Key Takeaways

- Platinum is scarce and is both a valuable metal and an essential industrial metal. This makes it a great way to protect your portfolio from inflation and diversify it.

- The market is affected by a lack of supply from South Africa and a growing demand for hydrogen fuel cells and replacements in catalytic converters.

- To choose the best platinum stocks, you should look at the volume of production, low All-in Sustaining Costs (AISC), and the diversification of commodities and locations.

- Some companies, like Sibanye Stillwater (SBSW), give you a lot of exposure to gold and platinum group metals (PGMs). In contrast, others only provide you with exposure to platinum as a byproduct.

- Platforms like Intellectia.ai offer AI trading signals that can help you time short-term trades. The AI Screener, on the other hand, can help you choose long-term growth stocks.

Introduction

Are you missing out on the next big commodity rally? Gold and silver have often stolen the headlines, but there's a quieter, more powerful metal that’s essential for the future of green energy and industrial growth: platinum.

The issue for investors like you is determining the actual value of platinum. You’ve probably read about the supply problems of PGM and the boom in demand from industries. But how can you make a practical list of platinum stocks out of that information?

That's where Intellectia.AI comes in. We focus on AI stock and crypto analysis to eliminate all the noise. We’re here to provide you with a detailed guide on the best platinum stocks to include in your portfolio in 2026, utilizing AI trading signals to navigate this complex industry.

By the time you finish reading, you will be well informed about the platinum market and a list of companies to investigate, so that you’re in a good standing to invest in the marvelous future of platinum.

What Are Platinum Stocks?

The third most widely traded precious metal in the world is platinum, and it is significantly rarer than both gold and silver. In context, according to experts, one ounce of platinum is mined for every ten ounces of gold mined.

- Precious Metal: Platinum, like gold, is a safe-haven asset and an inflation hedge.

- Industrial Metal: The majority of platinum demand is in industrial use, primarily in catalytic converters (used in diesel cars) and, increasingly, in hydrogen fuel cells, which are key to the hydrogen economy.

Types of Platinum Stocks

Platinum Mining Stocks are businesses whose main business operation is the mining and refining of PGMs. They depend upon the price of platinum and their efficiency (quantity of production and cost) directly.

- Diversified Miners: These firms primarily produce copper, gold, or silver, but also generate platinum as a valuable by-product, and hence they may not be as volatile as pure-play miners.

- Royalty/Streaming Companies: These companies offer an upfront loan to miners on a percentage basis in the future (a "stream") or revenue (a royalty). This provides exposure to the metal without the business risks associated with mining.

Why Invest in Platinum Stocks?

Investing in platinum stocks is a strategic move that positions your portfolio at the intersection of traditional precious metals and future-forward green technology.

- Supply Limits and Scarcity- South Africa is the world leader in the mining of the vast majority of platinum. Such a geographic concentration exposes the global supply chain to the dangers of political instabilities, labor conflicts, and power outages. The reduction in supply, along with the natural shortage of the metal, provides an excellent foundation on which the price increase can be built.

- Spurring Industrial and Green Demand- Platinum, being both a precious and industrial metal, is its strength. Palladium is being replaced by platinum in gasoline-powered engines' catalytic converters, a process known as substitution. Back then, even platinum was a vital element in Proton Exchange Membrane (PEM) fuel cells, which transform hydrogen into electricity with zero emissions.

- Portfolio Diversifier and Inflation Hedge- Similar to other precious metals, platinum will save your fortune in times of inflation or economic instability. Since the price drivers of platinum stocks are typically different (consumer spending vs. industrial demand), adding platinum stocks to your portfolio can significantly enhance diversification and reduce overall risk.

Criteria for Selecting Top Platinum Stocks

Choosing the best platinum stocks is about finding companies that are resilient to commodity price swings and well-positioned to capitalize on future demand.

- Production Volume and Reserves - The core metric for a miner is its ability to produce metal efficiently and consistently. Look for companies with large, proven, and probable reserves, as well as a strong track record of production volume.

- Cost Structure and Geographical Diversification- Focus on miners with low All-in Sustaining Costs (AISC). A lower AISC means the company can remain profitable even if the price of platinum drops. Geographical diversification (e.g., mines in North America or Russia, not just South Africa) reduces the risk associated with a single country.

- Financial Health and Dividend Policy- Look for a strong balance sheet, manageable debt, and positive free cash flow. For income-focused investors, a history of paying a consistent dividend (common among mature, large-cap miners) can be a bonus.

5 Top Platinum Stocks List for 2026

Here is a comparative overview of top companies that offer excellent exposure to the platinum sector, including both pure-play PGM miners and highly diversified producers with significant platinum byproducts.

| Company Name | Ticker Symbol | Primary Commodity | Market Cap (Approx.) | Key Strengths |

|---|---|---|---|---|

| Sibanye Stillwater | SBSW | PGMs & Gold | $7.6 | Global PGM leader, diversified into gold and battery metals. Strong operational turnaround. |

| Freeport-McMoRan | FCX | Copper & Gold | $60 | Massive copper exposure, high-value gold and silver byproducts. Excellent industrial play. |

| Pan American Silver | PAAS | Silver & Gold | $6.5 | Major silver producer. Platinum/PGMs are valuable byproducts from diversified mines. |

| Southern Copper Corp | SCCO | Copper | $70 | Platinum/PGMs are valuable byproducts. Excellent copper exposure with industrial diversification. |

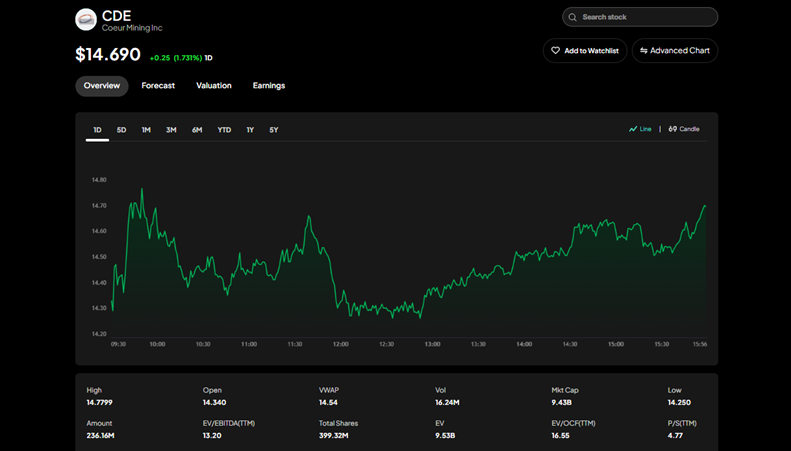

| Coeur Mining | CDE | Gold & Silver | $1.3 | Smaller, high-growth focus. Exposed to precious metals with some PGM byproduct potential. |

Detailed Overview of Top Platinum Stocks

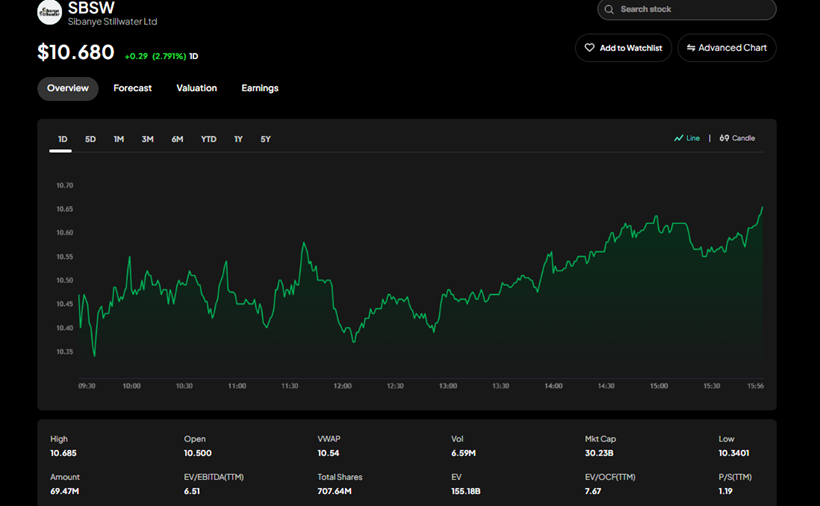

Sibanye Stillwater (SBSW)

SBSW is a large South African and US-based mining company that provides exposure to the PGM complex (platinum, palladium, rhodium), as well as to large-scale gold and base metal mining, including lithium. This diversification has served it well in carrying out an effective reorganization, which has led to significant growth in earnings recently. The addition of the US-based Stillwater mine is one of the main strengths that would help minimize South Africa's reliance on geopolitical risks. Its combined precious and battery metals has placed it better in any market cycle.

If you need to invest in a diversified PGM leader with robust exposure to the future of battery metals and lower South African risk, then SBSW would be your choice. This is the current analysis and data of Find SBSW :

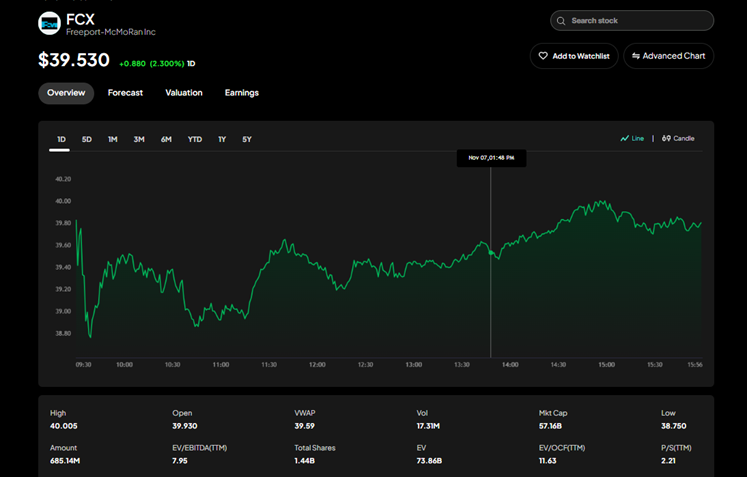

Freeport-McMoRan (FCX)

Freeport-McMoRan is a multinational company primarily associated with its significant copper production activities, but it also produces substantial amounts of gold and molybdenum. Platinum is not a significant target, but as it is so huge and exposed to the electrification trend, it is an outstanding diversified option. As a leading industrial miner, it is a direct beneficiary of the global production process and the green energy initiative driving copper demand. PGM price volatility can be countered by the stability of its copper and gold production.

If you believe that the green energy push will boost demand for main industrial metals, such as copper, and you wish to diversify with exposure to other precious metals, then consider FCX.

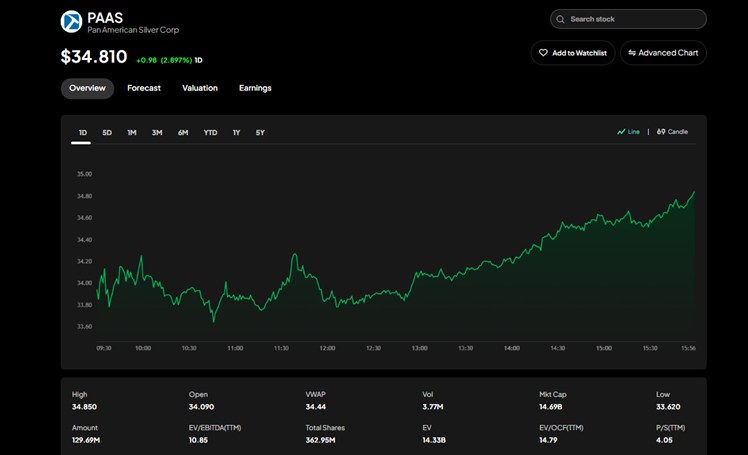

Pan American Silver (PAAS)

Pan American Silver is a major silver mining company in the world with operations going on in the Americas. The company is a major silver and gold producer; however, due to diversification in the mine portfolio, it is also able to produce various byproducts, including PGM. This company has developed a method for wagering on the volatility of silver prices while also capturing the value of other precious metals, which tend to rise in tandem with platinum. PAAS is characterized by its low-risk operations in jurisdictions considered relatively stable. If you consider focusing on exposure to a potential silver rally while maintaining the diversity and benefits of a precious metals portfolio, PAAS is worth studying.

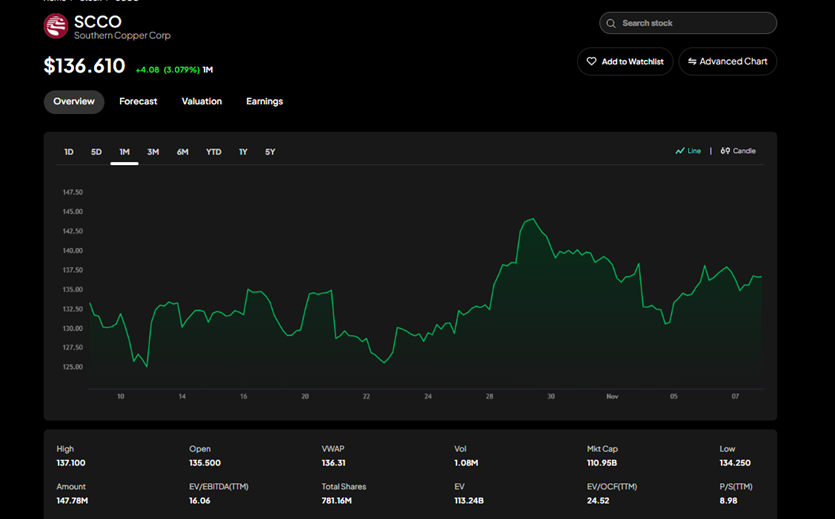

Southern Copper Corporation (SCCO)

Southern Copper is fundamentally a copper giant operating in Peru and Mexico, but it produces a range of valuable byproducts, including platinum. Investing in SCCO provides high-quality exposure to the booming global copper market—essential for electrification—with the added benefit of platinum revenue, which serves as a valuable natural buffer. This diversification reduces the single-commodity risk associated with pure-play PGM miners.

If you want exposure to the platinum story without taking on the sole risk of the PGM market, and prefer a safe bet on the electrification-driven copper sector, SCCO offers excellent industrial diversification.

Coeur Mining (CDE)

Coeur Mining is a North American-focused producer of gold and silver. It operates a diversified portfolio of mines and is considered a smaller, more growth-oriented player than the large-cap producers. While its PGM output is lower, the company's focus on high-grade deposits and expansion gives it high leverage to rising precious metal prices across the board, which often pull platinum higher. CDE offers a good choice for investors willing to take on slightly higher risk for potentially greater returns in the gold/silver space.

If you are looking for a smaller, high-growth precious metals producer that has leverage to the broader commodity rally,CDE provides a stable foundation.

Investment Strategies for Platinum Stocks

Intellectia.ai AI stock and crypto analysis can help you make better decisions, whether you're looking for a quick trade or long-term growth.

- Learn the Basics of the Platinum Sector: Long-term growth investing utilizes Intellectia's AI Screener to identify low-cost, high-exposure platinum mining stocks that capitalize on the shift toward hydrogen. Short-term trading utilizes our AI Trading Signals to identify high-probability entry and exit points in volatile platinum prices.

- Think about ETFs for more exposure: If you don't like how volatile individual stocks are, you might want to look into an Exchange Traded Fund (ETF) that follows the price of real platinum or a group of PGM miners. Use the AI Screener to examine PGM-focused ETFs, including their costs, liquidity, and holdings.

Conclusion

Implementing a position in the best platinum stocks is a strategic move that aligns your portfolio with both traditional safe-haven assets and the undeniable global push toward green energy. It’s time to stop guessing and start investing smarter. Your next step: Sign up and subscribe to Intellectia.ai today. Start receiving daily AI stock picks, AI trading signals, and market analysis to ensure you are navigating the commodities markets with the best intelligence available.