Key Takeaways

- Recession-proof stocks belong to industries with inelastic demand, such as consumer staples, healthcare, and utilities.

- Companies like Walmart and Costco thrive during economic downturns because consumers prioritize value and essential goods.

- NextEra Energy offers a unique defensive play by capitalizing on the "golden age of power demand" driven by AI data centers.

- Dividend consistency is a hallmark of recession-resistant investments, providing passive income when stock prices are volatile.

- Utilizing AI tools to monitor market sentiment can help you time your entries into defensive positions effectively.

Introduction

Have you ever looked at your portfolio during a market dip and felt a knot in your stomach? You are not alone. It is a frustrating experience to watch your hard-earned gains evaporate because of macroeconomic factors completely out of your control. All have experienced this anxiety firsthand, watching high-flying tech stocks crumble while boring, steady companies held their ground.

The problem is that most investors chase growth without building a safety net. When the economic winds change, portfolios heavy on speculation get hit the hardest. By ignoring defensive assets, you expose your financial future to unnecessary risk. However, there is a solution that allows you to stay invested without losing sleep.

By shifting a portion of your capital into recession-proof stocks, you can build a portfolio that withstands volatility. These are companies that sell things people need, not just what they want.

Here, you will discover the best recession-proof stocks to buy in 2026, backed by recent earnings data and robust fundamentals, helping you secure your wealth regardless of what the economy does next.

What Are Recession-Proof Stocks?

Before you start picking stocks, you need to understand exactly what makes a company "recession-proof." These are not necessarily the stocks that will double in price overnight. Instead, recession-proof stocks are equities of companies that provide essential goods and services that consumers and businesses cannot easily cut from their budgets, even when money is tight.

Source: Investopedia

Definition and Key Characteristics

When the economy slows down, you might delay buying a new luxury car or cancel a fancy vacation. However, you will not stop buying groceries, paying your electric bill, or picking up your prescription medication. This concept is known as inelastic demand. The demand for these products remains relatively stable regardless of changes in the consumer's income.

To identify which stocks are recession-proof, look for these key characteristics:

1. Essential Products: The company sells goods or services that are daily necessities (food, hygiene, energy, healthcare).

2. Strong Balance Sheets: They have manageable debt levels and healthy cash flow, allowing them to survive periods of high interest rates or lower revenue.

3. Pricing Power: These companies can pass inflationary costs on to consumers without losing significant sales volume.

4. Dividend Consistency: Many of the most reliable recession-proof stocks are "Dividend Aristocrats" or "Dividend Kings," meaning they have a long history of paying and increasing dividends through multiple economic cycles.

The Defensive Sectors

Generally, you will find these stocks in three specific sectors:

- Consumer Staples: Companies that make household items, food, and beverages.

- Utilities: Companies that provide electricity, gas, and water.

- Healthcare: Pharmaceutical and medical device companies.

By focusing on these areas, you insulate your portfolio from the extreme highs and lows of the broader market.

Why Investors Seek Recession-Proof Stocks in 2026

As you look toward the investment landscape of 2026, the case for defensive investing is becoming stronger. While the markets have shown resilience, underlying currents suggest that caution is warranted. Understanding why smart money is moving toward safety can help you position your portfolio ahead of the curve.

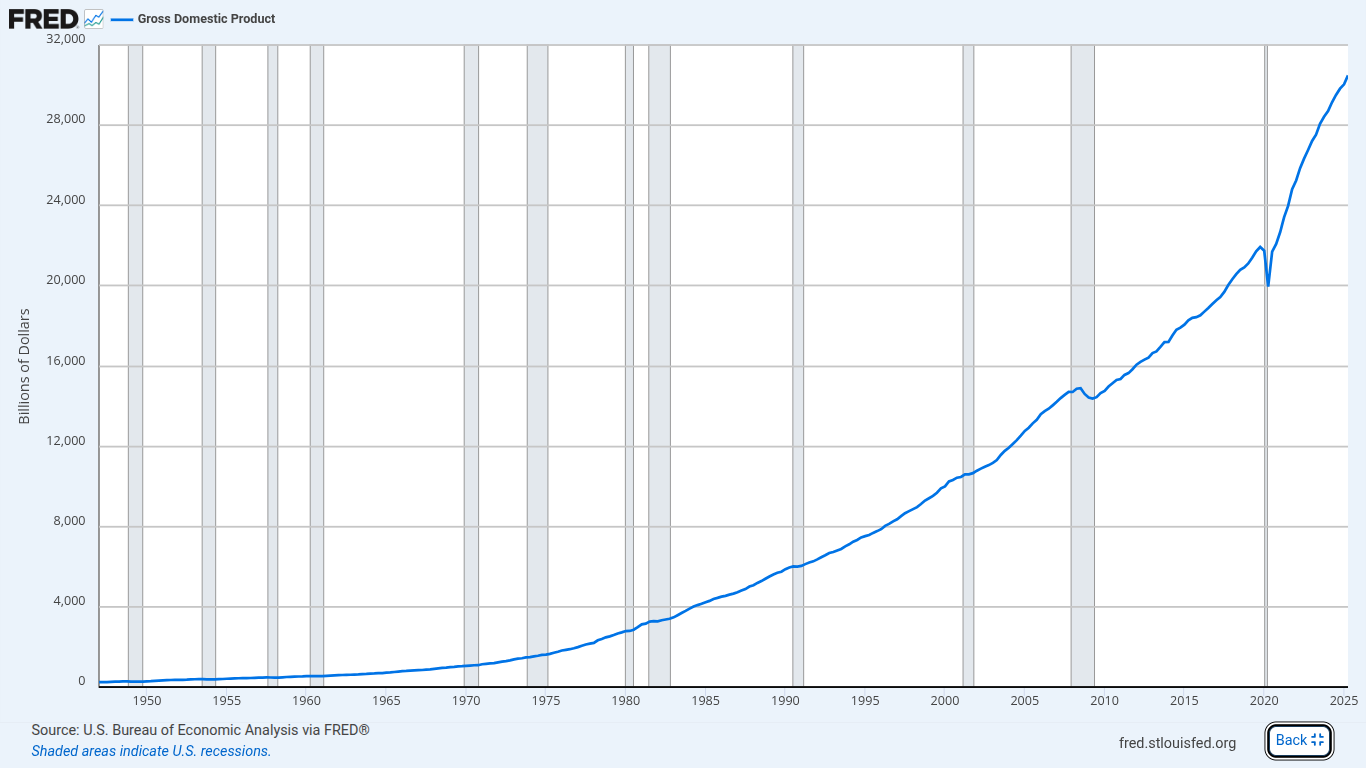

Economic Slowdown Fears

Even if a full-blown recession hasn't officially hit, the fear of an economic slowdown drives market behavior. In 2026, analysts are closely watching consumer spending habits. When savings rates dip and credit card debt rises, consumers inevitably pull back on discretionary spending. If you are holding stocks that rely on booming economic growth, a slowdown can severely impact your returns. Recession-proof stocks 2026 offer a hedge against this scenario, ensuring you have exposure to companies that perform well even when GDP growth stalls.

Source: fred.stlouisfed.org

High Interest Rates

We have entered an era where "free money" is a thing of the past. Higher interest rates increase the cost of borrowing for corporations. Growth companies that rely on debt to fuel expansion often struggle in this environment. In contrast, mature, defensive companies often fund their operations through their own cash flow. Furthermore, companies with strong cash positions can actually benefit from higher interest earnings. Seeking recession-proof stocks is a strategic move to avoid companies that might be crushed by debt servicing costs.

Shift to Defensive Investing

Institutional investors often rotate capital from cyclical sectors (like luxury goods or basic materials) into defensive sectors when they detect volatility. By analyzing these rotations early, you can ride the wave of institutional money. This shift isn't just about avoiding loss; it's about capturing steady, risk-adjusted returns. In 2026, the smart play is to balance your high-growth bets with a solid foundation of defensive assets.

5 Best Recession-Proof Stocks to Buy in 2026

If you are looking for the best recession-proof stocks to buy, the following five companies represent the gold standard in stability, cash flow, and market dominance. Based on recent earnings reports and forward-looking guidance, these companies are positioned to thrive in 2026.

| Company Name | Ticker | Sector | Market Cap | Key Strength |

| Walmart Inc. | WMT | Consumer Defensive | ~$881B | Low-price leader gaining market share across all income levels. |

| Procter & Gamble | PG | Consumer Defensive | ~$346B | Daily-use products with immense pricing power. |

| Johnson & Johnson | JNJ | Healthcare | ~$499B | Diversified healthcare giant with a top-tier credit rating. |

| Costco Wholesale | COST | Consumer Defensive | ~$405B | Membership model ensures recurring revenue and customer loyalty. |

| NextEra Energy | NEE | Utilities | ~$178B | Regulated utility stability mixed with renewable energy growth. |

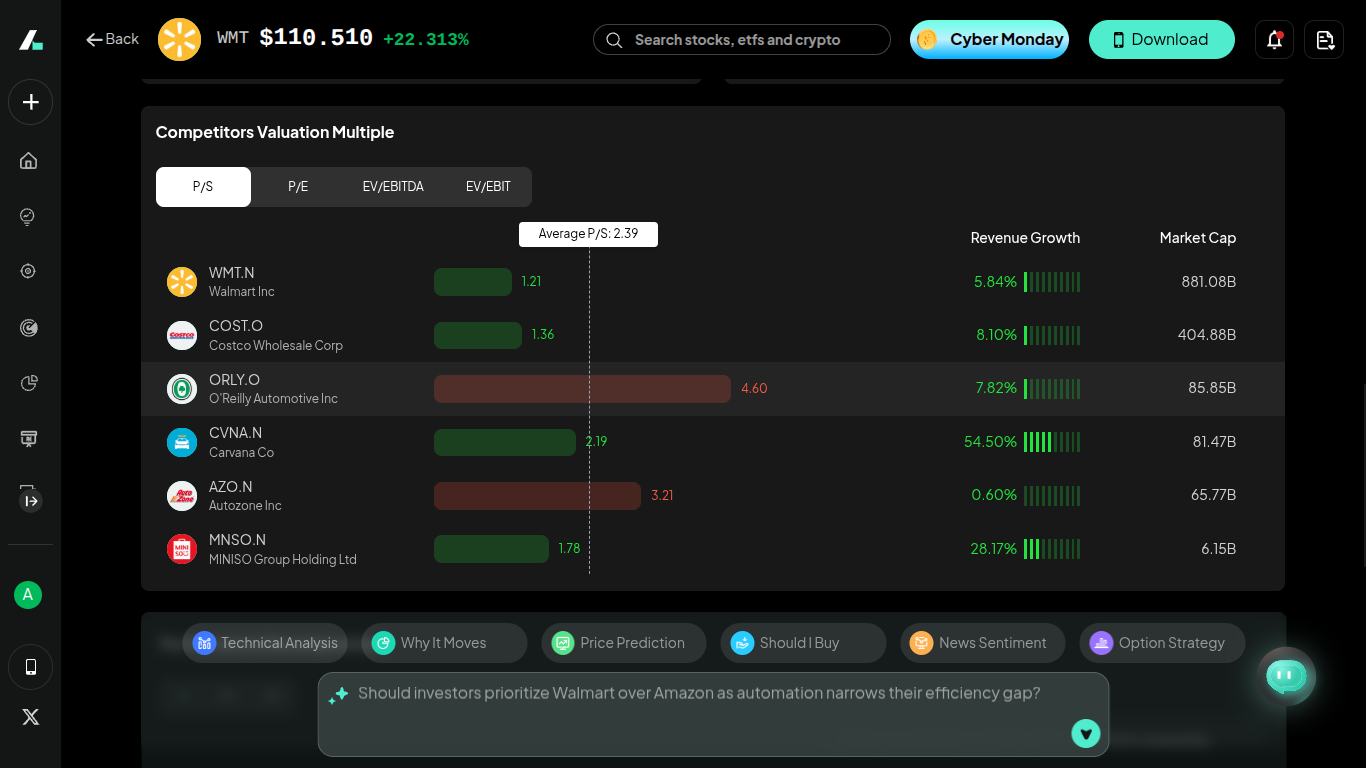

1. Walmart Inc. (WMT)

Walmart is the textbook definition of a recession-proof stock. When times get tough, consumers flock to value, and nobody does value better than Walmart.

In its recent Q3 2026 earnings report, Walmart demonstrated incredible resilience. Sales grew nearly 6% in constant currency, and operating income grew even faster at 8%. What makes Walmart a top pick for 2026 is that it isn't just attracting low-income shoppers; the company reported strength across all income cohorts, specifically gaining market share among upper-income households.

Walmart is aggressively closing the gap in e-commerce, with global e-commerce sales up 27%. They are leveraging their massive physical footprint to speed up deliveries, with 35% of digital orders delivered in under three hours. With 7,400 active "rollbacks" (price reductions), Walmart reinforces its value proposition, ensuring that even if the economy dips, their volume of sales remains robust.

Source: intellectual.ai

2. Procter & Gamble (PG)

Procter & Gamble owns the brands you find in almost every bathroom and kitchen in America, from Tide to Pampers.

P&G recently marked its 40th consecutive quarter of organic sales growth. Despite a difficult geopolitical and consumer environment, they maintained organic sales growth of 2% with core EPS up 3%. The company is a cash-generating machine, returning $3.8 billion to shareholders in a single quarter through dividends and buybacks.

P&G focuses on "daily use" categories—cleaning, hygiene, and personal care. These are the last things consumers cut from their budget. Their focus on innovation (like the new Tide Evo tile) allows them to maintain premium pricing even when competitors discount. For recession-proof stocks with dividends, P&G is a staple for any portfolio.

Source: intellectual.ai

3. Johnson & Johnson (JNJ)

Johnson & Johnson is a healthcare titan that offers stability through diversification.

In Q3 2025, J&J reported operational sales growth of 5.4%. Their "Innovative Medicine" segment grew 5.3%, driven by blockbuster oncology drugs like Darzalex (up 20%). Notably, the company is sharpening its focus by planning to separate its Orthopaedics business to concentrate on higher-growth areas like cardiovascular tech and robotics.

Healthcare is non-cyclical. People need surgery and cancer treatments regardless of inflation or GDP. J&J's investments in high-growth MedTech areas (like the Shockwave acquisition) combined with a pipeline of new drugs (like Tremfya growing 40%) provide growth potential on top of safety. Plus, their dividend history is impeccable.

Source: intellectual.ai

4. Costco Wholesale (COST)

Costco operates on a membership model that creates a fiercely loyal customer base and a recurring revenue stream that buffers against retail volatility.

Costco recently reported an 8% increase in net sales for the quarter. Their membership renewal rates remain astronomical—over 92% in the U.S. and Canada. Importantly, they are seeing a shift toward younger demographics, with half of new sign-ups coming from people under 40.

Costco provides extreme value on essentials (gas, food) which becomes even more attractive during a recession. Their "Kirkland Signature" brand has massive penetration, offering high margins for the company and low prices for you. With plans to open 35 new warehouses in fiscal 2026, their growth story is far from over.

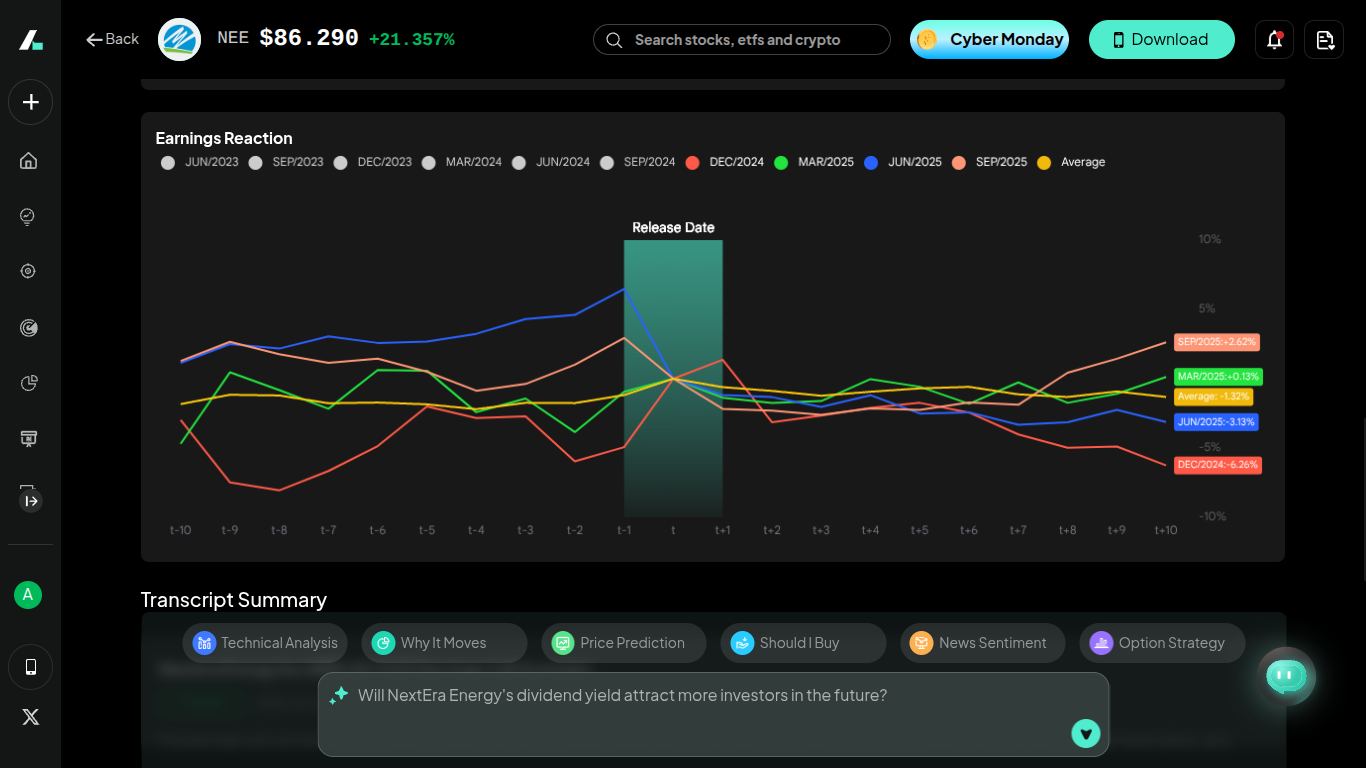

5. NextEra Energy (NEE)

NextEra Energy blends the safety of a regulated utility with the growth of a renewable energy developer.

The company describes the current environment as a "golden age of power demand." In Q3 2025, adjusted EPS grew nearly 10%. They are capitalizing on the massive energy needs of AI data centers, recently announcing a deal with Google to restart a nuclear plant to power data operations.

Utilities are classic recession-proof plays because electricity is a basic necessity. However, NEE offers growth that standard utilities cannot match due to its renewable energy backlog (nearly 30 gigawatts). With a predicted 10% dividend growth rate through 2026, it is an excellent income generator.

Source: intellectual.ai

Recession-Proof Investing Strategies (Beginner & Advanced)

Identifying the stocks is only half the battle. You also need a strategy to implement them into your portfolio effectively. Whether you are a beginner or a seasoned trader, these strategies will help you navigate 2026.

Building a Defensive Portfolio

You do not need to sell everything to buy defensive stocks. A balanced approach is best. Consider allocating a "core" portion of your portfolio (e.g., 20-30%) to these recession-proof stocks 2026. This acts as an anchor. If high-growth tech stocks sell off, your positions in companies like Walmart and NextEra Energy can help stabilize your total account value.

Dollar-Cost Averaging During a Recession

Trying to guess the bottom of a market dip is a recipe for disaster. Instead, use Dollar-Cost Averaging (DCA). This means investing a fixed amount of money into your chosen stocks at regular intervals (e.g., monthly), regardless of the share price. When prices are down, your fixed amount buys more shares; when prices are up, it buys fewer. Over time, this lowers your average cost basis and removes the emotional stress of timing the market.

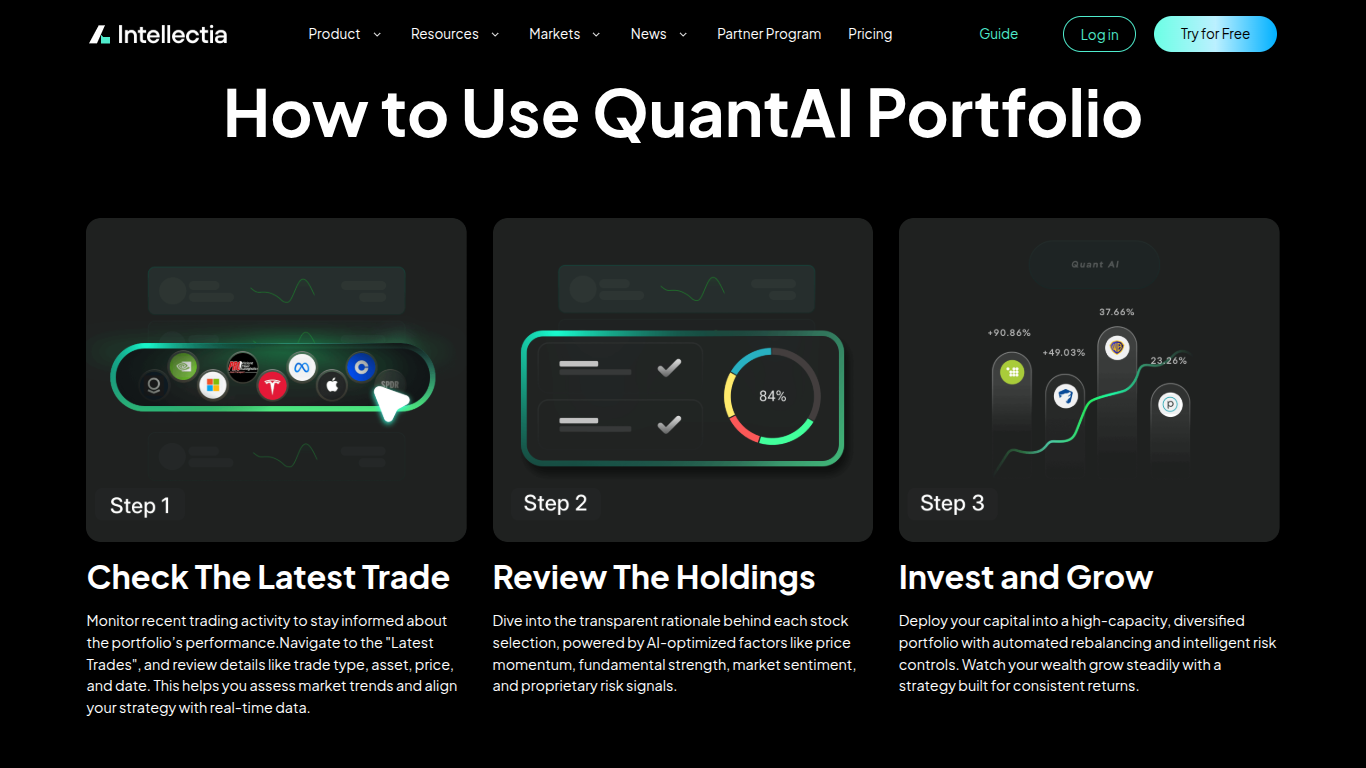

Mixing Value Stocks With Recession-Proof Picks

Recession-proof stocks often overlap with "value stocks"—companies trading for less than their intrinsic value. By using tools like the Intellectia AI Stock Picker, you can identify which defensive stocks are currently undervalued. This gives you a margin of safety; you are buying high-quality assets at a discount, increasing your potential upside when the economy recovers.

Why Timing the Market Is a Bad Strategy in Recessions

During economic uncertainty, the market can be irrational. It might rally on bad news or drop on good news. If you try to time the market by selling out and waiting for the "perfect" time to re-enter, you will likely miss the best recovery days. Staying invested in high-quality, dividend-paying companies ensures you continue to compound your wealth through income, even if stock prices remain flat. Utilizing Intellectia's Technical Analysis and Quant AI features can help you identify major trend reversals without falling into the trap of day-to-day speculation.

Source: intellectual.ai

Conclusion

Navigating the financial landscape of 2026 doesn't have to be a source of anxiety. By anchoring your portfolio with recession-proof stocks like Walmart, Procter & Gamble, Johnson & Johnson, Costco, and NextEra Energy, you are investing in companies with proven resilience, essential products, and the ability to generate cash flow in any economic climate.

These companies provide the stability you need to weather potential storms while continuing to build wealth through dividends and steady growth. Remember, the goal isn't just to survive a downturn, but to position yourself to thrive through it.

Ready to take your portfolio protection to the next level? Sign up for Intellectia.AI today to get daily AI-powered stock picks, deep market analysis, and trading signals that help you stay one step ahead of the market. Don't just guess—invest with intelligence.