BNP Paribas Lowers Verizon Stock (VZ) Price Target Amid Lackluster Leadership Changes

Price Target Cut: BNP Paribas has downgraded Verizon's stock from Outperform to Neutral, lowering the price target to $44 per share, which still indicates an 8% upside potential.

Leadership Change Concerns: The appointment of Dan Schulman as the new CEO has raised questions about Verizon's strategic direction, especially as the company faces subscriber losses amid competition.

Mixed Analyst Opinions: While some analysts, like TD Cowen, view the leadership change positively and have raised their price targets, others, including BNP Paribas, express skepticism about Verizon's market defense strategies.

Current Market Consensus: Verizon's shares hold a Moderate Buy consensus rating, with an average price target of $48.03, suggesting a potential growth of about 19% from current levels.

Trade with 70% Backtested Accuracy

Analyst Views on ASTS

About ASTS

About the author

- Significant Revenue Growth: AST SpaceMobile's Q4 revenue surged 2731% year-over-year to $54.3 million, significantly exceeding analysts' expectations of $39.5 million, indicating the company's robust market performance and growth potential.

- Sales Forecast Upgrade: Roth Capital raised AST SpaceMobile's 2027 sales estimate to nearly $1 billion, anticipating that increasing mobile network operator activity and government opportunities will drive revenue growth, highlighting the company's strengthening strategic position in the industry.

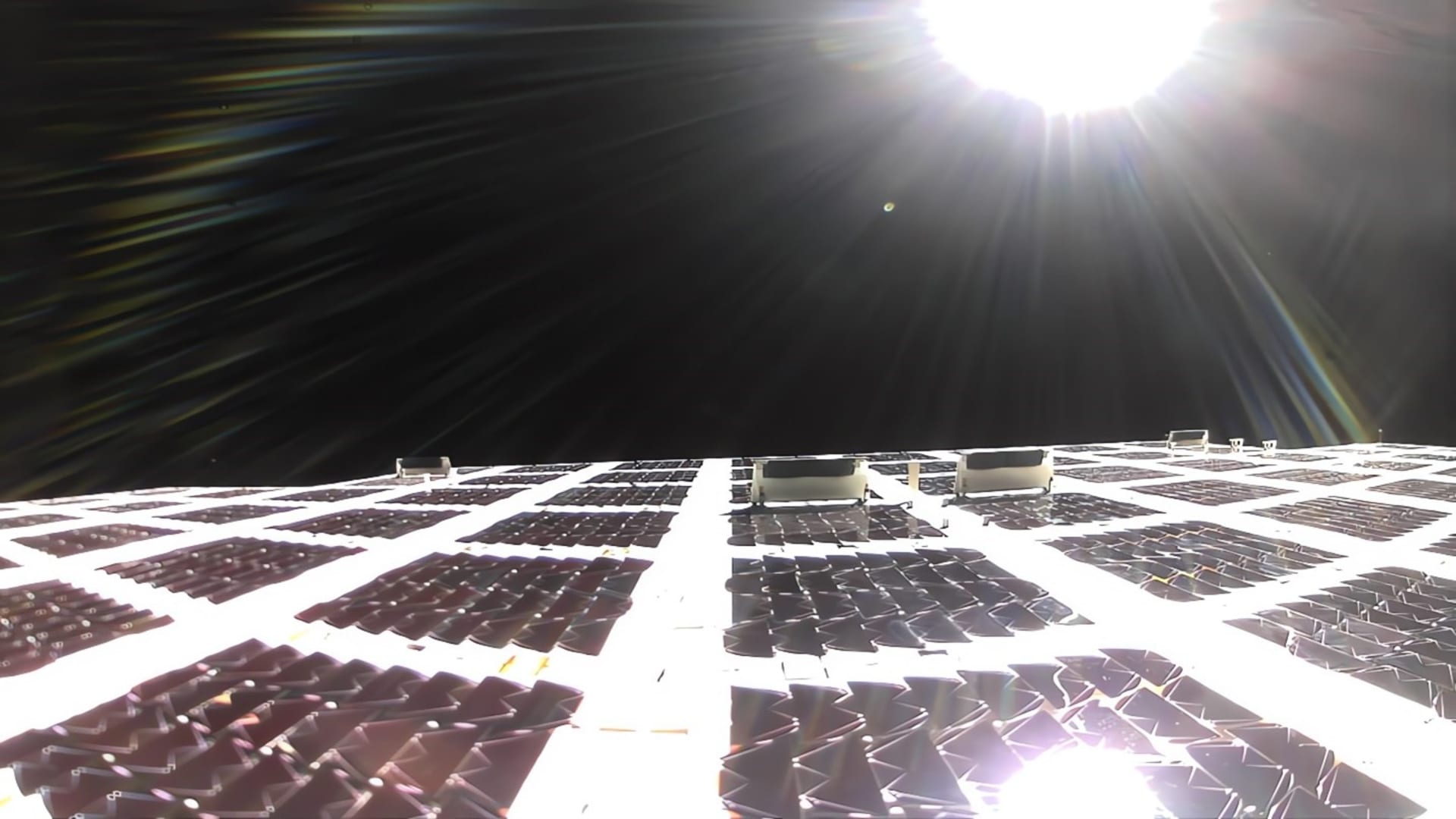

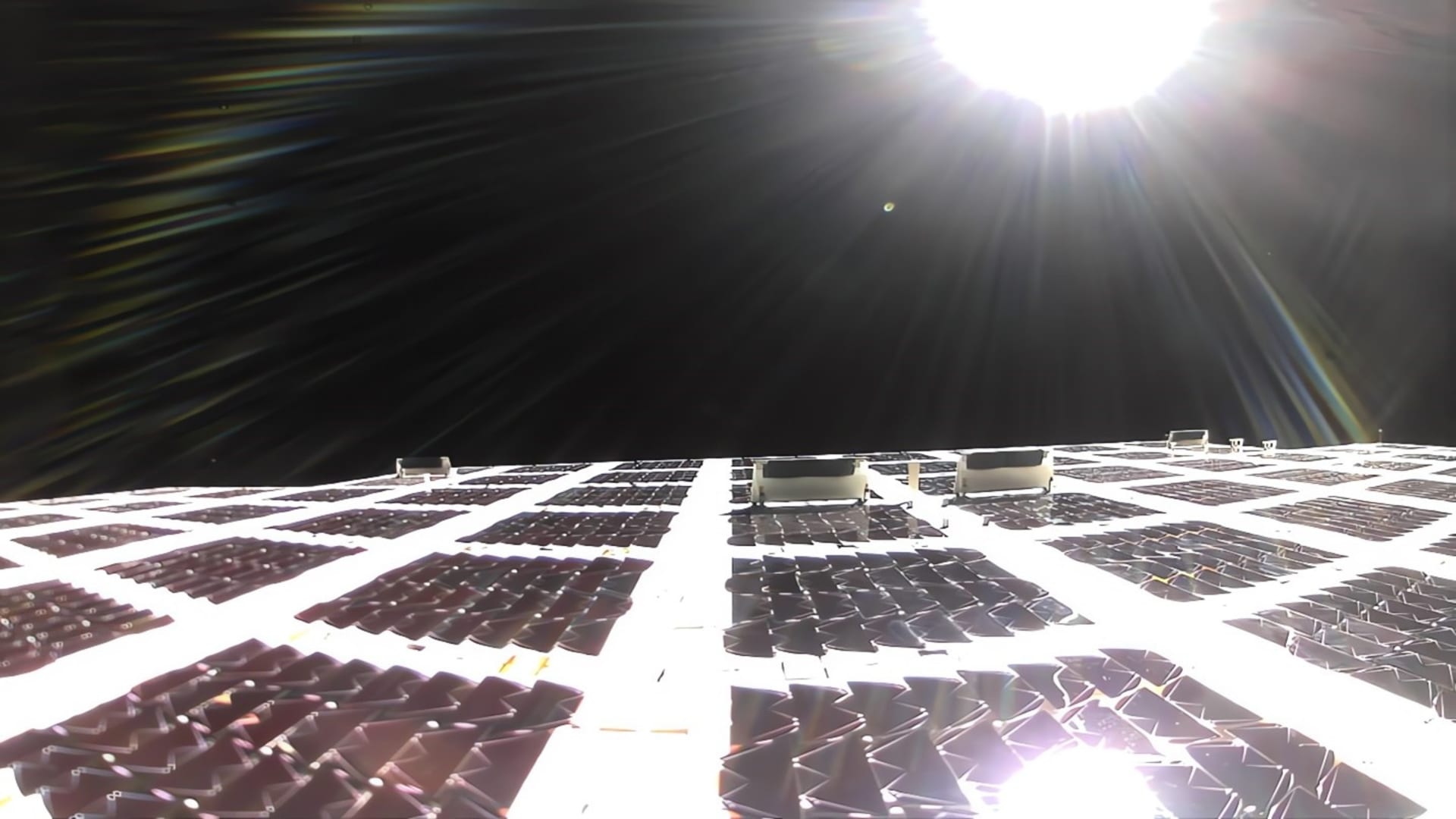

- Satellite Launch Plans: AST plans to deploy approximately 45 to 60 Block 2 BB satellites by the end of 2026, launching one every month, aiming to provide intermittent service in selected markets, which will lay the groundwork for the company's commercial service activation.

- Positive Market Reaction: Following the Q4 revenue report, AST SpaceMobile's shares rose over 10%, and the stock has soared 234% over the past 12 months, reflecting strong investor confidence in the company's future prospects.

- Company Performance: A report indicates that Space Mobile shares have gained 2.5% following the release of their Q4 results.

- Market Reaction: The increase in share value reflects positive investor sentiment after the company's quarterly performance announcement.

- U.S. Stock Market Performance: Stock indexes in the U.S. closed higher on Wednesday, indicating a positive market trend.

- Index Gains: The S&P 500 gained 1.29%, the Dow Jones increased by 0.78%, and the Nasdaq rose by 0.49%.

- Partnership Agreement: AST SpaceMobile has partnered with Canadian telecom company Telus, which will invest in ground-based satellite infrastructure and acquire equity in AST SpaceMobile, enhancing ASTS's competitive position in the market.

- Commercial Service Outlook: Once ASTS launches its commercial services, Telus customers will be able to send texts, make calls, and use data services in the most remote areas of Canada, significantly improving user experience and expanding market coverage.

- Price Target Increases: UBS analyst Christopher Schoell nearly doubled the price target for AST SpaceMobile from $43 to $85, reflecting optimistic market expectations for the company's future revenue growth, while Deutsche Bank raised its target to $139, implying a 34% upside.

- Positive Market Sentiment: Retail sentiment on Stocktwits regarding AST SpaceMobile trended in the 'extremely bullish' territory with high message volumes, indicating strong investor confidence in the company's future partnerships and market potential.

- Market Rally: Wall Street experienced a relief rally on Wednesday, driven by optimism surrounding potential US-Iran diplomatic talks, with the Nasdaq 100 gaining 1.5% to 25,100, indicating investor confidence in future economic stability.

- Oil Price Decline: Following two consecutive days of gains, Brent crude fell 0.5% to $81.00 per barrel and WTI crude slipped 0.8% to $74.07, reflecting the impact of diplomatic optimism on the energy market.

- Volatility Index Drop: The CBOE Volatility Index plunged 11.6% to 20.84, indicating a rise in market risk appetite and a decrease in demand for safe-haven assets, further fueling the stock market's upward momentum.

- Stable Treasury Yields: The 10-year U.S. Treasury yield held steady at 4.07%, suggesting that as risk appetite increases, demand for safe assets is capped, reflecting a positive outlook on economic prospects.

- Partnership Announcement: AST SpaceMobile has signed a partnership with Canadian telecom giant Telus, which will invest in ground-based satellite infrastructure while AST provides BlueBird satellites, aiming to deliver satellite broadband to remote areas in Canada, thereby enhancing AST's competitive position in the market.

- Equity Stake: Telus will become an equity shareholder in AST SpaceMobile, reinforcing the long-term alignment between the two companies; however, it remains unconfirmed whether Telus will directly purchase AST shares, yet this equity relationship ensures Telus will entrust its direct-to-cell business to AST going forward.

- Market Reaction: Following the partnership announcement, AST's stock surged by 10%, indicating a positive investor response, although the direct-to-cell service is not expected to launch until late 2026, which may impact short-term profitability expectations.

- Profitability Outlook: Despite the optimistic partnership prospects, AST's service readiness in the U.S. or Canada remains uncertain, potentially disappointing investors who anticipated profitability next year, leading analysts to maintain a cautious stance on AST's stock.