Voyager Technologies announces Starlab space station and fiber optic innovations

Voyager Technologies Inc's stock fell by 6.53% as it crossed below the 5-day SMA, reflecting broader market weakness with the Nasdaq-100 down 2.22% and the S&P 500 down 2.12%.

Despite the recent announcement of plans to build the Starlab space station by 2030 and innovations in fiber optic manufacturing, the stock's decline indicates sector rotation away from growth stocks amid current market conditions. The company has patented a method for producing ultra-pure optical fiber crystals in microgravity, which could enhance optical communication performance and attract significant investment in the space sector.

The implications of these developments suggest that while Voyager Technologies is positioning itself for future growth in the space industry, the immediate market reaction reflects a shift in investor sentiment, prioritizing stability over speculative growth.

Trade with 70% Backtested Accuracy

Analyst Views on VOYG

About VOYG

About the author

- Commercial Space Reservation: LambdaVision has secured a strategic partnership with Starlab Space LLC to pre-book commercial space in low-Earth orbit, paving the way for scaling the manufacturing of its protein-based artificial retina, which is expected to significantly enhance the company's competitive position in treating retinal degenerative diseases.

- Funding Support: The company recently closed a $7 million seed funding round, providing runway into 2027 and further validating its innovative space-based manufacturing technology aimed at restoring vision for patients, thereby expanding its market reach.

- Microgravity Advantages: By leveraging microgravity for production, LambdaVision's layer-by-layer manufacturing process improves the homogeneity and stability of protein films, potentially leading to breakthroughs in biosensors, optical systems, and drug delivery applications, thus enhancing the market applicability of its technology.

- Future Development Prospects: LambdaVision's artificial retina technology not only focuses on vision restoration but also lays the groundwork for future clinical research, showcasing the transformative potential of space biotechnology and likely attracting further investment and collaboration opportunities.

- Agreement Signed: LambdaVision has entered into a reservation agreement with Starlab to extend its research and production activities for protein-based artificial retinas to a commercial space station, ensuring continued access to microgravity as the International Space Station approaches retirement.

- Enhanced Technical Advantages: The layer-by-layer assembly process of LambdaVision is significantly improved in the low Earth orbit environment, where reduced gravity enhances the homogeneity, stability, and performance of thin films, laying the groundwork for future biomedical production.

- Significant Market Potential: This agreement not only supports LambdaVision's initial application in vision restoration but also paves the way for its layer-by-layer protein manufacturing platform's broader potential in biosensors, optical systems, and drug delivery, demonstrating the feasibility of commercial-scale production in microgravity.

- Sustainable Manufacturing Transition: Starlab's market-driven business model aims to reduce costs and risks for research and commercial partners, ensuring full certification and operational readiness within weeks of launch, thereby maximizing efficiency and minimizing delays.

- Successful Design Review: Starlab Space LLC has successfully completed its Commercial Critical Design Review (CCDR), marking a decisive transition from design to manufacturing and systems integration, ensuring continuity of human presence and research in low Earth orbit.

- Technical Maturity Confirmation: The CCDR confirms that Starlab's architecture, safety approach, and performance requirements are technically mature and executable, allowing the program to fully enter fabrication, testing, and assembly phases, thereby ensuring ongoing capabilities for science and industry.

- Business Plan Validation: Starlab's business plan and model have been reviewed, substantiating a sustainable revenue model and ISS-equivalent payload and crew capabilities, demonstrating its development as a market-driven platform rather than a government-dependent asset.

- Global Collaboration Achievement: This achievement reflects years of disciplined engineering and close coordination with NASA, ESA, and JAXA, along with strong collaboration across a global team, validating both Starlab's technical maturity and the credibility of its underlying business case.

- Axiom Funding Success: Axiom Space raised $350 million last week from investors including Type One Ventures and 1789 Capital, with funds earmarked for completing the first module's construction, scheduled for launch in 2028 to dock with the ISS, thereby laying the groundwork for its future independent space station.

- Module Development Progress: The first module, a Payload Power Thermal Module (PPTM), is set to link with a second habitation module in 2029, showcasing Axiom's strategic timeline and commitment to establishing a new independent space station.

- Market Competition Landscape: With Axiom and Vast racing to develop new space stations, Axiom's module is expected to be operational in 2029, potentially ahead of Vast's Haven-1, which could give Axiom a competitive edge in the market.

- Uncertain IPO Prospects: Despite Axiom's funding achievements, its private market valuation has declined from $2.6 billion in 2023 to $2 billion in 2025, raising concerns about its long-term profitability and casting doubt on its IPO prospects.

- Funding Milestone: Axiom Space recently secured $350 million from various private investors, including venture capital firms Type One Ventures and 1789 Capital, which will be utilized to complete the construction of its first space station module, reflecting strong market confidence in its project.

- Module Construction Timeline: Axiom plans to launch its first module, the Payload Power Thermal Module (PPTM), in 2028, followed by a second habitation module in 2029, which will form an independent space station, positioning Axiom favorably in the competitive landscape.

- Competitive Market Dynamics: While Axiom faces stiff competition from companies like Vast, which aims to launch its own space station module in 2027, Axiom's modules are expected to be habitable by 2029, potentially giving it a competitive edge in the market.

- Uncertain IPO Prospects: Despite the funding progress, Axiom's private market valuation has declined from $2.6 billion in 2023 to $2 billion in 2025, which may adversely affect its future IPO plans, prompting investors to proceed with caution.

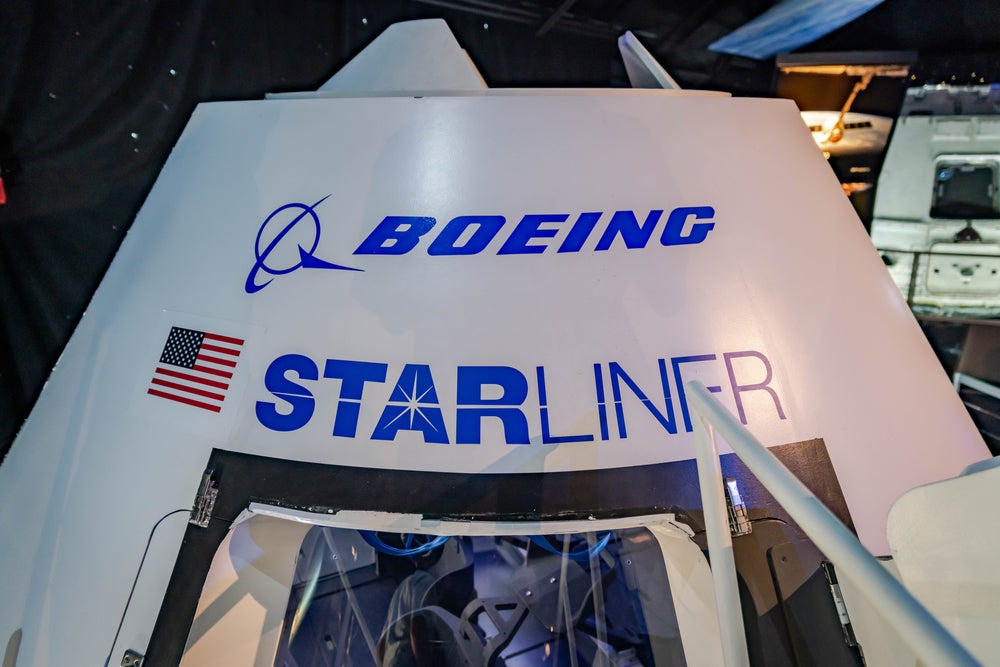

- Project Background: Orbital Reef, led by Blue Origin and backed by billionaire Jeff Bezos, includes partners like Sierra Space, Redwire, Boeing, and Amazon, showcasing significant financial and technical strength in the space station race.

- Competitor Analysis: Starlab boasts the largest funding and international partnerships, including Voyager Technologies, Hilton, Janus Henderson, Leidos, Northrop Grumman, and Palantir, highlighting its competitive edge in the market.

- Independent Team Advantages: Axiom Space has successfully sent astronauts to the ISS for training, with a fifth mission scheduled for next year, while Vast plans to send astronauts for a 14-day training mission in summer 2027, enhancing its market competitiveness.

- Investment Outlook: With the ISS expected to cease operations in 2030, stocks from the Orbital Reef and Starlab teams are becoming focal points for investors, as the market competition remains open and investors need to choose wisely.