Constellation Energy Faces Decline Despite Positive Policy Support

Constellation Energy Corp's stock is down 5.04% in pre-market trading, hitting a 5-day low amid a generally positive market environment where the Nasdaq-100 is up 0.45% and the S&P 500 is up 0.16%.

The decline comes despite the White House's proposal for an emergency power auction aimed at alleviating grid pressure from AI data centers, which is expected to benefit energy producers like Constellation Energy. This initiative is designed to enhance energy supply and curb price hikes, indicating strong policy support for the energy sector. However, the stock's performance suggests sector rotation as investors may be reallocating their investments in response to broader market trends.

This situation highlights the challenges Constellation Energy faces despite favorable policy developments. The company's partnership with Microsoft to revive a nuclear plant for AI data centers positions it well for future demand, but current market dynamics are impacting its stock performance.

Trade with 70% Backtested Accuracy

Analyst Views on CEG

About CEG

About the author

- Defensive Investment Strategy: Wells Fargo analysts highlight that utility stocks like American Water Works and Exelon can serve as strong defensive plays amid escalating market volatility due to the U.S.-Iran conflict, with expectations of continued relative outperformance in both down and up markets.

- Historical Performance Advantage: The utilities sector has historically outperformed the S&P 500 by approximately 780 basis points during global conflicts and recessions, indicating its stability and risk mitigation capabilities during uncertain times, a trend expected to persist amid the current conflict in Iran.

- AI Demand Driving Growth: With a surge in data center construction, utility companies like American Water Works are poised to benefit as they provide essential water resources for AI facility operations, with the stock rising about 8% over the past month and a current dividend yield of 2.4%.

- Exelon's Growth Potential: Exelon's business structure allows it to complete reliability upgrades in the coming years, with load growth expected to reach 3.3% from 2026 to 2029, while its stock has jumped 10% in the past month, currently yielding 3.5% in dividends.

- GOOG Ex-Dividend Info: Alphabet Inc will go ex-dividend on March 9, 2026, with a quarterly dividend of $0.21, translating to an approximate yield of 0.07% based on its current stock price of $303.45, suggesting a potential 0.07% drop at market open, which could influence short-term investor decisions.

- CEG Dividend Announcement: Constellation Energy Corp will pay a quarterly dividend of $0.4265 on March 20, 2026, with an expected price drop of 0.13% post-ex-dividend, reflecting the company's efforts in maintaining stable dividends, potentially attracting yield-seeking investors.

- VTRS Dividend Dynamics: Viatris Inc will distribute a quarterly dividend of $0.12 on March 18, 2026, with an anticipated 0.82% decline at market open, indicating the company's ongoing commitment to dividend payments, which may enhance its market appeal.

- Dividend History and Yields: Historical data shows an annualized yield of 0.28% for Alphabet, 0.53% for CEG, and a notable 3.26% for VTRS, providing investors with a basis for assessing future dividend stability, which could impact their investment strategies.

- Strong Financial Performance: Constellation Energy reported nearly $6.1 billion in revenue and $2.30 per share in adjusted operating earnings for Q4, both exceeding analyst expectations, which propelled shares up 17.5%, showcasing the company's robust market performance.

- Annual Earnings Growth: The company's full-year adjusted operating earnings rose from $8.64 to $9.39 per share, surpassing the midpoint of its earnings guidance for the fourth consecutive year, reflecting favorable market conditions and boosting investor confidence.

- Acquisition and Power Supply Agreements: Following the completion of its acquisition of Calpine in January, Constellation signed a deal with CyrusOne to supply 380 megawatts of power for a new data center, further solidifying its position in the data center power supply market.

- Future Growth Potential: Although trading at over 28 times forward earnings, significantly higher than the S&P 500's 22 times, Constellation Energy is expected to continue delivering high returns due to the successful acquisition of Calpine and power contracts, attracting investor interest.

- Earnings Beat Expectations: Constellation Energy reported nearly $6.1 billion in revenue and $2.30 per share in adjusted operating earnings for Q4, both exceeding analyst expectations, which propelled shares to soar 17.5% in February, reflecting the company's strong market performance and profitability.

- Acquisition Synergies: The completion of the Calpine acquisition in January combined Calpine's natural gas and geothermal capabilities with Constellation's nuclear energy platform, expected to provide robust growth momentum and further solidify its leadership position in the energy market.

- Data Center Power Agreements: Constellation Energy secured a deal to supply 380 megawatts of power to CyrusOne for a new data center in Texas, along with an exclusive agreement for phase two, showcasing the company's ongoing expansion and success in the data center market.

- Optimistic Future Outlook: The company plans to release its financial outlook and strategy for 2026 at the end of next month, and with Calpine's growth potential, it is expected to continue driving high returns for Constellation Energy, despite its elevated P/E ratio exceeding 28 times, indicating market confidence in its future growth.

- Self-Power Commitment: Trump is set to sign an agreement with major tech firms like Amazon, Google, and Meta, mandating them to supply their own power for AI data centers, addressing rising public anger over electricity prices, although the specifics of the commitment remain unclear.

- Rising Electricity Pressure: Average residential electricity prices in the U.S. increased by 6% in 2025, contrasting Trump's promise to halve prices during his term, highlighting the government's challenges in controlling energy costs, which could impact his support in the midterm elections.

- Implementation Challenges: The decentralized nature of electric grid regulations across states poses significant hurdles for the Trump administration in converting the pledge into actionable policy, with experts indicating that new federal legislation is necessary to address power supply shortages.

- Increased Political Pressure: Trump is leveraging his political influence to pressure tech companies into absorbing the costs associated with their data centers, despite the complexities arising from state-level regulation of power generation, which may complicate policy implementation.

- Surge in Energy Consumption: The IEA forecasts that global energy consumption from data centers will double by 2030, with U.S. data centers projected to consume between 6.7% and 12% of all energy produced by 2028, creating significant pressure on electricity supply.

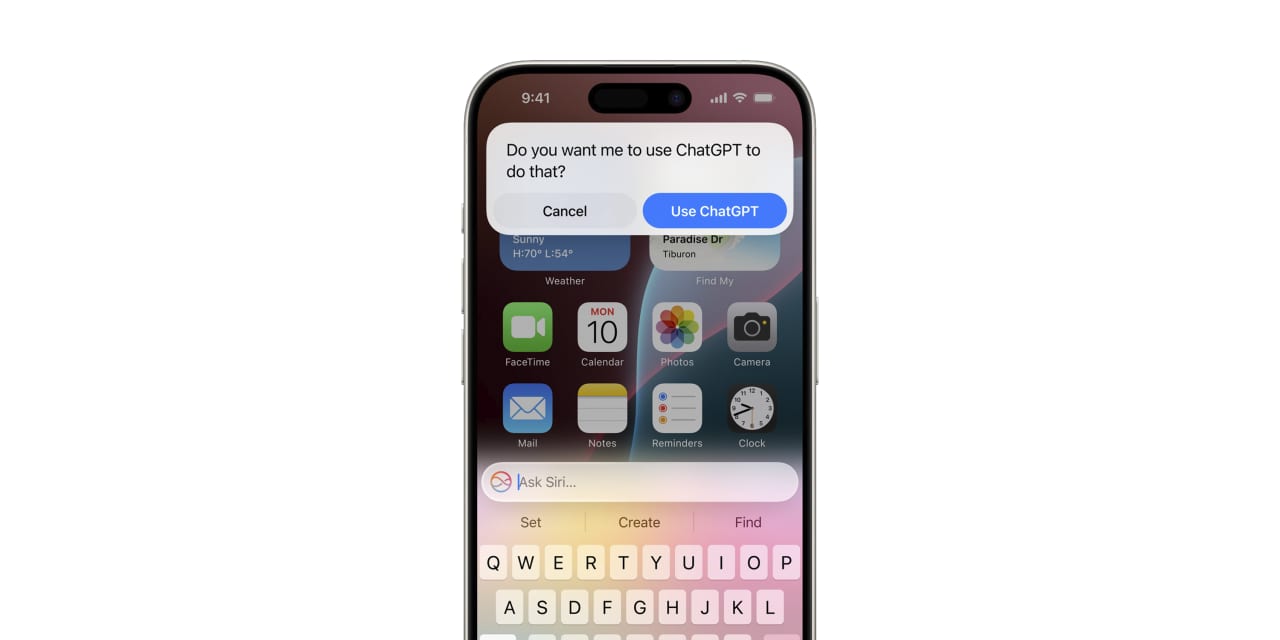

- Accelerated Nuclear Investment: The U.S. Department of Energy aims to triple nuclear energy production by mid-century, with tech giants like Microsoft and Alphabet investing in reviving decommissioned nuclear plants to meet the rising electricity demands of AI.

- Microsoft's Partnership with Constellation: Microsoft has signed a 20-year power purchase agreement with Constellation Energy, the largest clean energy producer in the U.S., agreeing to pay approximately $110-$115 per megawatt hour to restart the Three Mile Island nuclear plant, ensuring a stable power supply.

- NextEra Energy Growth: NextEra Energy has partnered with Google to bring Iowa's Duane Arnold Energy Center back online, expecting a 13% adjusted EPS growth for 2025 and maintaining an 8% CAGR over the next decade, highlighting the critical role of nuclear energy in the AI era.