CEMIG (Companhia Energética de Minas Gerais) Q2 2025 Earnings Call Summary

Earnings Conference Call: Companhia Energética de Minas Gerais (CEMIG) held its Q2 2025 earnings conference call on August 18, 2025, featuring key executives including CEO Reynaldo Passanezi Filho and CFO Andrea Marques de Almeida.

Investment Program: The company is currently executing its largest investment program to date, with reported investments reaching BRL 2.7 billion.

Investor Relations: The call included a welcome from Carolina Senna, the Superintendent of Investor Relations, who provided information about accessing the recorded video conference and simultaneous interpretation options.

Executive Team Participation: The conference featured participation from various members of CEMIG's executive team, highlighting the company's commitment to transparency and communication with investors.

Trade with 70% Backtested Accuracy

Analyst Views on CIG

No data

About CIG

About the author

- EPS Revision Overview: As earnings season approaches, analysts have shown a negative trend in earnings revisions for utility companies, with Companhia Energética de Minas Gerais (CIG) receiving an FM grade, indicating declining market confidence in its near-term performance.

- Bottom-Ranked Companies: Middlesex Water (MSEX), ReNew Energy Global (RNW), and UGI (UGI) all received F grades, reflecting analysts' pessimistic outlook on their profitability, which could adversely affect their stock performance.

- Other Affected Firms: Chesapeake Utilities (CPK), Enel Chile (ENIC), and Pampa Energía (PAM) also face D grades, suggesting that their earnings expectations have not met market forecasts, potentially leading to diminished investor confidence.

- Market Outlook Analysis: In the context of the 2026 market rotation, investors should monitor the performance of these utility companies to avoid potential risks in future investment decisions.

- Reinvestment Distribution Confirmation: CI GAM confirms the reinvested capital gains distributions for 2025 across multiple ETFs, expected to be reinvested on December 31, 2025, ensuring that the number of units held by investors remains unchanged, thereby protecting long-term investor interests.

- Tax Implications Explained: Although the reinvested distributions will not be paid in cash, investors holding units will need to report taxable amounts, and the adjusted cost base of their investments will increase, impacting their tax planning and future returns.

- Distribution Amount Details: For instance, the CI Galaxy Blockchain Index ETF has a confirmed capital gains distribution of $10.80 per unit, with a distribution rate of 25.12%, indicating strong performance in the digital asset space, which may attract more investor interest.

- Market Reaction Expectations: This confirmation of reinvested distributions replaces previous estimates and is expected to enhance investor confidence in CI GAM, potentially leading to positive impacts on the market performance of its ETFs and further solidifying its position in the investment management industry.

- Cash Distribution Announcement: CI GAM has announced cash distributions to be paid on or before December 31, 2025, to unitholders of record on December 23, 2025, highlighting the company's commitment to investor returns.

- Distribution Amount Details: For instance, the CI Canadian Equity Index ETF will distribute $0.1733 per unit, while the CI Balanced Growth Asset Allocation ETF will distribute $0.0822 per unit, reflecting the company's ability to generate stable returns across a diversified portfolio.

- Investor Support Measures: CI GAM offers a Distribution Reinvestment Plan (DRIP) that allows investors to automatically reinvest cash distributions into the respective ETFs, thereby enhancing the potential for long-term returns for investors.

- Market Positioning: As one of Canada's leading investment management firms, CI GAM is dedicated to providing a comprehensive suite of investment solutions, serving over 1.3 million investors, which further solidifies its competitive position in the market.

Validea's Low PE Investor Model: Today's upgrades for Validea's Low PE Investor model, based on John Neff's strategy, highlight several stocks with improved ratings due to strong fundamentals and valuations, including Edison International, Mercantile Bank Corp, and others.

Edison International (EIX): This large-cap value stock in the Electric Utilities industry saw its rating increase from 58% to 77%, indicating growing interest based on its fundamentals and valuation.

Mercantile Bank Corp (MBWM): A small-cap value stock in the Money Center Banks industry, its rating improved from 60% to 79%, reflecting positive changes in its underlying fundamentals and stock valuation.

Asbury Automotive Group Inc (ABG): This mid-cap value stock in the Retail (Specialty) industry also experienced a rating increase from 62% to 81%, suggesting strong interest based on its financial performance and valuation metrics.

Earnings Conference Call: Companhia Energética de Minas Gerais (CEMIG) held its Q2 2025 earnings conference call on August 18, 2025, featuring key executives including CEO Reynaldo Passanezi Filho and CFO Andrea Marques de Almeida.

Investment Program: The company is currently executing its largest investment program to date, with reported investments reaching BRL 2.7 billion.

Investor Relations: The call included a welcome from Carolina Senna, the Superintendent of Investor Relations, who provided information about accessing the recorded video conference and simultaneous interpretation options.

Executive Team Participation: The conference featured participation from various members of CEMIG's executive team, highlighting the company's commitment to transparency and communication with investors.

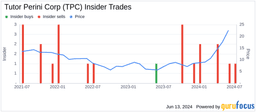

Validea's Contrarian Investor Model: The model, based on David Dreman's strategy, identifies unpopular mid- and large-cap stocks with improving fundamentals; Energy of Minas Gerais Co (CIG) received a rating increase from 84% to 91%, indicating strong interest.

Company Overview: Energy of Minas Gerais Co is a Brazilian holding company primarily focused on the distribution and commercialization of electrical energy, along with gas distribution and energy generation services.