Key Takeaways

- The electric vehicle industry is surging forward, driven by global policies and tech innovations that make EVs more accessible than ever.

- You can capitalize on this growth by focusing on leaders like Tesla and NIO, which offer strong market positions and innovation edges.

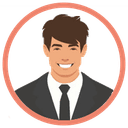

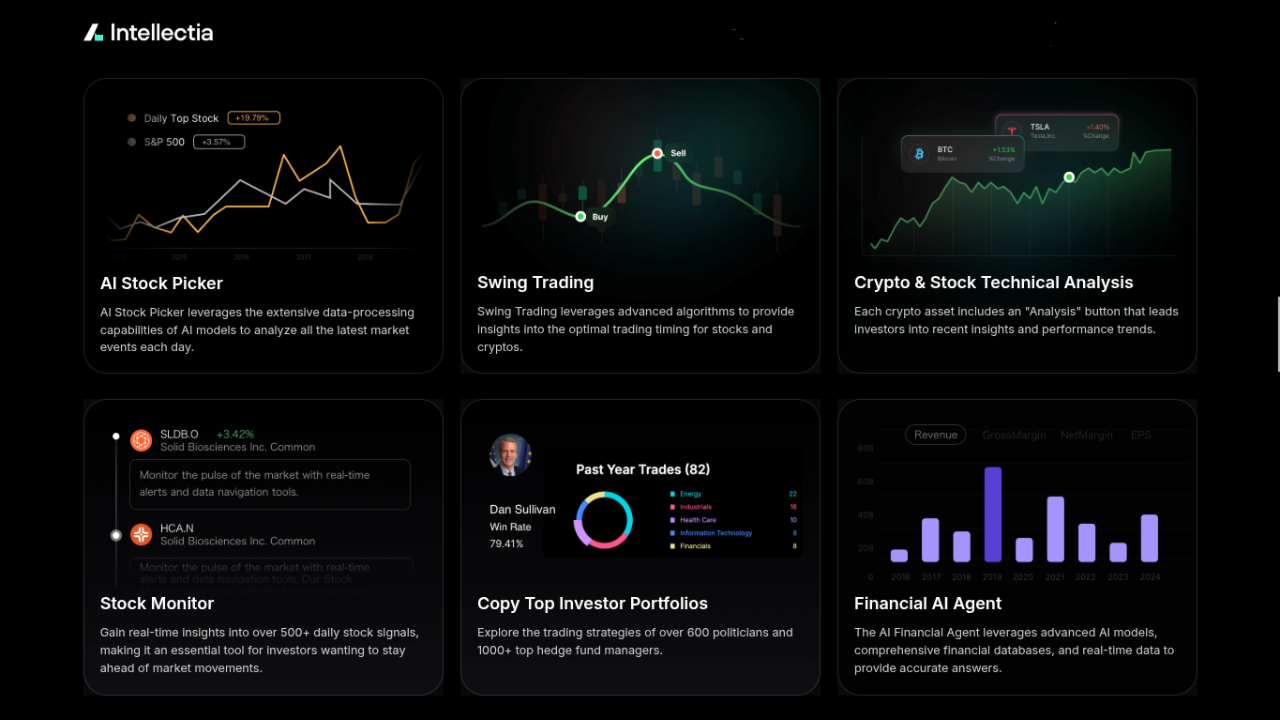

- Using tools like Intellectia.ai's AI stock screener helps you spot the best opportunities based on real metrics.

- Diversification and long-term holding are key strategies to navigate risks in this dynamic sector.

- With projections showing EVs reaching up to 40% of global sales by 2030, now's the time to build a future-proof portfolio.

Introduction

Have you ever felt overwhelmed trying to pick winning investments in a market full of hype and uncertainty? You're not alone—many investors chase trends but end up missing the real opportunities because they lack clear data on what's driving growth.

The electric vehicle sector aggregates massive potential, with sales climbing as governments push for cleaner energy and consumers demand sustainable options. But sorting through the noise requires expertise in analyzing trends like battery tech and market shifts.

As someone who's crunched the numbers on AI-driven stock predictions, I've seen how focusing on fundamentals can turn confusion into confidence.

The solution? Dive into top EV stocks using proven criteria and tools like Intellectia.ai's features for stock selection and analysis. For instance, imagine spotting a stock like Tesla early—its tech edge has delivered huge returns for savvy investors. By leveraging AI insights, you can position your portfolio for the EV boom ahead.

The Rise of the Electric Vehicle Industry

You're witnessing a massive shift toward electric vehicles, fueled by urgent needs to cut emissions and embrace greener tech. Governments worldwide are rolling out policies like subsidies and emission standards to speed this up.

Consumer demand is skyrocketing as people like you seek eco-friendly rides with lower running costs—think no more gas station stops. Technological advancements in batteries and charging make EVs practical for everyday use.

This global push isn't just talk; it's backed by real progress in infrastructure and innovation. For example, Europe aims for 60% EV sales by 2030 under stricter CO2 rules. Your chance to get in early lies in understanding these drivers, which are setting the stage for explosive growth.

Why Invest in Electric Vehicle Stocks?

You should consider EV stocks because the sector's potential is enormous, with EV sales projected to hit 56% of global vehicle sales by 2035. This growth stems from falling battery costs and expanding charging networks, making EVs cheaper and more convenient.

Investing here means tapping into a market that's not just trending but transforming transportation. You'll benefit from companies innovating in autonomy and efficiency, outpacing traditional autos.

Risks like supply chain issues exist, but the rewards—think high returns from leaders—make it compelling. With AI tools at Intellectia.ai, you can track trends like these for smarter decisions.

Criteria for Selecting the Best EV Stocks

When picking EV stocks, you want to focus on key metrics that signal strong potential. Start with revenue growth—look for companies expanding sales rapidly in this booming market. Production capacity matters too; firms scaling up output can meet rising demand without hiccups. Innovation is crucial—check for advancements in battery tech or AI integration.

Market cap gives a sense of stability, while key strengths like global reach set winners apart. Use Intellectia.ai's AI stock screener to filter these easily. This approach helps you avoid duds and spot gems, ensuring your picks align with long-term EV trends.

5 Best Electric Vehicle Stocks for 2025

You've got options in the EV space, but these five stand out for their growth potential. Here's a quick comparison:

| Company Name | Ticker | Market Cap (USD) | Revenue Growth (Quarterly YoY) | Key Strengths |

| Tesla | TSLA | 1.13T | -11.8% (with projected recovery) | Market leader with advanced technology and global reach |

| NIO | NIO | ~6B (est.) | 20.8% (deliveries growth) | Fast-growing Chinese EV maker with strong battery-swapping tech |

| Li Auto | LI | 23.71B | 1% | Hybrid EV focus with robust sales in China |

| Rivian | RIVN | 16.04B | 12.5% | Premium EVs with Amazon-backed contracts |

| BYD | BYDDY | 138.35B | 35.6% | Diversified EV manufacturer with leading battery production |

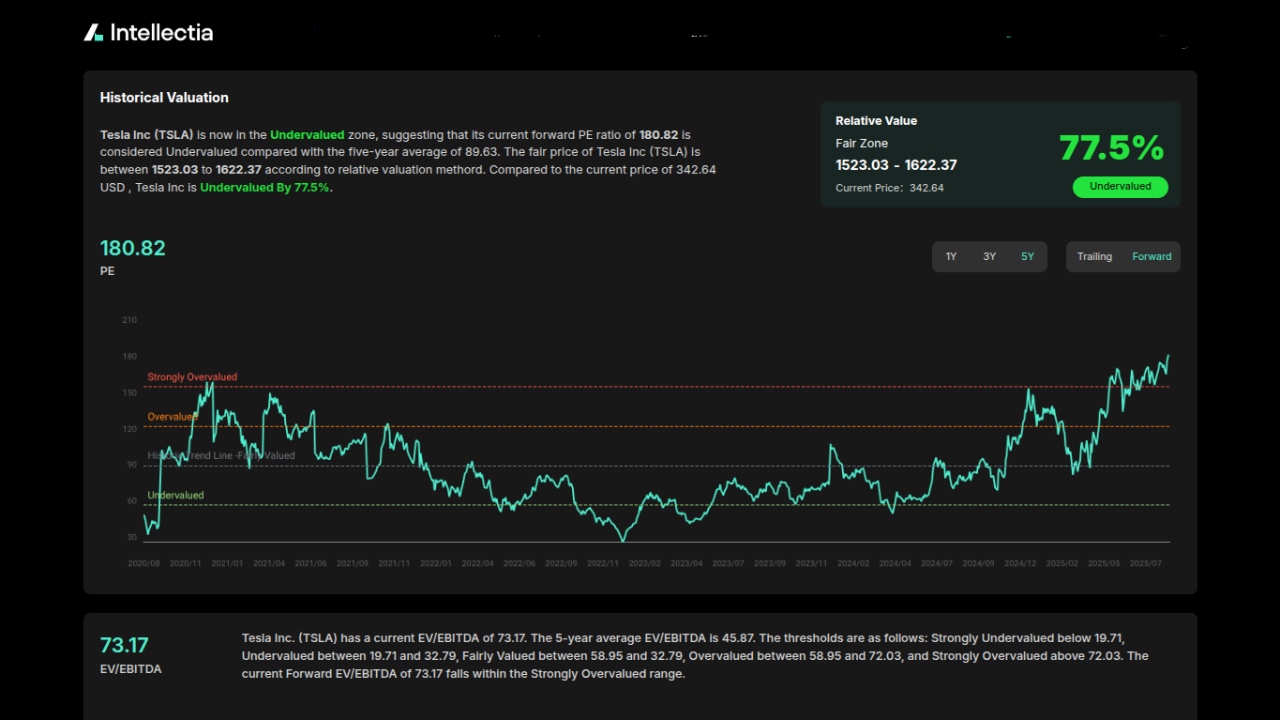

Tesla (TSLA)

Tesla dominates as the EV pioneer, with its Autopilot and vast supercharger network. Let's talk about Tesla's recent progress—it's been firing on all cylinders in 2025. Just this month, you've seen the rollout of software update 2025.32, introducing Low Power Mode to cut energy use while parked, which is a game-changer for efficiency.

They're also teasing a new Model Y trim with 21-inch wheels and a black headliner, possibly launching soon, and pushing Full Self-Driving (FSD) into Australia by August 29. On the production side, their lithium plant is advancing, with site updates showing operational ramps as of August 22. Plus, the new Roadster with SpaceX thrusters promises insane performance, hitting new EV speed benchmarks.

Financially, Tesla's results showed resilience despite a revenue dip, with projections for recovery amid stock advances above buy points. Operationally, their strengths lie in vertical integration—from battery production to software—that keeps costs down and innovation high. You've got a massive global footprint with over 50,000 Superchargers and Gigafactories pumping out vehicles.

Why should you invest? Tesla's not just selling cars; they're building an ecosystem with autonomy and energy storage. With EV adoption surging, your portfolio could benefit from their market lead and projected growth—despite China pressures, the upside in FSD and new models makes it a must-watch for long-term gains.

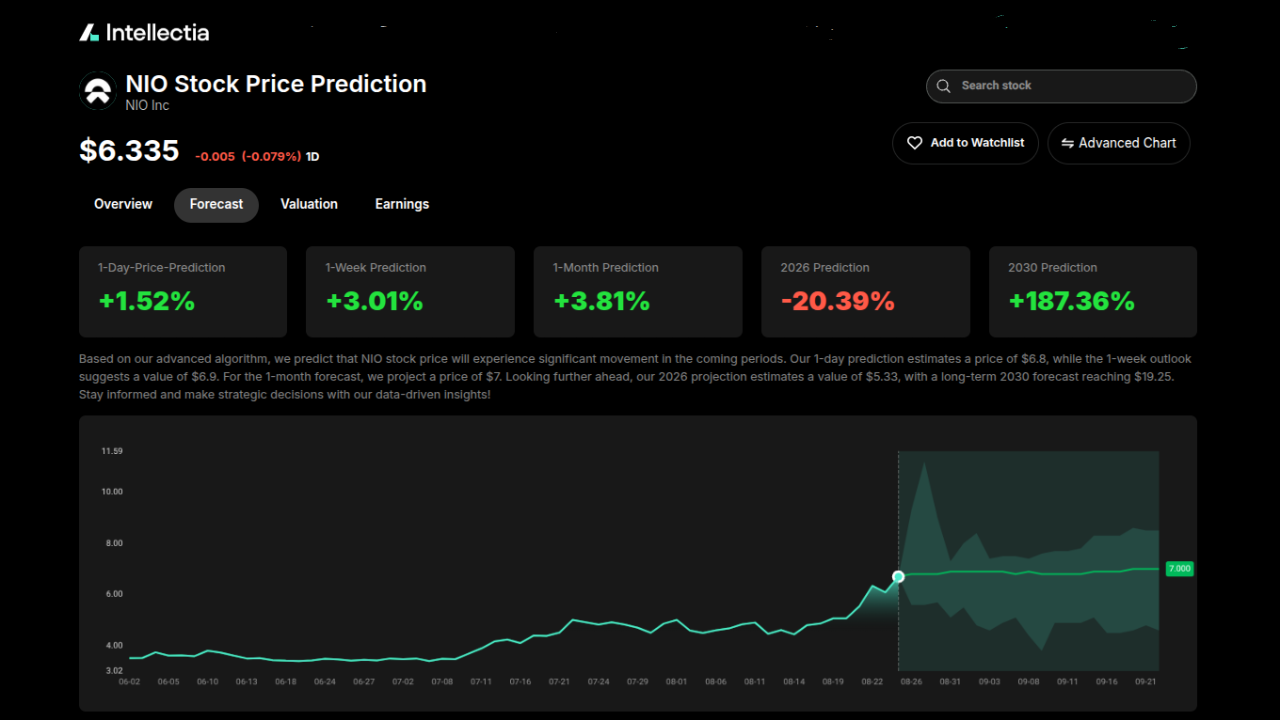

Nio (NIO)

Nio shines in China with battery-swapping stations that solve charging woes quickly as delivery surges show real momentum. Your interest in NIO should spike with their 2025 progress: July deliveries hit 21,017, pushing year-to-date to 135,167, and they've built over 3,460 battery swap stations by August.

New SUV launches, including the affordable ES8, are driving excitement, with forecasts for 50% delivery growth this year and 47% in 2026. They're also advancing net-zero goals and expanding lines like Onvo and Firefly. Stock-wise, it surged 45% in 2025, up 37% in recent weeks.

Financially, NIO's focusing on margins with affordability shifts, though a recent stock dip shows volatility. Operationally, their battery-swapping tech is a standout, offering swaps in minutes, plus strong R&D in autonomy and smart cockpits. You've got a growing presence in Europe too.

Investing in NIO makes sense if you're betting on China's EV boom— their path to profitability, innovative tech, and delivery momentum could deliver big returns, especially at 2025 highs. With rivals struggling, your stake here taps into high-growth potential.

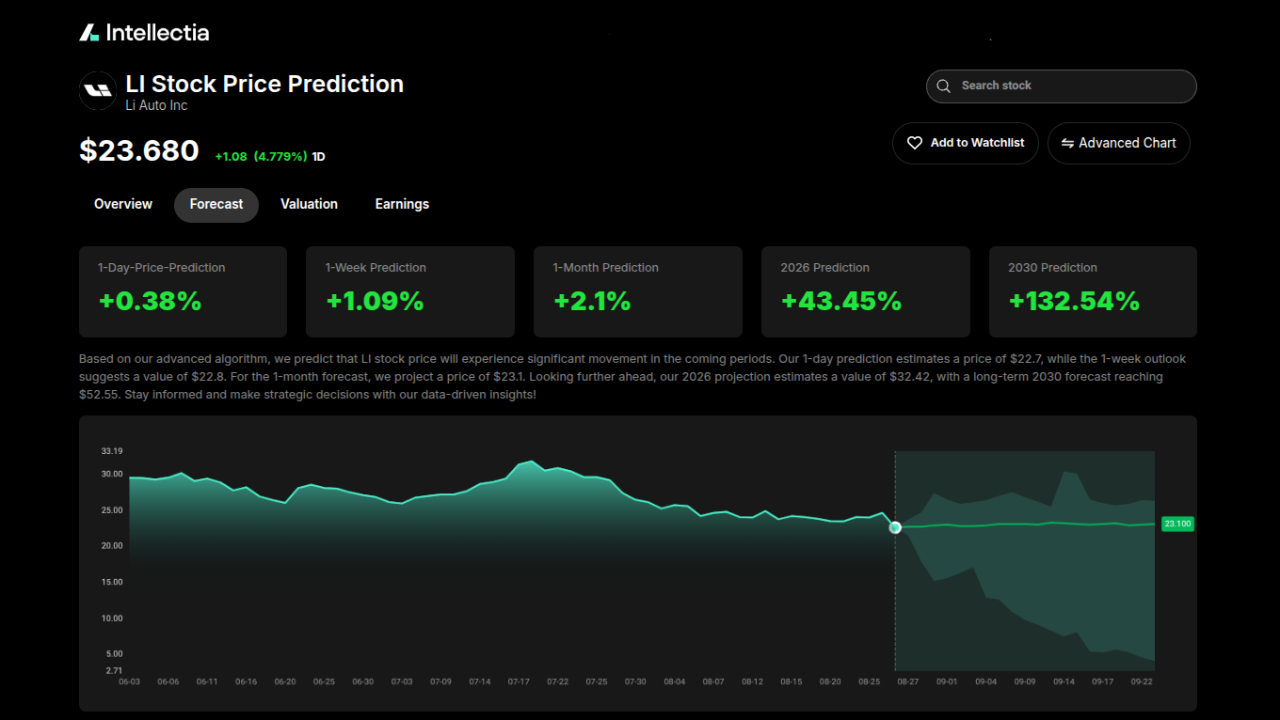

Li Auto (LI)

Li Autoblends hybrids for practical appeal, boosting sales in competitive markets for its edge in affordability. You've got fresh news on Li Auto: Their Q2 deliveries reached 111,074, outpacing rivals, and July added more, hitting a cumulative 1,368,541.

The big launch? The pure-electric Li i8 SUV, a six-seater poised as a 2025 breakthrough. Shares dipped after relaunch but remain stable overall. Revenues are setting a solid base.

Financially, they're growing steadily, with hybrid models driving profits in a tough market. Operationally, strengths include robust China sales, advanced ADAS, and efficient supply chains. You've seen consistent delivery growth, making them reliable.

Why invest? Li Auto's hybrid-to-electric shift with the i8 could capture more market share, offering you balanced risk and reward in EVs. Their financial stability and innovation make it a smart pick for diversified growth.

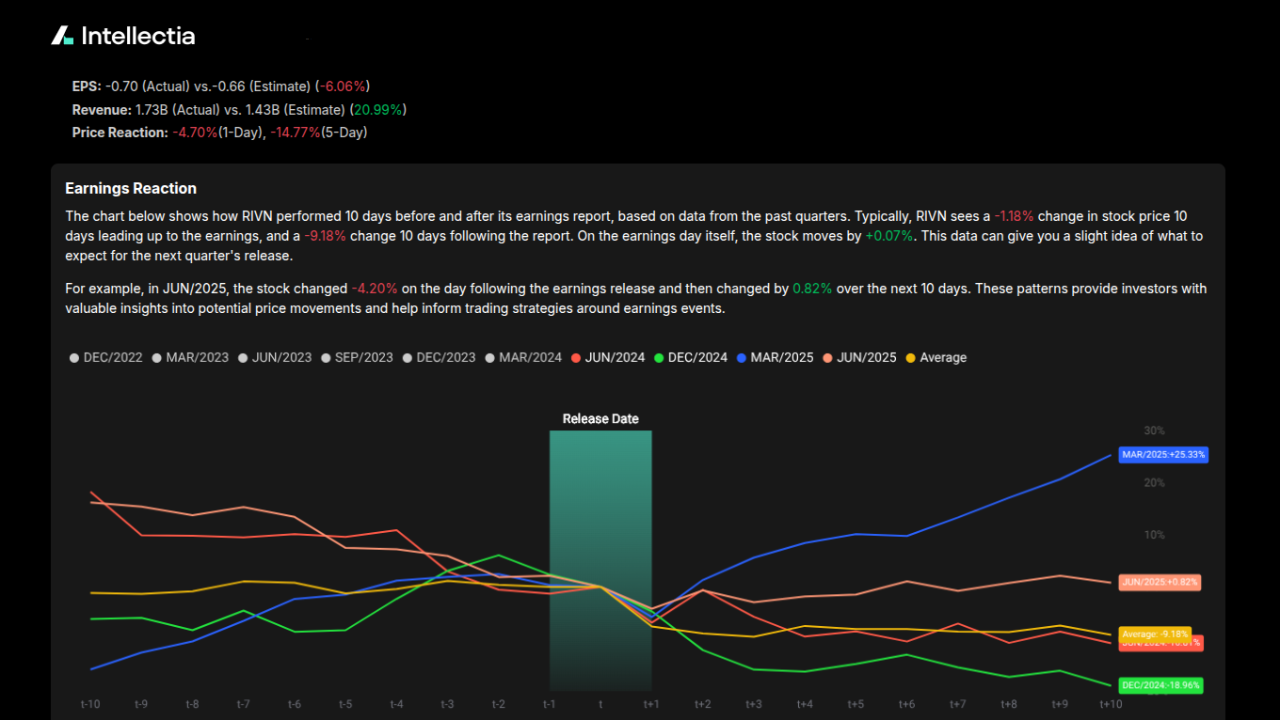

Rivian (RIVN)

Rivian targets adventure seekers with rugged trucks, backed by big deals like Amazon's. Rivian's making waves in 2025: Q2 financials showed $1.3 billion revenue growth. They're prepping the R2 launch at $50K, scaling production, and announcing an Atlanta HQ.

Software update 2025.26 tweaked Highway Assist (with fixes coming), and they're eyeing point-to-point hands-free driving by 2026. App v3.4.0 adds demo drives, showing user focus. Shares surged 7.4% recently on production news.

Financially, revenue's up, but losses highlight scaling challenges. Operationally, Amazon contracts provide steady orders, and premium builds like the 2025 R1S with structural tweaks shine in safety. You've got flexibility in tariffs and strong manufacturing ramps.

You should invest because Rivian's R2 could democratize premium EVs, turning losses into profits. With autonomy, progress and big partnerships, it's positioned for explosive growth in your portfolio.

BYD (BYDDY)

BYD excels in vertical integration, making its own batteries for cost advantages. BYD's 2025 has been blockbuster: July production dipped 0.9%, but overall growth continues with record deliveries after 34% price cuts on 20+ models. They set a new EV speed record at 472.41 km/h with YANGWANG U9. Global expansion hits Nepal, Malaysia, Cambodia—reaching 2,500 in Cambodia, eyeing 10,000 yearly.

H1 best-sellers like Seagull took 5% share. Raised 2025 sales target to 500,000, ranked 91st in Fortune 500. Launched China's first NEV track. Financially, aggressive pricing sparked margins but drove volumes; board meeting August 8 for updates. Operationally, battery leadership and diversification into buses, trucks give edge. You've got a juggernaut reshaping markets.

You can invest in BYD for its dominance—top sales, global push, and cost efficiencies mean high returns as EVs go mainstream. Your bet here hedges on China's lead.

Strategies for Investing in EV Stocks

You can build a solid EV portfolio by diversifying across makers and suppliers to spread risk. Hold long-term, as the sector's growth unfolds over years, not months.

Monitor trends with Intellectia.ai's AI analytics to stay ahead of market shifts. Consider swing trading signals for shorter plays.

Balance with crypto if you're adventurous for overlaps in green tech. Always use tools like technical analysis to time entries.

Powering Your Portfolio with Top EV Stocks

Electric vehicle stocks like Tesla and NIO offer high-growth opportunities as the industry expands rapidly.

Investors should balance potential rewards with risks like competition and supply chain issues.

Leverage Intellectia.ai’s stock screener to identify the best EV stocks and build a diversified, future-focused portfolio.

Conclusion

Wrapping up, these top EV stocks—Tesla, NIO, Li Auto, Rivian, and BYD—present exciting ways to tap into a sector poised for massive expansion. With tech breakthroughs and supportive policies, your investments here could yield strong returns.

Remember, success comes from smart analysis and diversification. For final recommendations, prioritize companies with solid innovation and market share.

Ready to take action? Sign up and subscribe for daily AI stock picks, trading signals, strategies, and market analysis from Intellectia.ai. Don't miss out—start powering your portfolio today.