Key Takeaways

- A congress stock tracker gives you direct insight into the investment moves made by U.S. politicians, helping you spot potential market trends.

- The STOCK Act of 2012 mandates that members of Congress publicly disclose their stock trades within 45 days, making this data legally accessible.

- These trackers work by aggregating public disclosures into easy-to-understand dashboards, showing you what politicians are buying and selling.

- Tools like Intellectia's AI-powered Whale Tracker not only follow Congress but also top hedge funds, giving you a broader view of "smart money" movements.

- Using these tools can help you generate new investment ideas and gain confidence by seeing where influential people are putting their money.

Introduction

Have you ever watched a stock's price move dramatically and wondered how certain investors seemed to know it was coming? It can be incredibly frustrating to feel like you're always a step behind, especially when you see news reports about politicians making suspiciously well-timed trades. This information gap can feel unfair and might make you second-guess your own investment strategy.

You're not alone in feeling this way. Many savvy investors have realized that the trading activity of U.S. Congress members can be a valuable source of insight. The great news is that a congress stock tracker is the perfect tool to close that gap. It gives you a clear window into these trades, leveling the playing field and empowering you to make more informed decisions based on the actions of the nation's most powerful insiders.

Why Congress Stock Trading Matters More Than Ever

The idea of tracking politicians' investments isn't new, but it has exploded in popularity for a few key reasons. Your interest, along with that of thousands of other retail investors, is driven by a simple premise: members of Congress are in a unique position. They debate and vote on legislation that can directly impact entire industries, giving them a potential, indirect insight into market-moving events before the general public.

This isn't just speculation; it's a recognized issue. To promote transparency and prevent potential conflicts of interest, the Stop Trading on Congressional Knowledge (STOCK) Act was passed in 2012. This crucial piece of legislation mandates that members of Congress, their spouses, and their dependent children publicly disclose any stock, bond, or other security transaction over $1,000 within 30 to 45 days of the trade. While the ethics of their trading activity remain a hot topic of debate, the law makes their actions available for everyone to see.

The public's curiosity has been fueled by high-profile examples that regularly make headlines. Trades by figures like Nancy Pelosi have become legendary in retail investing circles, with some investors choosing to mirror her portfolio's moves. At the same time, others like Tommy Tuberville have faced public scrutiny for their trading activities while sitting on influential committees. This growing awareness has turned congressional disclosures into a powerful dataset for investors like you who are looking for a unique edge. A congress stock trades tracker takes this publicly available, but often hard-to-find, data and makes it accessible and actionable.

What Is a Congress Stock Tracker?

So, what exactly is a congress stock trading tracker? Think of it as your personal watchdog for political investments. At its core, a congress stock tracker is a tool, usually a website or an app, that automatically collects, organizes, and displays the financial disclosures made by members of the U.S. Congress. Instead of you having to sift through dense, hard-to-navigate government websites and official documents, the tracker does all the heavy lifting for you.

The purpose of these platforms is simple: to give you a clear, concise, and timely view of the stocks and other securities that politicians are buying and selling. The process is straightforward but powerful. The tracker taps into the official databases where congressional disclosures are filed. When a politician submits a new report, the tracker's system pulls that information, parses the important details—like the politician's name, the stock ticker, the transaction type (buy or sell), and the estimated trade size—and then presents it in a user-friendly format.

You can typically see dashboards ranking the most active traders, view the most purchased or sold stocks by politicians, or even follow specific members of Congress to get alerts on their latest moves. By turning raw data into organized intelligence, a US congress stock tracker empowers you to see patterns and trends that would otherwise be hidden. This allows you to generate new investment ideas, validate your own research, or simply stay informed on how political leaders are managing their own wealth in the market. It’s a transparent way to follow the "smart money" in Washington D.C.

Best Congress Stock Tracker Apps

Choosing the right congress stock tracker app depends on what you're looking for. Some offer simple, no-frills data, while others provide advanced analytics and AI-powered insights. Here’s a look at some of the best options available to help you start your journey.

| Platform | Key Features | Ideal User |

|---|---|---|

| Quiver Quantitative | Real-time data feeds, lobbying data, government contracts | The data-driven analyst who wants to connect multiple political datasets. |

| Intellectia Whale Tracker | AI-powered insights, tracks both Congress & hedge funds, alert system | The beginner-to-intermediate investor who wants simplified, powerful signals. |

| Capitol Trades | Simple interface, historical data, politician-specific dashboards | The casual investor who wants an easy-to-use, free overview of trades. |

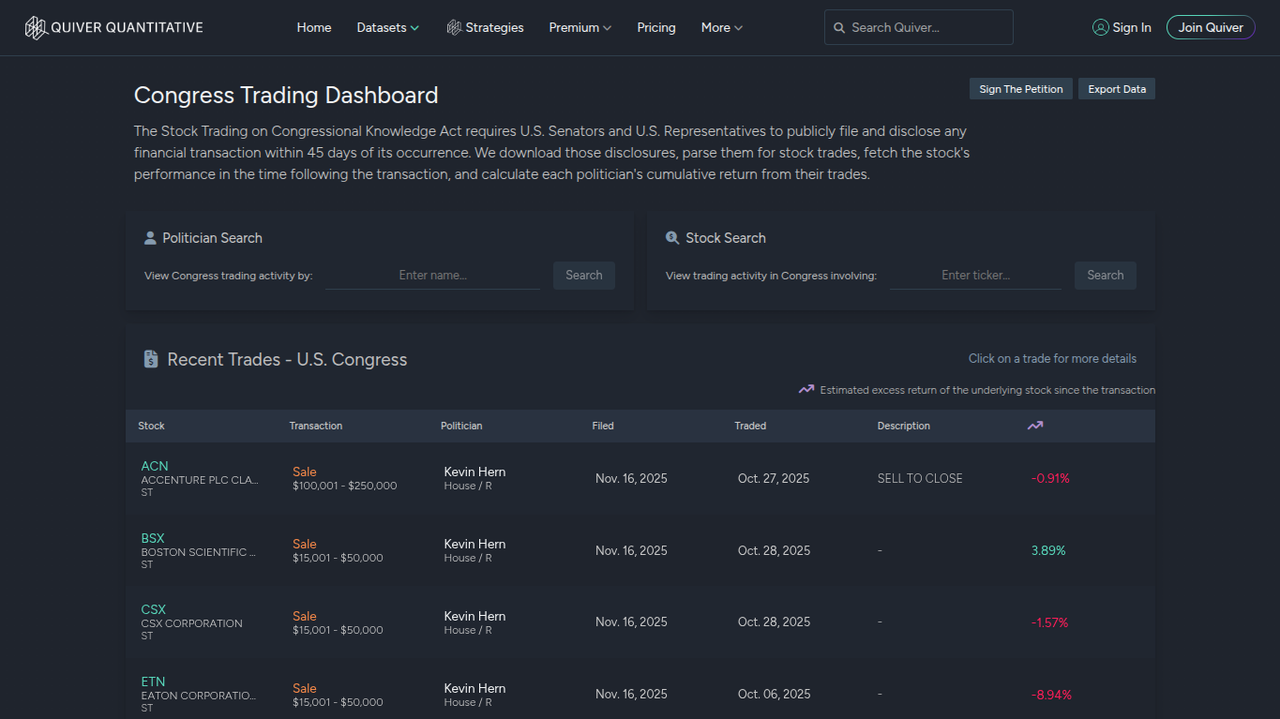

Quiver Quantitative – Real-time Congressional Trading Feed

Quiver Quantitative, often known as QuiverQuant, is a data-first platform that provides alternative data to retail investors. Its congress trading tracker is one of its most popular features, offering a nearly real-time feed of disclosures.

- Key Features: Beyond just congressional trades, Quiver also tracks corporate lobbying efforts, government contracts, and even mentions of stocks on social media platforms. This allows you to see a much broader picture of a company's political and social influence.

- Pros: The sheer amount of data is its biggest strength. You can cross-reference congressional trades with other datasets to build a more complex investment thesis. It’s a data researcher's dream.

- Cons: The platform can be overwhelming for beginners. With so much information, it can be difficult to know where to focus or how to derive actionable insights without a clear strategy.

- Review: If you love diving deep into spreadsheets and connecting disparate dots of information, Quiver is a powerful tool. However, if you're looking for clear, guided signals, you might find it a bit too complex.

Recommended Rating: 8/10 for advanced users.

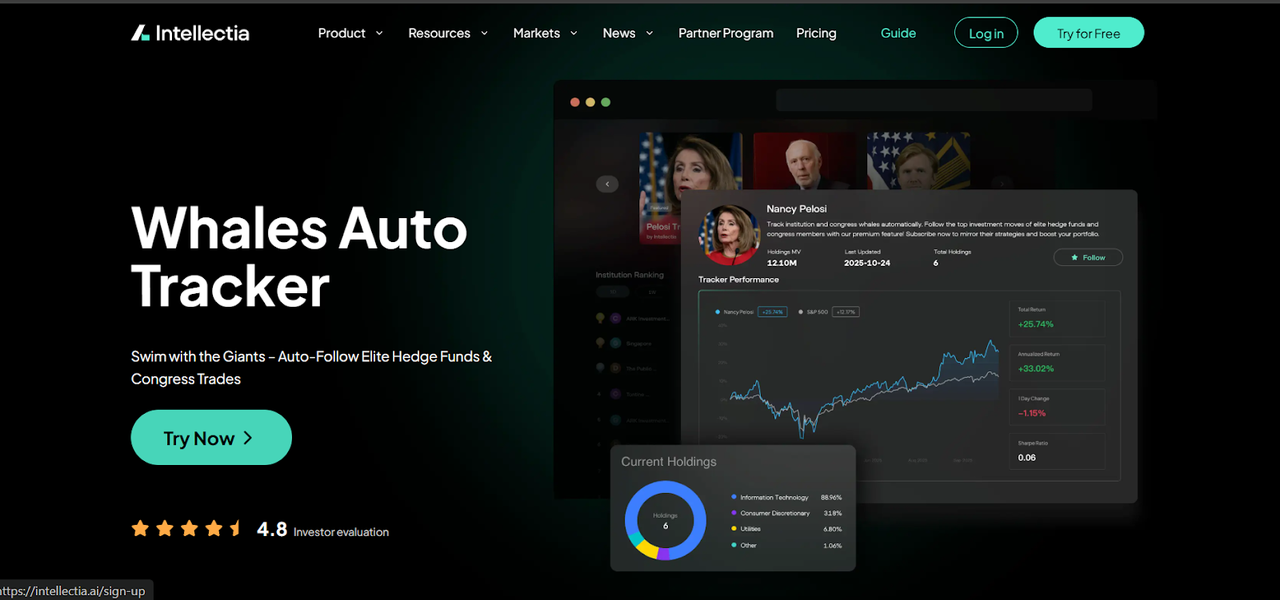

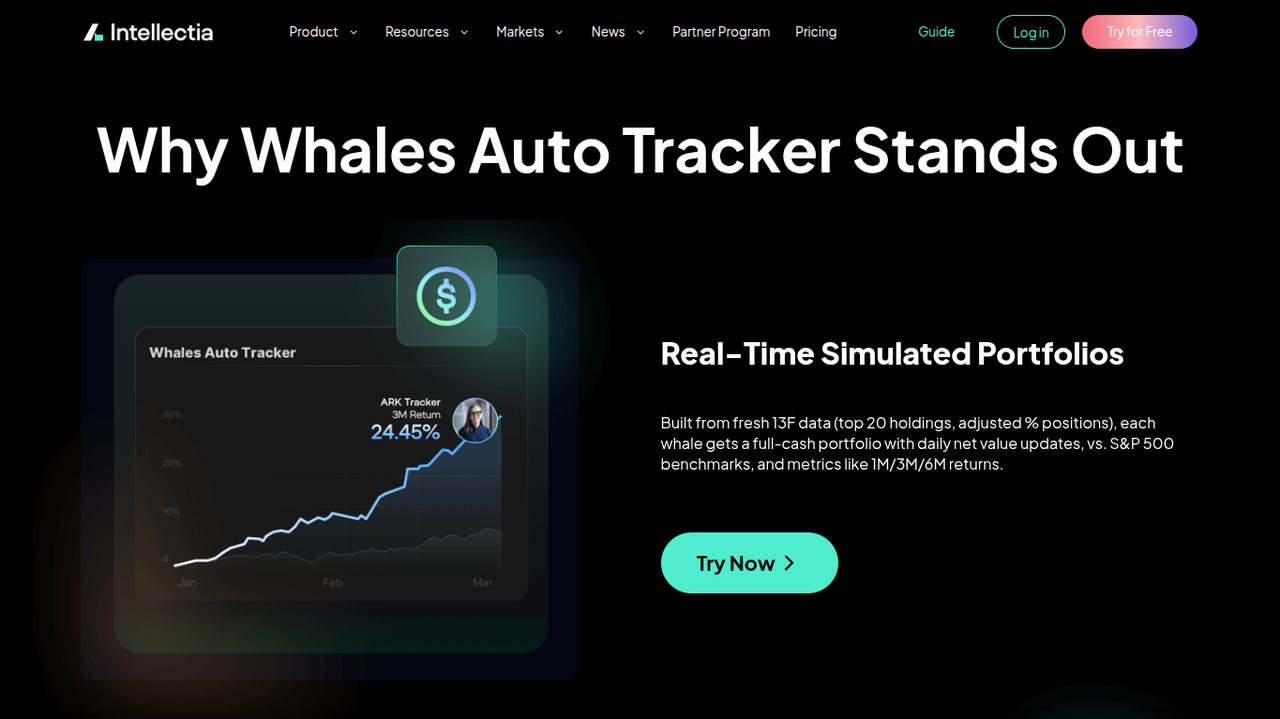

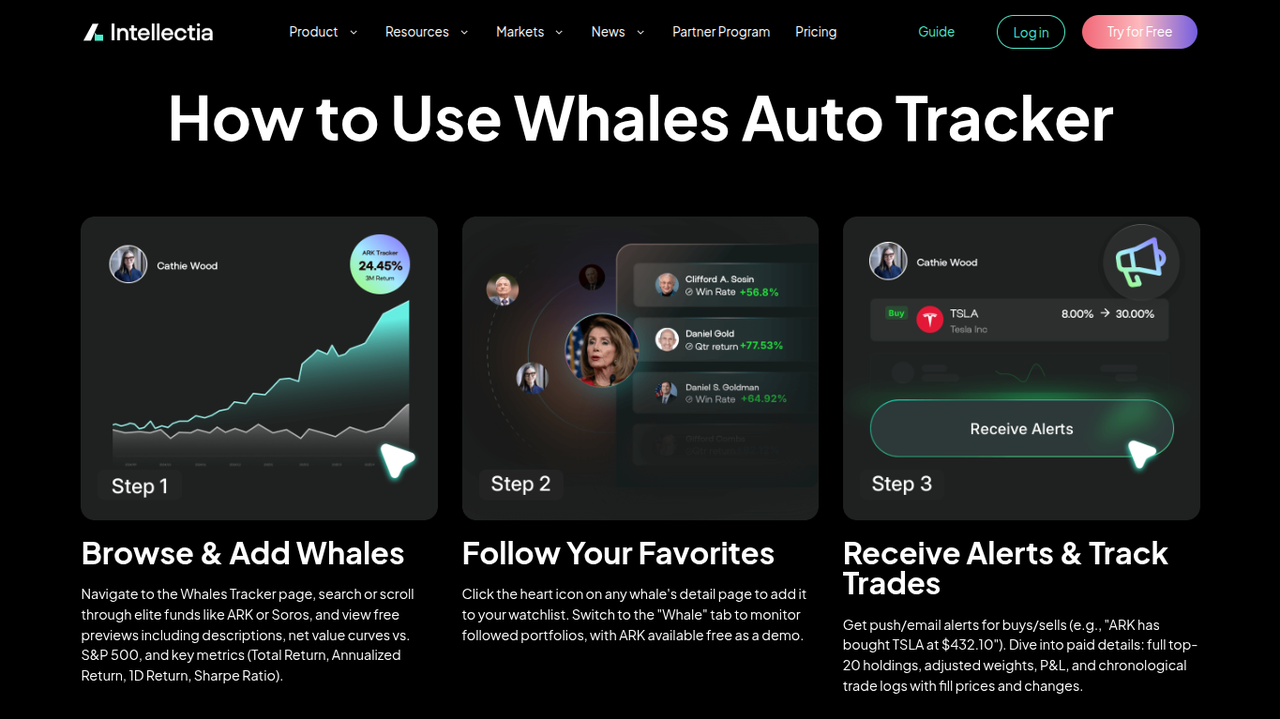

Intellectia Whale Tracker – Follow Congress and Wall Street with AI

Intellectia takes a unique and powerful approach by combining congressional tracking with hedge fund monitoring in its Whales Auto Tracker feature. It's built on the idea that the "smart money" isn't just in Washington; it's also on Wall Street. By tracking both, you get a more complete picture of what influential investors are doing.

- Key Features: Intellectia uses AI to create "simulated portfolios" for both top hedge fund managers and active members of Congress. You can follow specific individuals (like Nancy Pelosi) or funds (like Berkshire Hathaway) and receive automatic buy and sell alerts when their portfolios are updated. The platform provides performance curves and metrics to show you how these "whales" are performing against the market.

- Pros: The AI-driven, all-in-one approach is incredibly beginner-friendly. Instead of just giving you raw data, it provides actionable alerts. Combining political and institutional tracking offers a more robust signal, helping you identify trends supported by different types of "smart money." It simplifies a complex strategy into an easy-to-follow system.

- Cons: The full power of the Whale Tracker, including detailed holdings and real-time alerts, is a premium feature.

- Review: Intellectia is the ideal choice if you want more than just data—you want guidance. It’s perfect for those who believe in the "smart money" concept but don't have the time to analyze thousands of filings themselves. The AI does the heavy lifting, making it a powerful yet simple tool.

Recommended Rating: 9.5/10 for investors who want actionable, AI-powered insights.

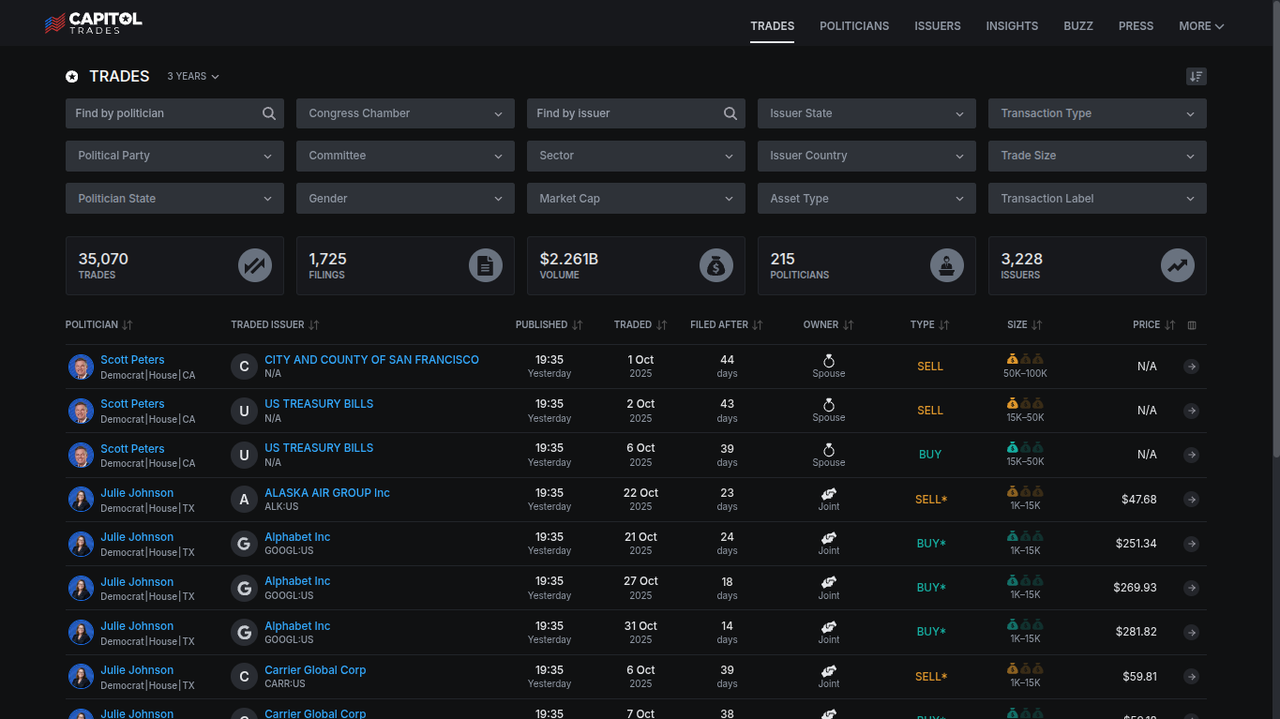

Capitol Trades – Easy-to-Navigate Congress Stock Trading Tracker

Capitol Trades focuses on one thing and does it well: presenting congressional stock trading data in a clean, simple, and easy-to-understand way. It's a great entry point for anyone curious about what politicians are trading.

- Key Features: The platform offers a very intuitive interface with clear dashboards. You can easily see top trades, filter by politician, party, or chamber (House/Senate), and view detailed transaction histories for each member.

- Pros: It’s incredibly easy to use and completely free, making it highly accessible. The visual layout is excellent for quickly grasping which stocks are popular among politicians.

- Cons: It lacks the advanced analytical features of other platforms. You won't find AI insights, hedge fund data, or other alternative datasets. It tells you what is being traded, but not necessarily why or what to do about it.

- Review: For a straightforward, no-cost look into congressional trading, Capitol Trades is a fantastic resource. It’s perfect for a quick check-in or for those who are just starting to explore this niche of market research.

Recommended Rating: 7.5/10 for beginners and casual observers.

Conclusion

Using a congress stock tracker can be an incredibly insightful way to enhance your investment strategy. It pulls back the curtain on the financial decisions of the nation's leaders, giving you a unique dataset to work with. Whether you want to generate new ideas, validate your research, or simply see where the "smart money" in Washington is flowing, these tools offer an undeniable edge.

For those who want to take it a step further, combining political tracking with institutional insights provides the most powerful view. Tools like Intellectia's AI Whale Tracker are designed for this, giving you clear, actionable signals from both politicians and top fund managers.

Ready to redefine your investment decisions? Sign up for Intellectia.ai today and subscribe to get daily AI stock picks, advanced trading signals, and the market analysis you need to stay ahead.