Bond ETFs Outshine Equities In Weekly Flows As Rate Cut Bets Build

Investor Trends in ETFs: U.S.-listed ETFs saw nearly $19 billion in inflows during the week ending August 8, primarily driven by fixed income investments, particularly bond ETFs which attracted $15.3 billion, reflecting a defensive market sentiment amid expectations of Federal Reserve rate cuts.

Market Outlook and Preferences: While bonds dominated the inflows, some equity ETFs like the Communication Services Select Sector SPDR Fund and Vanguard S&P 500 ETF also received significant attention, indicating selective buying as investors navigate geopolitical tensions and economic uncertainties.

Trade with 70% Backtested Accuracy

Analyst Views on XLC

About the author

- Revisiting Stock Picks: Analyzing past stock recommendations can uncover new investment opportunities rather than just assessing their historical performance.

- Investment Insights: Old stock calls may provide valuable insights into current market trends and potential future gains.

- Strategic Analysis: Investors can benefit from a strategic review of previous picks to inform their current investment strategies.

- Market Dynamics: Understanding how past selections performed can help investors navigate changing market conditions effectively.

Market Cycles: Markets operate in cycles, indicating that trends and leadership positions are temporary.

Leadership Rotation: Leadership within markets rotates, consolidates, and eventually reemerges over time.

- Recent Damage in Technology: The technology sector, especially software, has experienced significant and noticeable damage recently.

- Market Performance: Following three years of over 20% gains for the Nasdaq, a market correction was anticipated.

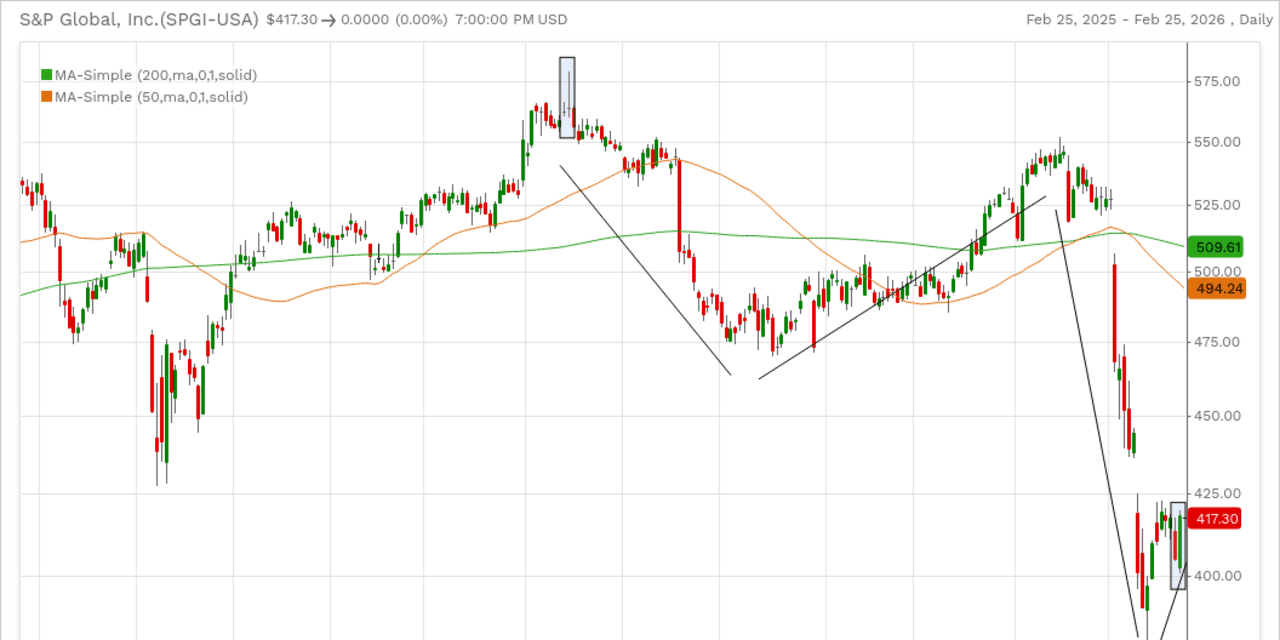

Market Performance: The U.S. stock market has shown broad gains recently, indicating a positive outlook as we approach 2026.

Tech Sector Importance: The S&P 500's ability to continue rallying may be hindered without significant contributions from the technology sector, especially in light of the ongoing artificial intelligence boom.

Sector Analysis: Bespoke Investment Group conducted an analysis of the S&P 500 and its 11 sectors, highlighting the critical role of technology in the index's performance.

Future Outlook: The reliance on the tech sector suggests that its performance will be a key factor in the overall market trajectory moving forward.

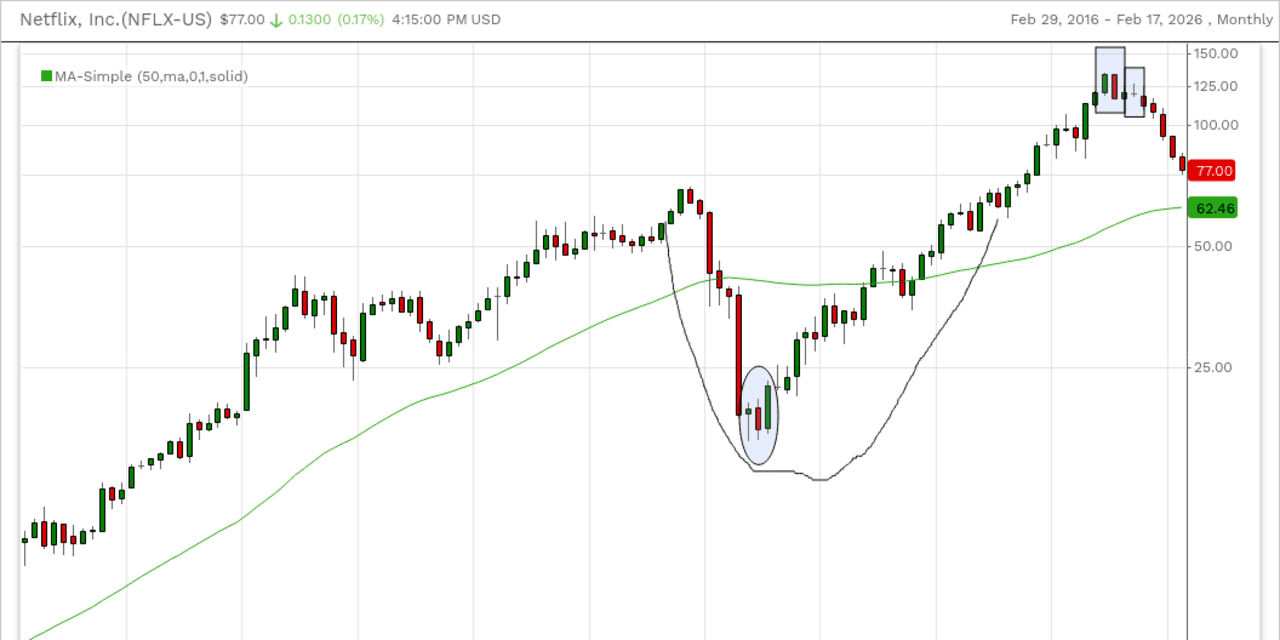

XLC's Bullish Formation: The State Street Communication Services Select Sector SPDR ETF (XLC) is showing a bullish setup with a potential breakout above a key level, which could lead to new all-time highs.

Sector Composition: The communication services sector, comprising about 10.5% of the S&P 500, is heavily influenced by a few mega-cap stocks, particularly Alphabet, Meta, Netflix, and Disney, which together account for nearly 40% of XLC.

Recent Performance Drivers: Recent strength in XLC has been attributed to stocks like TKO Group, Fox Corp., Warner Bros. Discovery, and Comcast, which have been making higher highs and lows, contributing to the ETF's upward movement.

Breakout Potential: For XLC to achieve a significant breakout, it must surpass the 118 level, which would enhance the likelihood of a sustained upward trend across the sector.

Stock Opportunities: Former stock ideas are gaining attention again, presenting new buying opportunities for investors.

Technical Levels: These stocks have broken out and are maintaining key technical levels while retesting previous launch points.

Market Sentiment: Price action indicates that buyers are returning as selling pressure diminishes, suggesting a potential for further advances.

Featured Stocks: The article highlights three standout stocks that are discussed in detail in this week's column.