Key Takeaways

Amazon's unprecedented $200 billion capital expenditure plan reveals the massive scale of Big Tech's AI infrastructure race and its implications for investors and the broader technology landscape.

• Amazon reinvests nearly 90% of operating cash flow into AI infrastructure, far exceeding competitors like Microsoft and Google who typically reinvest 40-60%

• The "Magnificent 7" tech giants will collectively spend over $655 billion on AI infrastructure by 2026, representing the largest corporate investment cycle in history

• Amazon's free cash flow plummeted 71% to $11.2 billion as CapEx surged $50.9 billion, highlighting the short-term financial trade-offs of long-term AI positioning

• Custom chip development (Trainium) threatens traditional suppliers like NVIDIA and Broadcom while potentially generating $10+ billion in revenue for Amazon

• Enterprise AI demand is driving this spending spree, with AWS adding 4 gigawatts of computing capacity in 2025 and planning to double that by 2027

The scale of these investments suggests tech leaders view AI as a fundamental shift requiring immediate infrastructure dominance rather than gradual adoption. For investors, the key question isn't whether these investments will pay off, but rather the timing and execution risks as companies race to build tomorrow's computing foundation.

Amazon earnings capex figures reveal just one part of a massive investment surge. Companies in the S&P 500 have invested more than $1.25 trillion in AI-related technology in the last 12 months. The Magnificent 7 tech giants represent about 28% of this enormous spending.

Amazon stands out remarkably in this investment landscape. The company reinvests almost 90% of its operating cash flow into property and equipment. AWS and data center expansion receive most of this investment. This bold strategy aligns with other tech leaders' approaches. To cite an instance, Alphabet has pushed its google earning capex up from $14.0 billion to $24.0 billion in just one year. The Magnificent 7's capital expenditures now make up 10% of their assets - a record high since 1993.

These investment patterns provide crucial insights into tech companies' long-term AI strategies and potential returns. Investors should watch these earnings reports carefully.

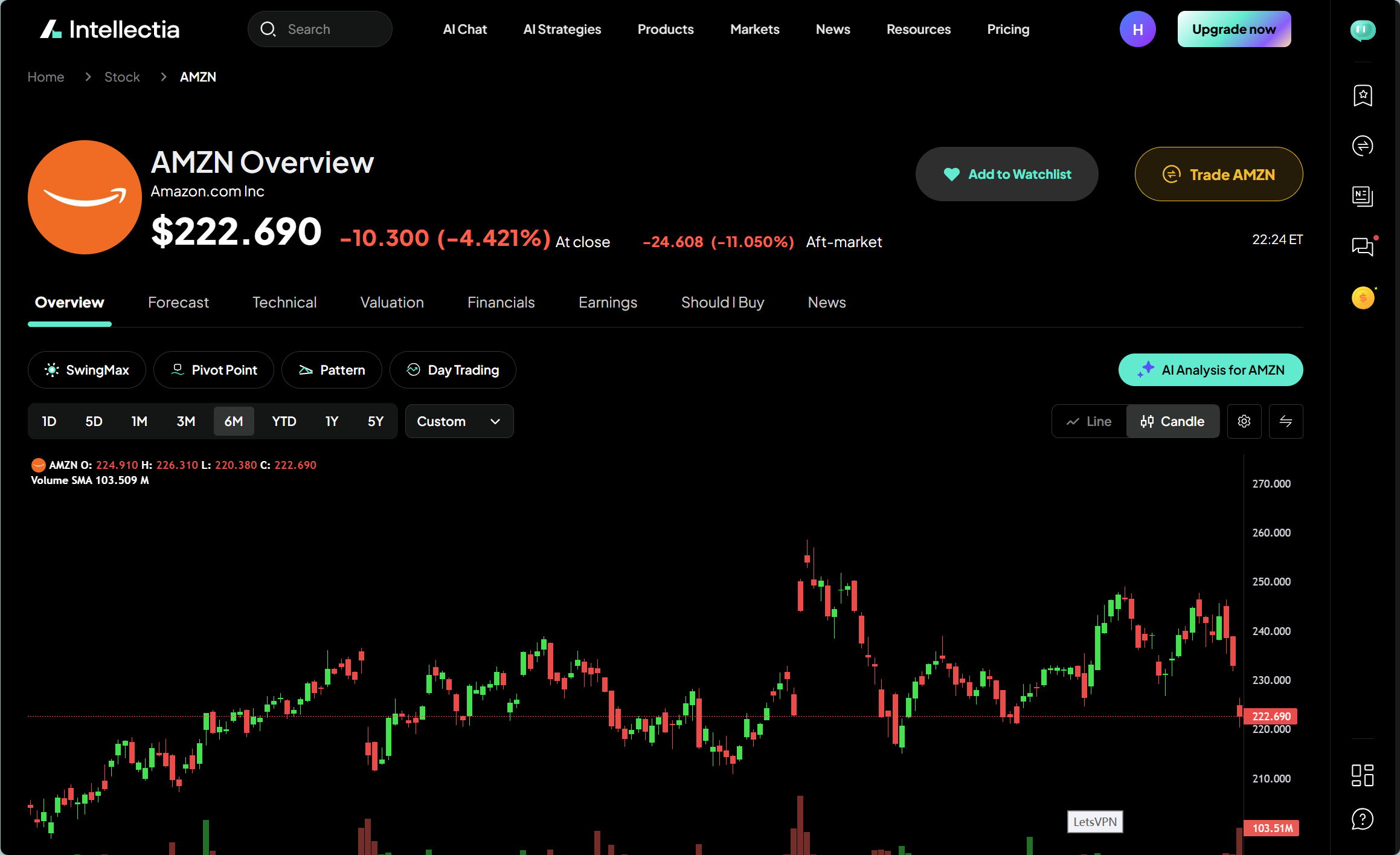

Amazon’s CapEx Surge: What the Numbers Say

Amazon's bold spending strategy reveals its vision for the future. The company chooses to sacrifice today's profits to dominate markets tomorrow.

Quarterly CapEx growth in 2024–2025

Amazon's investment levels have reached new heights. The company spent $14.0 billion on capital investments in Q2 2023, which was 43% more than the previous year. This number jumped to $16.6 billion in Q3 2023 and reached $19.0 billion in Q4 2023. The trend stayed strong with $14.9 billion spent in Q1 2024.

CFO Brian Olsavsky shed light on this increased spending during earnings calls. He explained that most investments went into AWS infrastructure. The company needs to expand its computing power, storage space, and network backbone to keep up with cloud computing's growing demands.

Latest Amazon Earnings CapEx Guidance

Amazon plans to keep this investment momentum going. The company expects to spend over $200 billion in 2026, with AWS infrastructure getting the lion's share. They'll also put money into improving their delivery network, though less than before.

This spending plan shows Amazon's focus on future growth instead of quick profits. The leadership team believes these big investments will help them stay ahead as cloud computing and AI reshape the tech landscape.

How Amazon compares to other Big Tech firms

Amazon outspends other tech giants by a wide margin. While Microsoft spent $11.5 billion and Google invested $12.0 billion in recent quarters, Amazon topped both with $14.9 billion.

The company's spending grows faster too. Amazon increased its yearly capital expenditure by 28% from 2022 to 2023. Microsoft only grew its spending by 16% during this time.

These numbers show Amazon's dedication to building infrastructure. While competitors focus on software or content, Amazon pours money into physical infrastructure and computing power for AWS.

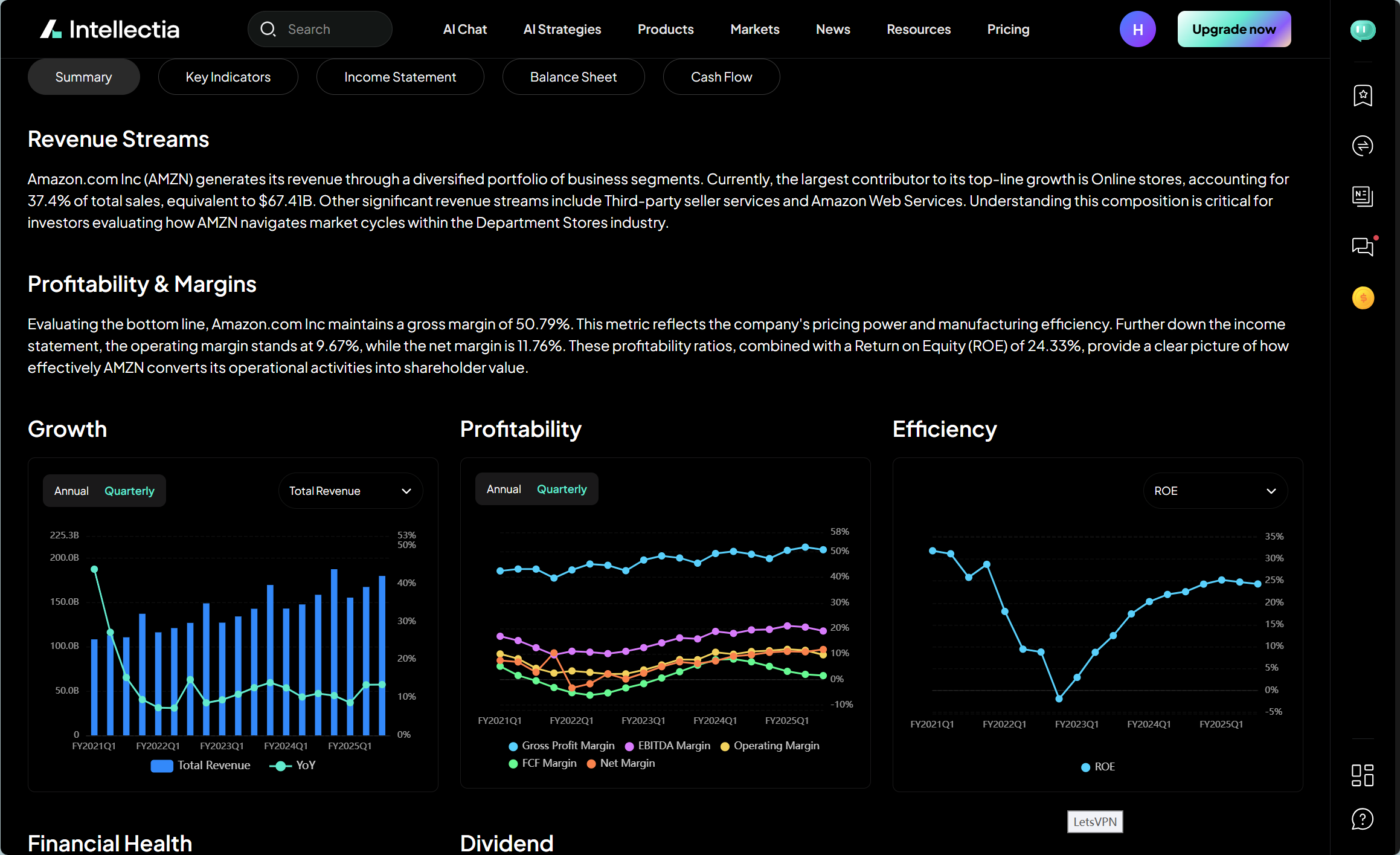

CapEx as a percentage of operating cash flow

Amazon's reinvestment strategy stands out even more when looking at cash flow numbers. The company puts almost 90% of its operating cash back into property and equipment. Other tech giants like Microsoft and Google typically reinvest 40-60% of their cash flow.

This high reinvestment rate shows Amazon's strategy of building for tomorrow rather than paying shareholders today. The company bets big on future growth instead of giving out dividends or buying back shares.

This aggressive investment affects other financial measures too. Amazon's free cash flow margin stays tight because of these huge investments. The leadership team must balance growth plans with investor expectations for returns.

Where the Money Goes: Inside Amazon’s AI Infrastructure Spend

Amazon's massive capital spending shows a clear pattern of resource allocation in key tech areas. A deeper look at their earnings capex reveals focused investments in three crucial areas that will shape the company's future growth.

AWS data centers and power expansion

AWS infrastructure gets the biggest chunk of Amazon's capital expenditure. The company builds new data centers, expands existing ones, and upgrades its networking capabilities. These investments are the foundations for Amazon's cloud dominance and AI goals.

Building data centers costs the most money. Each facility needs huge investments in buildings, cooling systems, and power networks. The company also buys land in areas that work well for data centers. They look at energy costs, fiber connections, and how close the centers are to customers.

Power capacity plays a crucial role, especially since AI workloads use up way more electricity than regular computing. The company invests in power infrastructure and builds on-site generation facilities. They've started renewable energy projects too. Their data centers now have new designs that can handle the high-power racks that AI computing needs.

Custom silicon: Trainium and chip investments

Custom chip development takes up much of Amazon's spending. Most cloud providers rely on other companies' processors, but Amazon makes its own AI chips.

The Trainium chip stands out as Amazon's biggest silicon project yet. These processors are built specifically to train machine learning models. They work better per dollar than regular processors. The company puts a lot of money into research, development, and partnerships with manufacturers to produce these chips.

Amazon keeps improving its Graviton processors that run many AWS services. These ARM-based chips cost less than traditional x86 processors but perform just as well. Making custom silicon costs a lot upfront, but it saves money in the long run and sets Amazon apart from other companies.

Fulfillment network and robotics upgrades

Beyond AWS, Amazon puts big money into making its logistics better. They build new fulfillment centers, sorting facilities, and delivery stations to keep up with online shopping demands.

Robotics technology plays a key role in these facilities. The company's warehouses now have advanced robotics that work faster and better. They use self-driving robots to move items around, robotic arms to sort and pick products, and conveyor systems to move things quickly.

AI has become part of logistics operations too. Computer vision helps spot products, organize storage, and guide robots. Machine learning makes it easier to predict what customers want and where to keep inventory. This tech needs both hardware and software investment but makes Amazon's operations run smoother.

Amazon keeps investing heavily in capital projects with one clear goal: building infrastructure that supports AI across all parts of its business, from cloud services to online shopping.

Why Amazon Is Spending So Aggressively

Andy Jassy's announcement of a $200 billion capital expenditure made Amazon's stock drop 11% in extended trading. The company stands firm with its aggressive spending strategy. This amazon earnings capex number is a big deal as it means that analysts' expectations by more than $50 billion. Amazon moves ahead with what could be the most ambitious investment cycle in corporate history, despite investor concerns. What drives this extraordinary financial commitment?

Meeting AI demand from enterprise clients

The unprecedented surge in spending comes from "very high demand" for AI compute from enterprise customers. AWS could have grown faster with enough capacity to meet this demand. Jassy emphasized that the company is being "incredibly scrappy" to handle these constraints.

The cloud unit added almost 4 gigawatts of computing power in 2025. It plans to double that capacity by the end of 2027. This quick expansion shows a radical alteration in how businesses see AI technology.

Jassy sees the AI market as a "barbell." AI labs sit on one side and enterprises on the other end. They see the technology as a "productivity and cost avoidance" tool. He believes "that middle part of the barbell very well may end up being the largest and most durable". This represents a huge untapped chance as AI adoption moves from testing to production workloads.

AWS sales grew 24% to $35.60 billion in the most recent quarter. The cloud unit achieved its "fastest growth in 13 quarters". This proves their investment strategy works.

Staying competitive with Microsoft and Google

We cannot look at Amazon's aggressive spending alone. It's part of an escalating "build-out race" for AI compute among Big Tech companies. Google announced its expected capital spending of $175-185 billion for 2026. This puts Amazon's $200 billion figure in perspective as a strategic move against key rivals.

Industry leaders at these companies share one belief: spending too little on AI would be worse than spending too much. This mindset has pushed combined annual capital spending plans across Amazon, Microsoft, Meta, and Google beyond half a trillion dollars.

Amazon's leaders frame this investment as crucial to stay competitive. Jassy stated, "We see this as an unusual opportunity, and we are going to invest aggressively here to be the leaders like we've been the last number of years".

Long-term vision for cloud and AI dominance

A deeper strategic calculation lies beneath immediate competitive pressures. Amazon sees AI as "an extraordinarily unusual opportunity" that could reshape AWS and Amazon's entire scale.

"This isn't some sort of quixotic, top-line grab," Jassy maintains. "We have confidence that we, that these investments will yield strong returns on invested capital". This confidence comes from seeing new AI capacity turn profitable as soon as it's deployed.

The company's future vision centers on making high-end compute a strategic asset. Amazon wants to cut AI training and inference costs for its customers by building its own chips and using unmatched scale. The Trainium chip strategy shows this approach. Amazon claims these processors deliver 30-40% better price-performance than similar GPU instances.

Amazon positions itself as the go-to infrastructure provider for the AI era. The company believes the "revolutionary potential of AI is going to turn high-end compute into the scarce resource of the future, and only companies that control their own supply will survive".

Long-term investors should focus on timing and execution risk as Amazon builds tomorrow's computing foundation, rather than questioning if Amazon can grow into its AI footprint.

The Financial Trade-Off: CapEx vs. Free Cash Flow

Amazon's massive CapEx strategy shows its effects clearly on the company's balance sheets. The company's scaling investments reveal the short-term price tag of its long-term AI goals.

Effect on Amazon's free cash flow margins

Amazon's trailing twelve-month free cash flow dropped to $11.20 billion in 2025. This represents a 71% fall from $38.20 billion in the previous year. The company's operating cash flow remains strong at $139.50 billion (+20%). However, they channel almost all of it back into infrastructure. A $50.90 billion surge in capital expenditure caused this sharp decline, mostly from AI-related investments.

Strong operating performance paired with weakened free cash flow shows the financial tension in Amazon's CapEx decisions. This creates an unusual case where business fundamentals look strong while shareholders see less available cash.

Investor concerns about ROI timelines

Wall Street analysts keep asking about when these massive investments will pay off. "The strong long-term return on investing capital—I think that's the debate in the market today," noted Mark Mahaney from Evercore ISI during an earnings call.

JPMorgan's Doug Anmuth directly asked whether Amazon had "financial guardrails" for the spending plan. The $200 billion capex forecast exceeded Wall Street's expectations by more than $50 billion.

Long-term investors worry less about Amazon's ability to monetize its AI infrastructure. Their main concerns focus on timing and execution risks. Returns could stay compressed for years if enterprise AI adoption moves slower than predicted or faces pricing pressure.

How Amazon justifies the spending to shareholders

Sign up for Intellectia.AI today to get daily AI stock picks and trading signals that can help you guide these high-stakes tech investments with in-depth market analysis.

Andy Jassy consistently describes these investments as an "extraordinarily unusual chance" that could reshape AWS and Amazon's scale. He emphasized that the company's in-house chips, Trainium and Graviton, will generate over $10 billion in revenue this year.

Jassy sees the AI market as "barbelled," with major AI labs on one end and enterprise productivity use cases on the other. The middle segment—enterprise production workloads and AI-native businesses—remains early but could become "the largest and most durable" source of business as the market matures. "The lion's share of that need is still yet to come," he maintains.

Signals from the Supply Chain and Competitors

Amazon's capital spending creates waves that reach every corner of the tech ecosystem, transforming the entire landscape.

Broadcom, NVIDIA, and chip supply constraints

Amazon's possible $10 billion investment in OpenAI has caused NVIDIA and Broadcom shares to drop by about 4%. The company plans to have OpenAI use its in-house Trainium chips, which could reduce hardware purchases from traditional suppliers. Amazon's new UltraServers, equipped with up to 144 Trainium 3 chips, perform four times better than their predecessors. This poses a direct challenge to Broadcom, whose AI semiconductor business grew 74% compared to last year.

Google earning CapEx trends and comparisons

Alphabet aims to increase its capital expenditures to $175-185 billion by 2026 to build AI and cloud infrastructure. Amazon's earnings capex of $200 billion slightly surpasses Google's substantial investment. When combined with Meta's $115-135 billion and Microsoft's expected $150 billion, these four tech giants will invest around $655 billion in 2026.

What suppliers reveal about future demand

These unprecedented spending levels raise an important question: are we in a bubble? All the same, U.S. market absorption rates indicate no signs of overbuilding. The Intellectia.ai AI Screener helps you filter the entire market quickly to find companies that benefit most from the Gemini 3 trend—maybe by spotting Google's suppliers or competitors increasing their chip orders. The AI Stock Picker provides useful, informed recommendations daily.

Conclusion

Amazon's massive $200 billion capital expenditure plan marks a turning point in the AI infrastructure race. The company's shareholders didn't like it at first and the stock dropped 11%. Yet this bold spending plan shows Amazon's steadfast dedication to lead the next wave of cloud and AI services. CEO Andy Jassy looks beyond quick profits. He sees this as a rare chance to capture the growing enterprise AI market.

The tech world isn't standing still. Google plans to spend $175-185 billion, Microsoft aims for $150 billion, and Meta will invest $115-135 billion in similar infrastructure. These four tech giants will pour about $655 billion into AI infrastructure by 2026. This unprecedented investment will revolutionize the digital world.

Amazon's strategy to build its own chips like Trainium takes on traditional suppliers such as NVIDIA and Broadcom. This move could give Amazon huge cost benefits. It also reduces their reliance on external chip makers who still face supply chain issues.

The impact of these huge investments shows up right away in Amazon's cash flow. Almost 90% of Amazon's operating cash goes straight back into property and equipment, mostly to grow AWS. Wall Street analysts have pushed the company to explain when these investments will pay off.

We ended up asking if Amazon's big AI infrastructure bet shows forward thinking or too much risk-taking. Amazon believes controlling high-end compute capacity will give them an edge in the next decade of computing. Their success depends less on making money from these investments and more on getting the timing right as companies adopt AI.

The AI infrastructure race is heating up. Amazon's spending choices teach us how big tech companies see the future. They're ready to give up today's profits for tomorrow's market share. This shows they see AI not just as another upgrade but as a fundamental change in computing that's worth this historic investment.