Analysts Predict More Than 20% Growth Potential in These 3 Quantum Computing Stocks – 10/10/2025

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Oct 10 2025

0mins

Should l Buy MSFT?

Source: TipRanks

Quantum Computing's Potential: Quantum computing is poised to revolutionize technology by solving complex problems faster than traditional computers, making it an attractive investment opportunity for long-term investors.

Top Quantum Computing Stocks: Key stocks in the quantum computing sector include QUBT, Honeywell (HON), and Microsoft (MSFT), each showing significant upside potential according to analyst consensus and price targets.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy MSFT?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on MSFT

Wall Street analysts forecast MSFT stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for MSFT is 631.36 USD with a low forecast of 500.00 USD and a high forecast of 678.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

34 Analyst Rating

32 Buy

2 Hold

0 Sell

Strong Buy

Current: 401.140

Low

500.00

Averages

631.36

High

678.00

Current: 401.140

Low

500.00

Averages

631.36

High

678.00

About MSFT

Microsoft Corporation is a technology company that develops and supports software, services, devices, and solutions. Its Productivity and Business Processes segment consists of products and services in its portfolio of productivity, communication, and information services, spanning a variety of devices and platforms. It comprises Microsoft 365 Commercial products and cloud services; Microsoft 365 Consumer products and cloud services; LinkedIn, and Dynamics products and cloud services. The Intelligent Cloud segment consists of its public, private, and hybrid server products and cloud services. It comprises server products and cloud services, including Azure, and enterprise and partner services, including Enterprise Support Services. Its More Personal Computing segment primarily comprises Windows and Devices, including Windows OEM licensing; Gaming, including Xbox hardware and Xbox content; Search and news advertising, comprising Bing and Copilot, Microsoft News, and Microsoft Edge.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Performance Concerns: Microsoft's fiscal Q2 2026 results revealed strong overall performance; however, modest weaknesses in AI software and cloud services led to a more than 10% drop in stock price in one day, raising investor concerns about future growth.

- Copilot License Sales Growth: As of Q2 2026, Microsoft 365's Copilot licenses reached 15 million, doubling year-over-year but representing only a 3.7% market penetration, indicating limited market uptake that could hinder future revenue growth.

- Azure Revenue Growth Slowdown: Azure's revenue grew 39% year-over-year in Q2, surpassing Wall Street's 37.1% forecast, yet slower than the previous quarter's 40%, suggesting a potential loss of momentum that may affect investor confidence.

- Data Center Capacity Shortage: Microsoft's order backlog surged 110% year-over-year to $625 billion, with 45% from OpenAI, which may limit Azure's expansion and increase investment risks due to reliance on external funding and revenue growth.

See More

- Leadership Change: Workday announced the immediate resignation of CEO Carl Eschenbach, with co-founder Aneel Bhusri stepping back into the role, having previously served as CEO from 2009 to 2020, which may significantly influence the company's strategic direction.

- Market Pressure Intensifies: Workday's stock has dropped 17% over the past year and more than 20% year-to-date, reflecting investor concerns about the potential impact of artificial intelligence on the software sector, indicating a lack of confidence in the company's future performance.

- Job Cuts and Investment: Last year, Workday cut approximately 1,750 jobs to bolster its investment in technology, a move that may negatively affect employee morale in the short term but could enhance the company's competitiveness in AI in the long run.

- Industry Outlook: Bhusri stated that AI represents a greater transformation than SaaS, indicating a strategic focus on leveraging AI technology to shape future market leaders, which could significantly impact Workday's market positioning and competitive strategy.

See More

- Sustained Earnings Growth: Deutsche Bank strategists highlighted that tech stocks maintained an earnings growth rate near 30% in Q4, which continues to bolster investor confidence despite a three-day market downturn.

- Software Stocks Struggle: The iShares Expanded Tech-Software Sector ETF (IGV) tumbled nearly 9% over eight consecutive days last week, reflecting investor concerns about potential disruptions to business models from artificial intelligence, leading to increased market volatility.

- Future Earnings Expectations: While analysts anticipate a slowdown in tech profit growth to 23%, forward estimates indicate an uptick in earnings expectations for megacap tech firms, suggesting sustained market confidence in future profitability.

- Market Digestion Phase: CFRA's chief investment strategist noted that the recent volatility in the information technology sector is a necessary digestion of prior gains, with projections for record earnings growth in 2026 and 2027, encouraging investors to remain patient.

See More

- Microsoft Downgrade: Melius Research downgraded Microsoft from buy to hold, citing that CEO Satya Nadella has lost the AI narrative and that the stock appears overpriced based on new free cash flow estimates, which may undermine investor confidence.

- Eli Lilly Acquires Orna: Eli Lilly announced the acquisition of biotech firm Orna Therapeutics for up to $2.4 billion, leading to a premarket surge in Eli Lilly and rival Novo Nordisk shares, indicating a positive market response towards biotech investments.

- Kroger's New CEO: Kroger's stock advanced nearly 7% in premarket trading after reports indicated that former Walmart executive Greg Foran will be appointed as the new CEO, having previously led Walmart's U.S. division for six years, suggesting a strategic shift for Kroger.

- Robinhood Upgrade: Wolfe Research upgraded Robinhood from hold to buy, despite the stock's recent decline amid a major cryptocurrency sell-off, as analysts believe its future potential remains strong, which could attract renewed investor interest.

See More

- Stock Rebound: Palantir Technologies Inc. shares rose 1.25% to $137.60 in premarket trading on Monday, extending Friday's 4.53% gain, indicating a positive market response to volatility in the software sector.

- Technical Analysis: Currently, Palantir's stock is approximately 14.7% below its 20-day simple moving average and 21.9% below its 100-day SMA, indicating a bearish short-term trend, although shares have increased by 16.5% over the past 12 months, reflecting relatively strong long-term performance.

- Earnings Expectations: Palantir is set to release its next financial update on May 4, 2026, with an EPS estimate of 26 cents (up 100% YoY) and a revenue estimate of $1.54 billion (up 74% YoY), showcasing robust growth potential.

- Analyst Ratings: The stock carries a Hold rating with an average price target of $161.33, with recent analyst actions including DA Davidson lowering its target to $180.00 and Citigroup raising it to $260.00, reflecting differing market perspectives on its future performance.

See More

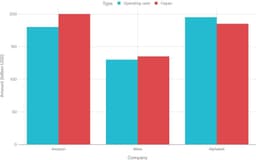

- Funding Shortages: Amazon expects to generate about $180 billion in operating cash this year against a capital spending plan of $200 billion, resulting in a $20 billion shortfall, marking the company's first entry into deficit territory which could impact future investment capabilities.

- Meta's Cash Flow Crisis: Meta anticipates operating cash flow of approximately $130 billion, while its capital spending guidance peaks at $135 billion, indicating significant financial pressure in building AI systems that may lead to depletion of cash reserves.

- Increased Debt Financing: Oracle raised $25 billion in bonds to support a $300 billion infrastructure deal with OpenAI, while Meta raised $30 billion last year, with tech companies expected to issue $337 billion in investment-grade bonds this year, reflecting the industry's urgent need for funding.

- Infrastructure Investment Risks: Big Tech firms are heavily investing in data centers and power facilities, yet the irreversibility of these infrastructures poses substantial financial risks, especially if AI demand does not grow as anticipated, potentially leading to massive depreciation and debt burdens.

See More