Key Takeaways

- The satellite industry is experiencing a surge, driven by increasing demand for global connectivity, crucial defense applications, and AI-powered data analytics.

- Top satellite stocks for 2026 include a mix of established communication providers and disruptive launch and data companies like Iridium (IRDM), Globalstar (GSAT), Viasat (VSAT), Planet Labs (PL), and Rocket Lab (RKLB).

- Key investment drivers include massive government contracts, the expansion of Low Earth Orbit (LEO) constellations, and the integration of satellite data with AI.

- Investors should look for companies with strong contract backlogs, innovative technology, and a clear path to profitability to navigate this high-growth, high-risk sector.

Introduction

With the global demand for data skyrocketing and private companies expanding space access, the satellite industry is no longer science fiction—it's a real investment frontier. However, navigating this fast-evolving sector can be challenging, with numerous players competing for market share and government contracts.

By understanding the key players, market drivers, and Intellectia.ai’s AI tools, you can confidently identify the satellite company stocks best positioned for success. This article will launch you into the world of satellite investing, breaking down the top five best satellite stocks to watch in 2026 and giving you the tools to make informed decisions.

What Are Satellite Stocks?

Satellite stocks represent shares in companies that design, manufacture, launch, or operate satellites. These companies form the backbone of a global infrastructure that powers everything from your GPS navigation to in-flight Wi-Fi and critical military communications.

You can find a comprehensive satellite stocks list across several sectors, but they generally fall into three main categories:

- Communication & Internet Providers: These companies, like Iridium and Globalstar, operate constellations of satellites to provide voice, data, and internet services to areas traditional networks can't reach.

- Launch & Infrastructure Companies: This category includes businesses like Rocket Lab that focus on building and launching rockets, deploying satellites into orbit for various clients.

- Data Analytics & Imaging Firms: Companies like Planet Labs operate satellites to capture high-resolution imagery and data of Earth, which is then sold to governments and commercial industries for analysis.

Why Invest in Satellite Stocks in 2026?

The satellite industry is at an inflection point, with powerful tailwinds creating significant investment opportunities. Here’s why 2026 is a pivotal year for investors looking to buy top satellite stocks.

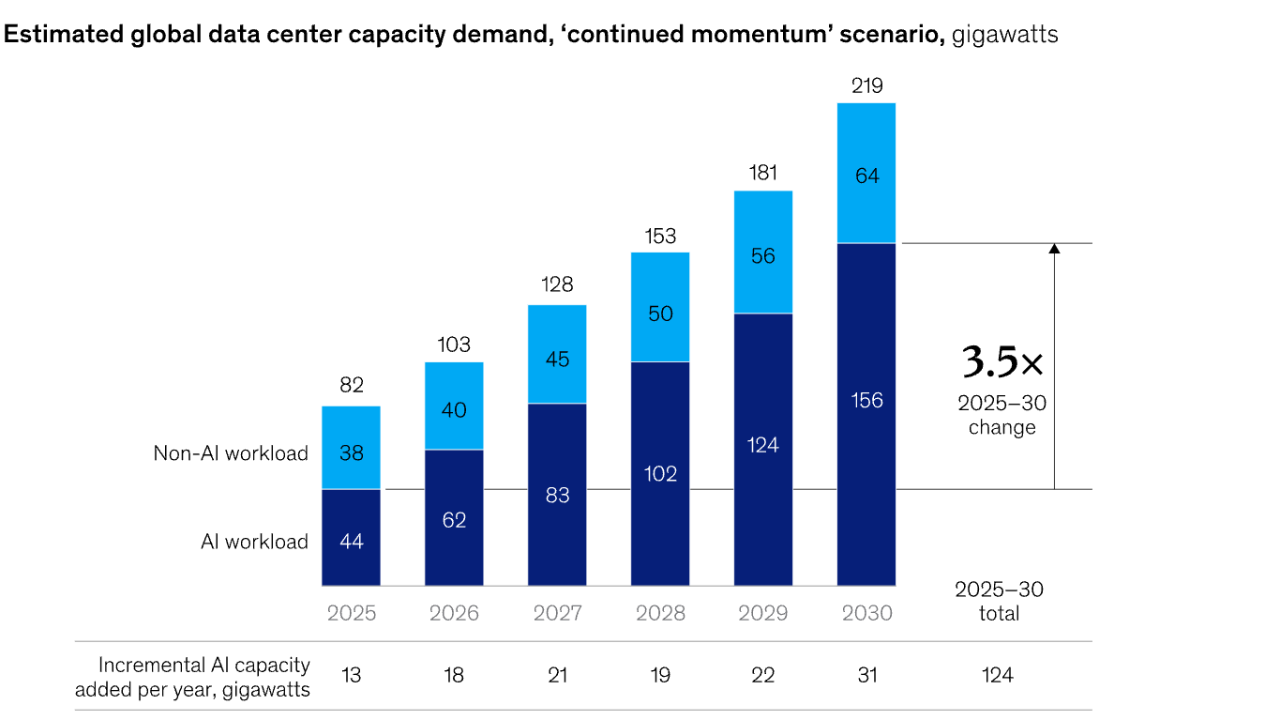

- Global Demand for Connectivity: The rollout of 5G networks and the expansion of LEO constellations are creating an insatiable demand for satellite-based internet and data backhaul, connecting remote regions and powering the Internet of Things (IoT).

- Government & Defense Contracts: Geopolitical tensions are driving record defense spending. Governments worldwide are awarding multi-billion dollar contracts for secure communications, missile defense systems like the "Golden Dome," and persistent surveillance, providing stable, long-term revenue for companies in this space.

- Commercial Satellite Internet: The race to provide high-speed internet from space is heating up, with rising adoption in developing countries and rural areas creating a massive new market for consumer-facing satellite services.

- AI and Big Data Integration: Satellites are now powerful data collection platforms. Companies are leveraging AI to analyze vast amounts of geospatial and environmental data, offering invaluable insights for agriculture, climate monitoring, and national security.

Criteria for Selecting Top Satellite Stocks

Investing in satellite companies requires a unique lens. Beyond standard metrics, you need to assess factors specific to the aerospace and defense industry.

Look for a strong contract backlog, a clear technological advantage, and a management team with a proven track record of execution. Financial stability is key, but so is the ability to secure large, multi-year government and commercial contracts that ensure future revenue.

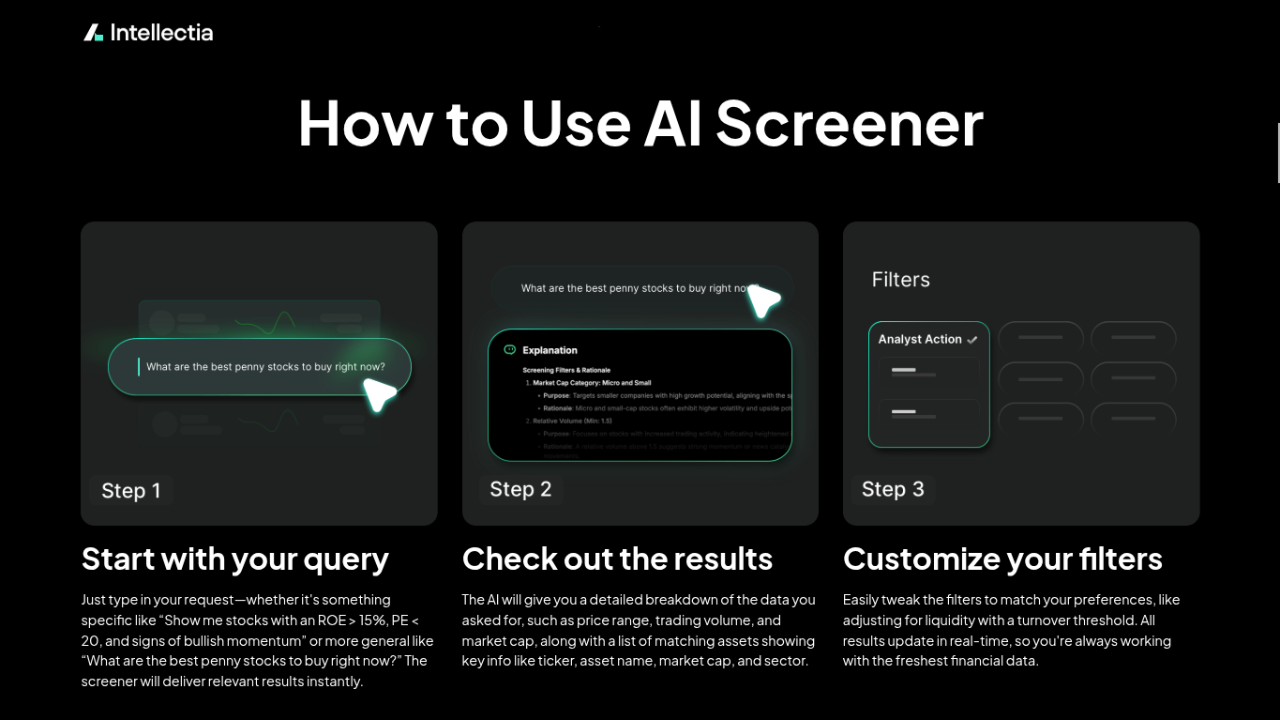

Instead of manually screening dozens of stocks, you can use AI Stock Screener to quickly identify companies with solid financials, healthy revenue growth, and attractive valuations.

5 Best Satellite Stocks to Buy in 2026

Here is a comparative overview of five of the best satellite stocks to consider for your portfolio in 2026, each with a unique position in the evolving space economy.

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Iridium Communications | IRDM | Communication Services | ~$2.0B | Global L-Band network, D2D/PNT growth, strong FCF |

| Globalstar, Inc. | GSAT | Communication Services | ~$5.6B | Band 53 spectrum, government contracts, SpaceX partnership |

| Viasat, Inc. | VSAT | Communication Services | ~$5.0B | Defense & Advanced Tech, Inmarsat integration, IFC leader |

| Planet Labs PBC | PL | Industrials | ~$4.2B | Daily Earth scan, massive data archive for AI, strong backlog |

| Rocket Lab Corporation | RKLB | Industrials | ~$32.6B | Leading small launch provider, Neutron rocket development |

Iridium Communications (IRDM)

Iridium operates a unique, cross-linked LEO satellite constellation providing reliable, low-latency voice and data services to the entire planet. It's a critical infrastructure provider for maritime, aviation, government, and IoT applications.

In its Q2 2025 earnings call, management highlighted progress in the maritime broadband segment and new investments in direct-to-device (D2D) and positioning, navigation, and timing (PNT) businesses. Despite revising its 2025 service revenue growth guidance to 3-5%, the company remains confident in its long-term target of $1 billion in service revenue by 2030, driven by its unique network capabilities and expanding partner ecosystem.

Iridium's fully upgraded L-Band fleet gives it a strong moat in the low-bandwidth satellite data market. The company is generating substantial free cash flow and is strategically positioned to capture growth from the emerging D2D and PNT markets, which provide critical services in GPS-denied environments.

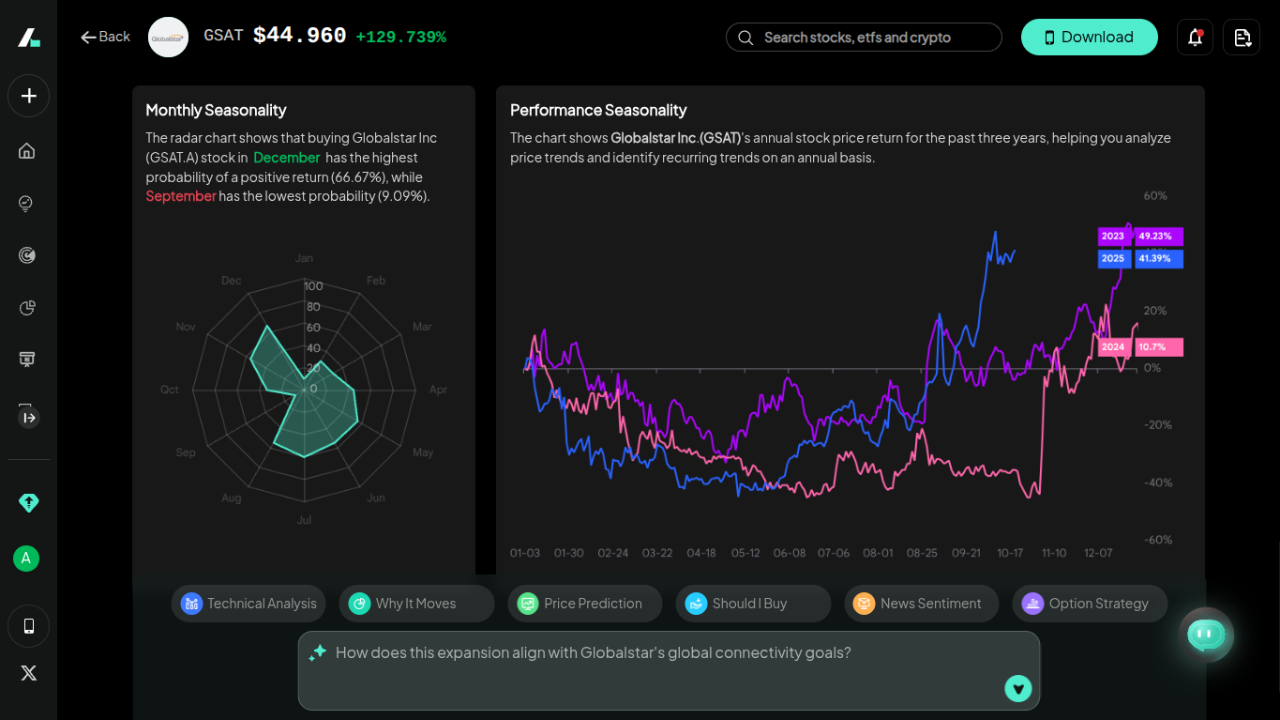

Globalstar, Inc. (GSAT)

Globalstar provides mobile satellite services, including voice and data, and is gaining significant traction with its proprietary Band 53 spectrum and its growing role in government and defense communications.

Globalstar announced strong momentum in its government sector in Q2 2025, securing major contracts and partnerships with Parsons and the U.S. Army. CEO Paul Jacobs also revealed a launch services agreement with SpaceX to deploy nine new satellites, bolstering its constellation and ensuring service continuity. These initiatives are expected to generate at least $60 million in revenue over five years.

Globalstar's strategic partnerships and its valuable spectrum assets position it for significant growth in defense-related revenue. The successful execution of its ground infrastructure program and new satellite launches will enhance its ability to deliver resilient, low-latency communications for mission-critical applications worldwide.

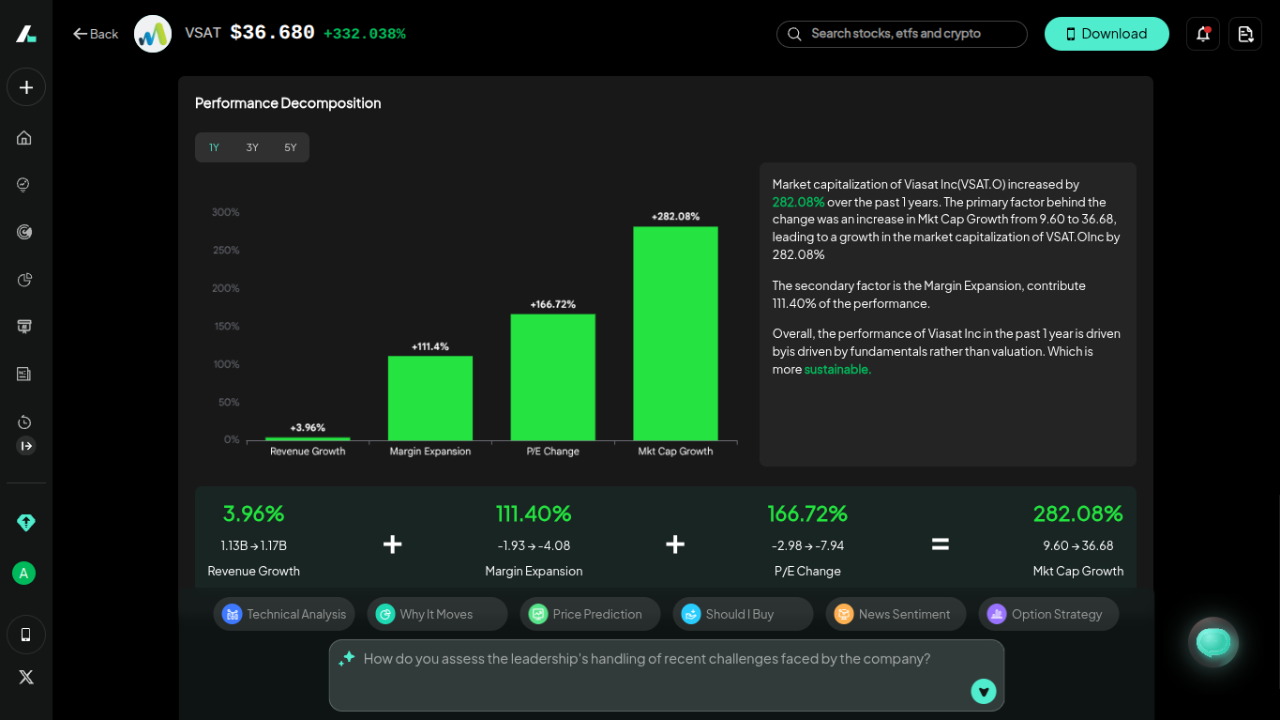

Viasat, Inc. (VSAT)

Viasat is a global communications company that provides high-speed satellite broadband services and secure networking systems for military and commercial markets. Its acquisition of Inmarsat has solidified its position as a leader in in-flight connectivity (IFC) and maritime communications.

In its Q1 2026 earnings report, Viasat demonstrated resilience with double-digit growth in its Defense and Advanced Technologies segment. The company highlighted strong traction for its NexusWave maritime product, which surpassed 1,000 orders, and reaffirmed its focus on achieving a positive free cash flow inflection as it completes the ViaSat-3 satellite constellation.

Viasat's diversified business across government and commercial sectors provides a balanced revenue stream. Its leadership in IFC and growing defense backlog, combined with the impending capacity boost from its ViaSat-3 satellites, positions it to capture long-term growth in high-demand markets.

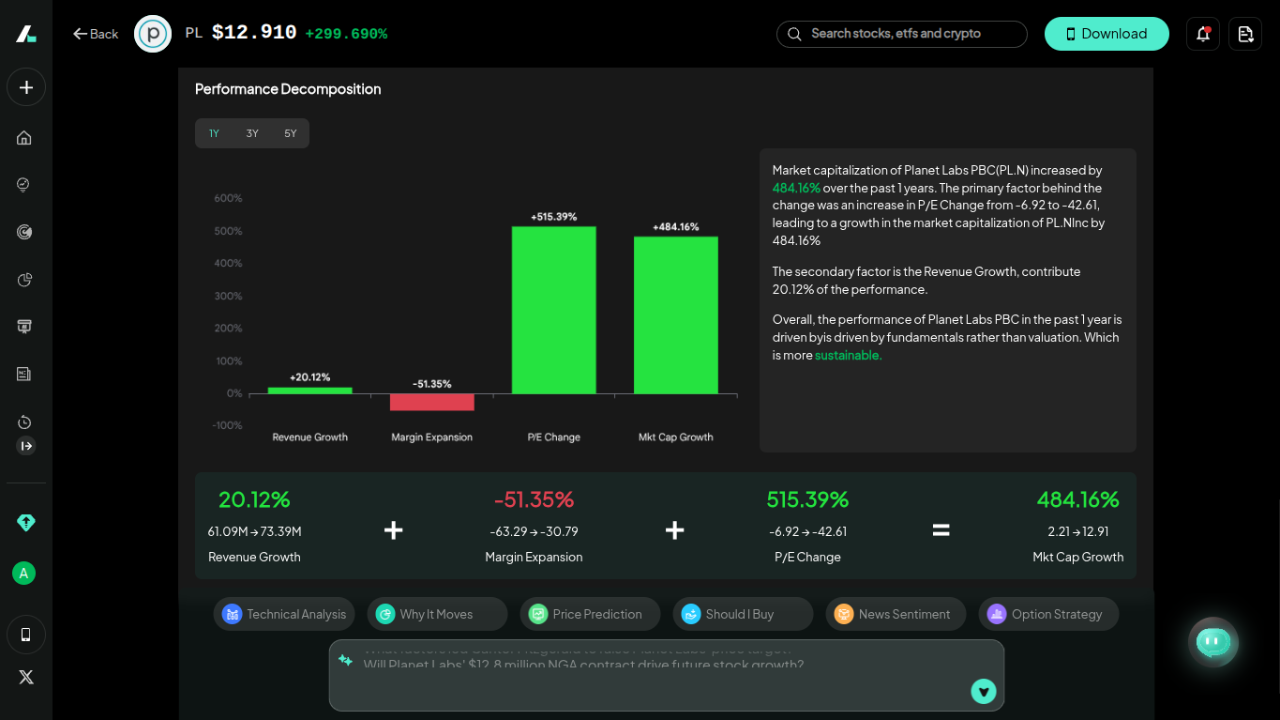

Planet Labs PBC (PL)

Planet Labs operates the world's largest fleet of Earth observation satellites, imaging the entire planet daily. This creates an unparalleled dataset that is becoming foundational for AI-driven geospatial intelligence in defense, agriculture, and climate monitoring.

Planet Labs reported a landmark year at its 2025 Investor Day, highlighting that its backlog had tripled to $736 million. The company has successfully pivoted to offering AI-enabled solutions and satellite services, securing massive contracts with the German government and Japan's JSAT. This momentum has put the company on track to be free cash flow positive a full year ahead of schedule.

Planet Labs has a powerful competitive moat with its daily global scan and deep data archive—a critical training dataset for AI models. Its shift to higher-margin solutions and services is accelerating revenue growth and expanding its addressable market, making it a unique "space and AI company."

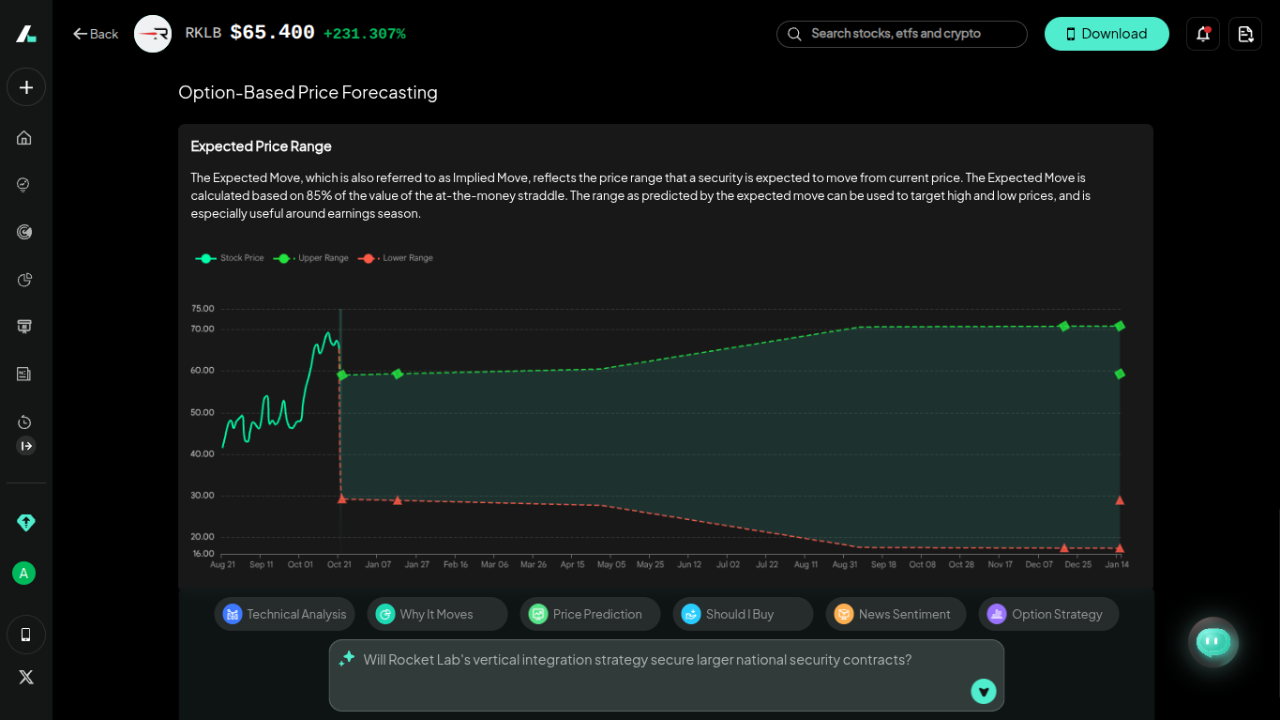

Rocket Lab Corporation (RKLB)

Rocket Lab is the leading provider of small satellite launch services, with its reliable Electron rocket having completed over 70 missions. The company is vertically integrated, also providing space systems and components, and is developing its next-generation Neutron rocket for medium-lift launches.

In its Q2 2025 earnings call, Rocket Lab announced record revenue of $144.5 million, up 36% year-over-year. CEO Peter Beck highlighted rapid progress on the Neutron rocket, the imminent acquisition of sensor-maker Geost to become a "one-stop shop for national security," and its readiness to compete for the DoD's $175 billion Golden Dome program.

Rocket Lab is the clear leader in the small launch market and is rapidly expanding into a vertically integrated space company. Its development of the reusable Neutron rocket positions it to challenge larger players, while its growing space systems division and strategic acquisitions are unlocking new revenue streams in national security.

Investment Strategies for Satellite Stocks

Investing in satellite stocks requires balancing long-term conviction with tactical timing. The sector’s volatility offers short-term opportunities for active traders, while its growth potential rewards investors who can hold through market cycles.

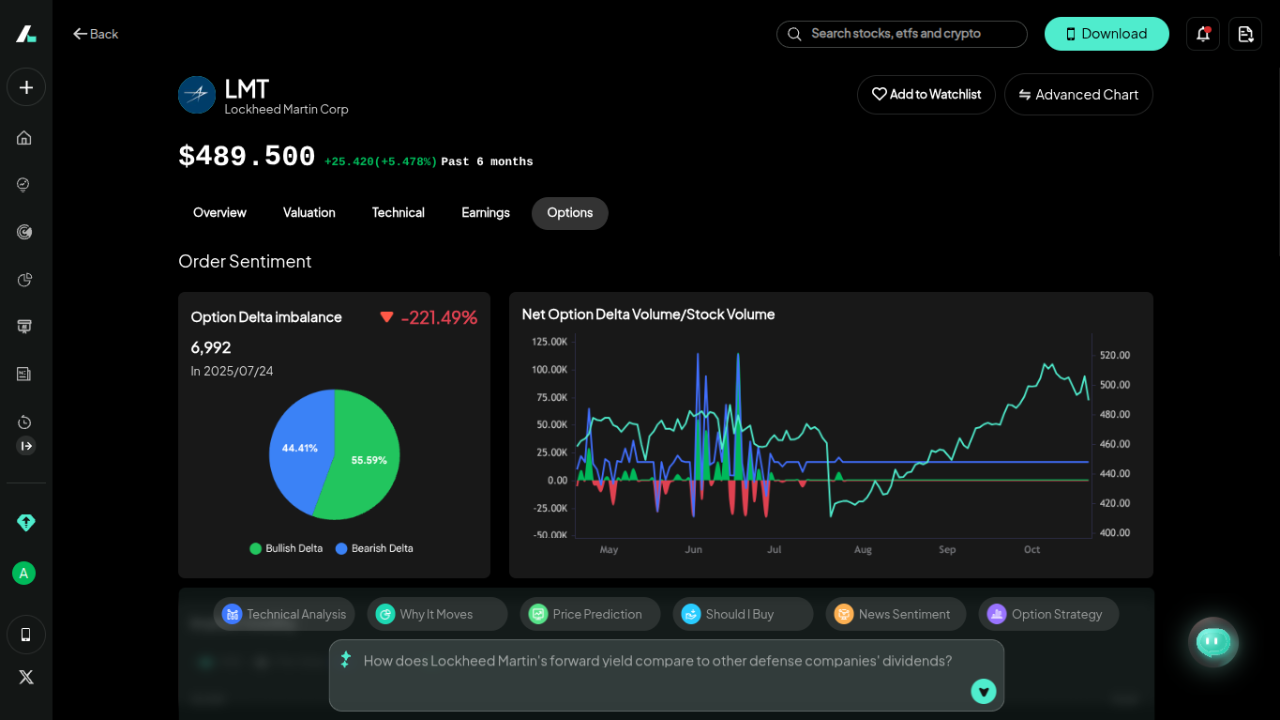

Long-term investors should prioritize companies with diversified revenue streams, strong government contracts, and clear paths to profitability. Meanwhile, traders can capitalize on catalysts such as rocket launches or major contract awards. Tools like Intellectia.ai’s Swing Trading Signals and Technical Analysis Suite help identify entry and exit points backed by real-time data, combining fundamentals and sentiment for more confident decision-making.

Conclusion

The space economy is no longer a distant dream—it's a dynamic, multi-billion dollar industry with tangible investment opportunities. From providing critical internet connectivity to powering next-generation defense systems, satellite stocks are at the forefront of this transformation. The companies highlighted here—IRDM, GSAT, VSAT, PL, and RKLB—each offer a unique way to invest in the future of space.

Navigating this complex sector requires the right tools and insights. To stay ahead of the market, you need access to real-time data and sophisticated analysis. Sign up for Intellectia.ai today to receive daily AI stock picks, advanced trading signals, and in-depth market analysis. Equip yourself with the intelligence you need to make smarter investment decisions in the satellite sector and beyond.