key Takeaways

- European stocks are already at low valuations compared to their US counterparts, and this is a good opportunity that you should use to get value and growth.

- The best performers are pegged on the most important sectors: semiconductor equipment (ASML), healthcare innovation (Novo Nordisk), enterprise software (SAP), and energy dividends (Shell).

- Selecting the appropriate stock in the EU calls on you to go past the regional headlines and concentrate on the global leaders in the market that have good cash flows.

- By utilizing tools like the Intellectia.ai AI Stock Picker and AI Screener, you can automatically filter for the best European stocks that fit your specific risk and growth profile.

- The overall trend demonstrates the transition towards European equities, particularly those that have a high growth driver such as AI and GLP-1 medicines.

Introduction

Have you felt like you’ve missed out on the explosive gains in U.S. markets and are now looking for smarter global diversification? It’s frustrating to watch your portfolio stay flat while other markets surge — but the solution isn’t chasing hype. It’s about identifying real value backed by sustainable growth trends.

Europe, often overlooked by investors, currently offers stability, high-quality companies, and significantly lower valuations than the U.S. As global capital rotates, 2026 may be the perfect time to revisit European equities.

This guide highlights four top European stocks poised for strong growth, and shows you how to use Intellectia.ai to find similar opportunities tailored to your goals.

What Are European Stocks?

When we talk about European stocks, we’re simply referring to the shares of companies listed on exchanges across the continent. It’s a vast, diverse landscape! You’re not just looking at the Eurozone, but also at the powerhouses in the UK and the specialized Nordic region. Think of it as a collection of vibrant local markets feeding one big global economy. The key places to watch are the heavy hitters: the London Stock Exchange, the multi-country Euronext (which includes Paris and Amsterdam), the Deutsche Börse in Frankfurt, and the SIX Swiss Exchange in Switzerland. Essentially, European equities play a crucial role in any truly diversified global portfolio. They often represent established, blue-chip companies with decades of international experience, giving your investments a solid base of stability.

Why Invest in European Stocks

Right now, the European market offers one of the best value opportunities in global equities. European stocks still trade at a meaningful discount compared to U.S. counterparts — letting you buy world-class companies at bargain valuations.

The continent is also in the midst of a green and digital transformation, driven by energy transition funding and massive infrastructure investment. For U.S.-based investors, European exposure provides the added benefit of currency diversification — a weaker dollar boosts your returns.

In short, Europe gives you a mix of value, growth, and global stability that few other regions can match.

Criteria for Selecting Best European Stocks

To build a resilient and high-performing European portfolio, you shouldn’t just chase headlines or rely on gut feelings. You need a set of strict criteria to filter for true long-term winners:

- Market Capitalization and Liquidity: Always focus on large-cap, blue-chip stocks that have high trading volume, or liquidity. Why does this matter to you? It ensures you can enter and exit your positions easily and efficiently, which is non-negotiable when implementing any serious trading strategy.

- Dividend Yield and Payout Sustainability: Many of the best European stocks are generous income payers. It’s not enough to look at the current yield, though. You must verify that the payout is sustainable by checking the company’s free cash flow and balance sheet strength. A reliable dividend is a sign of a fiscally stable business.

- Exposure to Growing Sectors: The best companies are always those positioned in unstoppable, long-term trends. You should prioritize firms leading in technology, green energy, finance, and, crucially, healthcare innovation, which are the engines of the next market cycle.

- Valuation and P/E Comparison: The valuation gap between European and US stocks offers you a compelling opportunity. Look for companies trading at a discount to their intrinsic value, such as those easily identified by Intellectia.ai proprietary AI Stock Screener, by comparing their Price-to-Earnings ratio with their long-term growth potential.

4 Top European Stocks

| Company Name | Ticker Symbol | Key Sector Exposure | Key Strength |

|---|---|---|---|

| ASML Holding | ASML | Semiconductor Technology | The EUV lithography market is a global monopoly, essential for AI chips. |

| Novo Nordisk | NVO | Healthcare / Pharmaceuticals | Market leader in weight-loss and diabetes drugs (Ozempic, Wegovy). |

| SAP SE | SAP | Enterprise Software / AI | Europe’s most valuable tech company, driven by cloud and AI adoption. |

| Shell PLC | SHEL | Integrated Energy | Key factors include high dividend yield, strong free cash flow, and low valuation. |

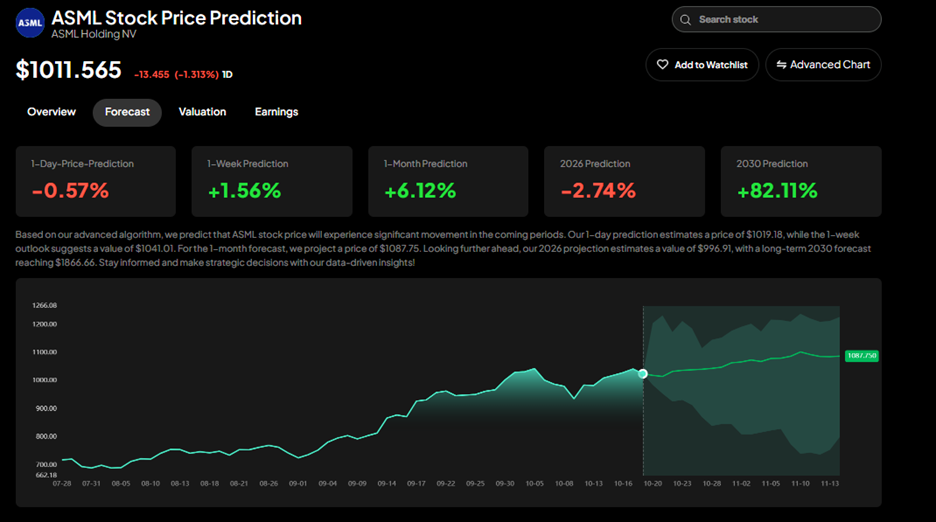

ASML

ASML is arguably the most crucial company in the world’s semiconductor supply chain. This Dutch giant holds a near-monopoly on Extreme Ultraviolet (EUV) lithography machines, which are absolutely required to manufacture the most advanced chips used in AI, 5G, and high-performance computing. Think of them as the only tollbooth on the road to next-generation technology. Your investment in ASML is a bet on the entire future of computing. Management expects strong growth for 2026, driven by chipmakers needing to expand production for advanced logic chips.

If you want to gain exposure to the backbone of the global semiconductor industry, ASML is a top pick. This is a long-term, all-semiconductor-ecosystem pure play, as explained by unbelievable pricing power and switching costs.

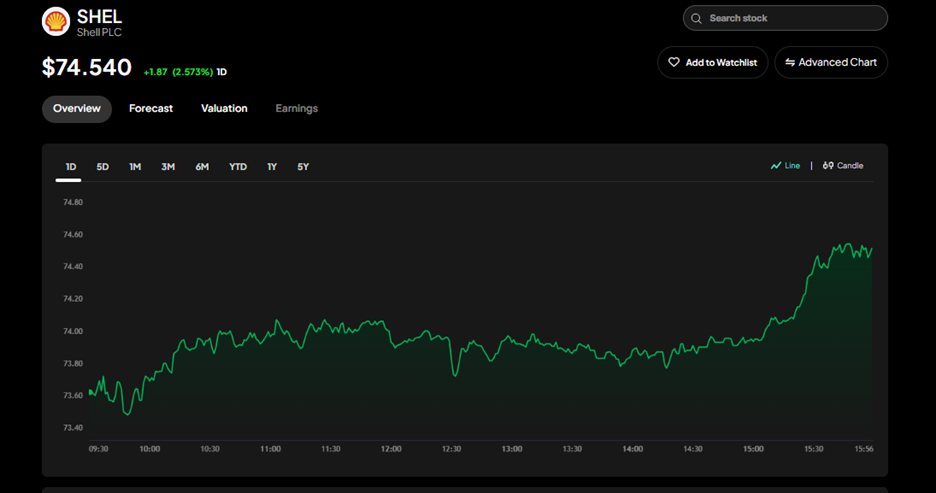

SHEL (Shell PLC)

Shell is a massive integrated energy company that offers you a compelling mix of value and income, essential elements for any balanced strategy. Shell has demonstrated immense free cash flow generation recently, and compared to its historical averages, it trades at a notable discount. This financial strength enables the company to return capital to shareholders through dividends and buybacks consistently. While the energy sector can be volatile, Shell’s global scale and strong balance sheet provide a huge buffer, making it a defensive income play. If you plan to diversify your income portfolio with a European dividend leader while benefiting from energy transition trends, Shell is a strong choice. Shell offers cash-flow resilience and a solid history of dividends, combined with a credible, well-capitalized plan for reinvesting into cleaner energy businesses.

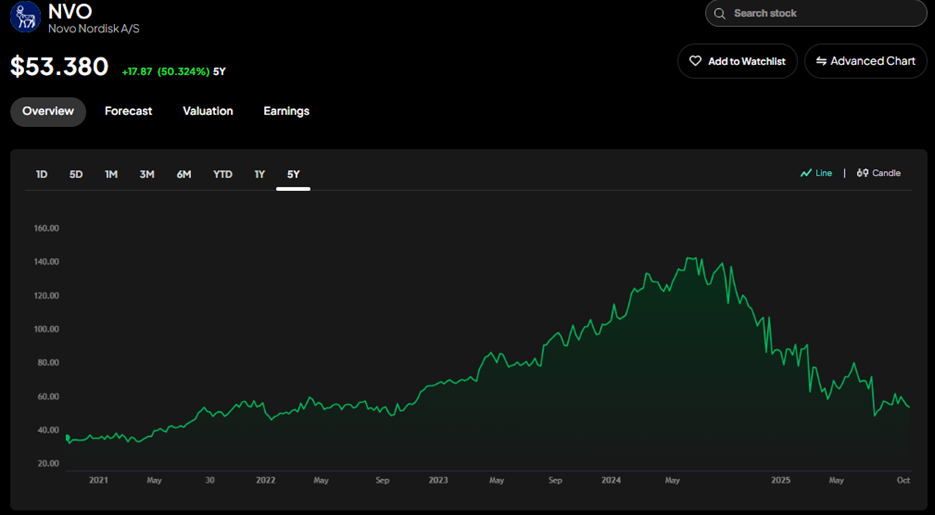

NVO (Novo Nordisk)

Novo Nordisk, the Danish pharmaceutical behemoth, is a global powerhouse thanks to the runaway success of its blockbuster drugs, Ozempic and Wegovy. Your investment here is a direct bet on the massive, structural, and sustained worldwide demand for weight-loss medications. This company has grown so large that it now accounts for a significant portion of the entire Danish stock market! Even after massive gains, analysts continue to see strong growth, driven by the company’s increasing production capacity and pipeline innovation. If you’re looking for defensive healthcare exposure and sustainable growth and innovation, Novo Nordisk is a fine choice. The company has high pricing power and a nearly guaranteed flow of recurrent prescription demand, driven by a global health crisis.

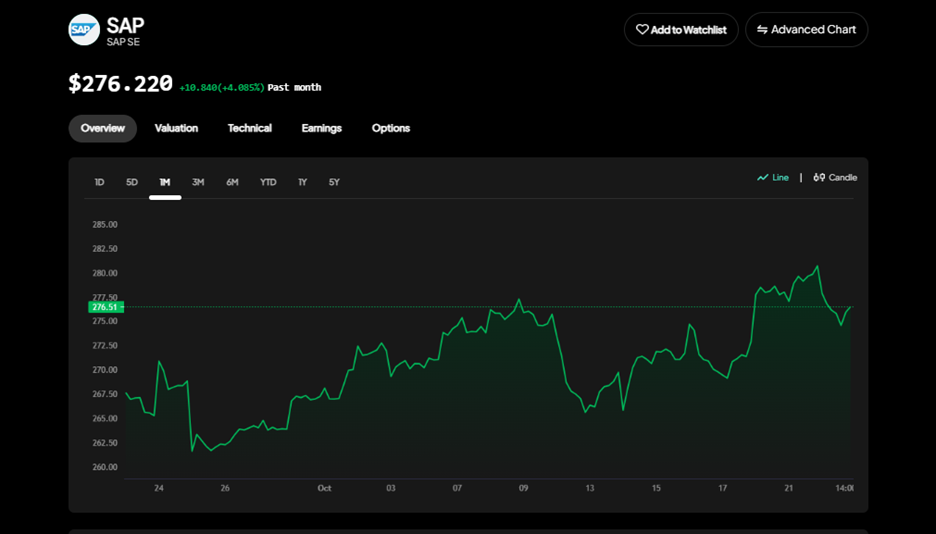

SAP SE

SAP is the German software titan that recently became Europe’s most valuable listed company. Its sheer scale comes from its Enterprise Resource Planning (ERP) software, which is the operational backbone for countless global corporations. The most significant catalyst for the stock lately has been its successful shift to cloud-based subscriptions and, most recently, the aggressive integration of generative AI into its core products. This ensures its software remains indispensable to corporate customers, securing its revenue stream for the foreseeable future. If you believe in digital transformation and enterprise software as a multi-year growth trend, SAP is a must-watch. The shift to subscriptions means more predictable recurring revenue, deep enterprise integrations ensure high customer loyalty and switching costs, and demand for ERP-cloud modernization creates a steady, high-margin revenue stream.

How to Invest in European Stocks Smartly

Navigating a foreign market like Europe can feel intimidating, but using the right tools can simplify the process and dramatically improve your investment results. Here’s how you can invest in the best European stocks with an edge:

- Understand the European Stock Fundamentals: You can’t rely solely on analyst soundbites. Before you buy any stock, you should use a platform to instantly give you the deep fundamental data—things like Price-to-Earnings (P/E), revenue acceleration, and debt-to-equity ratios for every European company. Knowing this allows you to spot value where others see risk.

- Choose the Right Stock Type with an AI Stock Screener or AI Stock Picker: Whether you are looking for high-risk, high-reward growth like ASML, or stable, low-valuation income like Shell, you need a powerful filter. Our Intellectia.ai AI Stock Screener can quickly filter the entire Euro Stoxx 600 list based on your specific criteria, helping you find the perfect match for your personal goals in seconds.

- Utilize AI Trading Signals for Precision: Don’t just pick the right stock; buy it at the right time. This is where the AI Agent and Trading Strategies & Signals become essential. Our algorithms continuously analyze price action, volume, and technical indicators to provide you with a high-probability entry or exit point. This removes the guesswork and emotion from your trading, ensuring you benefit from the stock’s growth while managing your risk effectively.

Conclusion

The European market currently offers a rare mix of value, quality, and innovation — the ideal setup for growth investors heading into 2026. By focusing on global leaders like ASML, Novo Nordisk, SAP, and Shell, you’re positioning your portfolio for both stability and upside.

Remember — AI isn’t replacing investors. It’s empowering them. With Intellectia.ai, you can identify winning European stocks faster, trade with better timing, and build confidence backed by real data. Sign up for Intellectia.ai today to get daily AI stock picks, trading signals, and market insights that help you invest smarter — not harder.