Key Takeaways

- The best stocks for beginners blend stability with growth potential.

- Companies like Apple and Coca-Cola offer newbie-friendly reliability.

- You can start small and still see steady gains over time.

- Low volatility and strong dividends make these picks ideal for you.

Introduction

Starting out in the world of investing is a challenge, you think you know what to buy, or perhaps heard a suggestion from a friend or family, but in reality, it's substantially more complex than that.

This is why I have listed out the 5 best stocks for beginners to help you get a hang of how investing works whilst mitigating against substantial losses through highly volatile stocks.

What are stocks and why start simple?

Stocks are shares of companies you can buy, giving you a tiny piece of their success. They trade on exchanges like the NYSE, where prices bounce daily based on demand.

For beginners, jumping into wild, risky stocks is a recipe for stress. You want the best stocks for beginners, ones with steady growth, not rollercoaster rides.

These are often big-named brands you already know, offering stability as you learn the ropes. Simple, right? That’s the goal for your first steps.

List of the 5 best stocks for beginners

Ready to kick off your investing journey? Here are the 5 best stocks for beginners you should consider:

- Apple (AAPL) - Tech giant with iconic products.

- Coca-Cola (KO) - Beverage king with global reach.

- Johnson & Johnson (JNJ) - Healthcare leader with reliability.

- Walmart (WMT) - Retail titan thriving in all markets.

- Visa Inc. (V) - Global leader in digital payments.

Criteria for great beginner stocks

How did I pick these best stocks for beginners? I used a clear checklist to ensure that each stock chosen would offer the most stability for beginner traders.

- Stability: Low volatility for peace of mind.

- Brand recognition: Companies you already trust.

- Dividends: Steady payouts to grow your cash.

- Affordability: Reasonable share prices or broad exposure.

- Growth potential: Room to rise without crazy risk.

These ensure you’re starting with stocks that won’t scare you off day one.

Tech giant with iconic products

Apple (AAPL)

It is unlikely you have not heard of Apple before, with its unchallenged successful market penetration across the globe, coupled with its $3.2 trillion market cap, making it one of the most valuable companies in the history of all stock trading.

Why Apple?

Aside from Apple's remarkable growth and popularity, the company's revenue continues to grow, seeing a 2% increase to $391 billion in 2024 compared to 2023. Apple also saw an increase in its operating profit by more than 7.8% totalling $123 billion in 2024.

With a steady stock climb of more than 23% over the last 12 months, Apple continues to provide strong stability backed by strong fundamentals.

If you want a steady tech play, Apple is a strong stock to add to your portfolio.

Beverage king with global reach

Coca-Cola (KO)

Another well-recognized brand, Coca-Cola, servicing over 200 countries and territories, has remained undefeated in the soft drinks industry with a current market cap of over $298 billion, making Coke a very strong beginner stock to look into.

Why Coke-Cola?

Coke is a globally recognized, stable company, with a 6.84% YoY growth in revenue, reaching $47 billion in 2024 coupled with an operating profit of $9.99 billion, Coke has solid fundamentals and shows signs of consistent growth.

With a steady stock growth of 16% over the last 12 months, Coca-Cola is a strong contender to consider as a starter stock for your portfolio.

Healthcare leader with reliability

Johnson & Johnson (JNJ)

Johnson & Johnson, valued at $395 billion, and known for its healthcare products, is another good stock to consider adding to your portfolio. Not to mention, JNJ also pays consistent dividends to its shareholders.

Why Johnson & Johnson?

In 2024 Johnson & Johnson's revenue increased by 4.3%, to $88.8 billion compared to 2023, and an increase of 4.6% in gross profit to $61.35 billion. JNJ's year-over-year growth shows the company has a solid future.

With a modest stock climb of more than 3.9% over the last 12 months, JNJ continues to provide strong stability backed by strong fundamentals.

If you want a safe healthcare bet, JNJ can be classed as a strong, steady beginner stock that won't let you down.

Retail titan thriving in all markets

Walmart (WMT)

Walmart, a Warren Buffet favorite, is currently valued at $686 billion and considered a strong stock, especially for beginners, during uncertain economic times due to its historic resilience to economic pressures.

Why Walmart?

In 2024 Walmart's revenue increased by 4.9%, to $680 billion compared to 2023, and an increase of 7.6% in gross profit to $169 billion.

Walmart's consistent yearly growth coupled with strong investor sentiment makes it a strong beginner stock coupled with a modest stock climb of more than 41% over the last 12 months.

Walmart continues to provide strong stability backed by strong fundamentals, certainly a top pick from us.

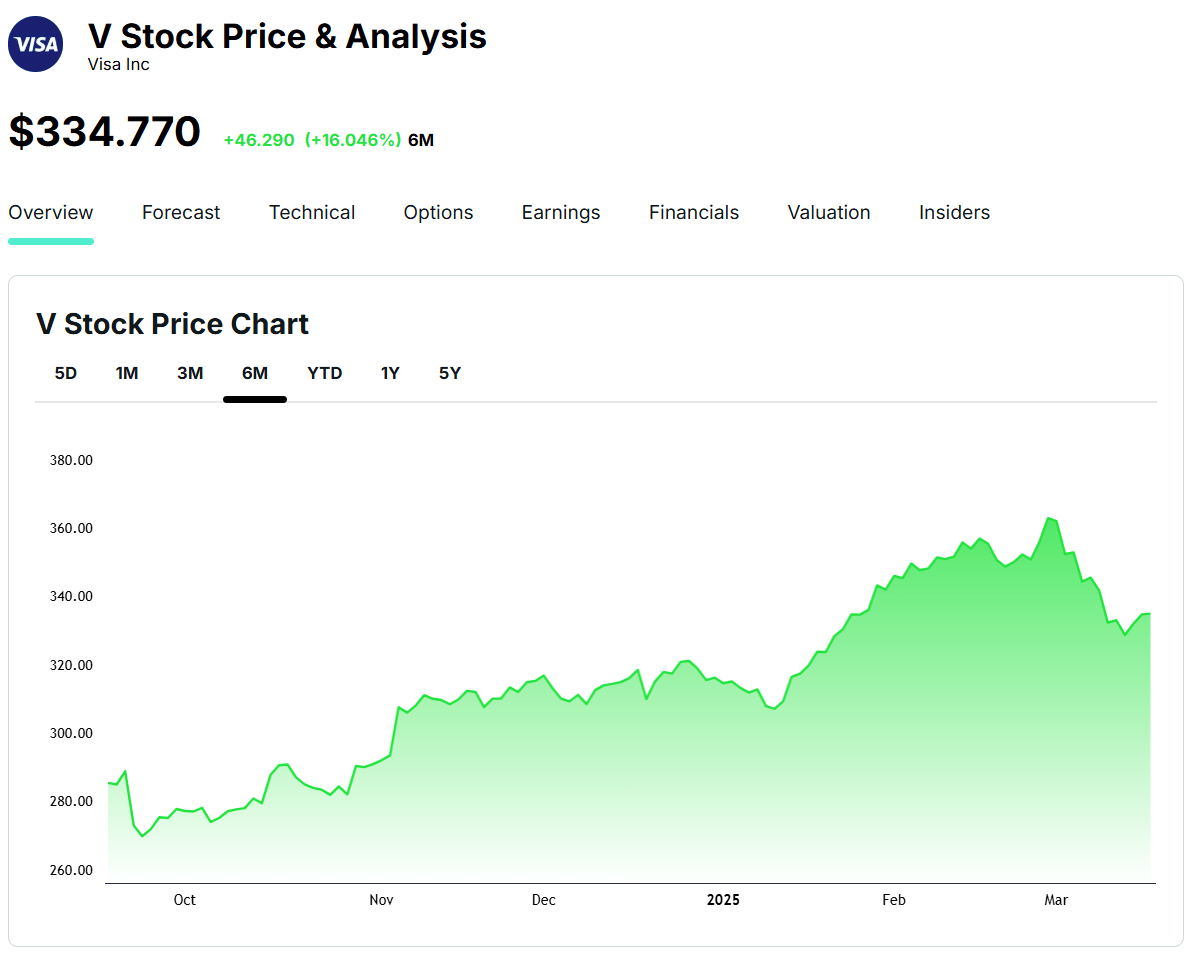

Global leader in digital payments

Visa Inc. (V)

Visa is a $650 billion powerhouse dominating digital payments worldwide, with a strong brand presence, government support, and overall trust in its operation, Visa had to make our list.

Why Visa Inc.?

Aside from the almost complete monopoly Visa has over the payments industry, the company saw a 10.1% increase in its revenue to $35.93 billion and a 9.5% increase in operating profits to $23.6 billion compared to 2023.

With a steady stock climb of more than 18% over the last 12 months, Visa continues to provide strong stability backed by its fundamentals and industry trust.

Conclusion

There you have it, five of the best stocks for beginners: Apple, Coca-Cola, Johnson & Johnson, Walmart, and Visa.

Remember starting out with investing is a tough path, and so, selecting the right stocks to get you more accustomed to the stock market is a good direction.

The 5 best stocks for beginners that we listed here are good places to start. If you want to do a more thorough analysis of stocks, I highly recommend you use Intellectia's powerful AI stock tool, it will help simplify to complexities of the markets.