Key Takeaways

- Official Stance: Costco’s management has publicly stated that a stock split is not a priority for 2026, citing the widespread availability of fractional share investing.

- The Real Cost: While the nominal share price (currently around $890-$950) is high, the bigger concern for investors is the stock’s elevated valuation (P/E ratio near 57x) compared to its historical average.

- The Dividend Alternative: Costco management prefers rewarding long-term shareholders via Special Dividends (e.g., the $15 special dividend in late 2023) over cosmetic stock splits.

- Historical Context: Costco has not split its stock since January 2000, marking over 25 years without a forward split.

Introduction

Costco Wholesale (COST) remains an investor darling, with a share price hovering near all-time highs. The recurring question dominating financial forums is: "Will Costco finally split its stock in 2026?"

While the retail investor community is eager for the event, our analysis, based on management’s latest comments and the stock’s fundamentals, suggests you may be waiting even longer. Let’s dive into the core reasons why a split is unlikely, and what smart investors should focus on instead.

What is a stock split?

A stock split is simply a practice that public companies may offer to reduce the cost of their shares. This is done by the company issuing more shares. For example, if a stock was valued at $100/share and the company did a 5:1 stock split, then the shareholder would hold 5 shares at $20/share after the stock split.

Recently Nvidia (NVDA) engaged in a 10:1 stock split as its shares soared to over $1,200/share. After the stock split, shareholders then held Nvidia stock at $120/share (depending on whether you owned 1x share(s) prior to the split).

Benefits of a stock split

- Increased liquidity: After a company splits its stock, there will be more shares in circulation, meaning the company's stock is more liquid due to higher trading volumes.

- Reduced barriers to owning a share: A company's stock price will be significantly cheaper than before the split, allowing investors to own shares at more affordable prices.

- Management confidence: A company usually splits its stock when there is strong confidence from the management that the company will produce future growth.

Will Costco split its stock in 2026?

Costco (COST) has seen exponential strong growth throughout the last 20 years. Over the last 12 months alone, Costco's stock has increased by over 40%, bringing its value per share to over $1,000 and a market cap of over $450 billion.

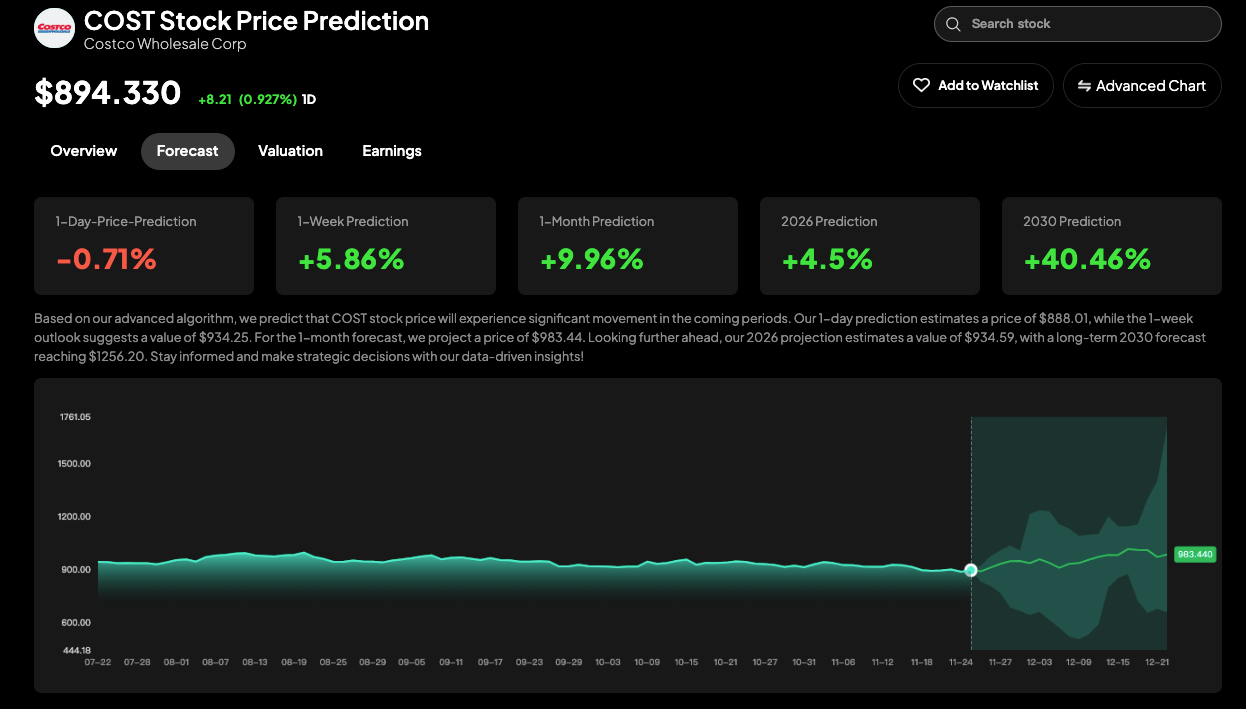

Costco's stock price

Based on Costco's stock price today, investors may be thinking whether it is time Costco splits its stock to reduce the price for more retail investors to get involved. However, Costco's CFO recently said they had no intentions to do so.

This is due to the accessibility to stocks that brokers now offer, through the option to purchase shares fractionally without owning an entire share. Meaning, that retail investors are not missing out on Costco share ownership and by this logic, Costco has no incentive to split its stock.

Historical stock splits

The last time Costco split its stock was in January of 2000, more than 25 years ago, offering a 2:1 stock split. During the company's stock split in 2000, the stock jumped by 7.27% from the previous month but an overall decrease of 5.5% in January 2001.

Who owns Costco shares?

Currently, more than 67.76% of Costco shares are owned by institutional investors, whereas other shares are held by unknown investors. This large portion of institutional shareholders holding Costco stock are likely unincentivized to push for a company stock split, due to their ability to purchase shares at their current value.

Is Costco Overvalued?

The company's success has pushed its stock to historically expensive levels.

- P/E Ratio: Costco's Price-to-Earnings (P/E) ratio currently hovers near 57x (as of late 2025), which is more than double the S&P 500 average and significantly higher than its own five-year average.

- Growth: Analysts forecast healthy, but modest, EPS growth (around 9% annually).

A split, historically, can temporarily help investors "look past" an expensive valuation. However, ignoring the underlying high multiple exposes investors to greater risk if growth slows down.

How to Take Advantage of Costco’s True Strategy

Costco’s preferred method of rewarding shareholders is not the split, but the Special Dividend. Since 2012, Costco has issued five special dividends (the latest being $15 per share in late 2023), distributing billions back to shareholders without cosmetically altering the share count.

- Actionable Step: Instead of waiting for a speculative split, investors should track Costco’s earnings and cash reserves. A strong cash position increases the likelihood of another profitable special dividend announcement in 2026.

Conclusion

As we have analysed, based on Costco's current market price, shareholders, and historical information, a Costco stock split seems rather unlikely. However, as the company is beginning to reach new milestones, surpassing $1,000/share, a 2026 Costco stock split is not entirely unthinkable. Let's wait and take advantage when the opportunity arises.