Zillow Group Stock Declines Amid Mixed Earnings and Legal Costs

Zillow Group's stock has declined as it hits a 52-week low, reflecting investor concerns amid mixed earnings results and rising legal costs.

The company's recent earnings report showed revenues and profits falling short of market expectations, compounded by increasing legal expenses that further compress profit margins. Analysts from Needham have expressed caution regarding Zillow's competitive risks, indicating that intensified market competition could lead to uncertain margins and heighten investor risk aversion. This combination of disappointing earnings and legal issues has resulted in a significant drop in Zillow's stock price, diminishing market confidence in its future growth prospects.

The implications of these developments suggest that Zillow may face ongoing challenges in regaining investor trust and stabilizing its stock price. The market's reaction to the mixed earnings report and legal costs indicates a cautious sentiment among investors, which could lead to further volatility in the short term.

Trade with 70% Backtested Accuracy

Analyst Views on Z

About Z

About the author

- 30-Year Fixed Rate Drop: The 30-year fixed mortgage rate has fallen to 5.98% according to Zillow, down two basis points, which may stimulate homebuying demand amidst increasing economic uncertainty.

- 15-Year Fixed Rate Decline: The 15-year fixed mortgage rate has also decreased to 5.46%, enhancing the appeal of shorter-term loans and potentially encouraging more borrowers to opt for quicker repayment, thereby reducing long-term interest expenses.

- Adjustable Rate Mortgage Status: The 5/1 ARM and 7/1 ARM rates stand at 5.99% and 5.75%, respectively; while current fixed rates are more competitive, the lower initial rates of ARMs may still attract short-term buyers, especially those planning to resell soon.

- Refinance Rate Trends: The 30-year fixed refinance rate is at 6.04%, slightly higher than purchase rates, indicating that borrowers may face higher costs when refinancing, prompting more cautious loan selection.

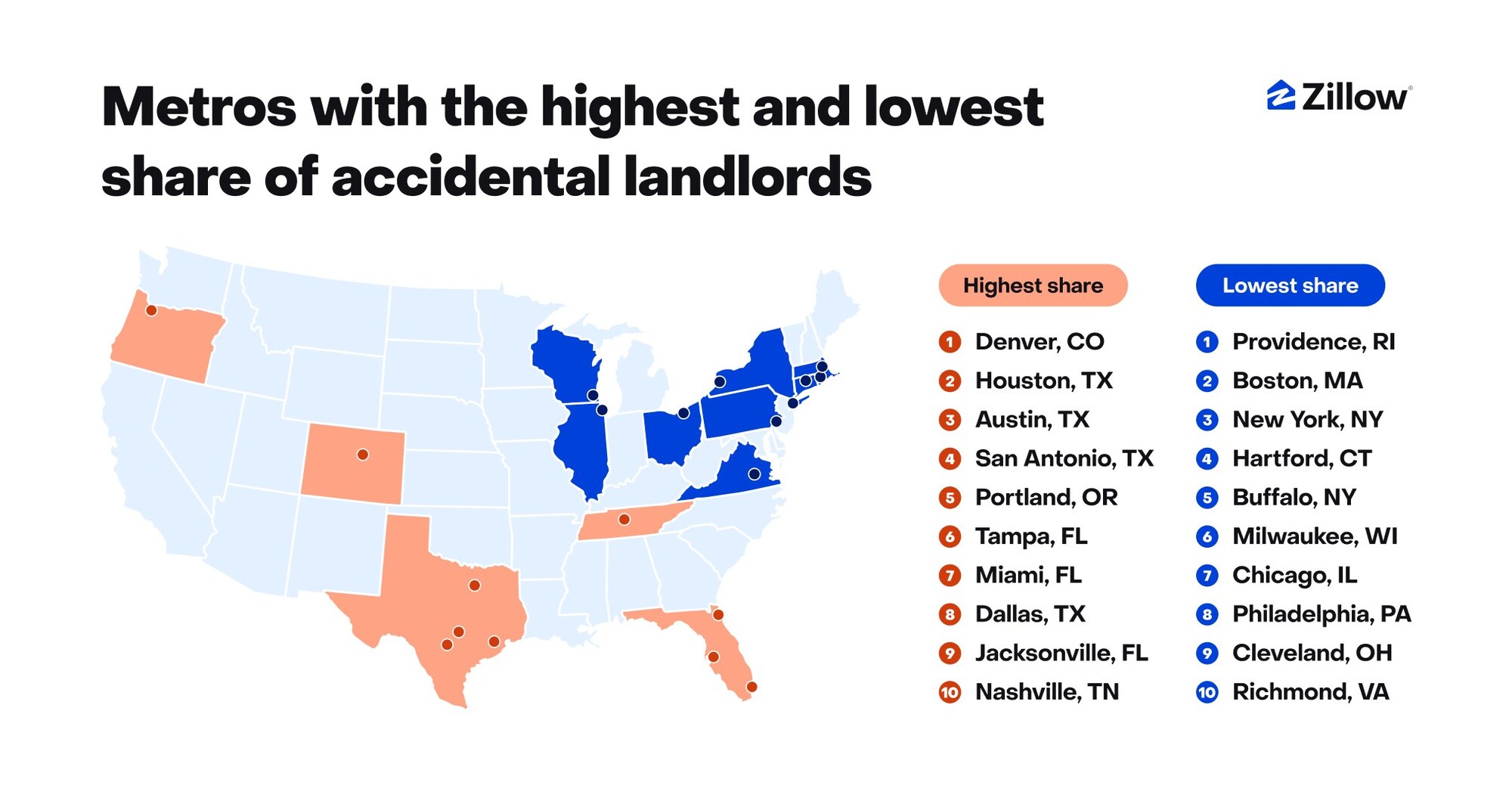

- Accidental Landlord Phenomenon: Research from Zillow indicates that nearly a record share of homeowners are converting unsold properties into rentals, with the current rate at 2.3%, reflecting a trend where homeowners opt for renting as buyer bargaining power increases during market rebalancing.

- Market Dynamics Shift: As mortgage rates skyrocketed from 3.11% to 7.08%, homeowners faced a drastically altered market landscape, leading many to become accidental landlords rather than sell at a loss, highlighting a choice-driven market characteristic.

- Significant Regional Variations: Among the metros with the highest share of accidental landlords, Denver leads at 4.9%, while cities like Boston are at just 0.6%, indicating that competitive market conditions significantly influence homeowners' decisions.

- Expansion of Rental Management Tools: Zillow has expanded its free rental management tools for the growing number of accidental landlords, including listing, tenant screening, and rent collection, aimed at enhancing homeowners' ability to manage rentals effectively and improve their competitive stance in the market.

- Long-Term Rate Increase: According to Zillow, the average 30-year fixed mortgage rate has risen by 2 basis points to 6.00%, which may increase borrowing costs for homebuyers and potentially dampen housing market demand.

- Short-Term Rate Decrease: The 15-year fixed mortgage rate has decreased by 2 basis points to 5.48%, which could entice some borrowers to opt for shorter loan terms, thereby reducing long-term interest expenses.

- Refinance Rate Overview: The 30-year fixed refinance rate stands at 6.12%, higher than purchase rates, indicating an increase in refinancing costs that may lead borrowers to delay refinancing decisions.

- Stable Market Forecast: According to MBA forecasts, the 30-year mortgage rate is expected to remain around 6.10% through the end of 2026, suggesting a relatively stable outlook for future rate changes.

- Affordability Improvement: According to Zillow, the median-income U.S. household can now afford a home priced at $331,483, a $30,302 increase from last year, marking the strongest affordability reading since March 2022, despite first-time buyers' market share dropping to 21%.

- Increased Housing Options: The gain in buying power allows median earners to access approximately 82,300 more listings, reflecting a 6% increase in inventory, with the affordable segment of listings rising from 34.8% to 40.3%, providing buyers with more choices.

- Cash Buyer Impact: The share of homes purchased entirely with cash has climbed to 26%, an all-time high, further squeezing first-time buyers, particularly in high-priced markets where older buyers have a competitive edge.

- Future Market Outlook: Zillow anticipates that mortgage rates will continue to drift lower through 2026, potentially expanding budgets further and supporting a 4% increase in existing-home sales in 2026 compared to 2025.

- Market Recovery Signal: According to Callum Thomas, 80% of the 70 companies tracked have stocks up at least 20% from their 52-week lows, a figure that has rarely exceeded 50% in the past decades, indicating strong signals of market recovery and potential investment opportunities for investors.

- Mortgage Rate Decline: The current 30-year fixed mortgage rate stands at 6%, down approximately 80 basis points from a year ago, providing greater affordability for homebuyers, especially as price growth slows, which may stimulate a recovery in the real estate market.

- Household Net Worth Growth: A report from the Federal Reserve Bank of New York indicates that home equity lines of credit (HELOCs) rose for the 15th consecutive quarter in Q4 2025, totaling $434 billion, a 36% increase over the past four years, reflecting improved household financial conditions and enhanced consumer spending capacity.

- Importance of Historical Data: Since 1928, the S&P 500 has lost more than 10% in only 12 calendar years, meaning the market has been profitable or lost less than 10% in nearly 88% of calendar years, emphasizing the significance of historical data in investment decisions to help investors grasp market trends.

- Global Bull Market: According to Callum Thomas of Topdown Charts, 80% of the 70 companies he tracks have seen stock markets rise at least 20% from their 52-week lows, a rare occurrence that typically signals a favorable environment for investors.

- US Stock Performance: Bloomberg illustrates that the year-to-date rally in US stocks is the broadest ever, with a record number of individual stocks in the S&P 500 outperforming the index, indicating a robust market recovery and increased investor confidence.

- Declining Mortgage Rates: The current 30-year fixed mortgage rate stands at 6%, down 80 basis points from a year ago, marking the lowest level since 2022, which may enhance homeownership affordability for buyers as home price growth slows.

- Growth in HELOCs: A report from the Federal Reserve Bank of New York reveals that the total amount in home equity lines of credit (HELOCs) rose to $434 billion in Q4 2025, a 36% increase over the past four years, reflecting sustained consumer confidence and demand for borrowing against home equity.