Dow Dips Over 1,000 Points; Comerica Earnings Top Views

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Apr 21 2025

0mins

Should l Buy TTGT?

Source: Benzinga

Market Overview: U.S. stocks experienced a significant decline, with the Dow Jones dropping over 1,000 points and major indices like NASDAQ and S&P 500 also falling sharply; consumer discretionary shares were notably impacted.

Company Highlights: Comerica reported better-than-expected earnings, while Upexi's shares surged by 619% due to a private placement announcement; in contrast, Thunder Power Holdings faced a 63% drop after receiving a delisting notice from Nasdaq.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy TTGT?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on TTGT

Wall Street analysts forecast TTGT stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for TTGT is 11.67 USD with a low forecast of 10.00 USD and a high forecast of 15.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

3 Analyst Rating

3 Buy

0 Hold

0 Sell

Strong Buy

Current: 5.160

Low

10.00

Averages

11.67

High

15.00

Current: 5.160

Low

10.00

Averages

11.67

High

15.00

About TTGT

TechTarget, Inc., which also refers to itself as Informa TechTarget, is a business-to-business (B2B) growth accelerator that informs, influences and connects the world’s technology buyers and sellers, helping accelerate growth from R&D to return on investment (ROI). It has scale in permissioned B2B first-party data and a unique end-to-end portfolio of data-driven solutions that services the full B2B product lifecycle, from R&D to ROI: from strategy, messaging and content development to in-market activation via brand, demand generation, purchase intent data and sales enablement. In intelligence and advisory, it offers expert analyst, data-driven intelligence products and advisory services to product managers, corporate strategists and the C-suite, challenging market strategies and sharpening product roadmaps. In brand and content, it provides expert editorial, data-driven brand products and content marketing services for brand marketers, product marketers and content marketers.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Shipment Growth: According to Omdia's latest research, global tablet shipments rose 9.8% year-on-year in 2025, reaching 162 million units, marking the highest annual shipment volume since the pandemic-driven demand surge in 2020, indicating a strong market recovery.

- Regional Performance Variance: Central and Eastern Europe emerged as the fastest-growing region in 2025, closely followed by Asia Pacific, while North America experienced a year-on-year decline; however, a healthy holiday season supported by vendor and retail discounts mitigated the overall downturn, showcasing regional market vitality.

- Key Vendor Dynamics: Apple shipped 19.63 million units in Q4 2025, capturing a 44.9% market share with a 16.5% year-on-year increase, while Samsung faced a 9.2% decline to 6.44 million units, highlighting the intense competition and shifts within the market.

- Future Outlook: As demand pressures mount in 2026, vendors will need to balance competitiveness with profitability, focusing on premium and flagship model replacement cycles, while also driving public-sector education demand in emerging markets, revealing selective growth opportunities in the market.

See More

- Shipment Growth: According to Omdia's latest research, global tablet shipments rose 9.8% year-on-year in 2025, reaching 162 million units, indicating a market recovery post-pandemic, particularly strong in the holiday quarter.

- Regional Growth Variance: Central and Eastern Europe emerged as the fastest-growing region in 2025, closely followed by Asia Pacific, while North America experienced a decline; however, holiday season promotions helped mitigate the annual drop, showcasing regional market vitality.

- Major Vendor Performance: Apple shipped 19.63 million iPads in Q4 2025, a 16.5% increase, solidifying its market leadership, while Samsung's shipments fell 9.2% to 6.44 million units, reflecting pressures from a slowing market and highlighting competitive intensity.

- Future Market Outlook: Tablet demand is expected to face pressures in 2026, requiring vendors to balance competitiveness with profitability while driving replacement cycles for premium products and addressing educational market demands to adapt to the evolving market landscape.

See More

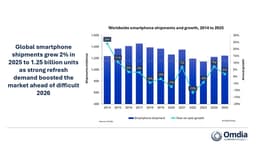

- Market Growth Trend: Global smartphone shipments reached 1.25 billion units in 2025, marking a 2% year-over-year increase and the highest annual volume since 2021, although Greater China saw a slight decline due to the fading subsidy effects.

- Apple's Strong Performance: Apple achieved its highest-ever shipment volume in 2025, with iPhone shipments growing 7% to 240.6 million units, maintaining its position as the world's largest vendor for the third consecutive year, particularly thriving in China with a 26% year-on-year growth.

- Samsung's Significant Rebound: After three consecutive years of decline, Samsung's shipments grew 7% year-on-year in 2025, culminating in a 16% increase in Q4, driven by strong flagship demand and a recovery in entry-level markets, indicating a positive shift in market share.

- Emerging Brands Rising: Nothing emerged as the fastest-growing vendor in 2025, with an 86% increase in shipments surpassing 3 million units, while vivo claimed the fourth spot for the first time, growing 4% to 105.3 million units, highlighting intensified market competition and brand diversification.

See More

- Earnings Release Schedule: TechTarget will release its Q4 and full-year financial results for 2025 after market close on March 11, 2026, highlighting the company's growth potential in the B2B technology sector.

- Call Timing and Participation: CEO Gary Nugent and CFO Dan Noreck will host a conference call at 5:00 p.m. ET on the same day, allowing investors to access financial results via the company's website and engage in discussions.

- Global Dial-In Information: The conference offers dial-in options for multiple countries, including toll-free numbers for the U.S. and U.K., ensuring global investor participation and enhancing company transparency and investor relations.

- Replay Information: A replay of the conference call will be available starting one hour after the call until April 10, 2026, allowing investors who missed the live event to access key information, further strengthening communication between the company and its investors.

See More

- Market Share Growth: Retailers are projected to increase their share of the North American TV operating system market from 27% in 2025 to 47% by 2029, indicating a strategic shift towards e-commerce-driven advertising over traditional TV shipments.

- Walmart Shipment Surge: Walmart's CastOS shipments are expected to reach 14 million units by 2027, driven by its acquisition of Vizio, which has seen its shipments rise from 4.8 million units in 2024 to 6.6 million in 2025, a 37.5% increase.

- Amazon Growth Trend: Amazon's FireTV shipments are also projected to grow from 6.1 million units in 2024 to 6.8 million in 2025, an 11.5% increase, showcasing the increasing competitiveness of retailers in the smart TV market.

- VIDAA OS Transformation: At CES 2026, VIDAA OS announced its rebranding to V Home OS and a significant partnership with Microsoft to integrate generative AI capabilities, aiming to enhance user experience and expand its role as a shopping portal.

See More

- Market Growth Potential: According to Omdia data, the Latin American media market is projected to reach $65 billion by 2026, with a year-on-year growth rate of 10.7%, significantly outpacing the US's 6.9% growth, highlighting the region's rapid rise in the global media landscape.

- Online Video Driving Growth: The expansion in LATAM is primarily driven by online video and advertising-led models, with Brazil and Mexico showing FAST service usage rates of 53% and 40%, respectively, indicating strong consumer demand for new media formats.

- Rise of Microdramas: Microdramas are expected to generate $14 billion globally by 2026, with $3 billion coming from outside China, as their low production costs and high engagement make them a core driver of mobile video consumption, threatening traditional streaming platforms' market share.

- Advertising as Growth Engine: By 2025, $42 billion of global online video expansion is attributed to ad-driven models, indicating a rapid transformation in the LATAM market where advertising strategies become a key growth engine in the media ecosystem.

See More