increase from the $0.50 per share paid in 2025, showcasing the company's strong capital foundation and disciplined financial management strategy.

- Payment Schedule: The dividend will be payable on February 5, 2026, to shareholders of record as of January 25, 2026, ensuring timely returns for investors and bolstering shareholder confidence.

- Company Background: Lake City Bank, a wholly-owned subsidiary of Lakeland Financial, boasts $6.9 billion in assets and has been serving Central and Northern Indiana communities since 1872, reinforcing its market position through community banking.

- Tech-Driven Services: With 55 branches and a robust digital banking platform, the bank prioritizes building long-term relationships with customers while delivering technology-forward solutions, enhancing customer satisfaction and competitive edge in the market.

See More