Elliott Investment Management Targets Structural Value, Driving Restructuring in Multiple Companies

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 26 2025

0mins

Should l Buy BILL?

Source: Benzinga

- Investment Philosophy: Elliott Investment Management has successfully achieved significant returns in sovereign debt in Argentina and Peru by focusing on capital structure and legal rights, demonstrating its ability to find opportunities in complex environments.

- Twitter Case: Elliott's investment in Twitter not only led to a board reshuffle but also applied pressure at a strategically vulnerable moment, ultimately resulting in substantial gains relative to its entry price.

- PepsiCo Investment: Elliott's multi-billion dollar stake in PepsiCo aims to drive operational efficiency and optimize capital allocation, highlighting its influence even in globally recognized brands that still have room for improvement.

- BILL Holdings Involvement: Elliott's investment in BILL Holdings reflects its emphasis on governance pressure, aiming to push the company towards profitability and strategic reset, indicating its keen insight into market sentiment.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy BILL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on BILL

Wall Street analysts forecast BILL stock price to rise

16 Analyst Rating

9 Buy

7 Hold

0 Sell

Moderate Buy

Current: 44.190

Low

42.00

Averages

54.92

High

75.00

Current: 44.190

Low

42.00

Averages

54.92

High

75.00

About BILL

BILL Holdings, Inc. provides a financial operations platform for small and midsize businesses (SMBs). The Company offers software-as-a-service, cloud-based payments, and spend and expense management products, which allow users to automate accounts payable and accounts receivable transactions, enable businesses to easily connect with their suppliers and/or customers to do business, eliminate expense reports, manage cash flows, and improve back-office efficiency. Its artificial intelligence (AI)-enabled financial software platform creates seamless connections between its customers, their suppliers, and their clients. Businesses on its platform generate and process invoices, streamline approvals, make and receive payments, manage employee expenses, sync with their accounting system, foster collaboration, and manage their cash flow. Its integrated platform also includes BILL Spend and Expense, its spend and expense management product, which provides a solution for businesses.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

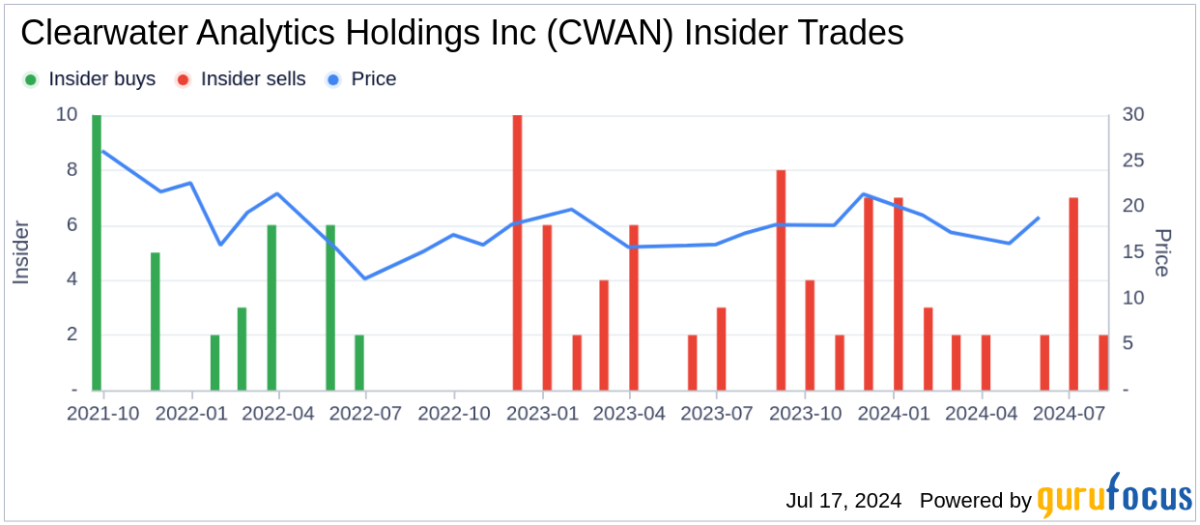

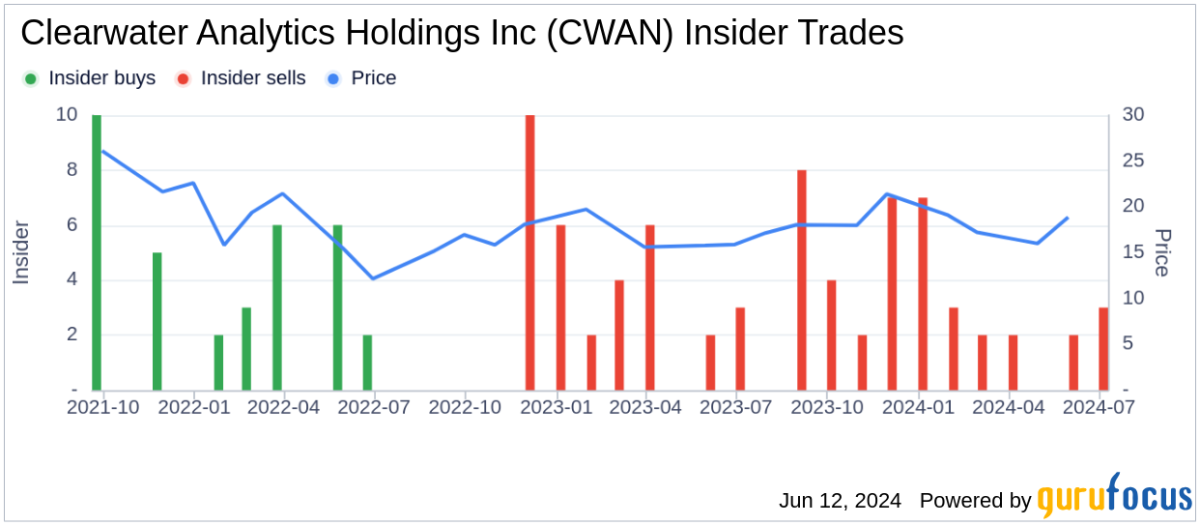

- New Investment Disclosure: According to a February 17, 2026 SEC filing, Starboard Value LP disclosed a new position in Clearwater Analytics by purchasing 9,959,031 shares valued at $240.21 million, indicating confidence in the company's growth potential.

- Asset Management Proportion: This acquisition represents 4.55% of Starboard's reportable assets under management as of December 31, 2025, highlighting the importance of Clearwater in their investment strategy and potentially influencing future allocations.

- Market Performance Analysis: As of February 17, 2026, Clearwater's shares were priced at $22.93, reflecting a 17% decline over the past year and underperforming the S&P 500 by 26.7 percentage points, which suggests market caution regarding its growth outlook.

- Business Model and Challenges: Clearwater Analytics focuses on providing automated investment data management solutions for institutional clients; while its cloud platform ensures steady recurring revenue, the complexity of client onboarding may slow margin growth, prompting investors to assess whether revenue can outpace service delivery costs.

See More

- Acquisition Overview: Starboard Value LP acquired 9,959,031 shares in Clearwater Analytics, with an estimated transaction value of $240.21 million, reflecting a new position in its investment portfolio.

- Asset Management Proportion: The newly acquired stake represents 4.55% of Starboard's 13F reportable assets under management, indicating a significant investment despite not being among the top five holdings.

- Market Performance Analysis: As of February 17, 2026, Clearwater Analytics shares were priced at $22.93, down 17% over the past year, underperforming the S&P 500 by 26.7 percentage points, raising concerns about its growth potential.

- Business Model and Challenges: Clearwater Analytics focuses on providing SaaS solutions for automated investment data management, ensuring stable recurring revenue through its subscription model, but the client onboarding process may slow margin growth, making future growth reliant on deeper usage by existing clients.

See More

- New Investment Disclosure: On February 17, 2026, Starboard Value LP disclosed a purchase of 9,959,031 shares in Clearwater Analytics, valued at $240.21 million, indicating a significant new investment that could influence market performance.

- Asset Management Proportion: This acquisition represents 4.55% of Starboard's reportable assets under management as of December 31, 2025, highlighting Clearwater's importance in its portfolio and potentially attracting more investor interest.

- Market Performance Analysis: As of February 17, 2026, Clearwater's shares were priced at $22.93, down 17.0% over the past year and underperforming the S&P 500 by 26.7 percentage points, reflecting market concerns about its future growth prospects.

- Business Model and Challenges: Clearwater Analytics focuses on automated investment data management, and while its cloud platform provides steady recurring revenue, the complexities of client onboarding and data integration may hinder margin growth, prompting investors to monitor whether revenue growth can outpace service delivery costs.

See More

- Enhanced Customer Value: Bill Holdings simplifies invoice management for small businesses through its cloud-based digital inbox, enabling clients to receive payments twice as fast, significantly improving cash flow management efficiency and enhancing its appeal in a competitive market.

- Robust Revenue Structure: Approximately 73% of the company's revenue comes from transaction fees, with only 17% from software licensing, which allows it to maintain strong revenue stability even if AI impacts customer workforces, thereby reducing business risk.

- Massive Market Potential: As of December 2025, Bill has 498,500 customers, compared to an estimated 72 million small businesses in its target market, indicating significant growth opportunities, especially given the $135 trillion in annual B2B payment volume.

- Analysts Bullish Outlook: According to The Wall Street Journal, 15 out of 24 analysts recommend buying the stock, with an average price target of $57.73, suggesting a 25% upside potential over the next 12 months, reflecting a positive market sentiment towards Bill's stock.

See More

- Profitability Shift: Bill Holdings is shifting its focus from revenue growth to profitability, with Q1 revenue at $810.4 million, reflecting a modest 12% year-over-year increase; however, this strategy has disappointed investors, contributing to an 86% decline in stock price since its 2021 peak.

- Customer Base and Market Potential: As of December 31, 2025, Bill has 498,500 customers, a small fraction of the estimated 72 million SMBs in its addressable market, yet the $135 trillion in annual B2B payment volume presents a significant growth opportunity for the company.

- Analyst Ratings Optimistic: Among 24 analysts covering Bill, 15 have issued buy ratings, with an average price target of $57.73 suggesting a 25% upside over the next 12 months, while the highest target of $84 implies an 82% potential increase.

- Software Product Advantages: Bill's cloud-based digital inbox streamlines billing processes for SMBs, enabling clients to get paid twice as fast, with 73% of revenue derived from transaction fees, providing a stable income source even as AI technology may impact customer demand.

See More

- Put Option Appeal: The current bid for the $35.00 put option is 50 cents, and if an investor sells this contract, they commit to buying the stock at $35.00 while collecting the premium, effectively lowering their cost basis to $34.50, which represents a 23% discount from the current price of $45.72, making it attractive for those interested in BILL shares.

- Yield Potential: Should the put option expire worthless, it would yield a 1.43% return on the cash commitment, or an annualized yield of 9.00%, referred to as YieldBoost, highlighting the potential attractiveness of this investment strategy.

- Call Option Returns: The $50.00 call option has a current bid of $1.20, and if an investor buys BILL shares at $45.72 and sells this call, the total return could reach 11.99% if the stock is called away at expiration, showcasing the potential profitability of this strategy.

- Risk Assessment: Current data indicates a 59% chance that the $50.00 call option will expire worthless, allowing investors to retain both their shares and the collected premium, thereby enhancing the safety and return potential of the investment.

See More