Gold Rises Slightly as ISM Manufacturing PMI Declines in October

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Nov 03 2025

0mins

Should l Buy CIFR?

Source: Benzinga

U.S. Stock Market Performance: The Dow Jones fell by 0.41%, while the NASDAQ and S&P 500 saw gains of 0.54% and 0.22%, respectively, with consumer discretionary shares rising by 1.8%.

Key Economic Indicator: The ISM manufacturing PMI decreased to 48.7 in October, below market expectations, indicating a contraction in manufacturing activity.

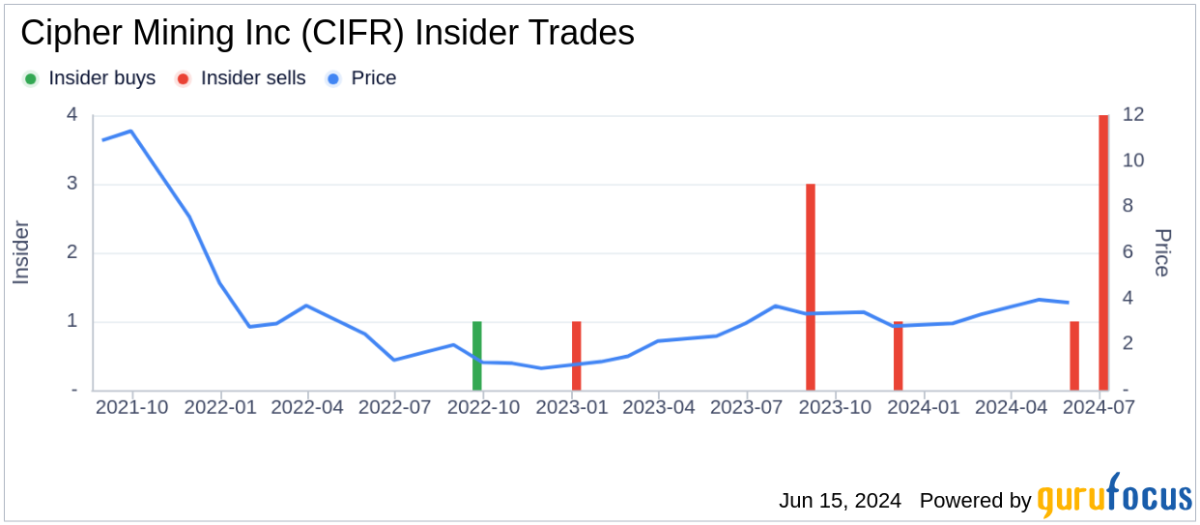

Notable Stock Movements: Cipher Mining's shares surged 22% after a major lease agreement with Amazon, while uniQure's shares plummeted 50% following negative FDA feedback on its gene therapy.

Global Market Trends: European shares were mixed, with slight gains in the eurozone, while Asian markets closed higher, led by Hong Kong's Hang Seng index.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy CIFR?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on CIFR

Wall Street analysts forecast CIFR stock price to rise

9 Analyst Rating

9 Buy

0 Hold

0 Sell

Strong Buy

Current: 13.620

Low

18.00

Averages

25.75

High

30.00

Current: 13.620

Low

18.00

Averages

25.75

High

30.00

About CIFR

Cipher Digital Inc., formerly Cipher Mining Inc., is a high-performance computing (HPC) data center developer and operator. The Company is dedicated to developing and operating industrial-scale data centers engineered for computing. Its vertical integration spans critical stages of the data center value chain, including land and power origination and interconnection, site development, data center design and construction, oversight and ongoing facility operations. It also operates and maintains energy-intensive data center facilities. Its data center portfolio consists of 4.2 gigawatts (GW) of capacity across 10 sites, at various stages of interconnection. It is engaged in developing 600 megawatts (MW) of HPC data center facilities across two sites for hyperscaler tenants and operates approximately 207 MW of power at one bitcoin mining data center in Texas. It also maintains a pipeline of approximately 3.4 GW across seven sites in Texas and one additional site in Ohio.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Strategic Shift: Bitfarms is transitioning from Bitcoin mining to AI data centers, with its board approving plans to relocate to the U.S. and rebrand as Keel Infrastructure, indicating a forward-looking approach to future market opportunities.

- Market Potential: The 15-year lease signed by Cipher Mining for 300 megawatts of AI infrastructure capacity, generating approximately $367 million annually, highlights the significant profit potential in this sector, suggesting that if Bitfarms secures similar deals, its revenue could soar.

- Energy Advantage: With a robust 2.1 gigawatts energy portfolio in North America, Bitfarms has also signed a $128 million agreement to provide 18 megawatts of data center capacity, further solidifying its market position and operational capabilities.

- Competitive Challenges: Despite the optimistic transition outlook, Bitfarms faces fierce competition from other mining operations and established data center providers, and with trailing net losses of $96 million, investors should carefully assess the associated risks before investing.

See More

- Energy Portfolio Advantage: Bitfarms boasts a 2.1-gigawatt North American energy portfolio, which can provide substantial power support for AI data centers, thereby driving revenue growth and enhancing market competitiveness.

- Strategic Transition Plan: The company's board has approved plans to relocate to the U.S. and rebrand as Keel Infrastructure, indicating a strategic focus on AI infrastructure that may attract more investor interest.

- Market Competition Pressure: Despite the significant potential for transformation, Bitfarms faces intense competition from other mining companies and established data center providers, particularly Applied Digital and Equinix, which could impact its market share and profitability.

- Financial Risk Warning: Bitfarms has already accumulated $96 million in net losses, and the high costs associated with the transition necessitate that investors carefully assess its high-risk, high-reward investment characteristics.

See More

- Bitcoin Price Surge: Bitcoin crossed the $70,000 mark in early Wednesday trading, reaching $70,906.31, which represents a 4.85% increase over 24 hours and an 8.29% rise over the past week, indicating strong market demand and a recovery in investor confidence.

- Global Market Capitalization Growth: The global crypto market capitalization reached $2.41 trillion, up 4.64% in the past 24 hours, reflecting a resurgence of investor interest in crypto assets, which may attract more capital into the sector.

- Ethereum's Strong Performance: Ethereum traded at $2,051.11, up 3.67% in 24 hours, aligning with Bitcoin's upward trend and further enhancing the overall vitality of the crypto market.

- Market Context Analysis: Crypto-related stocks jumped in premarket trading as risk assets attempted to stabilize following global volatility tied to the Middle East conflict, although oil prices remained elevated, market sentiment improved due to U.S. Navy intervention measures.

See More

- Strategic Transformation: CEO Tyler Page announced that Cipher Digital has completed its transition from a bitcoin miner to a digital infrastructure company, emphasizing a focus on providing power-dense, large-scale computing facilities to achieve stable, long-term cash flows and leases with top-tier clients.

- Financial Milestone: The company successfully completed a $2 billion bond offering that was met with exceptional investor demand, allowing it to price the new bonds at a yield 1% lower than the previous 6.125%, reflecting market confidence in its long-term lease revenues.

- Revenue Forecast: Management expects leases to generate $669 million in average annualized net operating income from October 2026 to September 2036, projecting this to rise to $754 million by 2035, indicating predictability and stability in contracted revenue streams.

- Market Demand: Despite a challenging bitcoin mining environment, Cipher reported Q4 revenue of $60 million, with management emphasizing that demand for power-dense sites remains strong, and their confidence in data center buildout and leasing continues to grow.

See More

- Earnings Performance: Cipher Mining reported an adjusted loss of 14 cents per share in Q4, missing analyst expectations of a 10-cent loss, with revenue at $59.711 million, significantly below the consensus estimate of $86.847 million, indicating challenges during the company's transformation.

- Strategic Shift: CEO Tyler Page highlighted that Cipher Digital is evolving into a leading HPC data center development company, having signed significant lease agreements with Fluidstack, Google, and Amazon, which enhances the company's market positioning.

- Capital Raising: The company successfully completed three high-yield bond offerings totaling $3.73 billion to finance its Barber Lake and Black Pearl projects, including $1.4 billion and $333 million in senior secured notes, showcasing strong capital-raising capabilities.

- Short Interest Situation: Cipher has 60.863 million shares sold short, representing 20.38% of its publicly traded float, reflecting a cautious sentiment among investors regarding its future performance, which may exacerbate stock price volatility.

See More

- Bitcoin Price Decline: Bitcoin is currently trading at $64,143, down approximately 26% year-to-date, severely threatening the profitability of most bitcoin miners, especially as their revenue has dropped to just 3 cents per hash.

- Hash Price Crash: The bitcoin hash price has fallen about 30% over the past three months, now hovering around $28 per terahash per day, directly impacting miners' earnings and pushing many into losses.

- Mining Firms' Performance Drop: Bitmine Immersion Technologies has declined by 29% in 2026, while MARA Holdings and CleanSpark are down 13% and roughly flat, respectively, highlighting the vulnerability of mining companies in the current market environment.

- Shift to High-Performance Computing: Some miners, such as Cipher Mining and TeraWulf, are pivoting their operations towards high-performance computing services to mitigate losses from bitcoin mining, with Rosenblatt analysts recommending that all miners actively transition to adapt to market changes.

See More