Is AI Truly Displacing Software? A Wall Street Expert Explains Why Not.

Current State of Software Market: The software market, once a favorite for growth, is now facing challenges, with concerns about overvaluation and the sustainability of major platforms despite the ongoing AI boom.

Investment Caution: Marc Chaikin advises investors to be cautious about buying into software stocks too early, emphasizing the need for market stabilization and thorough analysis before identifying potential winners and losers.

Focus on AI and Infrastructure: The AI boom is still thriving, driven by data centers and chip reliability, which are crucial for supporting AI technologies, while the software sector is experiencing a shift in leadership and market dynamics.

Highlighted Stocks for Investment: Analysts recommend five specific stocks that are currently seen as strong investment opportunities, suggesting that these companies are well-positioned to thrive in the evolving market landscape.

Trade with 70% Backtested Accuracy

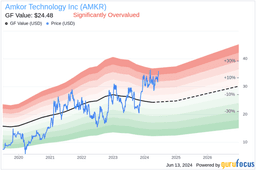

Analyst Views on AMKR

About AMKR

About the author

- Conference Participation: Amkor Technology will participate in the Morgan Stanley Technology, Media & Telecom Conference on March 3, 2026, showcasing its leadership in semiconductor packaging and testing services, which is expected to attract investor interest.

- Presentation Timing and Location: The presentation is scheduled for 8:30 AM Pacific Standard Time (11:30 AM Eastern Standard Time) in San Francisco, CA, providing opportunities for direct interaction with investors and enhancing the company's market engagement.

- Webcast and Replay: The presentation will be available via webcast and replay on the Investor Relations section of Amkor's website, ensuring that investors unable to attend in person can access key information, thereby increasing transparency.

- Company Background: Amkor Technology is the world's largest U.S.-headquartered OSAT, offering high-quality semiconductor packaging and testing solutions with a strong track record of innovation and a broad geographic footprint, supporting applications across smartphones, data centers, and artificial intelligence.

- Conference Participation: Amkor Technology (NASDAQ:AMKR) announced its participation in the Morgan Stanley Technology, Media & Telecom Conference on March 3, 2026, highlighting its leadership in semiconductor packaging and testing services, which is expected to attract investor interest.

- Presentation Schedule: The company's presentation is set for 8:30 AM Pacific Standard Time (11:30 AM Eastern Standard Time) in San Francisco, showcasing its innovative capabilities and market strategies within the industry.

- Investor Engagement: Management will be available for one-on-one and small group meetings, aimed at enhancing communication with investors, increasing company transparency, and boosting investor confidence to further drive shareholder value.

- Company Background: Amkor Technology is the world's largest U.S.-headquartered OSAT, providing high-quality semiconductor solutions with a strong track record of innovation and a broad geographic footprint, supporting advancements in technologies across smartphones, data centers, and artificial intelligence applications.

- Revenue Shortfall: Pinterest reported Q4 revenue of $1.32 billion, falling short of analyst expectations of $1.33 billion, indicating competitive pressures that may undermine future investor confidence.

- Earnings Miss: The company posted adjusted earnings of 67 cents per share, below the anticipated 69 cents, reflecting challenges in profitability that could lead to shareholder scrutiny of management.

- Significant Stock Decline: Pinterest shares plummeted 19.5% to $14.95 in pre-market trading, a drastic move that may raise concerns about the company's future performance and influence investor decisions.

- Mixed Market Sentiment: U.S. stock futures showed mixed results, with Dow futures down about 0.2%, reflecting cautious market sentiment potentially linked to Pinterest's earnings report, further exacerbating investor unease.

Current State of Software Market: The software market, once a favorite for growth, is now facing challenges, with concerns about overvaluation and the sustainability of major platforms despite the ongoing AI boom.

Investment Caution: Marc Chaikin advises investors to be cautious about buying into software stocks too early, emphasizing the need for market stabilization and thorough analysis before identifying potential winners and losers.

Focus on AI and Infrastructure: The AI boom is still thriving, driven by data centers and chip reliability, which are crucial for supporting AI technologies, while the software sector is experiencing a shift in leadership and market dynamics.

Highlighted Stocks for Investment: Analysts recommend five specific stocks that are currently seen as strong investment opportunities, suggesting that these companies are well-positioned to thrive in the evolving market landscape.

- Offering Details: Amkor Technology has announced a secondary public offering of 10,000,000 shares at a price of $48.75 per share, all sold by 915 Investments, LP, an investment vehicle for the Kim family, reflecting their confidence in the company's strategic vision.

- Shareholder Ownership: Following the offering, the Kim family will continue to own over 49% of Amkor's common stock, indicating that their status as the largest investor remains intact, which may enhance market confidence in the company's stability.

- Lock-Up Agreement Impact: The selling stockholder has entered into a 180-day lock-up agreement with the underwriter, restricting the sale of remaining shares during this period, which helps stabilize the stock price and reduce market volatility.

- Market Expectation Management: Amkor expects to enter into a clear market provision, agreeing not to sell any common stock for 75 days after the final prospectus date, aiming to maintain market confidence and ensure the successful completion of the offering.

- Secondary Offering Pricing: Amkor Technology has announced a secondary public offering of 10 million shares at a price of $48.75 per share, indicating sustained market demand for its stock, even though the company itself is not participating in the offering.

- Stable Shareholder Structure: Following the offering, the Kim family will continue to own over 49% of Amkor, reflecting their confidence in the company's strategic vision and potentially enhancing investor confidence in the company's long-term growth prospects.

- Underwriter Arrangement: Goldman Sachs is serving as the sole bookrunning manager for the offering, overseeing the entire issuance process and providing a market signal of the company's active presence in capital markets.

- Lock-Up Agreement Impact: The selling stockholder has agreed to a 180-day lock-up period post-offering, which helps stabilize the stock price and reduce market volatility, thereby creating a more favorable environment for the company's future capital operations.