Key Takeaways

- Stocks under $2, or penny stocks, offer high growth potential but come with increased risks due to volatility and lower liquidity.

- Top picks for 2025 include Denison Mines (DNN), Cardiol Therapeutics (CRDL), OS Therapies (OSTX), Peraso Inc. (PRSO), and HIVE Digital Technologies (HIVE).

- Selecting stocks based on financial health, market potential, and recent news can help you mitigate risks.

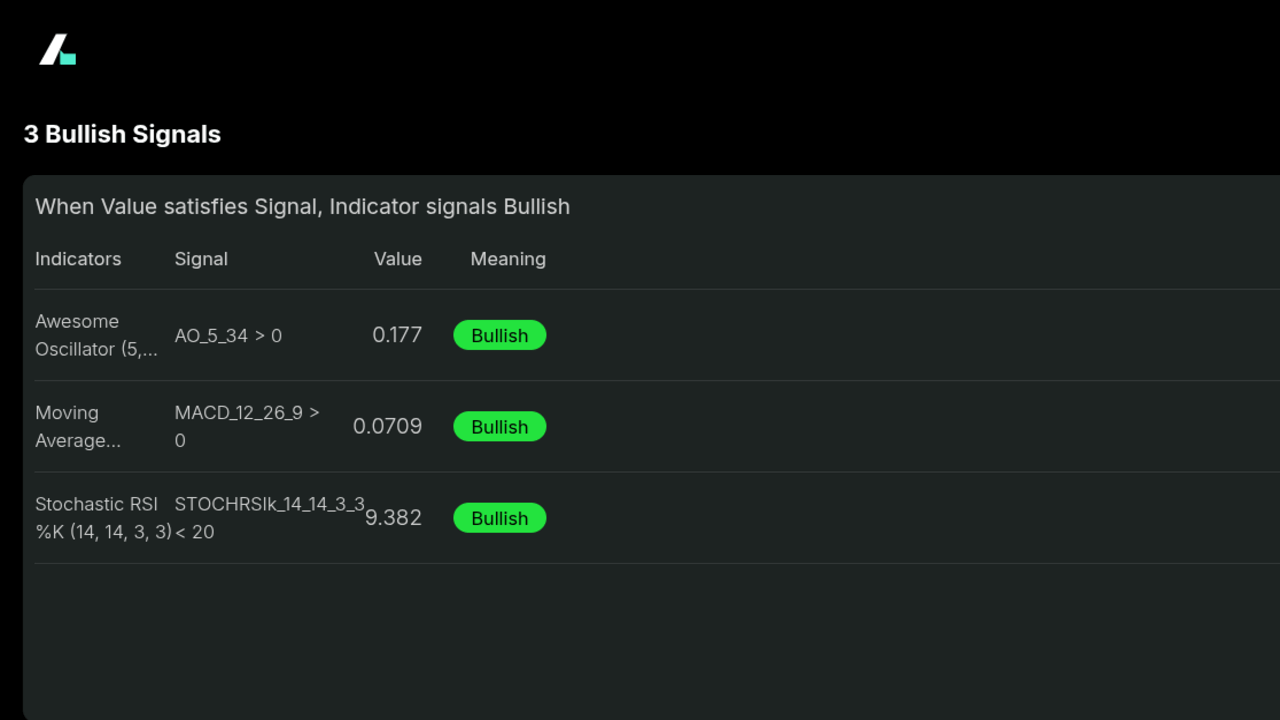

- AI-driven tools like Intellectia.AI’s stock picker provide valuable insights for informed investing.

- Diversification, stop-loss orders, and frequent monitoring are essential strategies for managing these investments.

Introduction

Have you ever wondered how to find affordable stocks that could deliver big returns? Stocks under $2, often called penny stocks, are attractive because they let you buy many shares without breaking the bank. However, their volatility can make investing feel like a rollercoaster.

Intellectia AI uses cutting-edge AI to analyze thousands of stocks, identifying those with the best potential. In this article, you’ll learn what stocks under $2 are, why they’re worth considering, and discover our top five picks for 2025, along with strategies to invest wisely.

What Are Stocks Under $2?

Stocks under $2 are shares of companies trading below $2 per share. Often labeled as penny stocks, they’re typically tied to small-cap firms, startups, or companies navigating financial hurdles. Some, though, are undervalued companies with strong growth prospects. These stocks are characterized by:

- High Volatility: Prices can swing dramatically, offering both opportunity and risk.

- Lower Liquidity: Fewer shares traded can make it harder to buy or sell quickly.

- Speculative Nature: Investors bet on future growth, often with limited information.

The $2 mark is a psychological and strategic threshold. Some brokerages restrict trading in stocks below certain prices, and $2 is a common cutoff. You’ll find these stocks on exchanges like Nasdaq, NYSE, AMEX, or OTC markets. They appeal to speculative traders and investors with smaller accounts eager for high-growth opportunities.

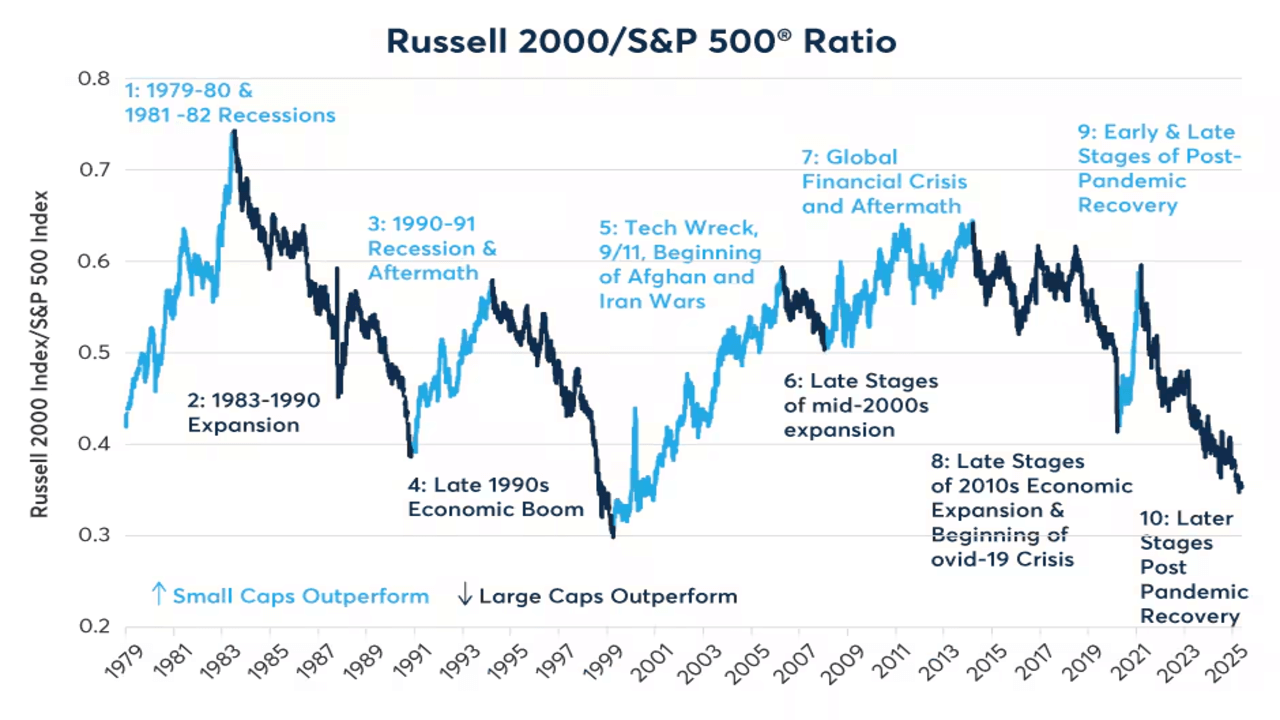

Source: CME Group

Why Invest in Stocks Under 2 Dollars

Investing in stocks under $2 can be exciting for several reasons:

- Significant Gains Potential: A small price increase, like $0.50, can mean a 50% return on a $1 stock.

- Accessibility: Affordable prices let you buy more shares with less capital.

- Hidden Value: Some companies are undervalued due to market oversight, offering bargains.

- Trading Opportunities: Volatility suits day traders and swing traders using strategies like those at Intellectia.AI’s day trading center.

- Emerging Industries Exposure: Many are in innovative sectors like biotech, clean energy, or tech.

But there are risks to consider:

- Higher Volatility: Prices can drop as quickly as they rise.

- Lower Liquidity: Selling shares at your desired price can be challenging.

- Less Information: Smaller companies may have limited public data, increasing uncertainty.

- Fraud Risk: Some penny stocks are targets for manipulation.

Balancing these pros and cons is key to successful investing in this space.

Criteria for Selecting Best Stocks Under $2

To pick the best stocks under $2, you need a disciplined approach. Here are the criteria we use at Intellectia.AI:

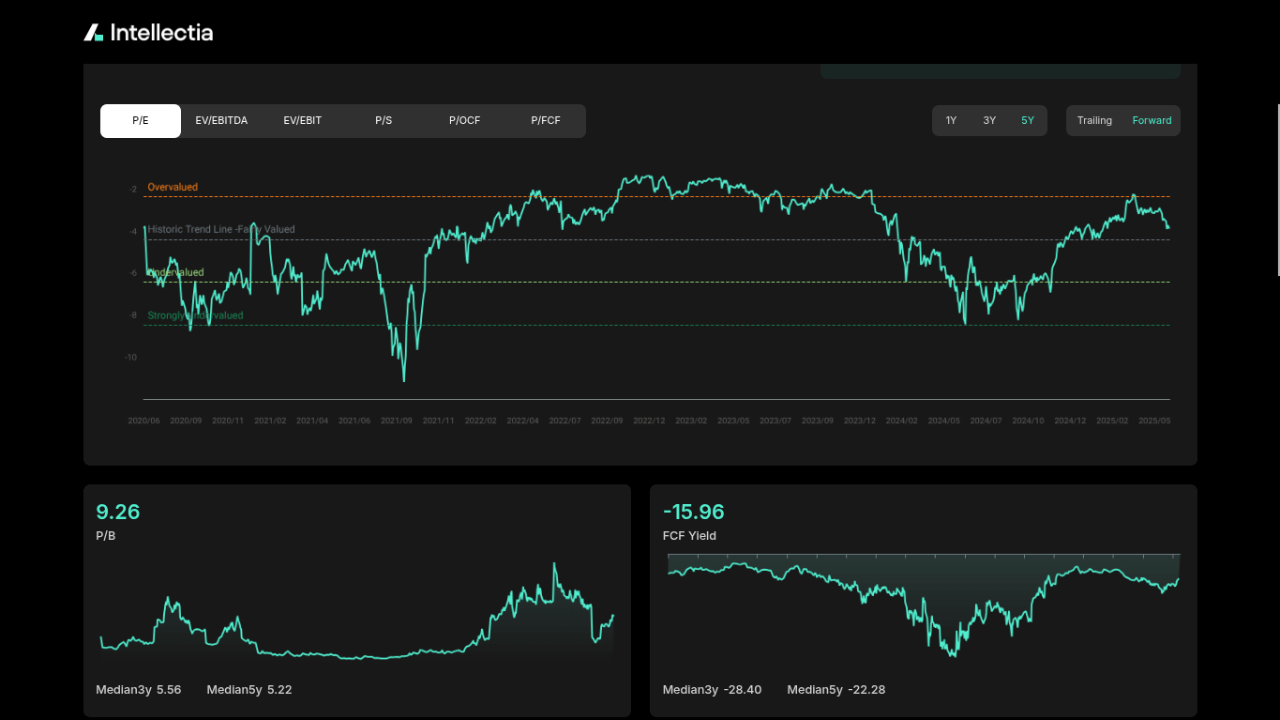

- Financial Health: Seek companies with positive earnings, low debt, and strong cash flow. Check metrics like P/E ratio or revenue growth.

- Market Potential: Focus on firms in growing industries, like biotech or renewable energy, with innovative products or services.

- Recent News: Look for positive developments, such as new contracts, partnerships, or clinical trial results, which can drive price growth.

- Market Cap and Trading Volume: Higher market caps and trading volumes ensure better liquidity and stability.

- Insider Buying or Institutional Interest: Purchases by company insiders or institutions signal confidence.

- Analyst Coverage: Buy ratings from analysts validate stock’s potential.

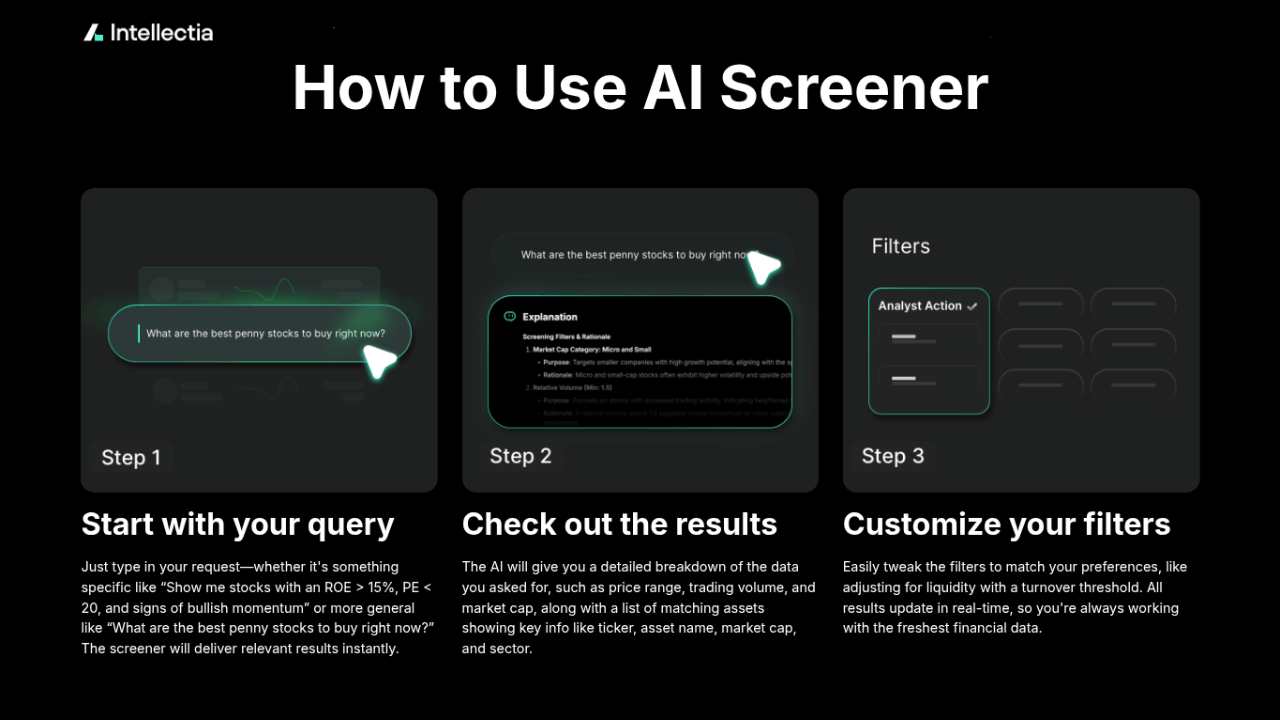

Using tools like Intellectia.AI’s AI screener can simplify this process by filtering stocks based on these factors.

Source: Intellectia.ai

List of Best Stocks Under $2

Based on our AI analysis and analyst insights, here are five top stocks under $2 for 2025:

| Company Name | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Denison Mines | DNN | Energy | $1.56B | Leading uranium explorer, strong analyst ratings |

| Cardiol Therapeutics | CRDL | Healthcare | $102.49M | Innovative biotech with promising pipeline |

| OS Therapies | OSTX | Healthcare | $47.77M | Developing treatments for rare diseases |

| Peraso Inc. | PRSO | Technology | ~$30M | Semiconductor company with 5G potential |

| HIVE Digital Technologies | HIVE | Financial | $325.26M | Crypto mining with sustainable energy |

Denison Mines (DNN)

Denison Mines, a premier uranium exploration and development company based in Canada, is well-positioned to capitalize on the growing global demand for clean energy. Operating primarily in the Athabasca Basin, a region rich in high-grade uranium deposits, Denison’s flagship Wheeler River project is one of the most promising uranium developments worldwide.

In November 2024, the company secured a strategic agreement with Cosa Resources to advance exploration efforts, followed by plans for a follow-up drill program at its Hatchet Uranium project announced in March 2025. These milestones underscore Denison’s commitment to expanding its resource base.

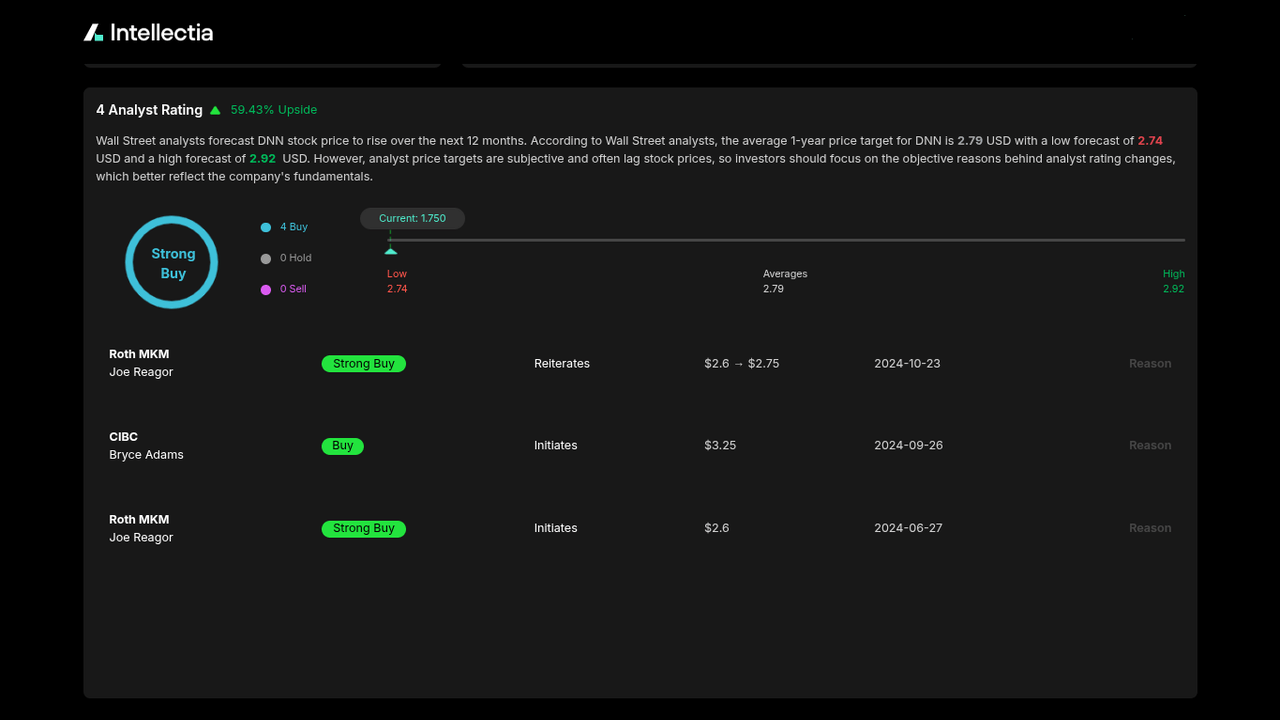

Analysts have assigned DNN a Buy rating with a consensus price target of $3.00, implying over 70% upside from its current price of $1.75. With rising uranium prices driven by nuclear energy’s resurgence, DNN stands out as a top pick for investors seeking exposure to the energy sector.

Source: Intellectia.ai

Cardiol Therapeutics (CRDL)

Cardiol Therapeutics is a clinical-stage biotechnology company focused on developing innovative therapies for heart diseases, particularly acute myocarditis and other inflammatory conditions.

Its lead drug, CardiolRx, is advancing through clinical trials, showing promising results in addressing unmet medical needs. Recent progress, including positive data from early-stage trials, has bolstered investor confidence. Trading at $1.28, CRDL has earned a Buy rating with a consensus price target of $8.67, suggesting a remarkable 577% upside potential.

The company’s strong intellectual property portfolio and strategic partnerships enhance its long-term growth prospects. As heart disease remains a leading global health challenge, CRDL’s focus on cutting-edge treatments makes it an attractive option for biotech investors.

Source: Intellectia.ai

OS Therapies (OSTX)

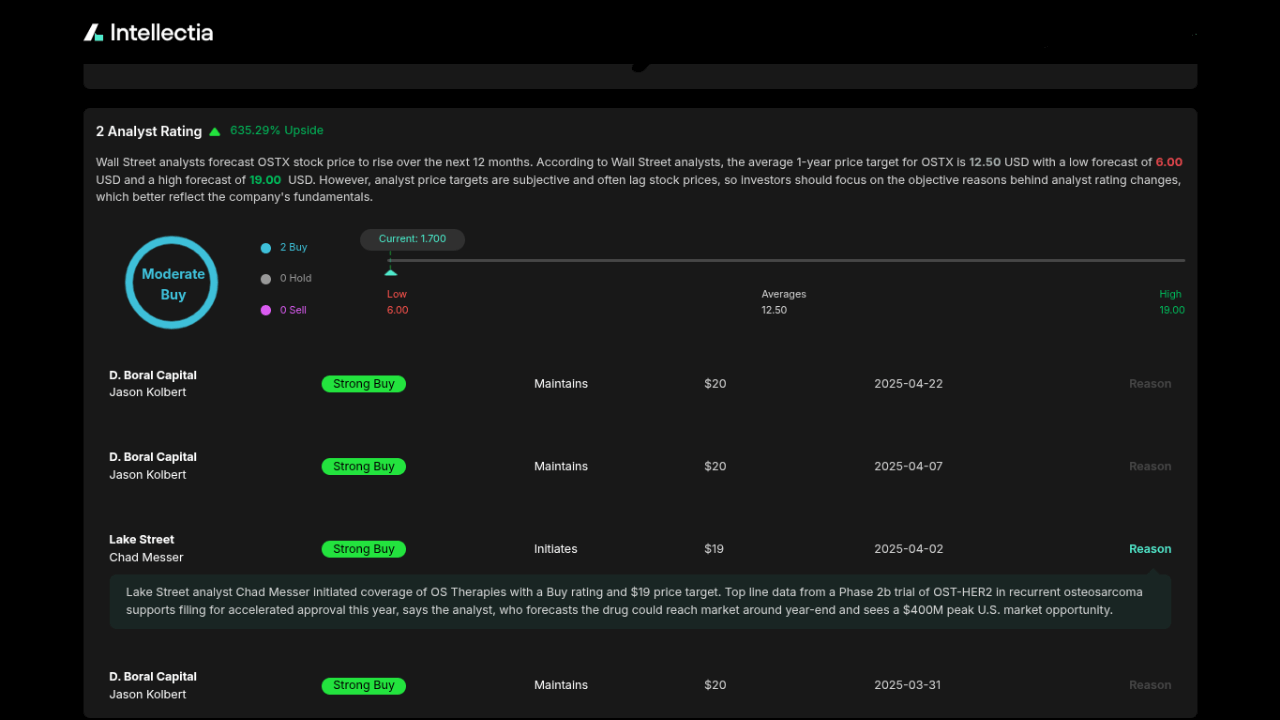

OS Therapies is a biotechnology firm dedicated to developing treatments for rare cancers, particularly osteosarcoma and other bone-related malignancies affecting children and young adults.

Trading at $1.70, OSTX is gaining attention for its innovative pipeline, which addresses critical gaps in oncology. Recent advancements in clinical trials, including promising preclinical data, have positioned the company for potential breakthroughs. Analysts have issued a Buy rating with a $18.00 price target, indicating an impressive 960% upside potential.

OSTX’s mission-driven approach and focus on underserved patient populations enhance its appeal to socially conscious investors. With a modest market cap of $47.77 million, OS Therapies offers significant growth opportunities.

Source: Intellectia.ai

Peraso Inc. (PRSO)

Peraso Inc. is a semiconductor company specializing in millimeter-wave technology, a critical component for high-speed wireless communications, including 5G networks and Wi-Fi 6/7 applications.

Priced at $1.90, Peraso is leveraging its expertise to secure contracts with major technology firms, driving revenue growth. Recent product launches and strategic partnerships, such as collaborations with wireless equipment manufacturers, highlight its momentum.

Peraso’s technology is well-suited for emerging markets like IoT and smart cities, where high-bandwidth connectivity is essential. With a market cap of approximately $30 million, PRSO offers substantial upside for investors betting on the 5G revolution.

Source: Intellectia.ai

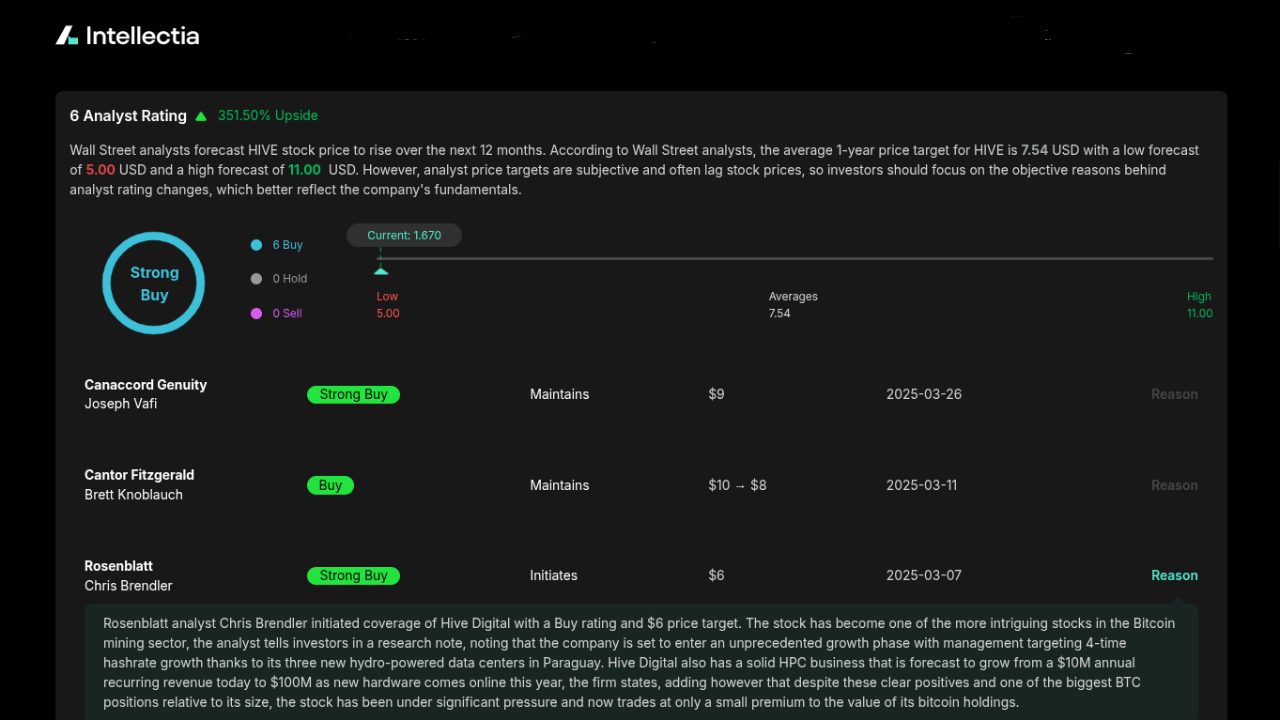

HIVE Digital Technologies (HIVE)

HIVE Digital Technologies is a leader in cryptocurrency mining, focusing on Bitcoin and Ethereum, while prioritizing sustainability through the use of renewable energy sources like hydroelectric power.

Trading at $1.67, HIVE is well-positioned to benefit from the cryptocurrency market’s recovery and growing institutional adoption. The company’s strategic expansion of mining facilities in Canada and Iceland, coupled with its commitment to green energy, enhances operational efficiency and public appeal.

Analysts have assigned HIVE a Buy rating with a $7.64 price target, suggesting a 357% upside potential. With a market cap of $325.26 million, HIVE offers a unique blend of crypto exposure and environmental responsibility, making it a compelling pick for diversified portfolios.

Source: Intellectia.ai

Investment Strategies for 2 Dollar Stocks

Investing in stocks under $2 requires careful strategies to manage risks:

- Set Stop-Loss Orders: Automatically sell if a stock drops to a set price to limit losses.

- Monitor Frequently: Volatility demands regular checks on your positions.

- Diversify: Spread investments across multiple stocks to reduce risk.

- Long vs. Short-Term: Decide between holding for growth or trading short-term, using tools like Intellectia.AI’s swing trading feature.

- Leverage AI Tools: Use Intellectia.AI’s AI stock picker and trading signals for data-driven decisions.

These strategies can help you navigate the challenges of penny stocks while maximizing returns.

Conclusion

Stocks under $2 offer a thrilling opportunity to invest in high-growth companies at a low cost. However, their risks require careful selection and disciplined strategies. Intellectia AI’s AI-powered tools help you identify top picks like DNN, CRDL, OSTX, PRSO, and HIVE, and provide trading signals to stay ahead.

Ready to dive in? Sign up now for daily AI stock picks, market analysis, and trading strategies to boost your portfolio.