Key Takeaways

- Artificial intelligence is needed to identify the most promising growth stocks in 2025, which are characterized by fast revenue growth and market dominance.

- You should seek high-quality metrics such as booming revenue growth, great profit margin, and significant free cash flow, as well as sophisticated tools.

- Use a tool such as the AI Stock Screener by Intellectia.ai to filter through the market noise and identify stocks that exactly fit your specific requirements.

- We have highlighted six different companies, including TRNO, MGM, MAIN, BKD, MRX, and TFPM, which provide differentiated and robust growth narratives.

- Your general plan should be both diversified and intelligent, taking into consideration both the pure growth potential and the advantages of growth plus income (dividends).

Introduction

Have you ever wondered how top investors spot breakout stocks before everyone else? It’s not luck — it’s data. With AI-driven tools like Intellectia.ai, you can identify growth signals in real time — from revenue momentum to insider sentiment — before Wall Street catches on.

In this guide, we’ll break down what makes a true growth stock, what metrics to watch in 2025, and reveal six picks with explosive potential.

What Are Growth Stocks?

Growth stocks are companies expected to expand faster than the market, fueled by innovation and reinvestment. Unlike value stocks that trade below intrinsic value, growth stocks often trade at a premium — investors pay for their future potential. Although growth stocks have the potential for greater reward, you should keep in mind that they also involve greater risk and volatility.

We are seeing significant economic trends, such as the further acceleration of technology adoption, huge demographic changes, and realignments in industries, which are generating ideal tailwinds to businesses that can seize new markets. And in 2025, you need to find the companies that are setting these trends.

Criteria for Selecting the Best Growth Stock

- Revenue and Earnings Growth Rate: Pay attention to businesses that consistently generate double-digit revenue and profit growth each year. A growing trend over numerous quarters indicates constant demand and solid business performance. For instance, a business growing from 15% to 20% annually is fast-tracking its momentum rather than slowing down.

- Market Leadership and Competitive Advantage (The “Moat”): Seek out companies that have a strong brand, innovate, or have outstanding technology to dominate their sector or niche. A strong moat ensures their market position remains protected from other players. As Warren Buffett puts it, a moat “keeps the castle safe.”

- Profit Margins and Free Cash Flow (FCF): The hallmarks of a financially sound company are positive free cash flow and high profit margins. They show that management doesn't need to rely so much on debt in order to reinvest profits into market expansion, acquisitions, and research.

- Scalability and Market Potential: The best growth companies operate in industries with massive total addressable markets — from AI and healthcare to digital gaming or commodities. The larger the market, the greater the upside potential.

- AI-Driven Forecast and Volatility Risk: This is where Intellectia.ai’s AI Stock Screener becomes your edge. Instead of manually comparing dozens of metrics, the platform uses machine learning to evaluate thousands of companies across dozens of real-time indicators — from volatility risk to sentiment and earnings forecasts. Combined with the Volatility Risk Index, it helps you gauge whether a stock’s potential reward justifies the risk, especially in high-beta growth sectors

6 Best Growth Stocks for 2025

Here’s a look at six companies our analysis points out as having significant growth potential in 2025.

| Company Name | Ticker Symbol | Market Cap (Approx.) | Dividend Yield (If any) | Key Strength | Growth Potential |

|---|---|---|---|---|---|

| Terreno Realty Corp | TRNO | $6.3 Billion | ~3.4% | High-demand industrial real estate (logistics) | Urban infill properties poised for e-commerce growth. |

| MGM Resorts International | MGM | $8.6 Billion | N/A | Global gaming and entertainment expansion | Recovery in travel, Macau, and digital gaming growth (i-gaming). |

| Main Street Capital Corp | MAIN | $5.2 Billion | ~5.3% | Unique Business Development Company (BDC) model | Consistent dividend growth combined with small business investment returns. |

| Brookdale Senior Living Inc | BKD | $2.1 Billion | N/A | Leading senior living provider | Favorable demographics (aging population) and occupancy recovery. |

| Marex Group PLC | MRX | $2.2 Billion | ~2.0% | Global financial services/commodities broker | Expansion in execution and clearing services, volatility in commodities driving demand. |

| Triple Flag Precious Metals Corp | TFPM | $8.9 Billion | ~0.7% | Precious metals streaming and royalty company | Lower-risk exposure to rising gold/silver prices and portfolio expansion. |

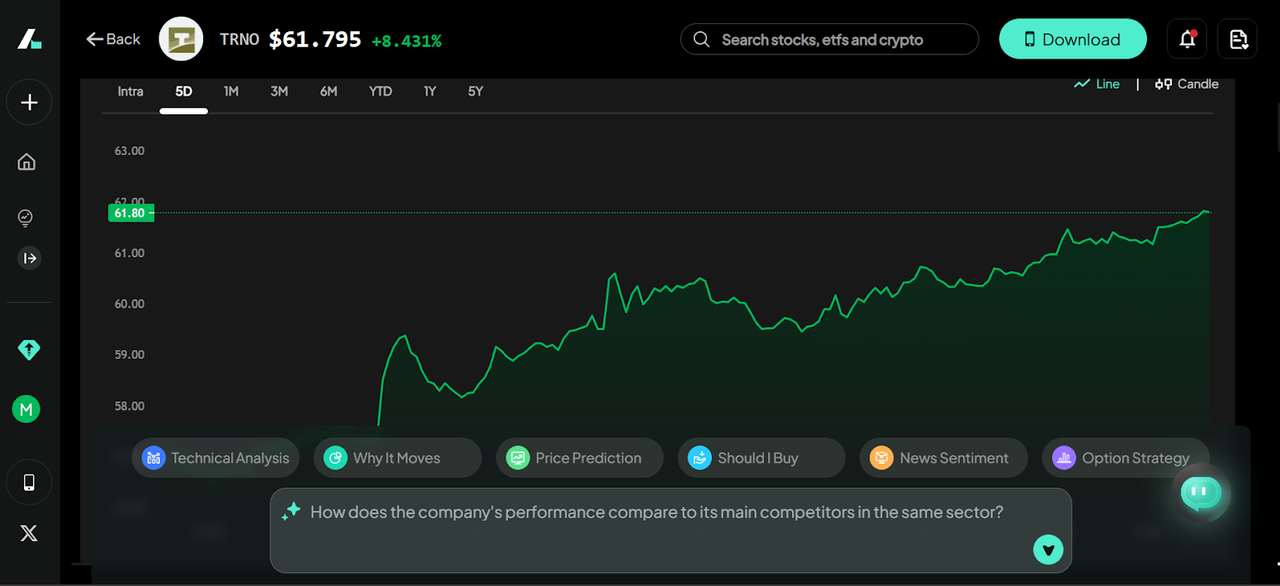

TRNO – Terreno Realty Corporation

If you think real estate is boring, you haven’t looked at industrial logistics. Terreno Realty is an industrial REIT that focuses on acquiring, owning, and operating coastal industrial real estate in key port markets across the United States—the highways of e-commerce. As global trade rebounds and logistics firms grow, the property value and rental earnings of TRNO have shot up. The company benefits directly from the supply chain's need for high-speed, last-mile distribution centers near dense population centers, allowing it to consistently raise rents on expiring leases.

This stock stands out because its high-barrier-to-entry coastal focus creates a resilient and scarcity-driven competitive moat in the booming logistics sector.

If you're looking to invest in stable, high-margin industrial real estate with a scarcity-driven competitive moat.

MGM – MGM Resorts International

MGM has made one of the most successful strategic pivots in the hospitality industry since the pandemic crash. While its core resort business is strong, the significant shift to digital gaming and sports betting, through its highly successful BetMGM platform, provided it with new, high-margin revenue streams that drive outsized growth. The digital segment is now a permanent, scalable growth engine that leverages the main brand's immense customer base.

The standout feature here is the synergistic growth driven by the BetMGM digital platform and the recovering global luxury travel market.

If you believe in the explosive synergy of reviving global tourism and a rapidly expanding, high-margin digital gaming platform like BetMGM.

MAIN – Main Street Capital

Main Street is what happens when you blend growth with stability. It is a Business Development Company (BDC) that invests in small to mid-sized firms in the United States, providing a diversified portfolio of debt and equity investments in the often-overlooked middle market. This strategy allows it to generate high income while also participating in the capital growth of its portfolio companies. Critically, its BDC status requires it to distribute most of its taxable income to shareholders.

Its standout feature is its high-quality combination of strong capital appreciation potential alongside high, dependable dividend income.

If you want to blend strong capital growth potential with a high, consistently increasing dividend yield from a well-managed BDC.

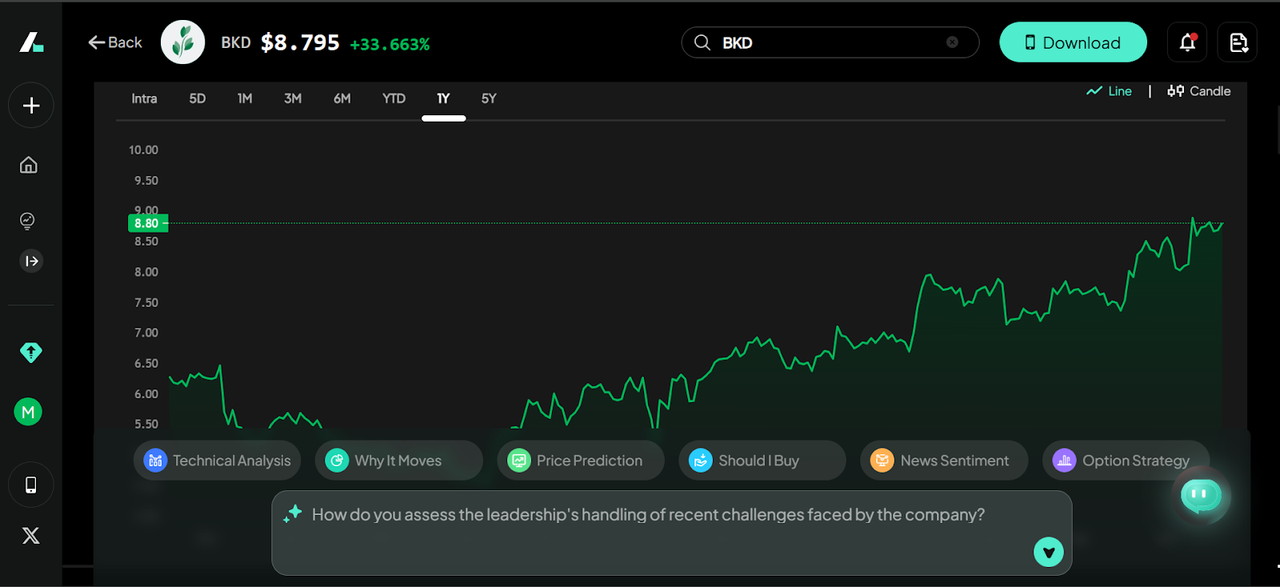

BKD – Brookdale Senior Living

Now, the aging U.S. population is largely reshaping healthcare. Brookdale operates senior living communities, a sector expected to grow steadily as baby boomers retire, creating a multi-year, structural tailwind for demand. Following a recovery in the post-pandemic environment, the company is now benefiting from rising occupancy rates and a greater ability to push prices.

The key feature that makes BKD stand out is the predictable, multi-year structural tailwind provided by the non-cyclical demand of the aging US population and rebounding occupancy rates.

If you plan to capitalize on the multi-year, structural growth driven by rising occupancy rates and the non-cyclical demand of the aging US population.

MRX – Merix Pharmaceutical

In biotech, innovation drives everything. Merix targets advanced drug delivery technology and personalized medicine - two subsectors with high growth potential that will flourish by 2030. Specifically, its focus on non-invasive or highly targeted delivery methods (such as specialized patches or advanced micro-dosing systems) can dramatically improve patient compliance and therapeutic efficacy, making Merix a key enabler for larger pharmaceutical partners.

This stock's standout feature is its high innovation-to-risk ratio, based on proprietary technology that solves critical patient adherence problems for the pharmaceutical industry.

If you believe the long-term, disruptive potential of proprietary drug delivery technology outweighs the short-term volatility inherent in the biotech sector.

TFPM – Triple Flag Precious Metals

A stealthy player in mining royalties, TFPM profits from gold and silver production without mining the metal itself. Instead, it provides upfront financing to miners in exchange for a percentage of future production (a stream) or revenue (a royalty). It’s the classic “pick-and-shovel” play for investors seeking defensive exposure to commodities, offering pure exposure to metal prices without the volatility of mine-level operational costs or management risk.

The key feature of TFPM is its low-risk, high-margin royalty model that offers exposure to commodity prices without the operational and capital expenditures of traditional mining.

If you're looking to gain high-margin exposure to precious metals without the significant operational and capital expenditure risks of running a mine.

How to Invest Growth Stocks Smartly

Finding a great growth stock is only half the battle; knowing how to manage it is absolutely key to successful investing.

1. You should select the right strategy. Growth stocks tend to be volatile, so you need to determine whether you want to make quick, short-term profits (where our Daytrading Center and quick signals can be useful) or long-term profits (more of the style of our Swing Trading features).

You must diversify and manage risk. Seriously, don't put all your eggs in one basket. Spread your capital across different sectors. This is where you can rely on tools. Consider using the AI Agent to actively track your entire portfolio risk and make custom alerts in case a stock is overly volatile.

3. Always remember to combine dividend + growth strategy; as we have seen with MAIN, you do not necessarily need to decide between income and growth. Use our AI Stock Screener to select only those companies that have high growth rates and a growing dividend yield to get the best of both worlds. Intellectia.ai is your magic wand tool here. Our AI Stock Picker uses advanced algorithms to give you a real advantage, running technical analysis of stocks and basic checks much faster and more reliably than you ever could. You receive data-driven insights, trading signals, and volatility assessments that are delivered directly to you, allowing you to make timely, profitable trades without emotional baggage.

Conclusion

Investing in the best growth stocks is one of the most exciting and profitable ways to build serious wealth in 2025, but it requires a disciplined, data-driven approach. You can be sure to be successful if you focus on metrics such as revenue growth, competitive advantages, and market-shaping trends, and implement the diversification strategy. We provided you with the six best candidates - TRNO, MGM, MAIN, BKD, MRX, and TFPM- and a strong growth story that you need to read more about.

Register and subscribe to Intellectia.ai. You will have immediate access to our AI stock selections of the day, automated AI trading signals and strategies, and the market analysis that you will need to become profitable in the stock market. Let AI do heavy lifting for your future investment.