Impinj Expects Strong Q4 Revenue Despite Stock Decline

Impinj Inc's stock fell 5.39% as it hit a 20-day low amid mixed market conditions, with the Nasdaq-100 down slightly while the S&P 500 showed minor gains.

Despite the stock's decline, Impinj has updated its Q4 sales guidance, expecting revenue between $90 million and $93 million, which exceeds analyst estimates of less than $92 million. The company also anticipates adjusted EBITDA to surpass the midpoint of its previous guidance, indicating potential improvements in profitability. However, market concerns about future profitability persist, particularly with analysts predicting a GAAP loss of $0.35 per share in 2025, leading to a 7% drop in stock price despite the positive sales outlook.

The optimistic sales forecast reflects Impinj's strong market position, particularly in the food and e-commerce sectors. Investors are keenly awaiting the upcoming earnings report on February 5, which will provide further insights into the company's performance and growth potential.

Trade with 70% Backtested Accuracy

Analyst Views on PI

About PI

About the author

- Flat Revenue Growth: Impinj's Q4 revenue increased by only 1.4% to $92.8 million, matching analyst expectations but failing to boost market confidence, resulting in a 21.4% drop in stock price.

- Profitability Pressure: Adjusted EBITDA rose from $15 million to $16.4 million, yet the earnings per share of $0.50 fell short of the $0.51 consensus, indicating ongoing profitability challenges.

- Pessimistic Outlook: The company forecasts Q1 revenue between $71 million and $74 million, implying a 2% decline at the midpoint, significantly below the $90.5 million consensus, reflecting weak demand from apparel retailers.

- Market Reaction: Although analysts maintained positive ratings on Impinj, the stock was heavily impacted by the expected GAAP net loss of $15.1 million to $16.6 million, intensifying concerns over its premium valuation amidst ongoing headwinds.

- Analyst Rating Changes: Top Wall Street analysts have adjusted their ratings on several stocks, including upgrades, downgrades, and initiations, reflecting the latest market views and expectations for these companies.

- Market Reaction: While specific stocks were not mentioned, such rating changes typically influence investor decisions and may lead to price volatility in the affected stocks.

- Investor Focus: Investors considering buying PI stock should pay attention to analysts' opinions to better assess potential investment risks and returns.

- Source of Information: This information is provided by Benzinga, highlighting the significance of analyst ratings in investment decisions, especially in a rapidly changing market environment.

- Analyst Rating Changes: Top Wall Street analysts have adjusted their ratings on several companies, reflecting varying market perspectives on their future performance, which could influence investor decisions and market sentiment.

- AMZN Stock Outlook: Analysts' opinions on Amazon (AMZN) stock indicate mixed views on its future growth potential, prompting investors to pay close attention to the latest ratings and recommendations when considering purchases.

- Impact of Rating Changes: Upgrades and downgrades from analysts can lead to stock price volatility, necessitating that investors closely monitor these changes to timely adjust their investment strategies and optimize their portfolios.

- Market Sentiment Reflection: Changes in analyst ratings not only affect individual stock performance but can also impact overall market sentiment, urging investors to consider these factors comprehensively for informed investment decisions.

Revenue Decline: Shares of Impinj have dropped by 31.7% following disappointing forecasts for Q1 revenue and profit.

Below Estimates: The company's projected financial performance fell short of analysts' expectations, contributing to the significant decline in share value.

- Quarterly Loss Report: Molina Healthcare reported a quarterly loss of $2.75 per share, significantly missing the Street estimate of a $0.33 profit, indicating substantial challenges in profitability that could undermine investor confidence.

- Revenue Performance: Despite the severe loss, Molina's quarterly revenue reached $11.38 billion, surpassing the consensus estimate of $10.86 billion, suggesting that the company still possesses some resilience in revenue growth, potentially laying a foundation for future recovery.

- Stock Price Reaction: Molina Healthcare's shares dipped 29.4% to $124.90 in pre-market trading, reflecting a negative market reaction to its earnings report, which may lead investors to reassess the stock's value.

- Market Trends: U.S. stock futures were generally higher, with Dow futures gaining around 100 points, indicating a prevailing optimism about the overall economic outlook, even as individual stocks like Molina performed poorly.

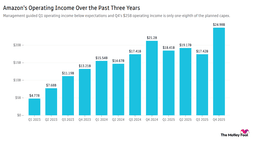

- Amazon's Capital Expenditure Surge: Amazon plans to increase its capital expenditure to $200 billion in 2026, nearly matching its total revenue of $213 billion for Q4, leading to an over 8% drop in stock price during morning trading, indicating market concerns about its financial health.

- Accelerating AWS Growth: CEO Andy Jassy reported a 24% growth rate for AWS, the fastest in 13 quarters, with an annualized revenue of $142 billion; however, management anticipates Q1 operating income will fall short of analyst expectations, reflecting intensified market competition.

- Bitcoin Price Volatility: Bitcoin has dropped 50% from its 2025 peak, falling to around $60,000, which reflects waning confidence in government support for cryptocurrencies, although some analysts suggest this is merely a market correction rather than the end of crypto.

- Severe Market Reactions: Despite a 10% revenue increase in Q3, DOCS and PIDoximity saw their stock plunge over 30% due to declining net income under margin pressure, highlighting investors' acute sensitivity to profitability.