Adobe's Acquisition of Semrush Faces Legal Scrutiny

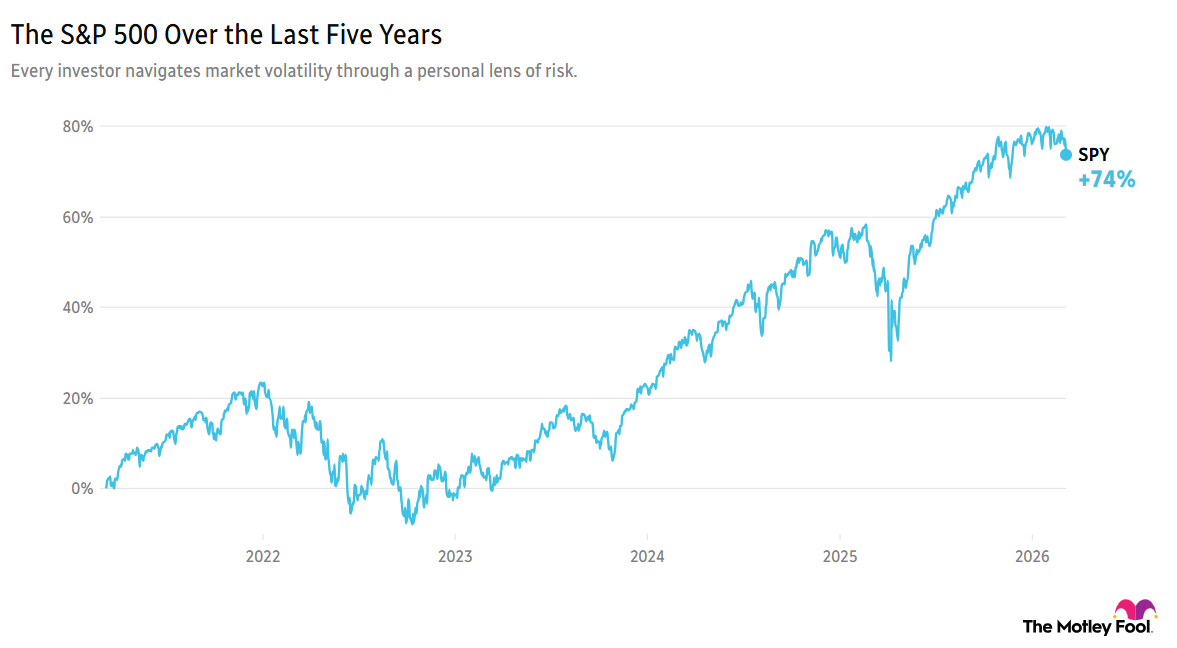

Adobe Inc's stock has hit a 20-day low, reflecting investor concerns amid broader market declines, with the Nasdaq-100 down 0.25% and the S&P 500 down 0.30%.

The proposed acquisition of Semrush Holdings, Inc. by Adobe for $12 per share is under investigation by former Louisiana Attorney General Charles C. Foti and Kahn Swick & Foti. They are assessing whether this valuation adequately reflects Semrush's worth, which could impact shareholder acceptance and future investment decisions. This scrutiny may lead to increased volatility in Adobe's stock as investor confidence is tested amid the ongoing legal concerns.

The implications of this investigation could be significant for Adobe, as it may affect its reputation and market position. Investors are likely to remain cautious, monitoring the situation closely as the outcome could influence Adobe's future growth potential.

Trade with 70% Backtested Accuracy

Analyst Views on ADBE

About ADBE

About the author

- Earnings Outlook: Adobe (ADBE) anticipates an “uneventful” first quarter, with analysts indicating limited upside revisions, reflecting a cautious market sentiment regarding its growth prospects.

- Price Target Reduction: Citi has lowered its price target for Adobe from $387 to $315 while maintaining a Neutral rating, indicating a conservative outlook on the company's future performance.

- Key Metrics Focus: Investors will be keenly watching new topline metrics such as Annualized Recurring Revenue (ARR), Business Professionals & Consumers (BP&C) revenue, and Creative & Marketing (C&M) revenue for early signs of growth acceleration.

- Margin Pressure: Analysts highlight that investors will closely monitor revisions to operating margins, particularly due to gross margin pressure from third-party models and the impact of ongoing investments.

- Earnings Season Dynamics: This week’s earnings season is strong, with retailers, tech giants, and AI winners taking center stage, as investors closely monitor how guidance and AI-driven demand will shape market direction.

- Oracle Cloud Infrastructure: Oracle Cloud Infrastructure (OCI) saw a 68% surge last quarter, and investors are keen to see if its massive $523 billion contract backlog is beginning to translate into realized revenue, particularly as capital expenditures soar.

- UiPath Earnings Expectations: UiPath is set to report after Wednesday’s close, with analysts expecting earnings of 26 cents per share on revenue of $464.49 million, as investors will focus on the durability of growth and profitability stabilization and the impact of AI on net new ARR.

- Adobe Earnings Outlook: Adobe anticipates earnings of $5.87 per share and revenue of approximately $6.28 billion, reflecting a year-over-year increase of about 10%, with investors watching how generative AI features drive upside in net new ARR and Digital Media growth.

- Strong Earnings Growth: Adobe's latest quarterly report reveals record revenue of $6.2 billion, a 10% increase, with net income also rising 10% to $1.85 billion, demonstrating resilience in the digital media sector despite AI disruption concerns.

- Robust Annual Revenue: For the full fiscal year, Adobe's revenue climbed 11% to $23.8 billion, while adjusted net income increased by 7% to $8.9 billion, indicating success in attracting customers and maintaining subscriptions, which bolsters market confidence.

- Optimistic Future Outlook: Adobe projects a 10.2% growth in total annual recurring revenue (ARR) for fiscal 2026, slightly down from 2025, suggesting that investments in AI products are gradually paying off, particularly in the digital media segment.

- Attractive Valuation: With a current price-to-earnings ratio of 16 and a forward P/E of 11, if upcoming earnings reports are solid, investors may be inclined to buy shares at a perceived bargain, potentially driving the stock price higher.

- Oil Price Surge: U.S. crude futures have surged above $100 per barrel for the first time since mid-2022, driven by Iran's threats to close the Strait of Hormuz, with a staggering 35.6% increase last week marking the largest weekly gain in futures history, which has directly impacted the stock market, leading to the Dow's worst week in nearly a year.

- Economic Pressure Intensifies: The rising oil prices have prompted Democrats to frame the conflict as a catalyst for increased living costs, potentially affecting the upcoming midterm elections negatively, while Republicans hope for a swift resolution to avoid economic fallout, highlighting the intersection of politics and economics.

- FDA Leadership Change: Vinay Prasad, the FDA's vaccine chief, announced his resignation effective at the end of April following widespread criticism of his decisions from the biotech and pharmaceutical sectors, illustrating the challenges and pressures regulatory bodies face in managing public health crises.

- Changing Canadian Consumption Trends: Canadians continue to boycott U.S. goods, with data indicating a shift towards domestic brands and increased local tourism spending, a trend that could significantly impact Canada's GDP and inflation rates in the long term.

- Oil Price Surge: U.S. crude futures have surpassed $100 per barrel for the first time since mid-2022, driven by output cuts from Iraq, Kuwait, and the UAE, which could have significant implications for the global economy.

- Economic Pressure Intensifies: The rising oil prices are being framed by Democrats as a threat to everyday Americans' living costs, potentially forcing the Trump administration to reconsider its stance on the Iran conflict ahead of the midterm elections.

- FDA Leadership Change: Vinay Prasad, the FDA's vaccine chief, announced his resignation effective at the end of April following widespread criticism of his decisions, which may impact the FDA's vaccine policies and public trust.

- Canadian Consumption Trends: Canadians continue to boycott U.S. goods, with data showing increased spending on domestic brands and tourism, which could affect Canada's GDP and inflation, indicating structural changes in the country's economy.

- Oil Price Surge Impact: The ongoing conflict in Iran has pushed West Texas Intermediate (WTI) crude oil prices above $100 for the first time, leading to a 1.33% drop in the S&P 500 on Friday, indicating market anxiety about future economic conditions.

- Historic Price Increase: WTI surged over 17% in a single day on Sunday, with a weekly gain of 36%, marking the largest increase in futures history, which has driven national gasoline prices up to $3.45 and diesel to $4.60, directly affecting consumer spending.

- Economic Data Expectations: The Consumer Price Index (CPI) is expected to rise slightly to 0.3% on Wednesday, while core CPI remains at 2.5%, indicating persistent inflationary pressures that could influence Federal Reserve monetary policy decisions.

- Trade Deficit Narrowing Forecast: January's U.S. trade deficit is projected to narrow to $65.3 billion, down from $70.3 billion last month, reflecting potential signs of economic recovery amid the uncertain long-term impacts of the Supreme Court's tariff ruling.