Key Takeaways

- Dividend Kings are elite companies that have increased their dividends for at least 50 consecutive years, offering unmatched reliability.

- Investing in Dividend Kings can provide a stable, growing income stream and defensive resilience during market downturns.

- Key selection criteria include a long dividend streak, strong financial health, a durable business model, and sector diversification.

- Top Dividend Kings for 2026, such as Procter & Gamble and Coca-Cola, demonstrate strong execution and margin expansion even in challenging environments.

Introduction

Have you ever looked for a reliable source of passive income from the stock market, only to be disappointed by companies that cut their dividends when times get tough? You're not alone. Many investors seek stability but find themselves chasing volatile yields that disappear during the first sign of a downturn.

Seasoned investors, however, know where to find consistency: a prestigious group of companies known as the dividend kings. These are businesses with an incredible track record of rewarding shareholders year after year, without fail.

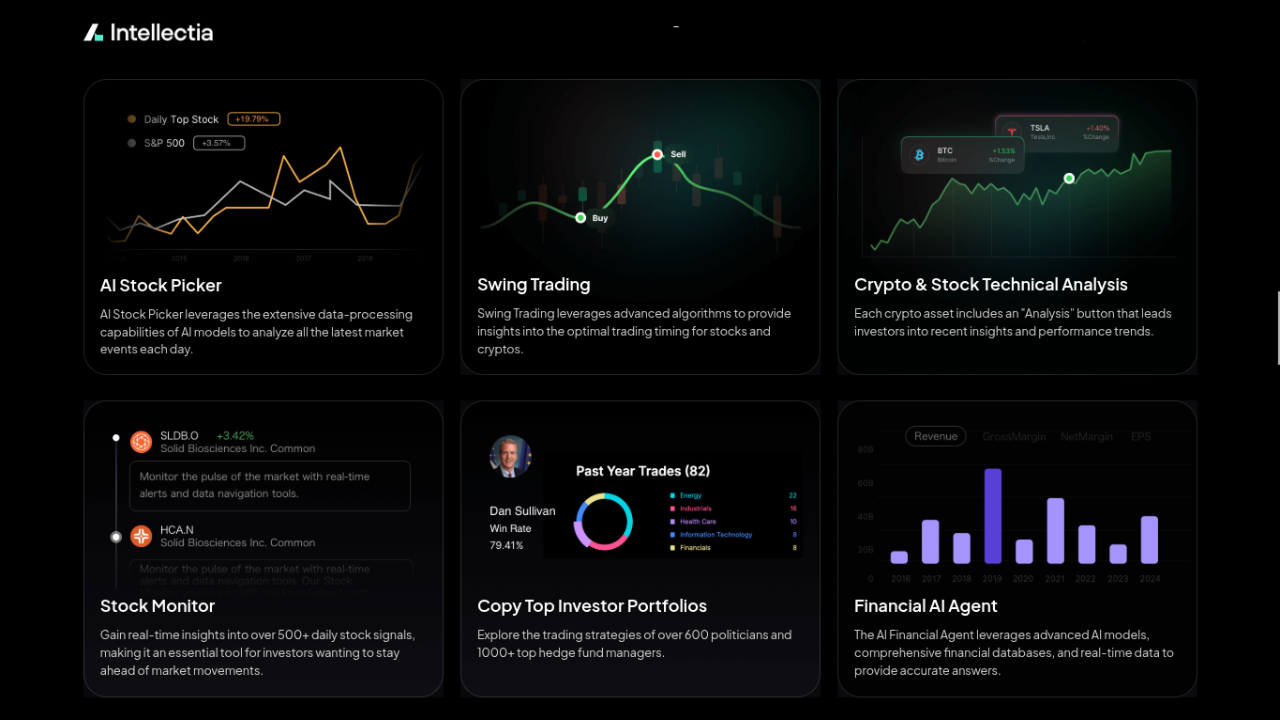

By focusing on this elite list, you can build a portfolio that not only pays you consistently but also grows its payout, helping you stay ahead of inflation and build lasting wealth. You can use AI-powered tools of Intellectia.ai to identify, analyze, and monitor the best dividend stocks.

What Are Dividend Kings?

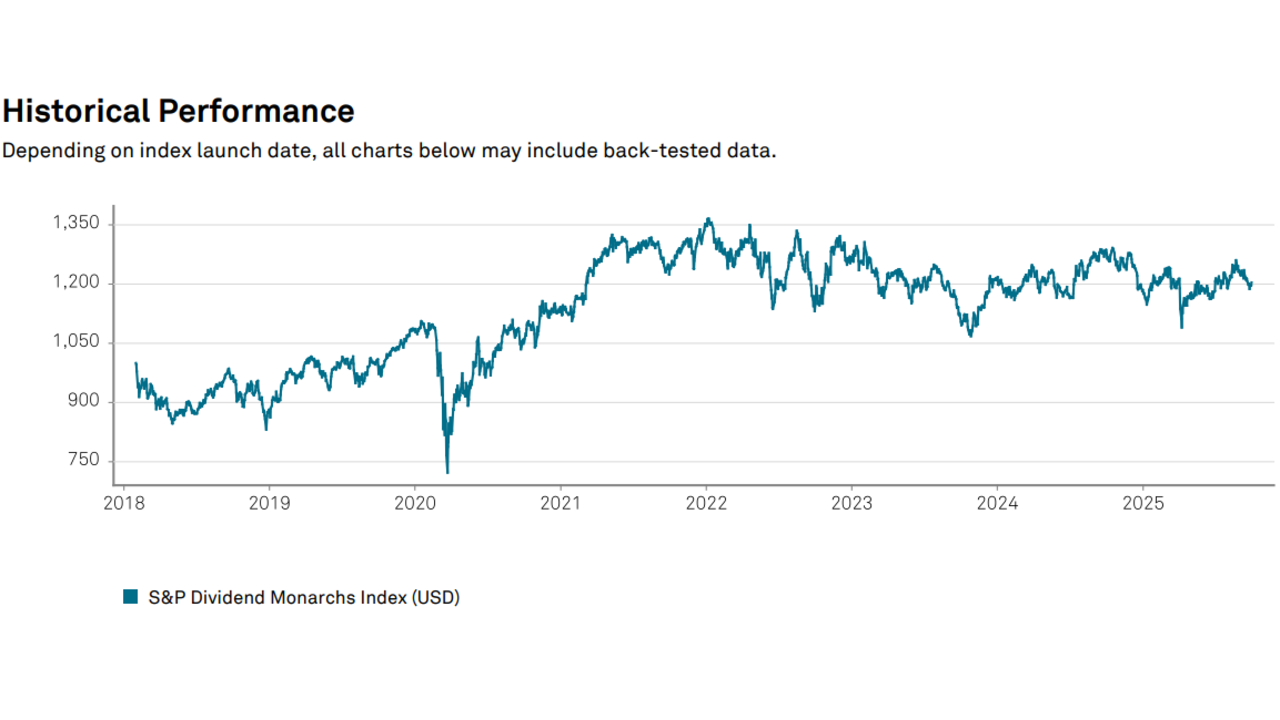

Dividend Kings/Monarchs are the gold standard in the world of dividend investing. To earn this title, a company must be in the S&P 500 index and have increased its dividend for at least 50 consecutive years. This isn't just a streak; it's a testament to a company's financial resilience, disciplined management, and durable business model.

Think about it: a company that has managed to raise its dividend through multiple recessions, market crashes, and geopolitical crises has proven its ability to generate consistent cash flow. For income-focused investors, this track record provides an unparalleled level of confidence and predictability.

This commitment to shareholder returns makes the dividend kings list a powerful starting point for anyone looking to build a reliable passive income stream. These aren't just stocks; they are financial fortresses.

Why Invest in Dividend Kings in 2026

As you navigate the financial markets in 2026, stability will be more valuable than ever. Dividend Kings offer a compelling case for inclusion in your portfolio for several key reasons.

First is their long-term income reliability. These companies have demonstrated a multi-decade commitment to increasing their payouts. This makes them an ideal cornerstone for retirement portfolios or anyone seeking a predictable and growing income stream to cover living expenses.

Second is their resilience in downturns. Because they are typically mature, well-established companies in stable sectors like consumer staples and industrials, their earnings are less susceptible to economic shocks. This defensive quality can help preserve your capital during periods of market volatility.

Finally, they offer a combination of capital preservation and modest growth. While they may not offer the explosive growth of tech startups, their stocks often appreciate steadily over time. When you combine that with a consistently growing dividend, you get a powerful engine for total return.

Criteria for Selecting the Best Dividend Kings to Buy

Not all Dividend Kings are created equal. To find the best dividend kings to buy, you need to look beyond the dividend streak and evaluate the underlying health of the business. A 50+ year dividend streak is the entry ticket, but you should also analyze the stability of that growth. A company that consistently raises its dividend by 5-10% is often more attractive than one with token 1% increases.

Next, examine the company's financial strength. Look for a healthy balance sheet with manageable debt, a strong free cash flow that comfortably covers the dividend, and a sustainable payout ratio (typically below 75%). Tools like Intellectia.ai's AI stock analysis can help you quickly assess these metrics.

You should also ensure the business model is durable. Does the company have a strong competitive advantage, often called a "moat"? Is it in an industry with long-term relevance? A company selling essential products is more likely to thrive than one in a declining industry. Finally, consider sector diversification to avoid concentrating your risk in a single area of the economy.

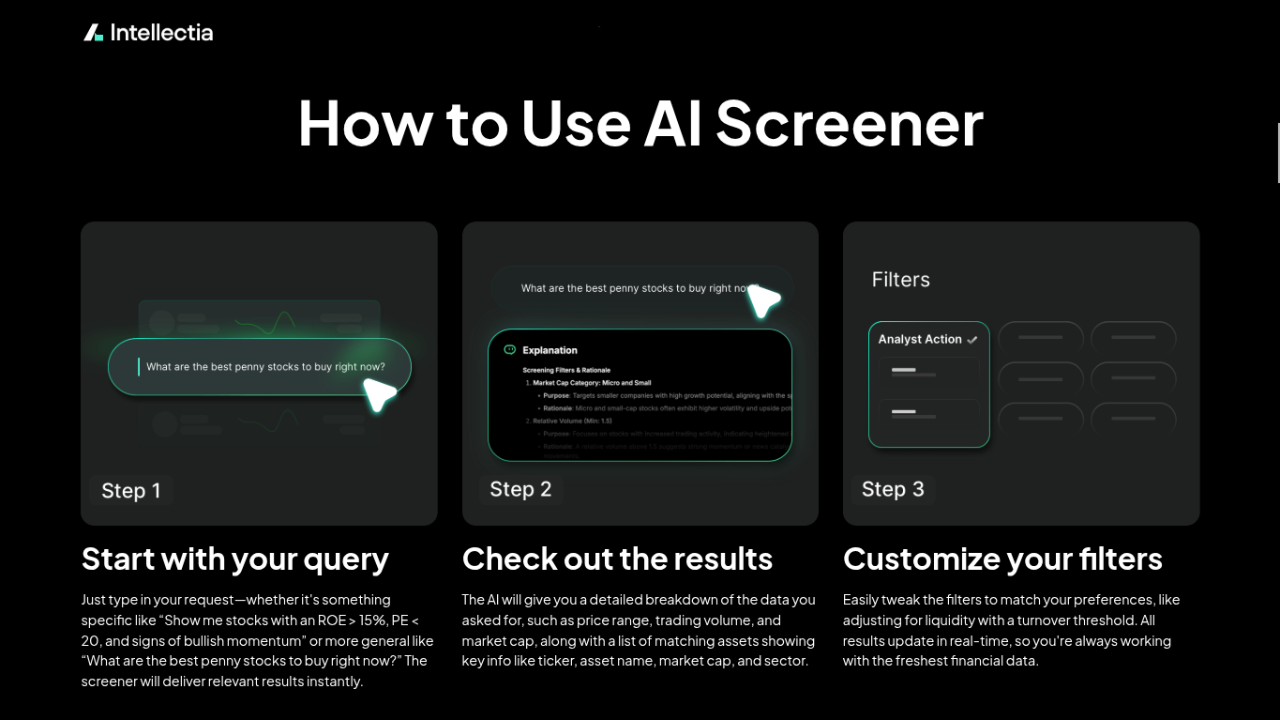

You can leverage AI-powered tools like Intellectia.ai’s AI Screener and AI Stock Picker to identify, analyze, and monitor the best dividend growth stocks for your portfolio.

Top Dividend Kings to Consider in 2026

To help you get started, here is a comparative overview of some of the top dividend kings that have shown strong performance and strategic positioning heading into 2026.

| Company Name | Ticker | Sector | Market Cap | Dividend Yield | Key Strengths |

|---|---|---|---|---|---|

| Procter & Gamble | PG | Consumer Staples | ~$351B | 2.8% | Dominant brand portfolio, consistent organic growth, strong execution. |

| The Coca-Cola Company | KO | Consumer Staples | ~$296B | 3% | Unmatched global brand recognition, refranchising strategy boosting margins. |

| Parker-Hannifin | PH | Industrials | ~$97B | 0.9% | Leader in motion & control tech, strong aerospace and industrial performance. |

| Dover Corporation | DOV | Industrials | ~$25B | 1.2% | Diversified industrial manufacturer, strong order momentum, record margins. |

| Genuine Parts Company | GPC | Consumer Discretionary | ~$18B | 3.2% | Leader in automotive and industrial parts, strategic acquisitions driving growth. |

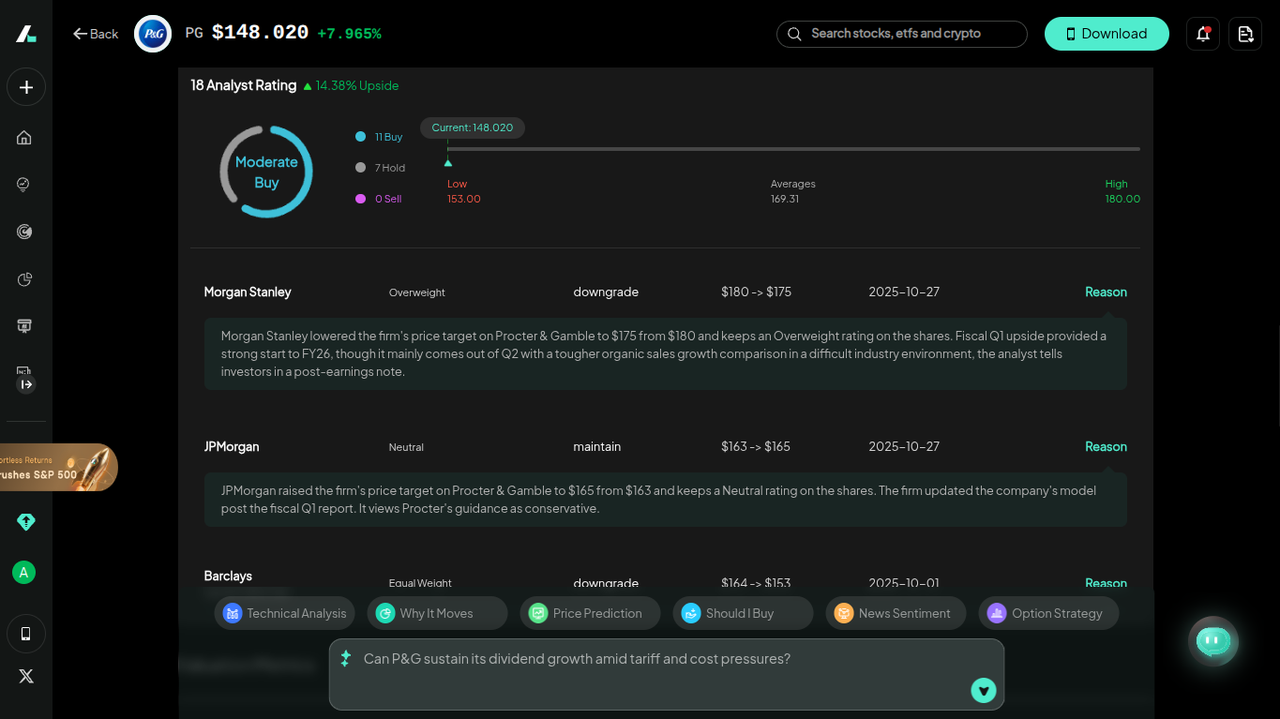

Procter & Gamble (PG)

Procter & Gamble is a global consumer staples giant with a massive portfolio of trusted brands like Tide, Pampers, and Gillette. Its products are used in households worldwide, ensuring consistent demand regardless of the economic climate.

In its Q1 2026 earnings call, P&G reported its 40th consecutive quarter of organic sales growth, showcasing incredible consistency. The company is executing a restructuring program to enhance agility and is maintaining its fiscal 2026 guidance for up to 4% organic sales growth despite competitive pressures. Management remains confident, focusing on innovation in core categories like Fabric Care and Baby Care to drive future growth.

P&G's ability to consistently grow sales and its commitment to returning cash to shareholders make it a quintessential Dividend King. Its strategic focus on innovation and efficiency ensures its long-term durability.

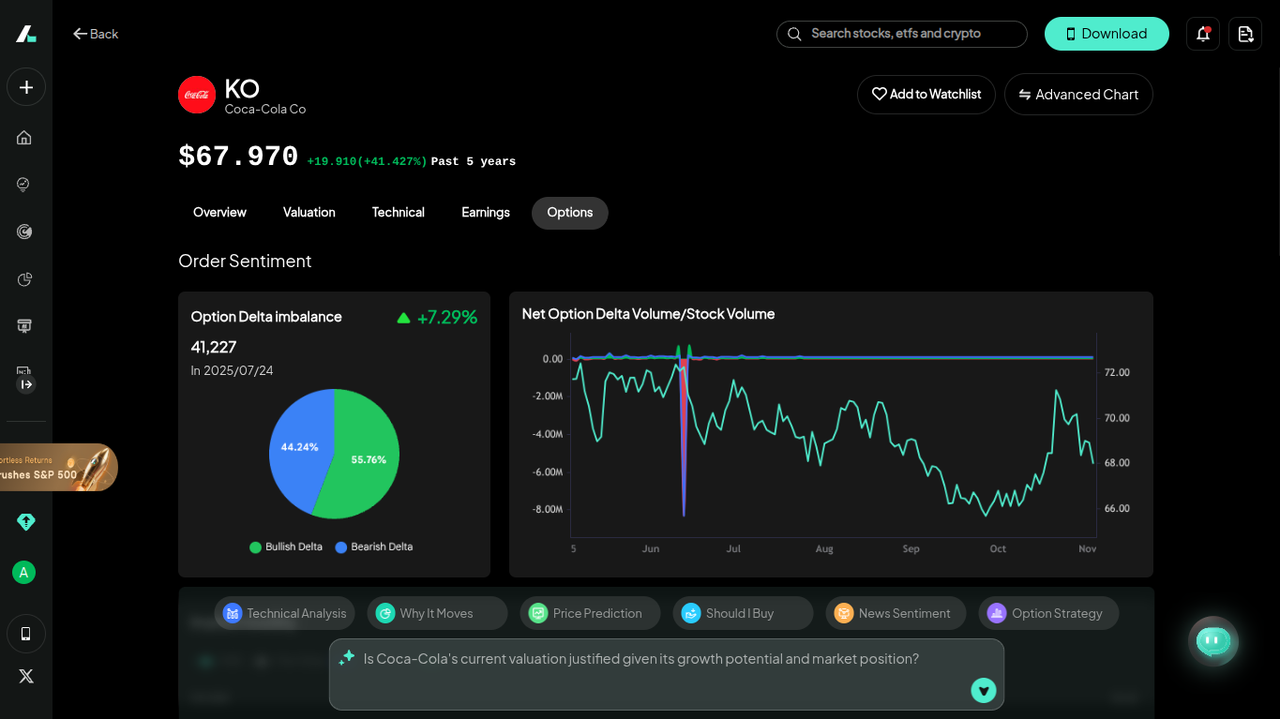

The Coca-Cola Company (KO)

The Coca-Cola Company is the world's largest non-alcoholic beverage company, known for its iconic flagship brand and a vast portfolio that includes sprites, juices, water, and teas.

Coca-Cola demonstrated strong performance in its Q3 2025 earnings, marking its 18th consecutive quarter of gaining value share. The company reported 6% organic revenue growth and reiterated its full-year guidance. A key strategic move is the near-completion of its global refranchising initiative, which is set to improve operating margins and allow for a greater focus on brand building.

KO's unparalleled brand power and global distribution network create a formidable competitive moat. The company's strategic shifts and consistent performance make it a reliable choice for income investors.

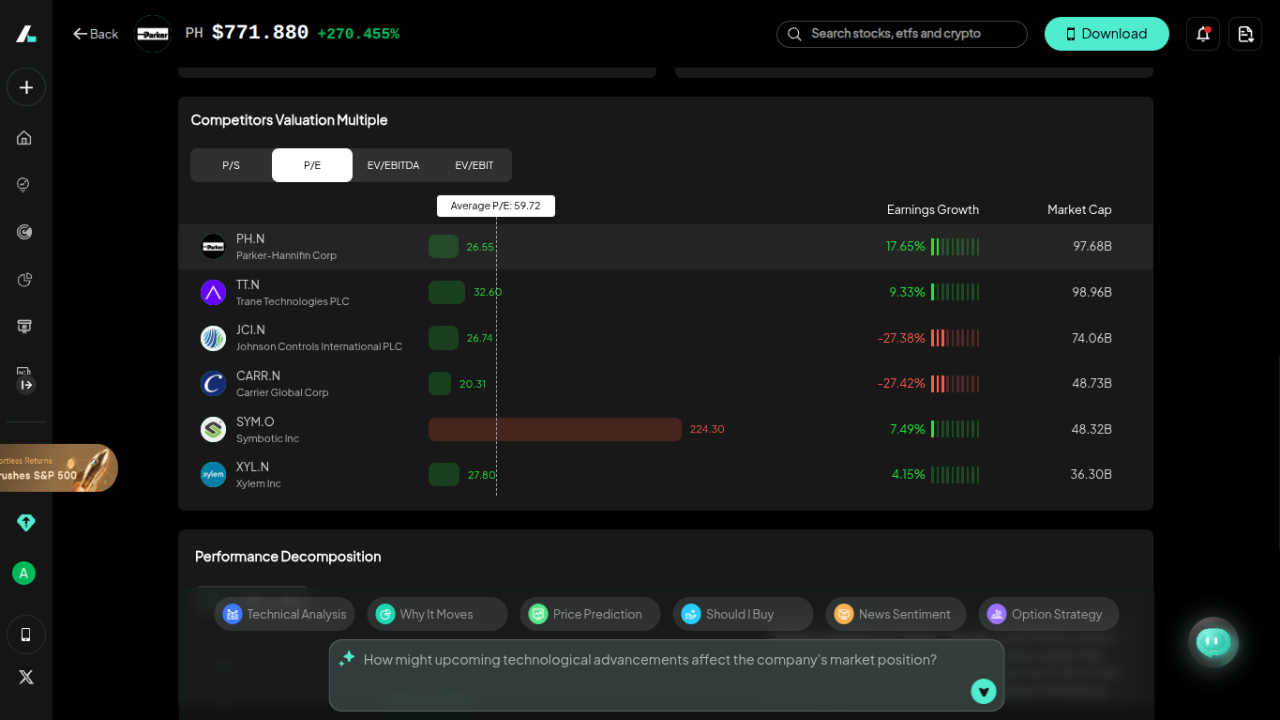

Parker-Hannifin (PH)

Parker-Hannifin is a global leader in motion and control technologies, providing precision-engineered solutions for a wide variety of mobile, industrial, and aerospace markets.

The company reported a record-setting fiscal year 2025, driven by outstanding performance in its Aerospace segment, which saw 13% organic growth. Parker-Hannifin declared a quarterly dividend of $1.80 per share and is forecasting another strong year with 8% aerospace growth in fiscal 2026. Management is highly confident in its "Win Strategy," a business system designed to expand margins and deliver consistent shareholder value.

PH is a high-quality industrial leader with strong secular growth drivers in aerospace and electrification. Its disciplined operational excellence and commitment to dividend growth make it a standout in the industrial sector.

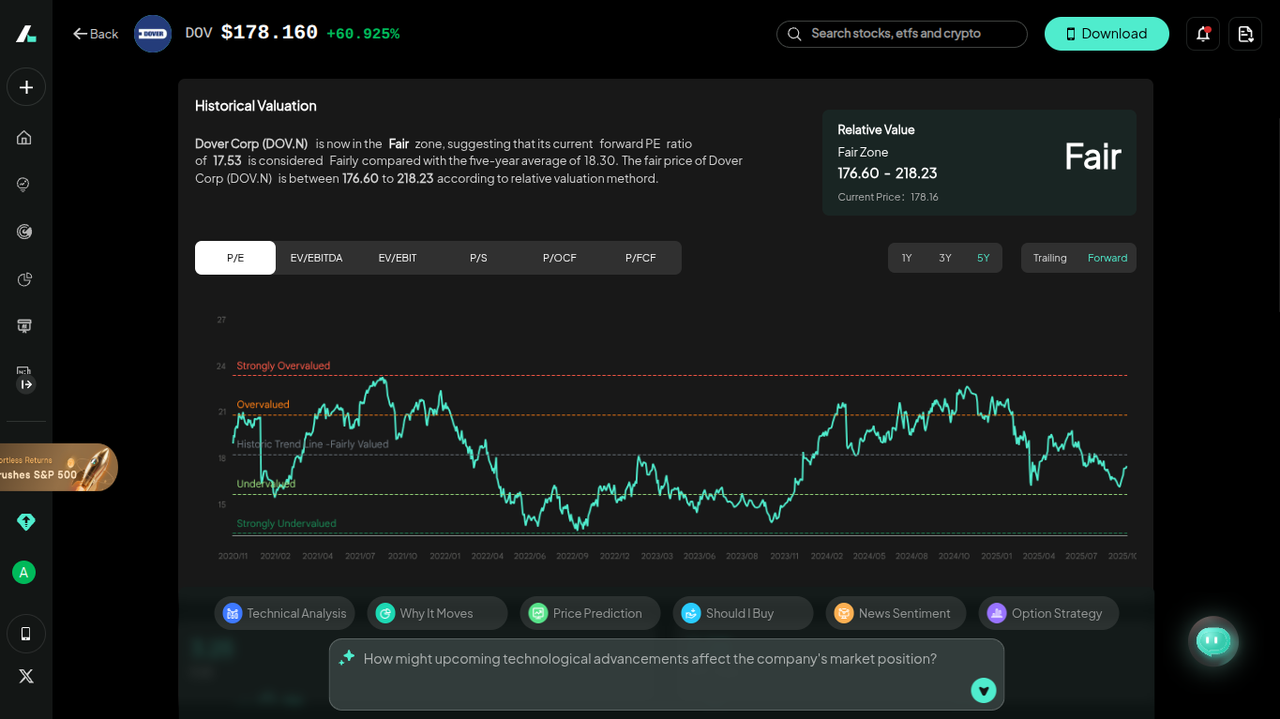

Dover Corporation (DOV)

Dover is a diversified global manufacturer and solutions provider that delivers innovative equipment and components, specialty systems, and support services through five operating segments.

Dover reported excellent Q3 2025 results with revenue up 5% and a record consolidated EBITDA margin of 26.1%. Citing strong order momentum and a constructive outlook for 2026, the company raised its full-year 2025 adjusted EPS guidance. Management highlighted positive trends in high-growth markets like clean energy and data centers and expects previously lagging segments, such as refrigeration, to recover.

Dover's diversified portfolio and strong execution have enabled it to achieve impressive margin expansion. Its constructive outlook and focus on high-growth secular trends position it well for continued earnings growth.

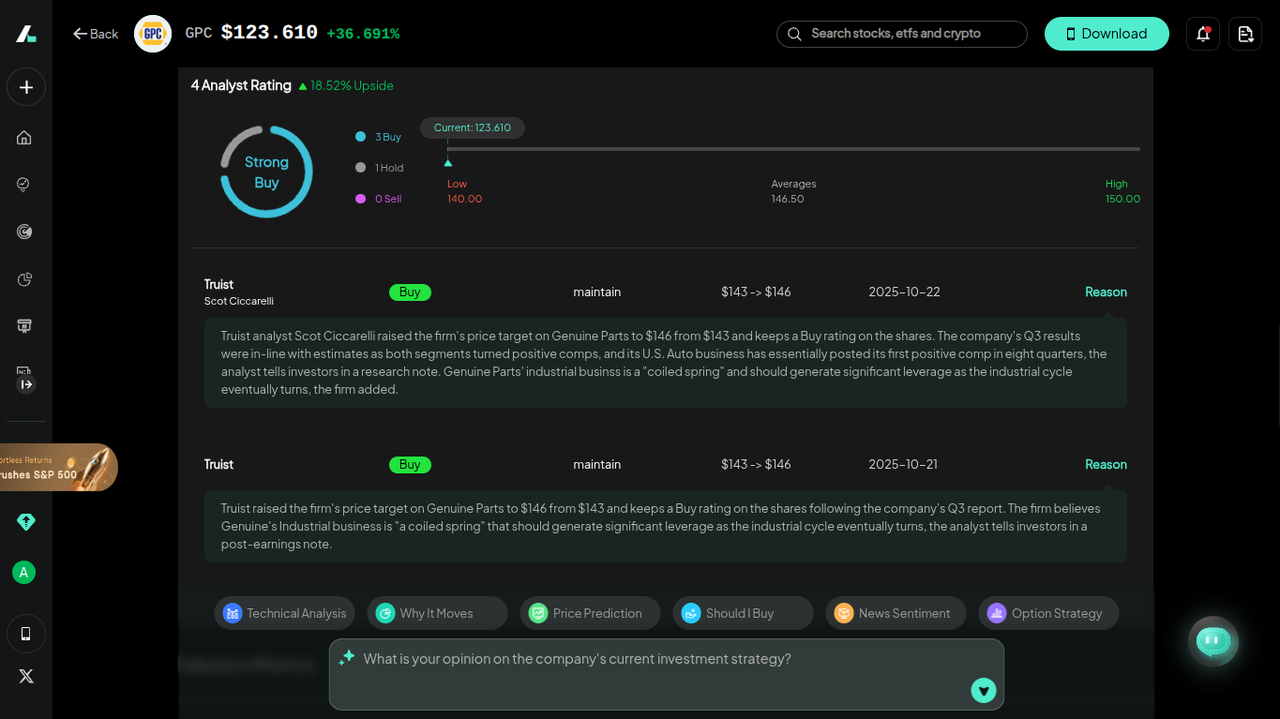

Genuine Parts Company (GPC)

Genuine Parts Company is a leading distributor of automotive replacement parts and industrial replacement parts. It operates the well-known NAPA Auto Parts brand in the U.S.

In Q3 2025, GPC reported a 5% increase in sales to $6.3 billion and raised its full-year revenue growth guidance to 3-4%. The company is expanding its automotive segment through strategic acquisitions and continues to improve margins despite a "muted" market in Europe and ongoing tariff challenges. Management remains focused on disciplined cost control and operational efficiency to drive long-term value.

GPC's leadership in the stable automotive aftermarket provides a defensive moat. The company's strategic acquisitions and focus on operational discipline are driving steady growth, making it a reliable dividend payer.

How to Invest in Dividend Kings Smartly

Investing in Dividend Kings is more than just buying and holding. A smart approach can help you maximize your returns and manage risk effectively.

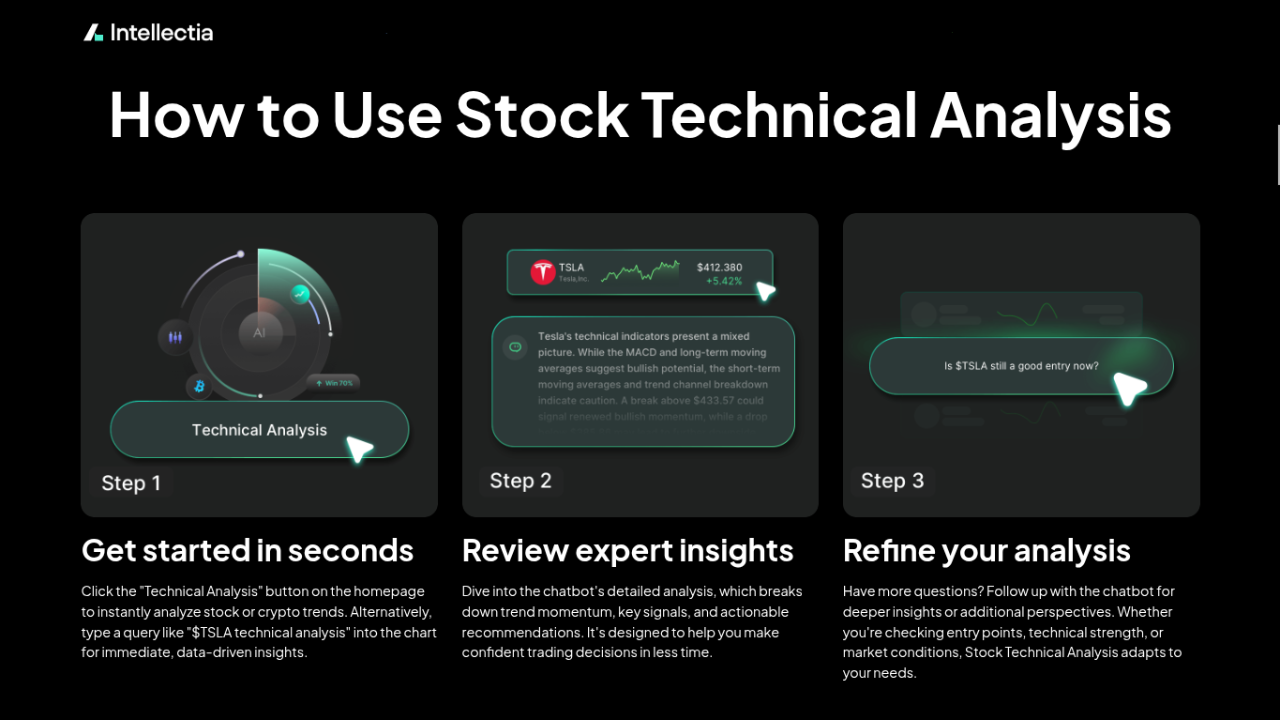

Start by using Intellectia.ai’s powerful AI Screener to filter for companies with long dividend growth streaks, healthy payout ratios, and strong fundamentals. This tool helps you quickly narrow down the list of dividend kings to a manageable number of high-quality candidates.

Once you have your list, build a balanced portfolio. While Dividend Kings offer stability, you may want to combine them with growth-oriented stocks to ensure your portfolio has a healthy mix of income and capital appreciation. Intellectia.ai’s AI stock picker can help you identify opportunities across different investment styles.

Timing your entry and exit points can also enhance your returns. Use Intellectia.ai's stock technical analysis tools and AI trading signals to identify favorable moments to buy or sell, rather than simply buying at any price.

Finally, consider implementing a Dividend Reinvestment Plan (DRIP). Reinvesting your dividends automatically buys more shares, allowing your investment to compound faster over time. This simple strategy can dramatically boost your long-term wealth.

Ready to build your dividend portfolio? Sign up for Intellectia.ai to access AI-powered tools that simplify your investment research.

Conclusion

In a world of market uncertainty, the reliability of Dividend Kings stands out. These companies have proven their ability to navigate challenges while consistently rewarding shareholders for over half a century. By focusing on the top dividend kings with strong fundamentals and durable business models, you can build a resilient portfolio that generates a steady and growing stream of passive income.

Are you ready to find the next dividend powerhouse for your portfolio? Subscribe to Intellectia.ai today for daily AI stock picks, advanced screening tools, and data-driven insights to help you invest smarter.