Key Takeaways

- Food stocks represent shares of companies that are involved in different stages of the food chain, which are listed on the stock exchanges or publicly traded.

- Food Stocks are attractive investment assets for investors who might seek long-term growth and avoid significant volatility.

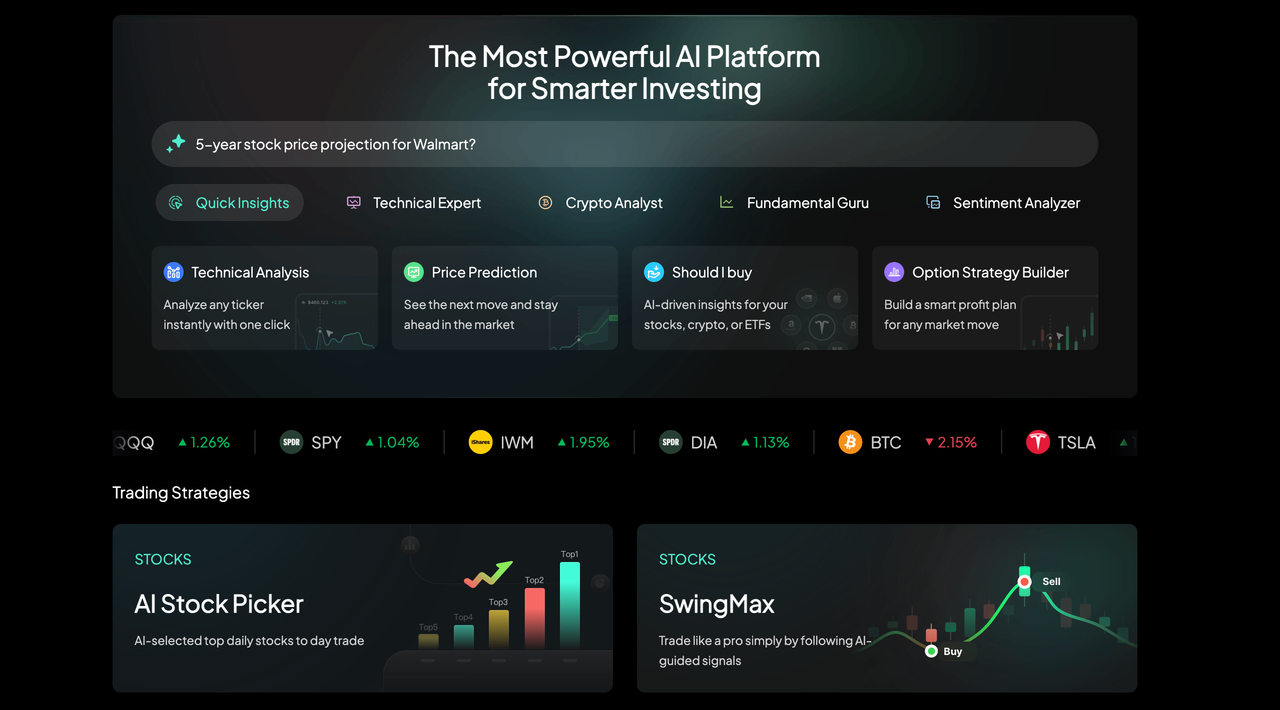

- Investors can leverage AI-powered tools to determine the best performer of the sector, track their portfolio, and stay ahead of market shifts and all in a single platform

Introduction

Have you ever noticed that, whatever the market condition is, people never stop buying food and groceries. That’s why food stocks remain a resilient, income-generating investment even amid inflation or geopolitical turmoil. The global food market market—valued at $11.9 trillion in 2024 and set to hit $14.8 trillion by 2030—is one of the few sectors that keeps growing no matter the economy.

In this guide, powered by Intellectia.ai’s AI-driven stock analysis, we’ll explore what makes food companies thrive, how to pick the best food stocks in 2025, and which top names stand out right now.

What Are Food Stocks

Food stocks are shares of companies engaged in various stages of the food supply chain — including production, processing, packaging, and retail. These firms ensure that meals and beverages reach store shelves worldwide. The sector is so diversified and can be grouped into different subsectors depending on various measures, for instance, packaged food manufacturers, beverage companies, quick-service restaurants, etc.

- Packaged Food Manufacturers: Companies in this category usually transform raw materials such as fruits, grains, meats, and vegetables into packaged or ready-to-eat items that consumers find in restaurants and stores worldwide. Companies like Nestlé, General Mills are prominent players in the industry under this category.

- Beverage Companies: The Beverage industry, or the drink industry, produces and maintains a supply for alcoholic and non-alcoholic beverages. The ongoing demand makes it attractive for investors, for instance Coca-Cola, PepsiCo are dominant players in the beverage industry.

- Quick-Service Restaurants: Quick-Service Restaurants usually focuses on providing quick food for consumers and fast-casual dining chains. Success depends on menu pricing powers, operational efficiency, and store Footprints. McDonald's, Yum! Brands, Chipotle, etc. are the leading companies of this industry.

Food Stocks are attractive investment assets for investors who might seek long-term growth and avoid significant volatility. Meanwhile, they can also generate income through divided payments over a certain period.

Why Invest in Food Stocks?

Consistent Demand Regardless Of Economic Cycles

The food industry is non-cyclical — people keep eating regardless of economic conditions. This steady demand makes food stocks a safe haven during recessions.

Dividend Reliability

Many established companies in this industry are dividend aristocrats, meaning they are paying dividends for decades to their shareholders, in some cases for 25 or even more than 50 years. This reflects a long-term commitment, steady growth, and periodical income, which are attractive attributes for investors who might seek retirement plans.

Global Growth Potential

Expanding populations and rising demand in emerging markets like Asia and Africa create strong growth opportunities for multinational food firms.

Inflation Resilience

Food stock companies have the capabilities to maintain profit margins and often pass production costs to consumers without even facing a significant sales drop, effectively acting as an inflation hedge. This inflation-resilience nature makes these company stocks attractive investment assets to financial investors.

ESG And Sustainability Trends Driving Innovation

The global shifts toward ESG (Environmental, Social, and Governance) drive innovation in the food industry. Increasing environmental concern makes companies attractive to both investors and consumers who are focused on providing plant-based, organic, and low-waste products.

Criteria For Selecting the Best Food Stocks

Before investing in food stocks, investors must check on some key metrics to ensure that the investment gets to the best performers in the industry. Criteria for selecting the best food stocks with dividends are as follows:

- Revenue Growth & Profitability: Check the company's performance for the past 3-5 years, ensure that the company has consistent revenue growth and remains profitable for the previous years.

- Dividend Yield and Payout Ratio: Seek companies that provide healthy payouts with sustainable ratios to shareholders. These attributes indicate sustainable growth and strong financial performance.

- Brand Strength and Market Share: Global recognition and brand value often influence consumer loyalty and pricing power. Check the company profile for brand strength and market exposure to determine the best companies.

- Innovation and Adaptability: The best companies are not static, so companies investors choose must have adaptability and innovation to provide better plant-based, healthy options, and automation to consumers for a competitive experience.

- Geographic Diversification: Companies that operate in different regions can offset regional slowdowns, and rapid expansion indicates sustainable growth.

- Valuation Metrics: Check on key valuation metrics of the compan,y such as PEG, P/E ratio, dividend history, etc. Attractive figures reflect potential food stocks.

5 Best Food Stocks in 2025

Company Name | Ticker | Sector Focus | Market Cap | Key Strength |

|---|---|---|---|---|

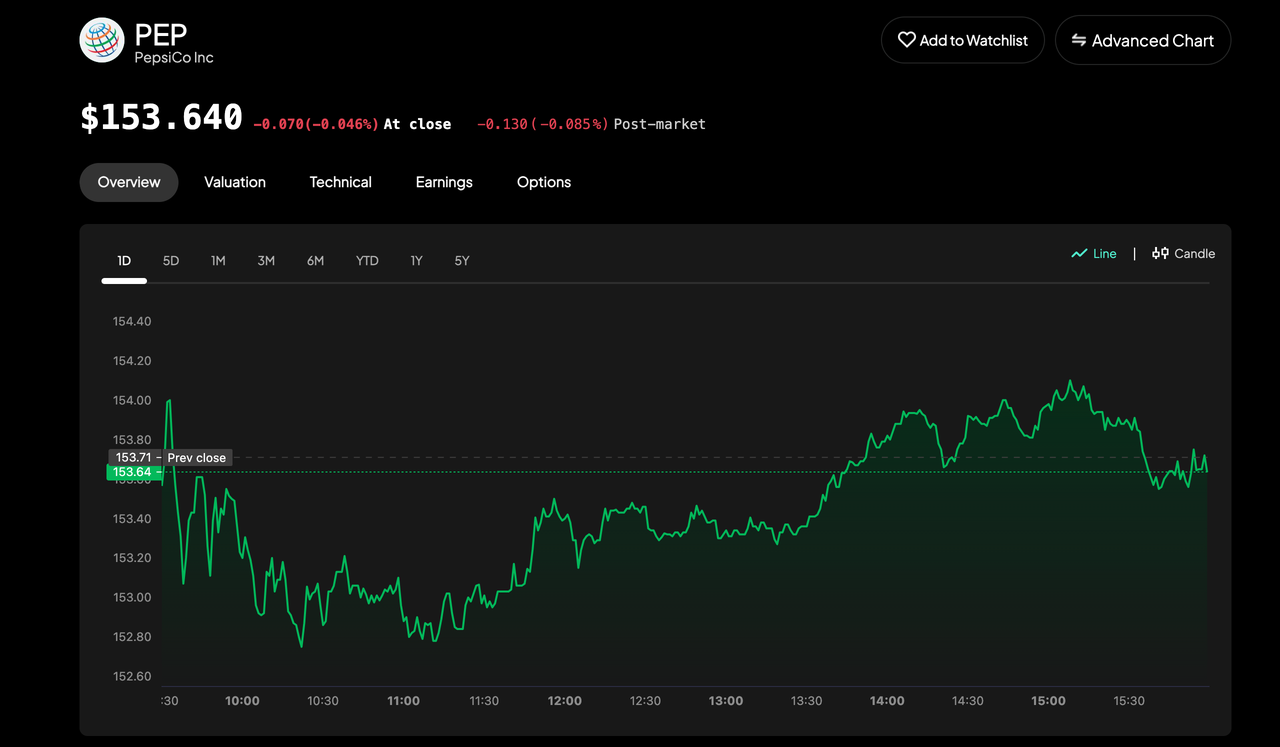

PepsiCo, Inc | PEP | Beverages & Snacks | $206.69 B | Global Brand, Constant dividends, strong pricing power |

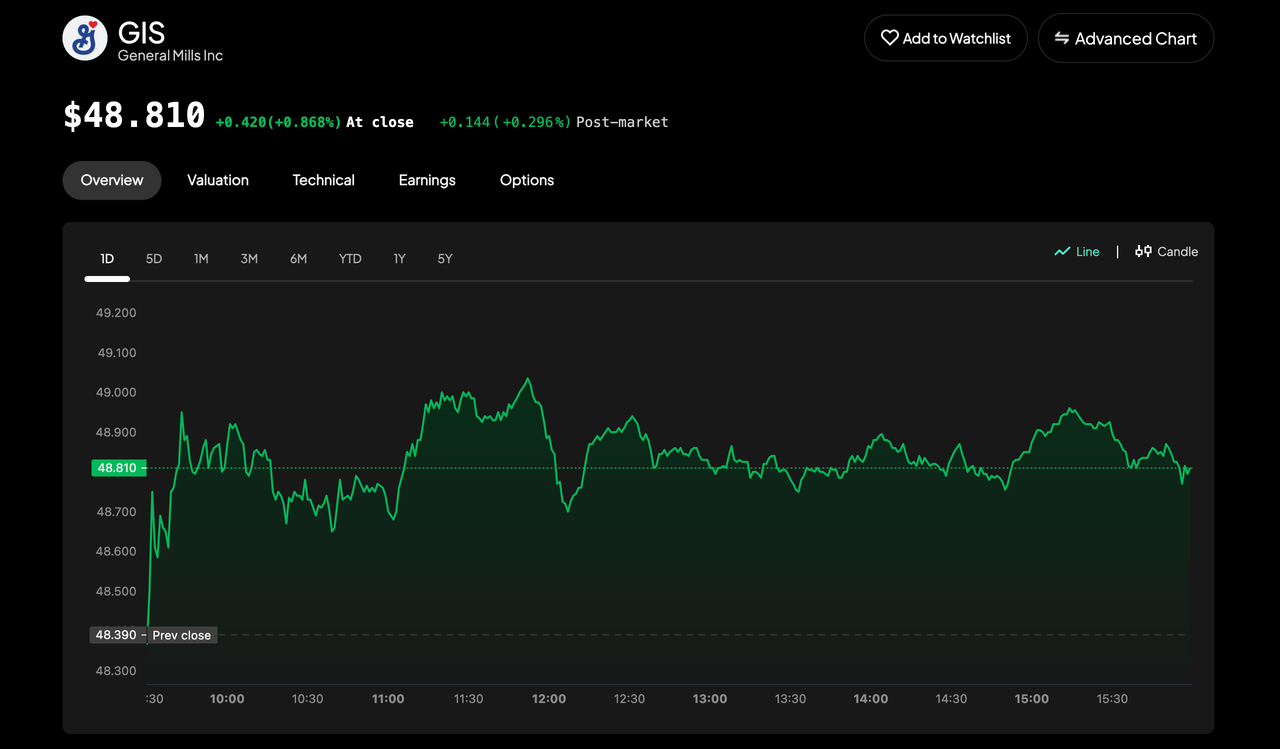

General Mills, Inc. | GIS | Packaged Foods | $25.449 B | Solid dividend history, consumer staples |

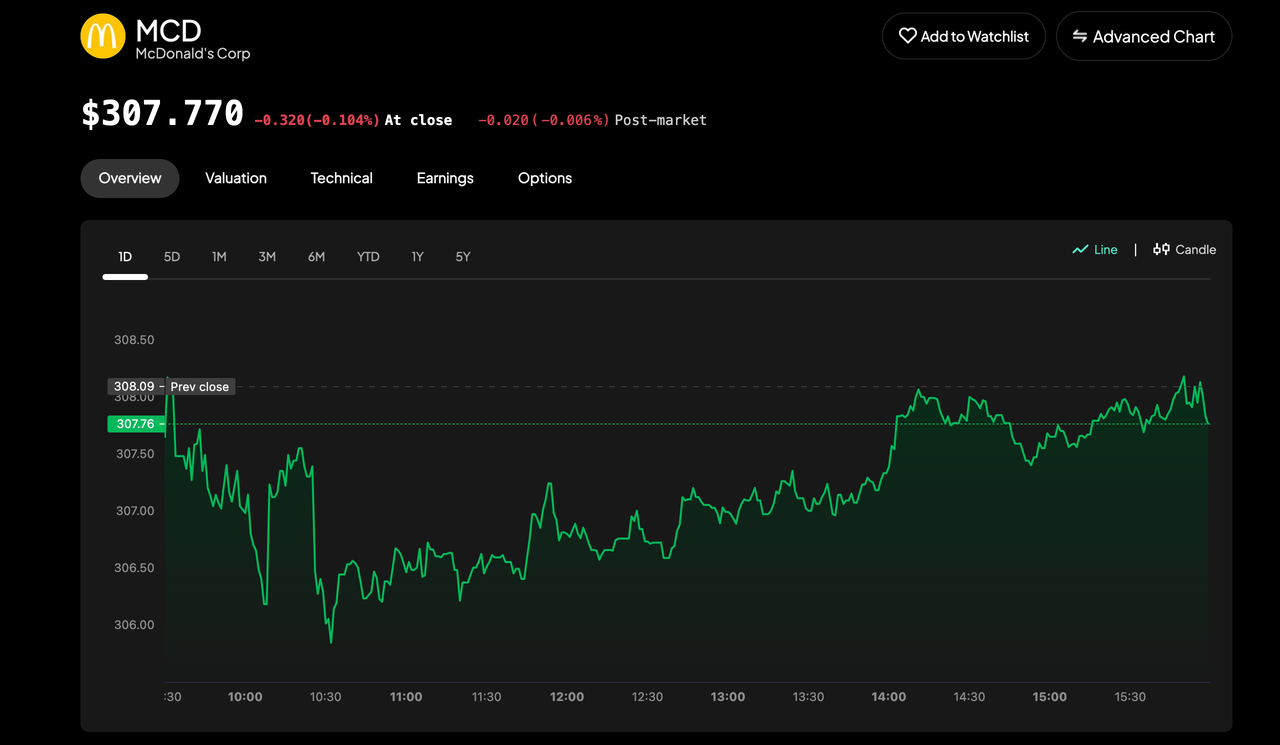

McDonald's Corporation | MCD | Quick-Service Restaurants (QSR) | $217.69 B | Global expansion, innovation |

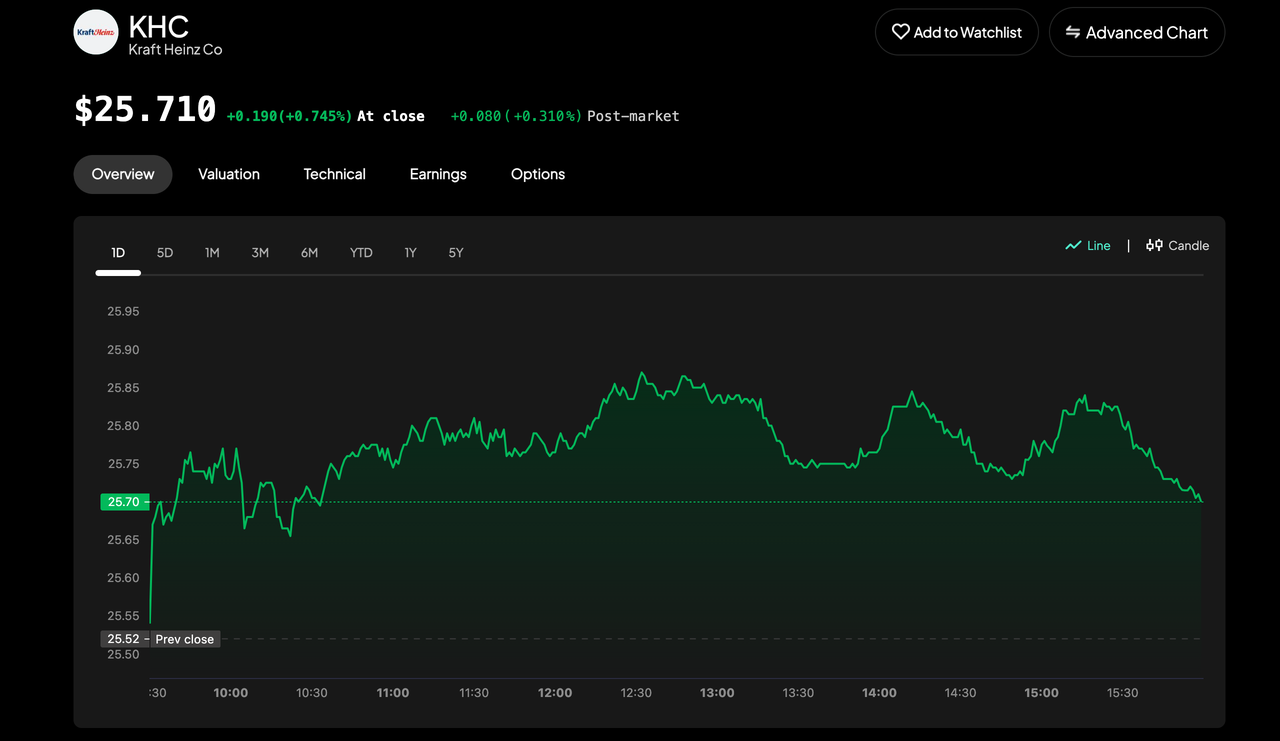

Kraft Heinz Company | KHC | Packaged Foods | $29.71 B | Brand value, sustainable dividends |

Mondelēz International, Inc. | MDLZ | Snacks | $79.64 B | Innovation, increasing demand |

PepsiCo, Inc (PEP)

PepsiCo is a giant maintaining two categories such as beverages (Pepsi, Gatorade, Mountain Dew) and convenient foods (Lay's, Doritos, and Quaker Oats). Broader market presence and diversified products make the company attractive to investors. The company has such a strong global presence that it is nearly impossible for new companies to beat or challenge Pepsico.

- Recent Highlights:

Focus on low-sugar beverages and healthier snacks.

Consistent dividend growth over 50 years.

Share buyback program.

General Mills, Inc. (GIS)

General Mills dominates the packaged food industry with iconic brands such as Cheerios, Häagen-Dazs, Pillsbury, and Betty Crocker. GIS has diversified businesses and focuses on cost optimization and digital transformation, which helps the company to remain profitable.

- Recent Highlights:

Robust dividend around 3.5%.

Recent focus on pet food (Blue Buffalo).

Strategic cost management.

McDonald's Corporation (MCD)

McDonald’s Corporation is the top quick-service restaurant (QSR) chain by revenue, and operates in many regions of the globe. The company focuses on innovation and digital adoption for instance, McDelivery, mobile app, and loyalty programs, etc.

- Recent Highlights:

Digital sales contribute approximately to revenue up to 40%.

It operates in various regions, cutting off regional slowdown risks.

Ongoing dividend increase over 40 years.

Kraft Heinz Company (KHC)

KHC is a packaged food company that owns dozens of ubiquitous brands, for instance, Heinz Ketchup and Velveeta. The company remains among the top food and beverage companies in the world. Despite previous challenges, the company is recovering rapidly and focuses on cost optimization and debt reduction.

- Recent Highlights:

Increase development on plant-based and health-conscious foods.

Improving the balance sheet aggressively and rapid debt reduction.

Attractive dividend yield of approx. 4%.

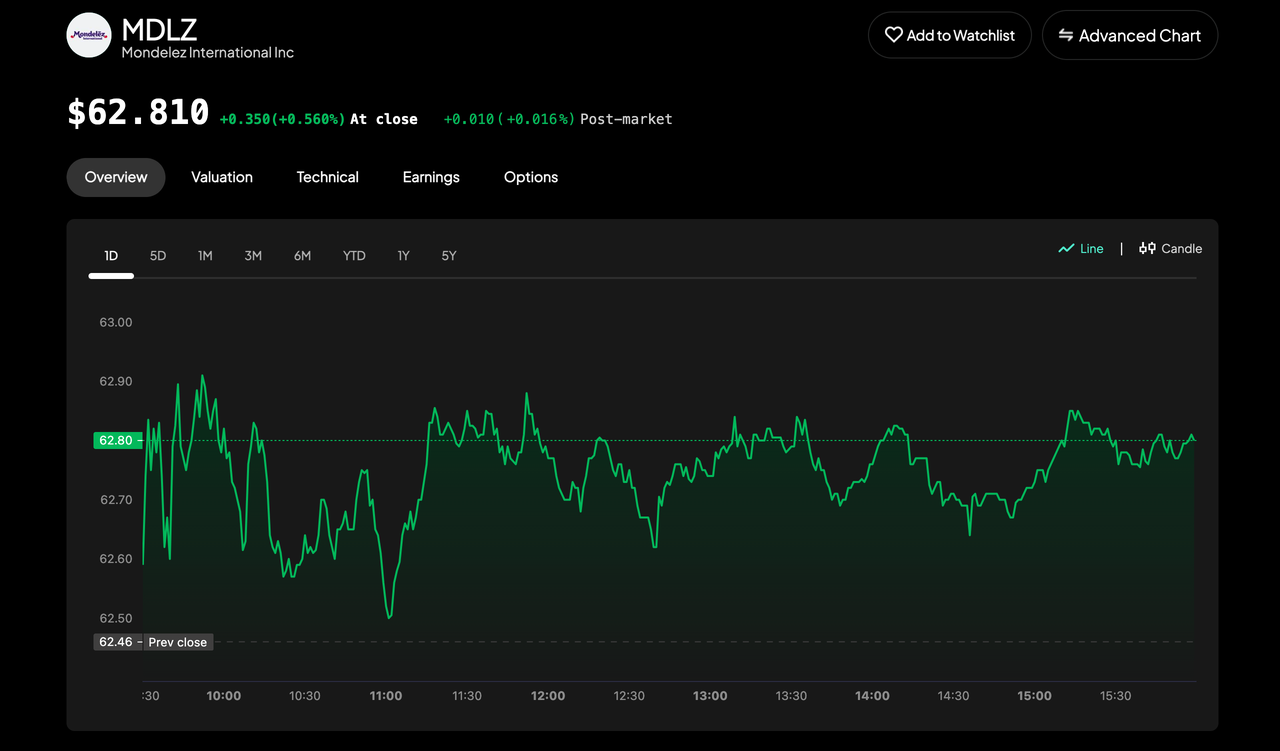

Mondelēz International, Inc. (MDLZ)

Mondelez is a dominant player in the chocolate, gums, candy, and biscuit industry and owns prominent brands like Cadbury, Oreo, and Toblerone. The company has products with solid consumer loyalty and strong presence in various markets in different regions.

- Recent Highlights:

Solid earnings and consistent dividends.

Record revenue growth in Asia and South America.

Sustainable packaging and ongoing innovation.

Strategies for Investing in Food Stocks

There are various approaches to invest in food stocks, such as

Long-Term Investing

Investors can invest in food stocks for a longer period to generate dividend income, just “buy and hold”. So the wealth value increases over a certain period and generates periodical income, suitable for retirement plans.

Diversification Across Subsectors

Balance risk by investing in packaged foods, beverages, and restaurants.

Using Financial Tools And Research Platforms

AI screener feature helps investors to determine the best food stock based on dividend, growth, valuation data, etc.

What's more, the Stock monitor feature monitors your portfolio and food stock price movements in real time.

The platform has AI agent features that provide trading insights and personalized recommendations. Meanwhile, the day trading center is useful for active traders to determine short-time investment opportunities.

Reinvesting Dividends For Compounding Returns

Many companies in the food stocks consistently pay high dividends yields, making it attractive to investors who might be interested in generating significant income over a longer period through dividend reinvesting. Many brokers allow automatic dividend reinvestment (DRIP) programs for investors, enabling boosting income over a certain period.

Tracking Inflation And Commodity Prices

Increasing inflation and key commodity prices such as corn, sugar, etc. affects the rising cost. So tracking these key factors help investors to predict performance shifts of a particular company.

Conclusion

The food industry is one among few industries that keeps increasing despite economic uncertainty or geopolitical issues, making it an attractive choice for investors. This sector is suitable for different investors, whether they seek inflation hedge, global exposure, or maybe sustainable dividends.

Meanwhile, investors can leverage AI-powered tools from Intellectia.ai to determine the best performer of the sector, track their portfolio, and stay ahead of market shifts and all in a single platform! So, don’t hesitate to sign up today and enjoy efficient trading.