Adverum to be Acquired by Eli Lilly at $3.56 per Share

Adverum Biotechnologies (ADVM) has mailed a letter to its stockholders in connection with its pending transaction to be acquired by Eli Lilly and Company (LLY). In accordance with the merger agreement between Lilly and Adverum, on November 7, 2025 Lilly commenced a tender offer to acquire all of the outstanding shares of Adverum's common stock for a per share price of $3.56 per share in cash payable at closing plus one non-transferable contingent value right that entitles the holder to receive up to an additional $8.91 per CVR in cash upon the achievement of two milestones, for total potential per share consideration of up to $12.47. The tender offer is scheduled to expire one minute past 11:59 p.m., Eastern time, on December 8, 2025. The transaction is subject to closing conditions, including the tender of a majority of the outstanding shares of Adverum's common stock and other conditions included in the merger agreement and described in the tender offer documents that have been filed with the SEC. The letter reiterates: that Adverum has issued a promissory note to Lilly pursuant to which Lilly has advanced an aggregate of $40M of up to $65M to Adverum and is obligated to fund the additional $25M on December 5, 2025. However, if the merger agreement with Lilly is terminated, including as a result of the minimum tender condition not being satisfied, all outstanding amounts under the Promissory Note will immediately become due and payable, and the Promissory Note includes a 5.0% prepayment premium applicable to any prepayment or acceleration of the obligations. Advances under the Promissory Note bear interest at a rate equal to the Secured Overnight Financing Rate plus 10.0% per annum, compounded bi-weekly, and the maturity date of the Promissory Note is January 22, 2026. Additionally, upon the termination of the merger agreement with Lilly, Adverum does not anticipate that it will have sufficient available liquidity to fund its ongoing operations or the required repayment of all outstanding amounts under the Promissory Note. If Adverum fails to repay the Promissory Note when due, Lilly will be entitled to pursue foreclosure remedies as a secured creditor under the Promissory Note, which would likely result in Adverum's bankruptcy; the immediate and certain cash value the transaction delivers to Adverum stockholders through the upfront cash consideration of $3.56 per share, which the Adverum Board of Directors believes to be compelling, especially when viewed against the likelihood of an imminent liquidation and the absence of other available alternatives; the fact that the CVRs provide Adverum's stockholders with an opportunity to realize additional value of up to an aggregate of $8.91 per CVR in cash to the extent that both of the milestones set forth in the CVR agreement are achieved within the time periods and subject to the conditions described therein; and the Adverum Board of Directors' belief, after considering the various alternatives available to Adverum, including remaining a standalone company, and taking into account the review of strategic alternatives undertaken by the Adverum Board of Directors with the assistance of outside financial and legal advisors over the course of eighteen months, which did not yield any acquisition proposals other than Lilly's, that the proposed transaction with Lilly represents the best alternative available to Adverum and its stockholders.

Trade with 70% Backtested Accuracy

Analyst Views on LLY

About LLY

About the author

- Price Target Analysis: Analysts currently project Eli Lilly's price target to be just under $1,230, indicating approximately 17% upside from its current price of $1,031.79, which presents a potential return opportunity for investors.

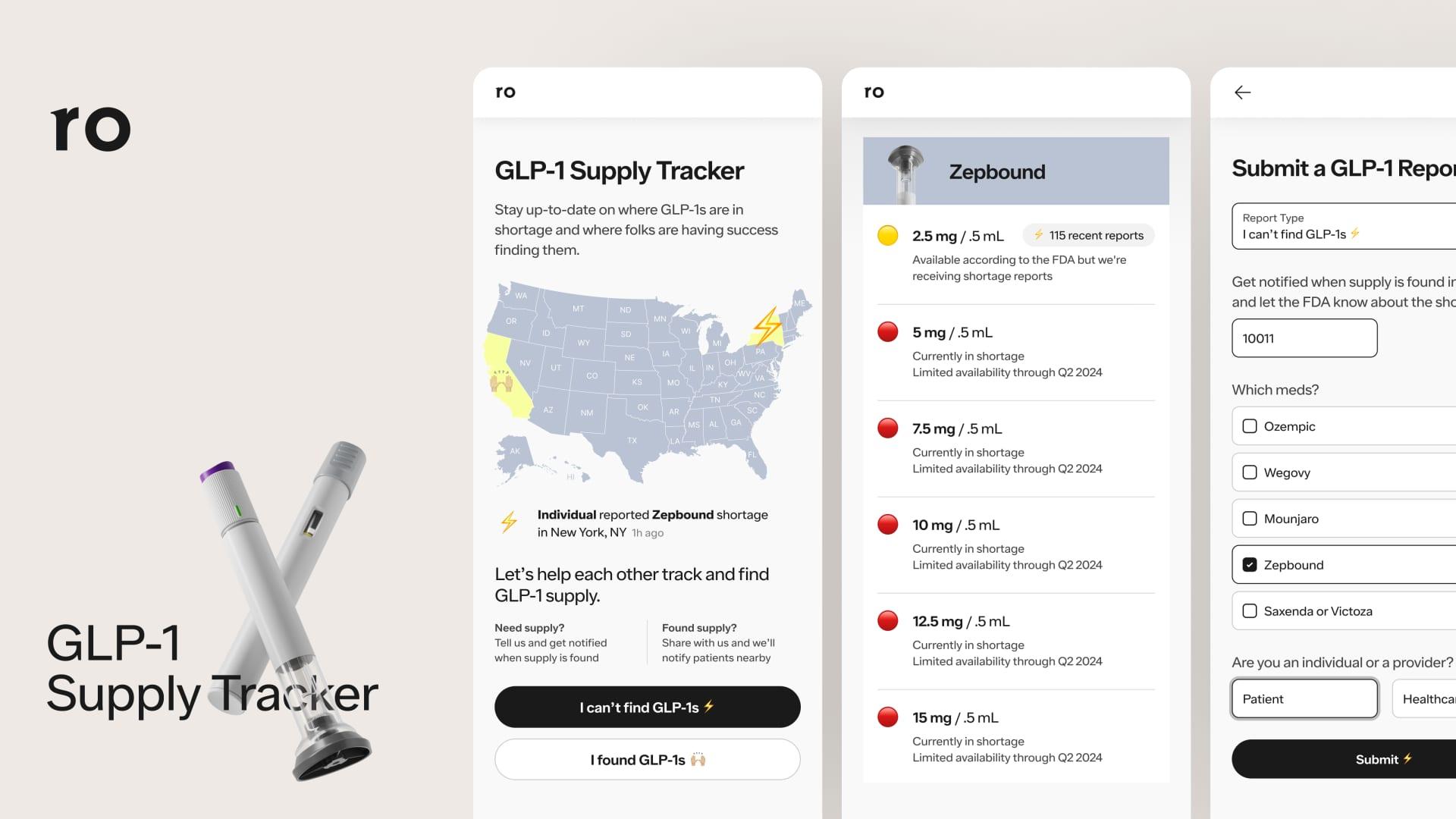

- Growth Drivers: The strong growth of Eli Lilly's GLP-1 drugs, Zepbound and Mounjaro, has fueled bullish sentiment, as investors grow confident in the company's potential to dominate the anti-obesity drug market, thereby continuing to drive the stock's rally.

- Valuation Considerations: Despite Eli Lilly's market cap nearing $1 trillion, its price-to-earnings ratio stands at 46, significantly higher than the S&P 500 average of 25, suggesting that much of the future growth is already priced in, which could lead to correction risks if expectations are not met.

- Long-term Investment Advice: For long-term investors, Eli Lilly remains a solid investment option, but it is crucial to temper expectations to avoid overestimating future gains, especially given the current high valuation context.

- Eli Lilly's Growth Momentum: Eli Lilly has demonstrated revenue growth rates exceeding mid-double digits in recent quarters, significantly outperforming large pharmaceutical companies, showcasing its leadership in the anti-obesity drug market, with new drug launches expected to further solidify its market share.

- Leader in Anti-Obesity Market: Eli Lilly's tirzepatide became the world's best-selling drug last year, with the anticipated launch of the oral GLP-1 drug forglipron this year and additional approvals expected in the coming years, enhancing the diversity of its product pipeline.

- Veeva Systems' Market Opportunity: Veeva Systems provides cloud solutions to life science companies, boasting over 1,500 customers, with a goal to double its annual revenue by 2030, indicating a compound annual growth rate of nearly 18%, reflecting its strong competitive position in a rapidly growing market.

- Growth Potential in Cloud Market: Veeva Systems estimates an addressable market of $20 billion, significantly higher than its trailing 12-month revenue of $3.1 billion, indicating substantial growth opportunities ahead, prompting investors to consider buying at current low levels.

- Strong Growth for Eli Lilly: Eli Lilly has achieved mid-double-digit revenue growth rates in recent quarters, significantly exceeding the pharmaceutical industry average, demonstrating its robust competitive position and future growth potential.

- Leader in Anti-Obesity Market: Eli Lilly's tirzepatide became the world's best-selling drug last year, and the anticipated launch of the oral GLP-1 drug forglipron this year will further solidify its leadership in the rapidly growing anti-obesity market.

- Market Opportunities for Veeva Systems: Veeva Systems provides cloud solutions to life science companies, boasting over 1,500 customers, and aims to double its annual revenue by 2030, indicating a compound annual growth rate of nearly 18%, showcasing its strong competitive edge in the large cloud market.

- Optimistic Industry Outlook: Despite intensified competition, Veeva Systems' high switching costs and unique market positioning provide ample growth opportunities, with an addressable market estimated at $20 billion, significantly surpassing its current revenue of $3.1 billion.

- Market Size Growth: According to analysis, the chronic kidney disease (CKD) market size was approximately $4.8 billion in 2024 and is expected to grow further by 2034, reflecting increased demand for new therapies and an expanding patient base.

- Rising Patient Numbers: In 2024, there were about 82 million prevalent cases of CKD across the 7 major markets (7MM), with projections indicating continued growth from 2025 to 2034, primarily driven by an aging population and the rising prevalence of diabetes and hypertension.

- Launch of New Therapies: The introduction of emerging therapies such as AstraZeneca's Zibotentan/Dapagliflozin and Boehringer Ingelheim's Vicadrostat + Empagliflozin is expected to significantly boost market growth and improve treatment outcomes for patients.

- Advancements in Biomarkers: Progress in biomarkers like KIM-1 and NGAL enables more precise early detection of CKD, thereby enhancing the potential for timely interventions and improving overall patient prognosis.

- Sales Growth Dependency: Eli Lilly's Mounjaro and Zepbound drugs achieved impressive sales growth of 99% and 175% in 2025, respectively, yet these two drugs account for nearly 45% of the company's total sales, raising concerns about the sustainability of such growth.

- Overvaluation Concerns: Despite the strong performance of Eli Lilly's drugs, its stock price has surged to a price-to-earnings ratio of 44, with a meager dividend yield of 0.6%, indicating that the market's expectations for future growth may be overly optimistic.

- Competitors' Opportunities: GLP-1 competitors Novo Nordisk and Pfizer offer more attractive investment profiles with dividend yields of 4.57% and 6.31%, respectively, and price-to-earnings ratios of 10 and 20, especially as Eli Lilly faces risks from patent expirations.

- Intensifying Industry Competition: While Eli Lilly's success in the GLP-1 space is notable, it may overshadow the risks it faces; as competition intensifies, the strong historical performance of Novo Nordisk and Pfizer could enable them to rebound in the market, presenting new opportunities for investors.

- Significant Sales Growth: Eli Lilly's Mounjaro and Zepbound drugs achieved sales increases of 99% and 175% respectively in 2025; however, such growth may not be sustainable, introducing uncertainty into the company's future performance.

- Market Share Risk: These two GLP-1 drugs account for 56% of Eli Lilly's total revenue, and with patent protections set to expire, the company may face a substantial revenue gap that could impact its long-term financial health.

- Competitor Dynamics: While Novo Nordisk and Pfizer lag in the GLP-1 market, Novo Nordisk recently launched an oral GLP-1 medication, and its dividend yield stands at 4.9%, indicating its ongoing competitiveness in the market.

- Investor Sentiment Analysis: Despite Eli Lilly's stock price surging due to market enthusiasm, resulting in a high P/E ratio of 44 and a meager dividend yield of 0.6%, analysts suggest that investors consider competitors like Novo Nordisk and Pfizer for potentially better returns.