New York Rangers Partner with Polymarket for Enhanced Fan Engagement

- Partnership Announcement: The New York Rangers have partnered with Polymarket, the world's largest prediction market, to become the official prediction market partner, which is expected to enhance fan engagement through LED signage and on-site activations, significantly increasing brand visibility.

- Event Integration: Polymarket will showcase its brand during Rangers games through various activations, including on-ice contests and digital advertising, which is anticipated to attract more viewers and enhance interactivity during events.

- Brand Promotion: As the presenting partner for 'In-Game Polls', Polymarket will feature prominently on MSG Networks with dedicated post-game segments and branded commercials, expected to significantly boost brand awareness among fans.

- Long-term Strategy: This partnership marks a significant step for the Rangers in the emerging market of prediction markets, aiming to attract a younger audience by enhancing the fan experience, thereby solidifying their position in the sports market.

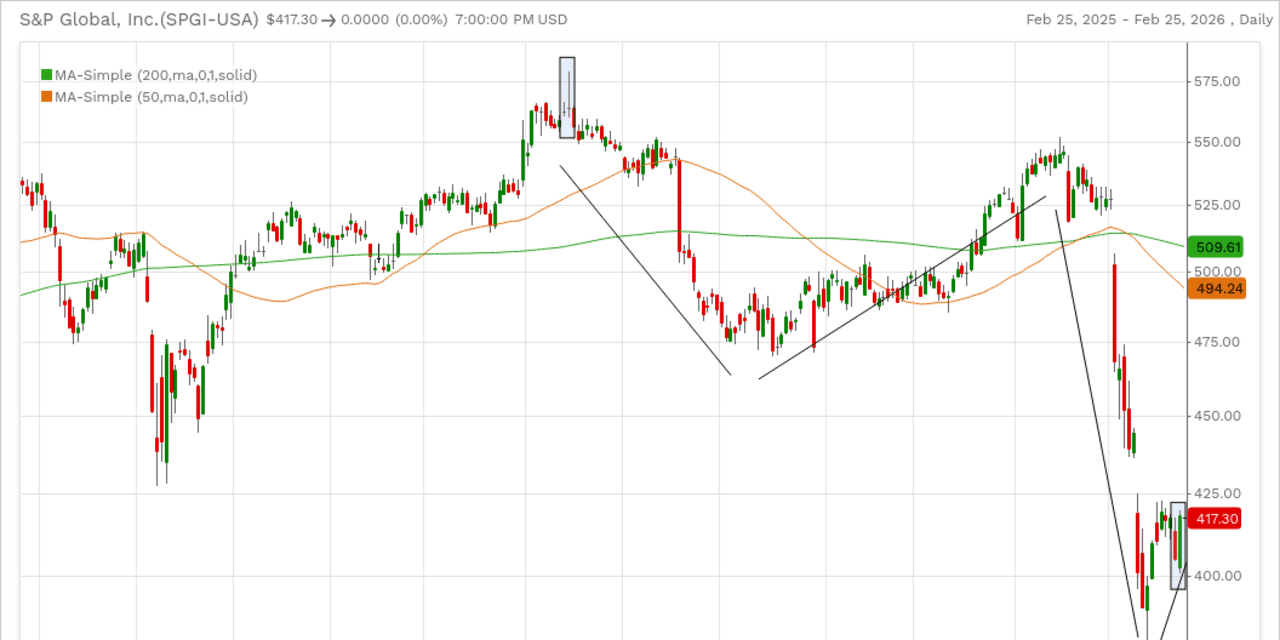

Trade with 70% Backtested Accuracy

Analyst Views on MSGS

About MSGS

About the author

- Revisiting Stock Picks: Analyzing past stock recommendations can uncover new investment opportunities rather than just assessing their historical performance.

- Investment Insights: Old stock calls may provide valuable insights into current market trends and potential future gains.

- Strategic Analysis: Investors can benefit from a strategic review of previous picks to inform their current investment strategies.

- Market Dynamics: Understanding how past selections performed can help investors navigate changing market conditions effectively.

- Stock Surge: Shares of Madison Square Garden Sports Corp. surged over 15% in morning trading after the announcement of plans to spin off the Knicks and Rangers, marking the largest intra-day gain since September 2015, indicating strong market enthusiasm for the initiative.

- Spin-Off Details: The proposed separation will encompass the NBA's Knicks and the developmental Westchester Knicks, along with the NHL's Rangers and Hartford Wolf Pack; while no timeline was provided for a final decision, the spin-off is expected to be structured as a tax-free transaction.

- Strong Financial Performance: MSG Sports reported a 13% increase in second-quarter revenue to $403.4 million, driven by higher ticket sales, sponsorships, and food and beverage income, showcasing robust performance in the sports market despite some declines in local media rights fees.

- Market Sentiment Shift: Retail sentiment on Stocktwits shifted from neutral to bullish, although some users cautioned that the spin-off could take considerable time, reflecting an optimistic outlook on MSG's future developments.

Investor Expectations: Investors are anticipating a shareholder-friendly action from Madison Square Garden Sports to address the disparity between the company's market value and the worth of its sports teams, the New York Knicks and New York Rangers.

Market Value Concerns: There is a significant gap between the market value of Madison Square Garden Sports and the estimated value of its two major sports franchises, raising concerns among investors.

- Stock Performance: Madison Square Garden Sports shares increased by 12% following the approval of a plan to explore potential spin-off opportunities.

- Strategic Move: The decision to consider a spin-off indicates a strategic shift aimed at enhancing shareholder value and operational focus.

- Price Target Increase: Citi analyst Jason Bazinet raised Madison Square Garden Sports Corp.'s price target from $290 to $337 while maintaining a Buy rating, indicating the company's openness to a potential minority stake sale, which could help narrow the valuation gap with private market benchmarks.

- Strong Financial Performance: Madison Square Garden Sports reported Q2 revenue of $403.42 million on February 5, 2026, exceeding the consensus estimate of $394.57 million, showcasing positive momentum across all in-game revenue categories and reflecting strong consumer and corporate demand that supports long-term value creation.

- Balanced Market Risk: Morgan Stanley analyst Benjamin Swinburne increased his price target from $220 to $295 while keeping an Equal Weight rating, noting that Q2 results were in line with expectations and per-game spending remained strong, suggesting a balanced risk/reward profile after a more than 35% rally in shares over the past six months.

- Attractive Rating Upgrade: JPMorgan analyst David Karnovsky raised his price target from $240 to $305 and maintained an Overweight rating, stating that the stock's risk/reward appears attractive following the fiscal Q2 report, indicating strong market confidence in the company.

Success of The Sphere: The Sphere arena in Las Vegas has proven to be a successful venture, benefiting investors significantly.

CEO's Vision: CEO James Dolan played a crucial role in the arena's conception, design, and construction, demonstrating his commitment by monitoring the project remotely.