Key Takeaways

PayPal's dramatic 20% stock drop following disappointing Q4 earnings has created a potential value opportunity for investors willing to navigate near-term uncertainty.

• Deep value opportunity: PYPL trades at just 7.71 P/E ratio, 81% below historical averages, with analysts targeting $62.87 (51% upside potential)

• Strong fundamentals persist: Despite challenges, PayPal generates $1.72B quarterly free cash flow and maintains 400+ million global users across established ecosystem

• Growth concerns are real: Revenue growth slowed to 6.8%, user engagement metrics declining, and intensifying competition from Apple Pay and fintech rivals

• Leadership transition underway: New CEO Alex Chriss implementing cost cuts (9% workforce reduction) while navigating structural competitive pressures

• Risk-reward favors patient investors: Strong balance sheet with $10.8B cash provides stability, but success depends on management's ability to reignite growth

The stock appears priced for pessimism rather than optimism, potentially rewarding long-term investors who can tolerate short-term volatility while the company executes its turnaround strategy.

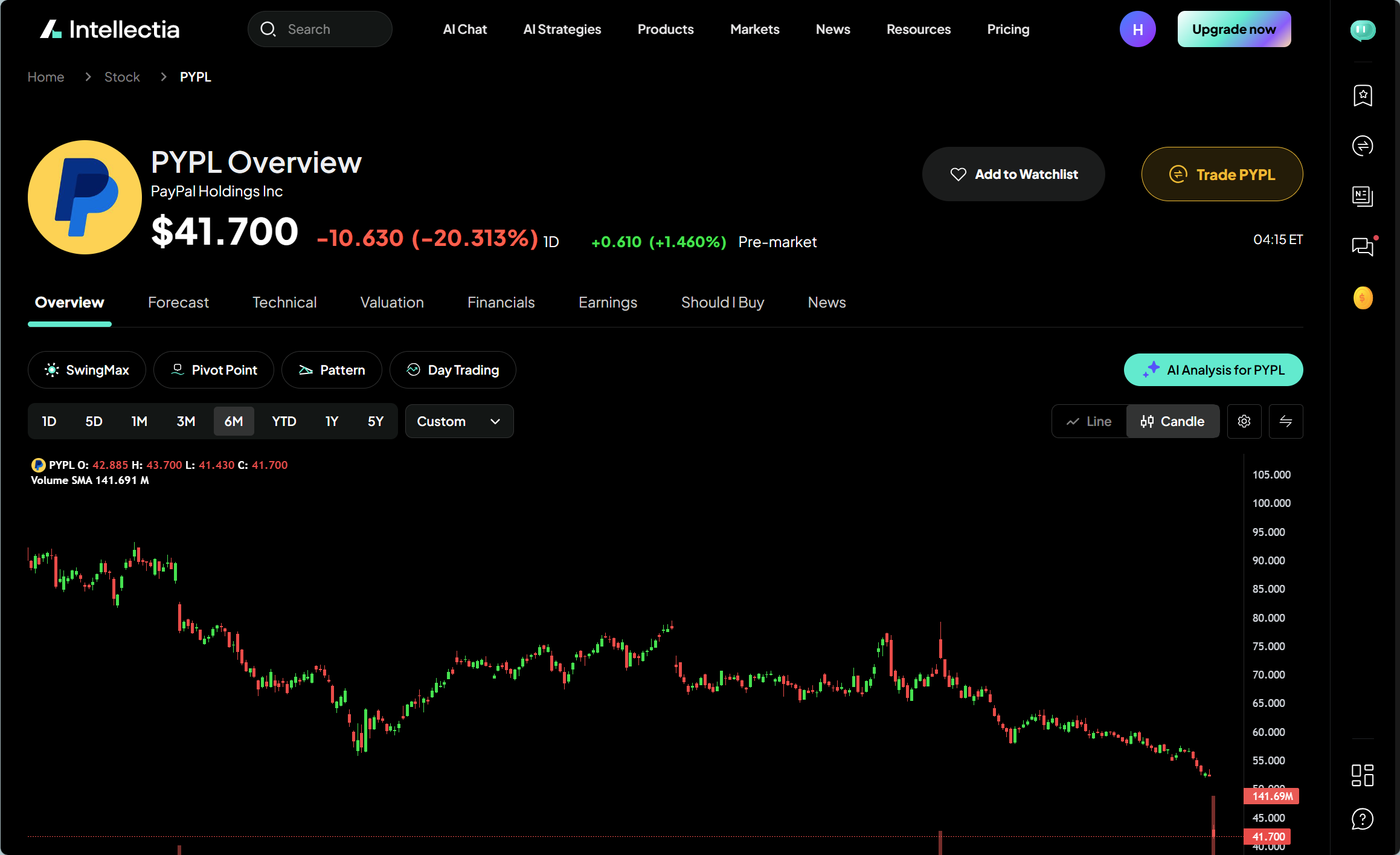

PayPal stock has plunged 20% after disappointing Q4 earnings results. PYPL stock trades at $42.26, showing a worrying 21.82% decline in the last week. The stock maintains a low P/E ratio of 7.71, which might interest value-focused investors.

PayPal Holdings, Inc. leads the digital payment revolution. The company builds technology platforms that create smooth buying experiences for merchants and consumers worldwide. The company faces structural hurdles and has made leadership changes to address these challenges. Analysts project a one-year target of $68.91. Many investors wonder why PayPal stock has dropped by a lot and whether it makes a good investment at current prices. The management team now focuses on controlling costs and bringing state-of-the-art products to counter slowing top-line growth. This analysis will help you determine if PayPal deserves a place in your portfolio.

PayPal stock price today: What’s happening now?

PayPal's stock has seen some dramatic price swings lately. Let's take a closer look at what's happening with this fintech giant.

Current PYPL stock price and recent changes

PayPal (PYPL) shares sit at $58.37 right now. The market reacted harshly to their latest earnings reports, pushing the price down sharply from earlier levels. Investors have started to question the company's growth path. Trading volumes have jumped well above normal levels.

The market mood around PayPal hasn't been great. Investors worry about the company's disappointing future outlook and its struggle to keep growing like before. Big institutional investors have also shifted their positions, which made the price bounce around quite a bit.

1-day, 1-week, and 1-year performance

PayPal's stock numbers tell a worrying story across different time periods:

1-day performance: The stock dropped more than 10% in a single day after earnings came out

1-week performance: PYPL shares fell about 22% in the last week

1-year performance: Looking at the bigger picture, the stock lost 42.8% in the last 12 months

These numbers show that PayPal's troubles aren't just short-term hiccups - they're part of a bigger downward trend. The stock tried to recover several times throughout the year, but each rally fizzled out as sellers took control again.

Chart experts say the stock broke through several key support levels. It might need to find a new bottom before buyers jump back in. While some technical indicators suggest the stock is oversold, buyers seem hesitant to make their move.

How PayPal compares to tech sector trends

PayPal sticks out like a sore thumb in the tech sector. The Nasdaq Composite has held up well, but PayPal lags behind both the broader tech index and many other fintech companies.

PayPal's stock has fallen harder than other payment companies too. Visa and Mastercard handled market turbulence much better, though their business models differ somewhat. Other digital payment companies have struggled too, which hints at broader challenges in this specific sector.

PayPal's relative strength index (RSI) compared to the tech sector sits near its lowest points in years. This gap makes people wonder if PayPal faces unique challenges or if investors just overreacted to temporary problems.

Stock watchers think the price drops reflect real concerns about competition rather than just quick profit-taking. Investors now need to figure out if the current price already accounts for these challenges or if the stock could fall further.

The market seems especially worried about PayPal knowing how to stay ahead as competition heats up. Traditional banks, big tech companies moving into payments, and new fintech startups targeting specific parts of PayPal's business all pose serious threats.

Understanding PayPal’s business model

You need to understand PayPal's fundamental business structure to review PYPL stock as an investment. The stock performance directly shows how well the company uses its digital payment ecosystem.

Core services: PayPal, Venmo, Braintree, Xoom

PayPal has a reliable portfolio of payment services that create a detailed financial ecosystem:

PayPal - The flagship service lets users make secure online transactions between individuals and merchants across 200+ markets. The platform processes payments in 100+ currencies and offers buyer and seller protection programs that set it apart from competitors.

Venmo - This peer-to-peer payment app has grown from a simple money transfer service into a social payment platform with 70+ million active users. Users can now get a physical debit card, trade crypto, and make business payments that boost its revenue potential.

Braintree - This payment processing solution helps merchants accept various payment methods through a single integration. Braintree handles mobile and web payments and simplifies complex payment systems for businesses of all sizes.

Xoom - This international money transfer service handles cross-border payments to 170+ countries. Xoom focuses on remittances and lets users send money, reload phones, and pay bills internationally at competitive rates.

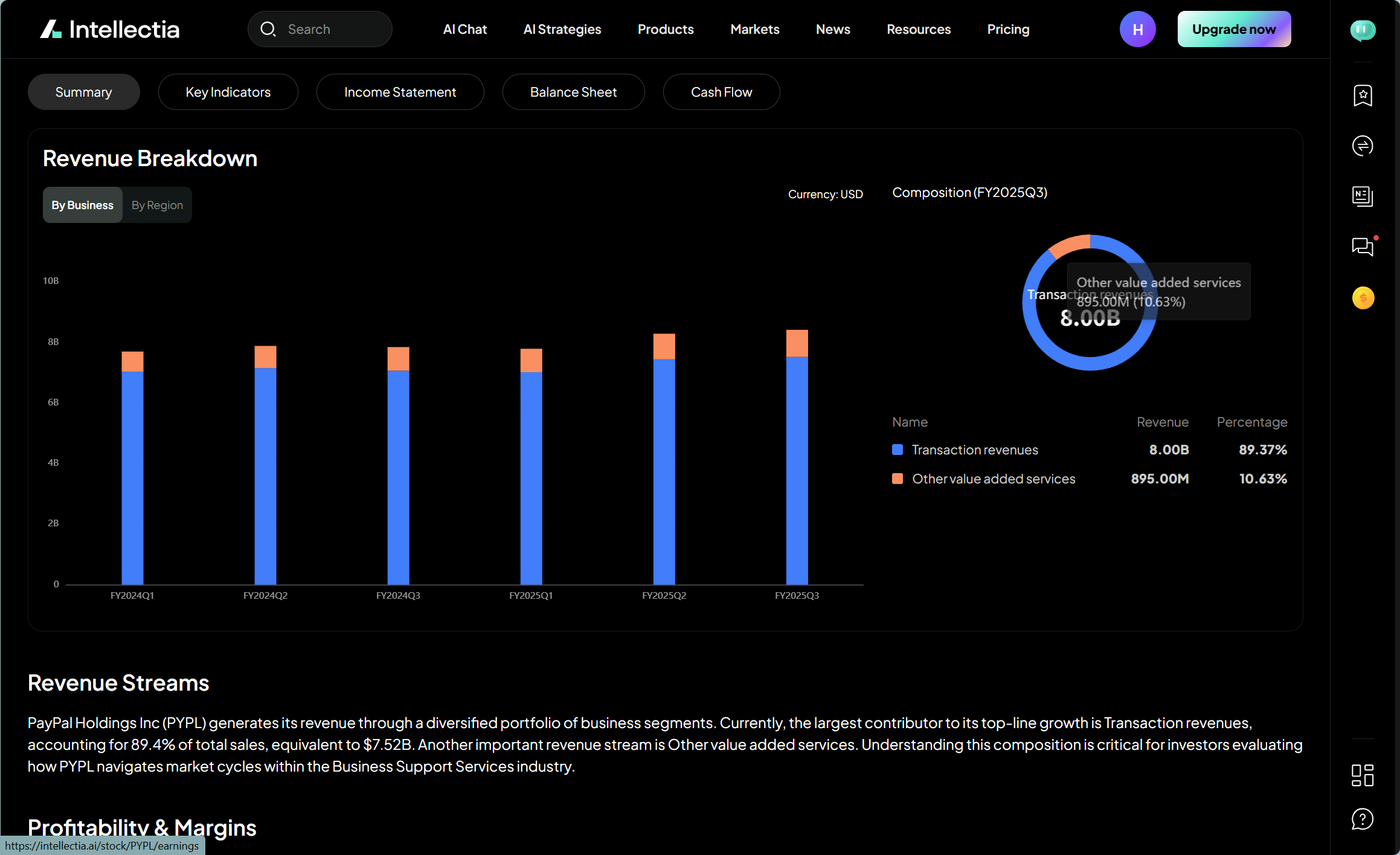

How PayPal makes money

PayPal's revenue comes from multiple streams that create a diverse income structure:

Transaction fees are the main source of revenue. PayPal charges merchants about 2.9% plus a fixed fee per transaction. These fees change based on country, transaction type, and merchant volume.

Currency conversion brings substantial income when users make transactions across different currencies. PayPal adds a spread to the exchange rate.

Interest and investment income comes from customer balances in PayPal accounts. This creates a substantial float that generates passive income.

Value-added services include working capital loans to merchants, buy-now-pay-later options, and subscription billing tools. These services help the company earn beyond simple payment processing.

PayPal keeps updating its money-making strategies. This helps PYPL stock maintain growth potential even as the core payment market matures.

Global reach and user base

PayPal's worldwide presence gives PYPL stock investors significant advantages:

The platform serves over 400 million active accounts in 200+ markets

Small-to-medium businesses make up much of PayPal's 30+ million merchant accounts

The company processes over 19.3 billion payment transactions yearly

Cross-border transactions make up about 18% of payment volume

This massive scale creates network effects that improve value for consumers and merchants. New users increase utility for existing ones, which creates a cycle that strengthens PayPal's competitive advantage.

PayPal adapts its services to local markets while keeping core features consistent. This strategy helps them expand into emerging markets where digital payments are growing faster.

PayPal attracts higher-income consumers with greater spending power. This makes its ecosystem valuable to merchants looking for premium customers. Such positioning explains why PayPal stock has often traded at premium valuations compared to traditional financial companies, even though the current paypal stock price shows investor concerns about slower growth.

Key financials every investor should know

A look at PayPal's financial metrics gives investors a clear picture when they think about buying at the current paypal stock price. Let's break down the numbers to see if PYPL offers a good buying chance.

Revenue and earnings trends

PayPal keeps growing steadily despite market challenges. The company earned $31.80B in annual revenue for 2024, which is 6.81% more than 2023. This growth pattern continues from previous years, with revenue reaching $29.77B in 2023 (8.19% growth) and $27.52B in 2022 (8.46% growth).

The company's Q3 2025 revenue hit $8.42B, growing 7.26% from last year. The earnings show an average growth of 3.2% each year in the last five years, jumping to 11% last year. Looking forward, analysts expect yearly earnings and revenue to grow by 5.64% and 5.8%.

Profit margins and cash flow

PayPal's profitability numbers show how well it runs its operations. The company's net profit margins grew to 15% from 14.1% last year. This improvement comes in part from services that bring higher transaction margins.

The company's cash generation looks impressive. Free cash flow (FCF) grew 18.9% to $1.72 billion in Q3, while adjusted FCF jumped 47.9% to $2.28 billion. FCF now makes up 27.1% of quarterly revenue, up from 19.6% last year. The trailing twelve-month FCF is 19.5% of the $32.86 billion revenue.

Debt levels and balance sheet health

A strong balance sheet helps companies survive economic uncertainty. PayPal's financial position stays healthy with $11.40B in total debt against $20.20B in shareholder equity, creating a 56.6% debt-to-equity ratio. The company's books show $79.80B in total assets and $59.60B in liabilities.

PayPal has plenty of cash on hand - $10.80B in cash and short-term investments. This matches its debt obligations and lets the company invest or return money to shareholders easily.

Valuation metrics: P/E, PEG, Price/Sales

For investors asking "is paypal a good stock to buy," these valuation numbers might be interesting:

P/E ratio: Sits at 7.64, way below its 10-year average of 40.04 (81% discount) and the financial services sector's 14.13 average (46% discount)

Future growth considerations: Growth has slowed down, but analysts still expect 5-6% yearly growth

Price targets: Analysts agree on a $66.24 target price, showing a possible 58.85% upside from current levels

The stock trades at its lowest historical values, even with ongoing revenue growth and strong cash flow. This suggests the market might have overreacted to recent challenges.

What’s driving the recent stock drop?

PayPal stock has fallen due to several key factors that have made investors cautious about the company's 25-year old market position.

Q4 earnings miss and guidance issues

The sharp decline in PYPL started with a disappointing Q4 2023 earnings report. Revenue climbed just 8% to $8.03 billion. While this slightly exceeded expectations, investors weren't impressed as they saw growth slowing down. The transaction margin dollar growth reached only 2% year-over-year, which raised concerns about profitability. The management's conservative 2024 outlook dealt the biggest blow, as they projected about 7% revenue growth and only 10-12% earnings per share growth. These numbers fell short of what analysts expected.

Leadership changes and CEO transition

PayPal's recent leadership changes have created more market uncertainty. Alex Chriss became the new CEO in September 2023, which initially created excitement among investors. However, they've grown restless waiting for strategic changes to take effect. The new leadership team announced a reduction of about 9% of its global workforce—roughly 2,500 positions. This move aimed to optimize operations but hinted at deeper internal challenges.

Competitive pressure from fintech rivals

The digital world has become crowded, and PayPal's early market advantage has diminished. The company faces threats from:

Apple Pay's wider acceptance and growing user base

Block (formerly Square) and its expanding services

Buy-now-pay-later companies like Affirm taking market share

Traditional banks upgrading their digital payment systems

These competitive pressures have forced PayPal to spend heavily on innovation while dealing with shrinking margins from price-sensitive merchants.

Investor sentiment and analyst downgrades

These challenges have damaged investor confidence substantially. Many analysts have downgraded PYPL stock since the Q4 report and cut their price targets. The negative narrative suggests PayPal might become a "mature" payment processor instead of a high-growth tech company. Note that institutional investors have started selling their positions, which creates more downward pressure as they move away from fintech investments.

These business challenges, leadership changes, and negative market perception explain why PayPal stock is down dramatically despite looking cheap on paper.

Is PayPal a good stock to buy right now?

The decision to invest in PayPal stock needs careful thought, especially given its big price drop. Let's get into multiple aspects that will help you make a smart investment choice.

Bull vs. bear case for PYPL

PayPal's strong market position and attractive valuation form the bull case. The stock trades at a forward P/E ratio of just 10, which is by a lot lower than its historical averages. Bulls love PayPal's substantial free cash flow that supports a massive $15 billion share buyback program. The company makes solid profits with its asset-light business model despite tough conditions.

Bears worry about user engagement numbers dropping. Active accounts show 4% fewer transactions. Apple Pay, Cash App, and traditional banks pose real threats to PayPal's market share. The slowdown in branded checkout volume growth hints at possible weakness in PayPal's core business.

Analyst price targets and ratings

Wall Street stays neutral on PYPL. The stock has a consensus "Hold" rating from 4 Buys, 35 Holds, and 5 Sells. The average price target sits at $62.87, suggesting a potential 51% upside from current levels. Price targets show wide variation from $40 to $100, which shows analysts disagree strongly about PayPal's future.

Long-term growth potential

Analysts predict PayPal's earnings will grow 5.3% yearly while revenue expands at 6.4%. The company's return on equity should hit 26.7% within three years. New growth initiatives like advertising services, wider Venmo adoption, and crypto offerings could boost future growth.

Risks to consider before investing

Execution risks remain high as the company goes through changes. The growth rate falls nowhere near the broader market and many fintech competitors. PayPal faces tough competition that might squeeze its margins further.

Start your investment success story with Intellectia.AI. You'll get daily AI stock picks, trading signals and in-depth market analysis to help you grow from beginner to pro.

Conclusion

PayPal stock shows mixed signals that make it hard to evaluate. The stock price fell 20% after poor earnings results, which could mean a good buying chance. It now trades at a P/E ratio of 7.71 - way below its usual levels and industry standards. Value hunters might find these price levels appealing since PayPal keeps growing revenue and generating impressive free cash flow.

PayPal faces real challenges from tougher competition and slower growth. Yet the company still has big advantages from its 25-year old global payment system. Its huge network of over 400 million users across more than 200 markets makes it hard for new players to compete. Products like Venmo look promising for growth ahead. The recent change in leadership and job cuts point to a company that's changing rather than growing fast.

Most analysts stay neutral, but their average price target of $62.87 hints at room for the stock to rise from here. PayPal's strong finances, with cash roughly equal to debt, give it flexibility to handle market ups and downs while funding new projects. The big question investors need to answer is whether these challenges will pass or if they show lasting problems with PayPal's business model.

The digital world changes faster than ever, which makes picking stocks tricky. You can start with the Intellectia.ai AI Screener. This tool helps you quickly find companies that benefit from the Gemini 3 trend by spotting Google's suppliers or competitors buying more chips. The AI Stock Picker gives you quick, informed daily stock picks if you want simple recommendations.

Your decision about PayPal should match how much risk you can take and how long you plan to invest. The stock price reflects lots of pessimism rather than optimism, which could mean a good entry point if you're patient enough to ride out short-term swings. PayPal's market position, steady cash flow, and low valuation suggest long-term value might beat current problems. Success depends on whether management can boost growth while fighting off aggressive competitors.