Jabil (NYSE: JBL) Stock Rises Daily, Goldman Sachs Raises Price Target to $282

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 15 2026

0mins

Should l Buy JBL?

Source: NASDAQ.COM

- Stock Performance: Jabil's stock has risen each trading day this week, closing 4.9% higher than the previous session as of Wednesday, indicating strong market performance and investor confidence.

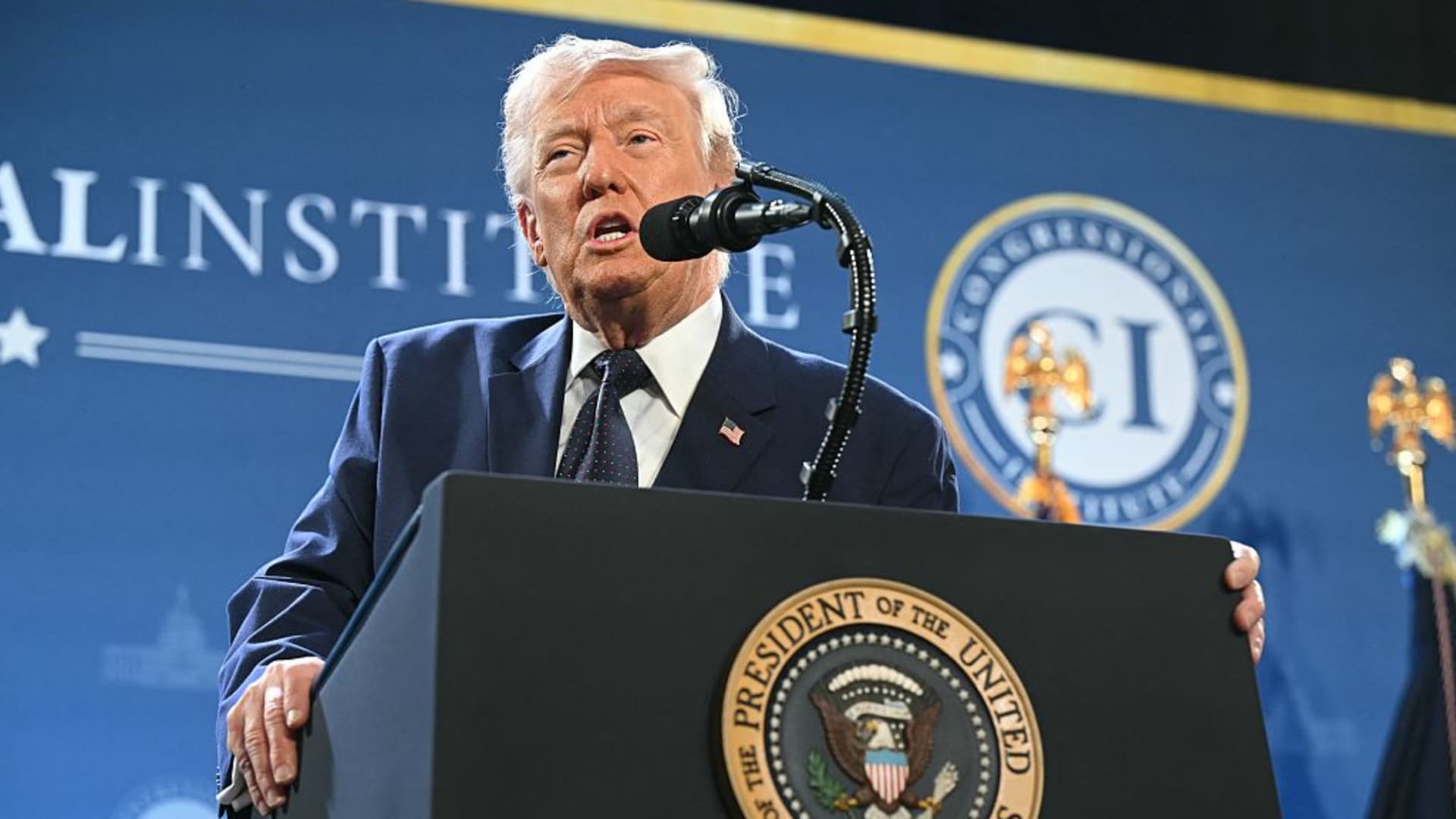

- Analyst Price Target Increase: Goldman Sachs analyst Mark Delaney raised Jabil's price target from $255 to $282, based on optimistic expectations for growing data center demand, implying nearly 17% upside potential.

- Consistent Bullish Views: Bank of America also raised its price target on Jabil from $265 to $280, further reflecting positive market sentiment, although investors should remain focused on the company's fundamentals.

- Financial Health Outlook: Jabil projects year-over-year revenue growth for fiscal 2026 and maintains consistent profitability, showcasing its extensive exposure to the artificial intelligence sector and significant growth potential, making it a worthy consideration for investors.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy JBL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on JBL

Wall Street analysts forecast JBL stock price to rise

6 Analyst Rating

5 Buy

1 Hold

0 Sell

Strong Buy

Current: 247.460

Low

244.00

Averages

265.00

High

283.00

Current: 247.460

Low

244.00

Averages

265.00

High

283.00

About JBL

Jabil Inc. provides comprehensive engineering, manufacturing, and supply chain solutions. The Company provides comprehensive electronics design, production, and product management services to companies in various industries and end markets. The Company’s Regulated Industries segment is focused on regulated markets and includes revenues from customers primarily in the automotive and transportation, healthcare and packaging, and renewable energy infrastructure industries. Its Intelligent Infrastructure segment is focused on the modern digital ecosystem including artificial intelligence (AI) infrastructure and includes revenues from customers primarily in the capital equipment, cloud and data center infrastructure, and networking and communications industries. Its Connected Living and Digital Commerce segment is focused on digitalization and automation, including warehouse automation and robotics. The Company is also engaged in drug development and manufacturing solutions.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Oil Price Fluctuations: U.S. benchmark WTI crude prices have fallen below $90 a barrel, despite being up over 50% year-to-date, indicating market optimism regarding improved U.S.-Iran relations, yet geopolitical risks continue to loom over oil prices.

- Tech Stock Rating Changes: Intuit was upgraded to buy from hold by Rothschild & Co Redburn, with its stock rising over 30% since late February, although it remains down 28.5% for the year, reflecting a recovery in market confidence in its software products.

- Cybersecurity Stock Bounce: Morgan Stanley upgraded CrowdStrike from hold to buy, with its stock up over 20% from last month's low, highlighting the positive impact of AI technology on the cybersecurity sector and indicating optimistic market expectations for future growth.

- Hewlett Packard Enterprise's Positive Outlook: Despite memory cost pressures, the company raised its full-year earnings outlook, with reported quarterly revenues slightly below expectations but gross margins and adjusted EPS exceeding forecasts, demonstrating strong demand in the data center buildout.

See More

- Financial Release Schedule: Jabil will release its Q2 fiscal year 2026 financial results on March 18, 2026, before market open, showcasing the latest financial performance updates that may influence investor confidence.

- Conference Call Details: The company will host a conference call and webcast at 8:30 a.m. ET on the same day to analyze the financial results in depth and engage with investors, enhancing transparency and communication efficiency.

- Investor Relations Access: Investors can access the live audio webcast and accompanying slide presentation through the Investor Relations section of Jabil's website, ensuring timely information retrieval and understanding, which enhances investor awareness of the company's strategy.

- Company Background: With 60 years of industry experience and over 100 sites globally, Jabil is committed to providing engineering, supply chain, and manufacturing solutions for top brands, emphasizing sustainability and community building to strengthen its market competitiveness.

See More

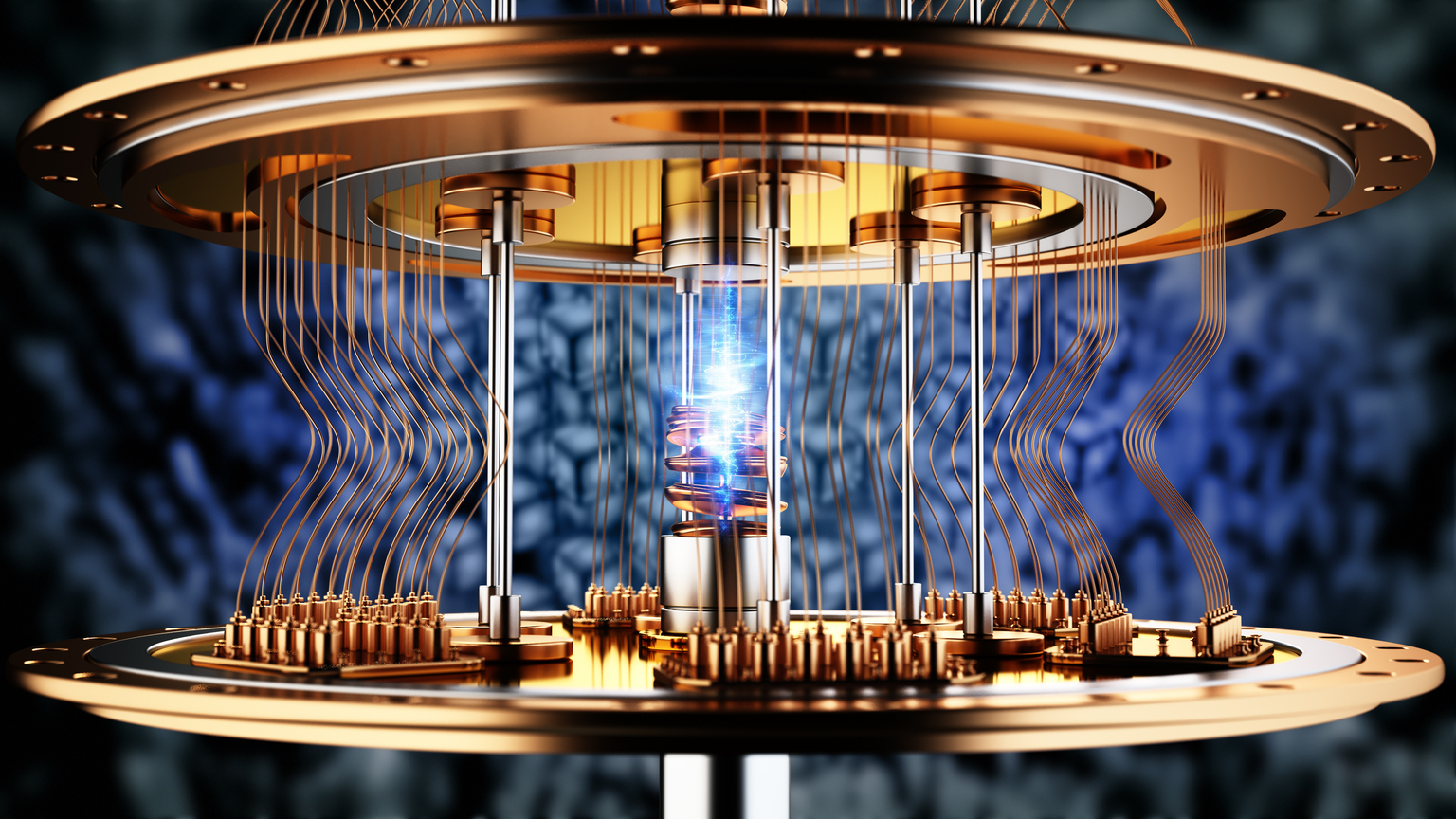

- Surge in AI Infrastructure Spending: According to Futurum, the top five hyperscalers in the U.S. are projected to spend between $660 billion and $690 billion on AI infrastructure in 2026, a significant increase from last year's $380 billion, indicating robust demand and growth potential in the AI market.

- Micron's DRAM Demand Soars: Micron Technology's DRAM chips are critical for AI data centers, with AI servers requiring six times the DRAM of standard servers, leading to a severe shortage and a 75% price increase from December 2025 to January 2026, providing strong support for Micron's earnings growth.

- Jabil's AI Revenue Growth: Jabil anticipates a 35% increase in AI revenue to $12.1 billion in fiscal 2026, an improvement over the previously forecasted 25% growth, showcasing the success of its investment in expanding AI infrastructure manufacturing capacity.

- Attractive Investment Valuations: Micron's trailing P/E ratio of 24 is significantly lower than the Nasdaq-100's 31, indicating attractive stock value, while Jabil's forward P/E of 19 suggests both companies present compelling investment opportunities in the growing AI market.

See More

- Market Spending Forecast: According to Futurum's research, the spending on AI infrastructure by the five largest hyperscalers in the U.S. is expected to reach between $660 billion and $690 billion in 2026, a significant increase from last year's $380 billion, indicating a strong investment commitment to AI technology.

- Micron's Technological Edge: Micron's high-bandwidth memory (HBM) is critical for AI data centers, with predictions that AI servers will require six times the amount of DRAM compared to standard servers, driving up memory chip prices and leading analysts to be bullish on Micron's earnings growth prospects.

- Jabil's Growth Potential: Jabil plans to invest $500 million to expand its AI data center infrastructure manufacturing capacity, with projected AI revenue growth of 35% to $12.1 billion in fiscal 2026, showcasing its strong growth momentum in the AI infrastructure space.

- Investment Opportunities: Both Micron and Jabil stocks are currently trading at 24 times and 19 times forward earnings, respectively, which are below the Nasdaq-100's multiples, providing investors with attractive opportunities amidst the rapid growth of AI infrastructure.

See More

- Stock Performance: Jabil Inc.'s shares rose by 0.15% to $278 in after-hours trading on Wednesday, following a 4.25% increase during the regular session, indicating positive market sentiment regarding its future performance.

- Market Capitalization: The company boasts a market capitalization of $29.31 billion, with an annual trading range of $281.22 to $108.66, reflecting its solid position and growth potential in the manufacturing services sector.

- Technical Indicators: With a Relative Strength Index (RSI) of 65.52, Jabil's stock has surged 76.22% over the past 12 months, currently trading near its annual high, suggesting potential for further upside.

- Sustainability Certification: Jabil opened the Cloud Corner at Q2 Stadium, which received TRUE Platinum certification from Green Business Certification Inc., highlighting its excellence in zero-waste management and enhancing the company's brand image.

See More

- Boeing Options Volume: Boeing Co. (BA) recorded an options trading volume of 43,821 contracts today, equating to approximately 4.4 million shares, which represents about 57.7% of its average daily trading volume of 7.6 million shares over the past month, indicating heightened market interest in its future performance.

- High-Frequency Contracts: Notably, the $235 strike call option expiring on February 20, 2026, saw a trading volume of 5,258 contracts today, representing around 525,800 underlying shares of BA, suggesting bullish sentiment among investors at this price level.

- Block Inc Options Activity: Concurrently, Block Inc (XYZ) also exhibited significant activity with an options trading volume of 39,203 contracts, representing approximately 3.9 million shares, or 48.2% of its average daily trading volume of 8.1 million shares over the past month, reflecting strong market interest in its stock.

- XYZ High-Frequency Contracts: Specifically, the $52 strike call option expiring on February 20, 2026, recorded a trading volume of 3,817 contracts today, equating to about 381,700 shares of XYZ, indicating bullish expectations among investors for this stock.

See More