Key Takeaways

- Blue chip stocks are the foundation of long-term wealth, providing stability, proven strength, and stable dividends even during economic downturns.

- The process of selecting the best blue chip stocks must extend beyond brand popularity to include metrics such as good Free Cash Flow (FCF), a history of consistent dividend payouts, and future-oriented innovation.

- The five best stocks to buy in 2026 are a blend of high-growth technology stocks (Apple, Microsoft) and defensive stocks (Johnson & Johnson, Coca-Cola, JPMorgan Chase).

- Investment strategy for blue chip stocks must focus on long-term holding and sector diversification, supplemented by dividend reinvestment.

- AI tools are necessary to help a contemporary investor track volatility, evaluate risk, and receive data-driven alerts on the optimal point to enter and exit.

Introduction

Are you tired of watching volatile growth stocks swing wildly, putting your capital at risk? Well, in the modern volatile market, many investors struggle to establish real stability without sacrificing potential returns. After years of studying market cycles, one truth stands out — long-term wealth isn’t built on hype, but on a foundation of reliable, high-quality blue-chip stocks. These are companies that not only withstand economic shocks but consistently emerge stronger. This guide will show you why blue-chip stocks remain essential and which five deserve your attention in 2026 — plus how AI can sharpen your investing edge.

What Are Blue-Chip Stocks?

In simple terms, blue chip stocks are stocks of financially stable, remarkably well-established corporations with a long history of steady growth and dependable income. Think of them as steady stock market veterans. These are the giants of their industries —the companies that have survived numerous economic cycles, recessions, and market dynamics without missing a step. When you hear an experienced investor discussing bedrock investments, they’re typically referring to blue chips. They offer that rare combination of familiarity, quality, and proven resilience.

Why Invest in Blue-Chip Stocks?

Investing in blue-chip stocks gives your portfolio a rare mix of safety, income, and long-term growth.

Long-Term Stability: Proven Track Records Across Market Cycles

These giants have thrived through recessions and market corrections, providing consistent returns when others falter.

Steady Dividends: Reliable Income for Conservative Investors

One of the most important attributes of most blue-chip stocks that pay dividends is their unyielding focus on giving back to the capital shareholders. They tend to have decades of experience not only in paying but also in steadily raising their dividends. This history indicates financial discipline and consistent profitability, providing a dependable flow of passive income that can pay off in the long run through compounding.

Inflation Hedge: Growth and Pricing Power in Established Markets

High-quality, established stocks tend to have significant pricing power due to their high brand recognition and the market position they hold. These companies can easily increase the price of their products without any client loss, even when the prices of raw materials or labor increase due to inflation. This ability to pass rising costs on to consumers effectively helps protect your investment's value against inflation better than many other less established asset classes.

Institutional Confidence: Preferred by Mutual Funds and Pension Funds

Because blue chip stocks are inherently stable, they’re typically the preferred holdings for giant institutional investors, including mutual funds, pension funds, and university endowments. Their presence on institutional buy lists provides a solid and predictable level of support to their stock prices, offering added protection to your investment.

AI and Tech Edge: Some Blue-Chips Are Integrating AI for Efficiency and Innovation

Don't ever mistake stability for stagnation. The most popular blue chip stocks are colossal investors in Research and Development, introducing the newest technologies in their operations and customer support systems. This is their unchanging, innovative advantage that ensures they maintain their market dominance and competitive edge for many years to come.

Criteria for Selecting Best Blue-Chip Stocks

You should not simply use famous names when you are seeking the really best blue-chip stocks. Use a data-driven methodology to make sure you select the ones that have the best future performance.

- Market Capitalization and Revenue Growth: You want to find businesses with market caps generally exceeding 100 billion, but most importantly, you must not find a company with flat revenue growth. You need stability plus forward momentum.

- Dividend Yield and Payout Ratio Consistency: An excellent dividend is good, but it must be consistent. You must examine a long record of paying and increasing dividends and ensure a sustainable payout ratio (preferably below 60-70% of earnings).

- Profit Margins and Cash Flow Strength: The best indicators of a healthy business are high margins and strong Free Cash Flow (FCF). High FCF gives the firm the leeway and ability to withstand any financial storm without a reduction in share dividends.

- Sector Diversification (Defensive vs. Growth): Build a balanced mix in your portfolio. When you combine defensive blue chips (such as utilities or consumer staples) with blue chip growth stocks (such as technology or healthcare), you’re able to optimize the overall risk-return profile.

- ESG and Innovation Potential: Contemporary investors must take into consideration the Environmental, Social, and Governance (ESG). Even without explicit innovation strategies, blue chips with a high ESG rating are better positioned to succeed in the long run and sustainably over time in the eyes of regulators and consumers.

- AI-Powered Performance Metrics: To gain a true advantage, you should use advanced AI tools like Intellectia.ai to check for key metrics that human analysis often misses, such as sudden earnings momentum shifts, changes in insider sentiment, and predictive volatility.

Best Blue-Chip Stocks List 2026

Choosing the best blue chip stocks means identifying companies that combine the established market power with a clear and aggressive developmental path. Here is a look at five industry leaders primed to deliver in 2025.

| Company Name | Ticker Symbol | Sector | Market Cap (Approx.) | Dividend Yield(Approx.) | Key Strengths |

|---|---|---|---|---|---|

| Apple | AAPL | Technology | $3.84 T | 0.4% | Ecosystem lock-in, recurring service revenue, and AI integration |

| Microsoft | MSFT | Technology | $3.89 T | 0.7% | Dominance in cloud computing (Azure) & AI innovation |

| Johnson & Johnson | JNJ | Healthcare | $464 B | 2.7% | Diversified pharmaceutical and med-tech segments, defensive |

| Coca-Cola | KO | Consumer Staples | $308 B | 2.85% | Unmatched global distribution, resilient brand pricing power |

| JPMorgan Chase & Co. | JPM | Financials | $809 B | 2.04% | Leading US banking franchise, strong balance sheet, rising rates beneficiary |

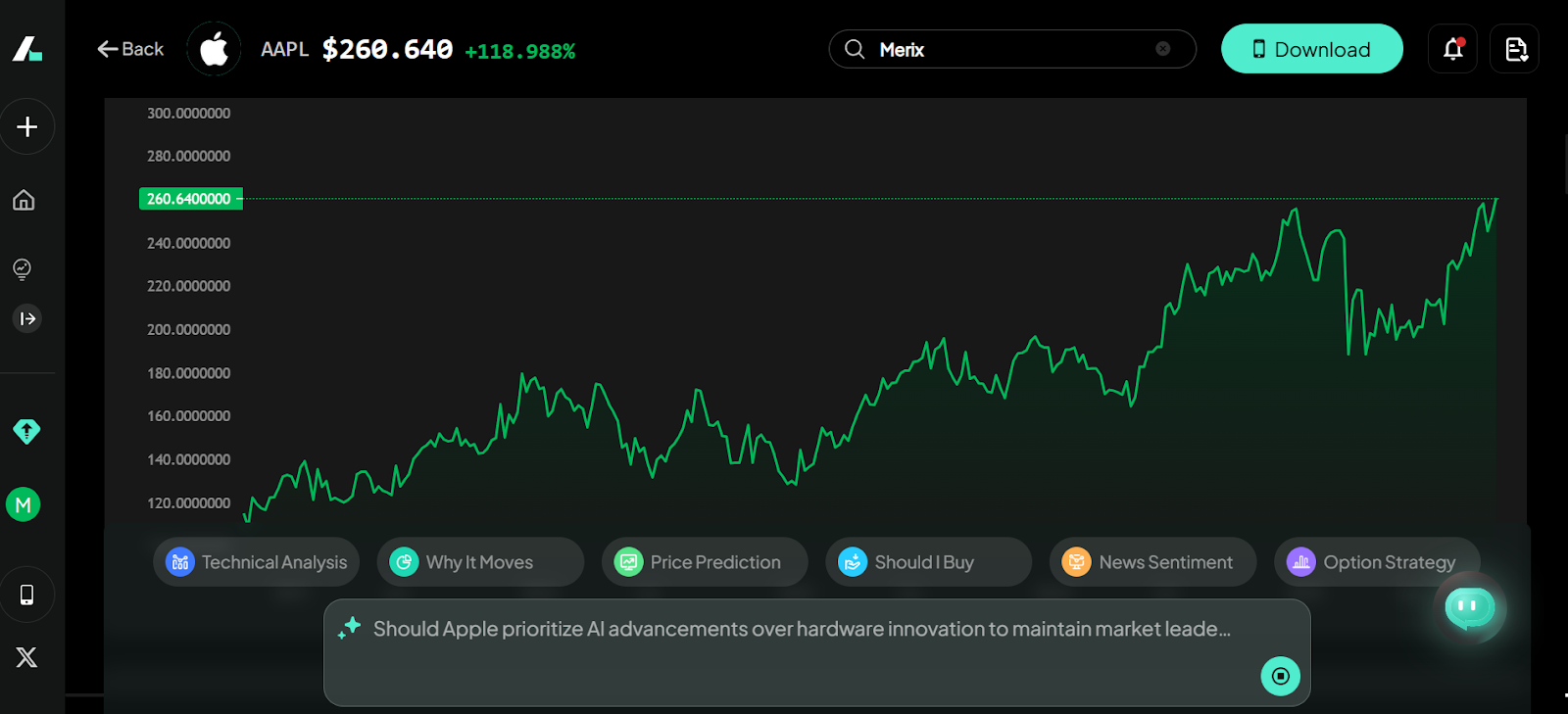

AAPL – Apple

Apple is the prototype of the new blue-chip stock. When you invest here, you’re looking at much more than just a hardware company; your actual investment is in its sticky, high-margin Services division (App Store, iCloud, Apple Pay), which offers stable and recurring revenue. Its pricing power is unmatched by most companies on the planet due to the sheer loyalty and integration of its ecosystem. In the future, with a huge investment in generative AI throughout its product range, Apple is poised for a significant product cycle update and long-term growth.

Apple has an unparalleled capacity to produce consistent high-margin revenue on its Services ecosystem, locking in billions of customers.

In case you want to invest in a long-term stock that combines a premium brand loyalty with a high-growth services revenue, Apple should definitely be at the top in your list.

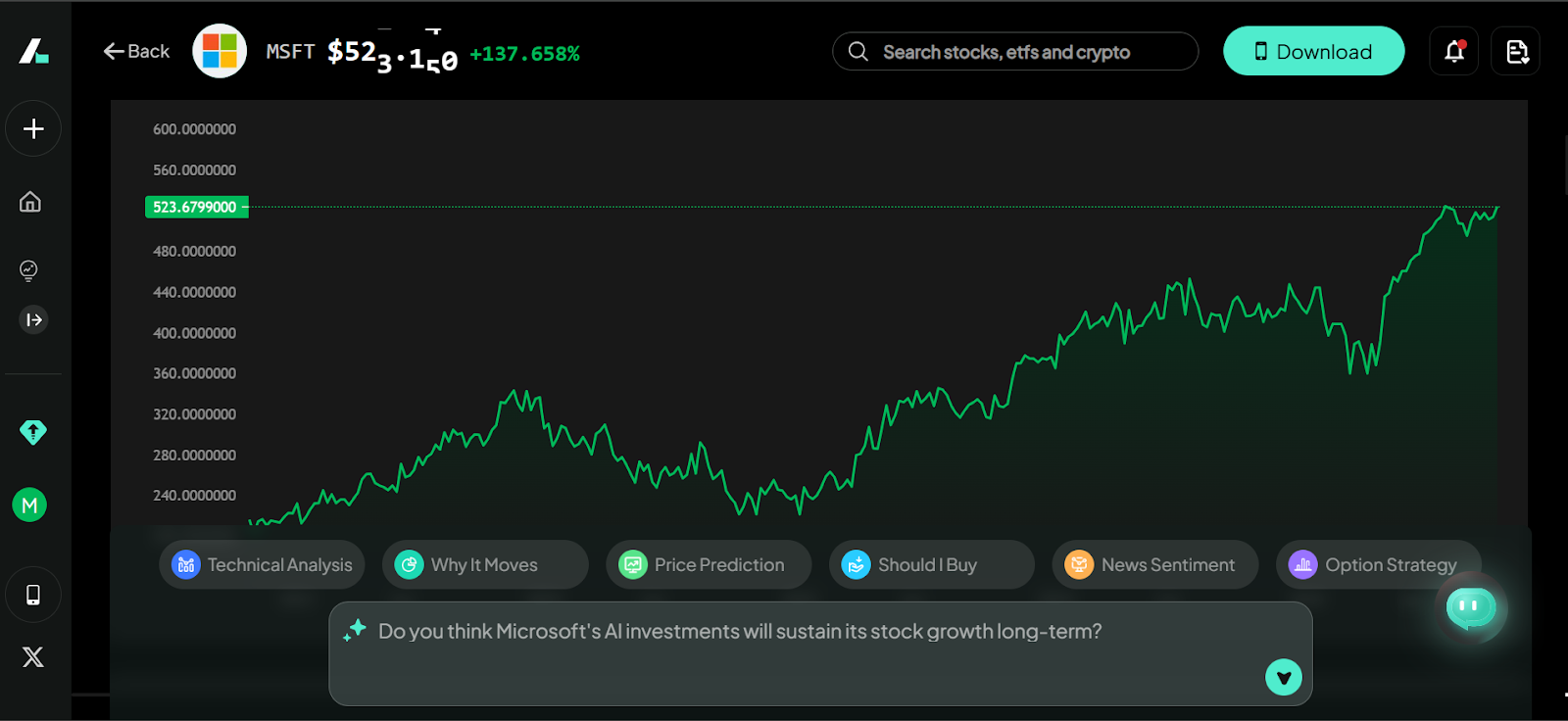

MSFT – Microsoft

Microsoft has creatively re-engineered itself into a cloud computing powerhouse, and it is now arguably the best blue-chip stock in the technology space today. Its Azure cloud platform is a powerful and high-growth engine, and its incorporation of advanced AI technology, particularly through collaboration with OpenAI, is generating colossal value across its entire enterprise and productivity software portfolio. This unique ability to integrate cutting-edge technology into essential business services makes its revenue exceptionally secure and scalable, which generates steady returns.

The feature that stands out is its virtual monopoly status in enterprise software, along with its substantial, industry-leading investment in AI through Azure and its collaboration with OpenAI.

If you believe in the exponential strength of dominating cloud infrastructure and ubiquitous AI integration throughout the corporate world, Microsoft is an essential holding for you.

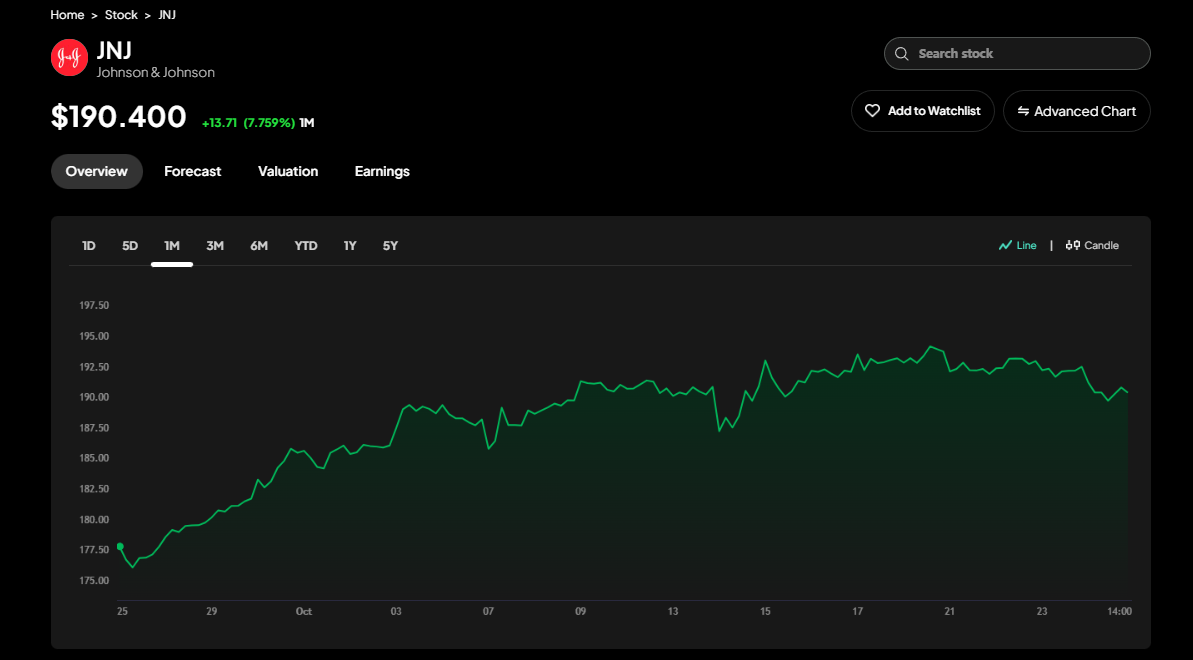

JNJ – Johnson & Johnson

Johnson & Johnson is the ultimate defensive high-quality stock. It’s strong due to its non-cyclical diversification that goes deep in Pharmaceuticals and MedTech, and meets the fundamental human needs that do not cease when the economy slows down. This structure enables JNJ to create strong, predictable cash flows, irrespective of the overall economic climate. Following its recent corporate restructuring, the company is highly focused on its high-margin, innovative drug pipeline and its critical medical devices.

The standout feature is the defensive, non-cyclical business model and its multi-decade history as a Dividend King, indicating unmatched reliability.

If you wish to locate a stable stock that has a high defensive power, consistent growth, and a forty-year history of dividend growth, JNJ is a foundational choice.

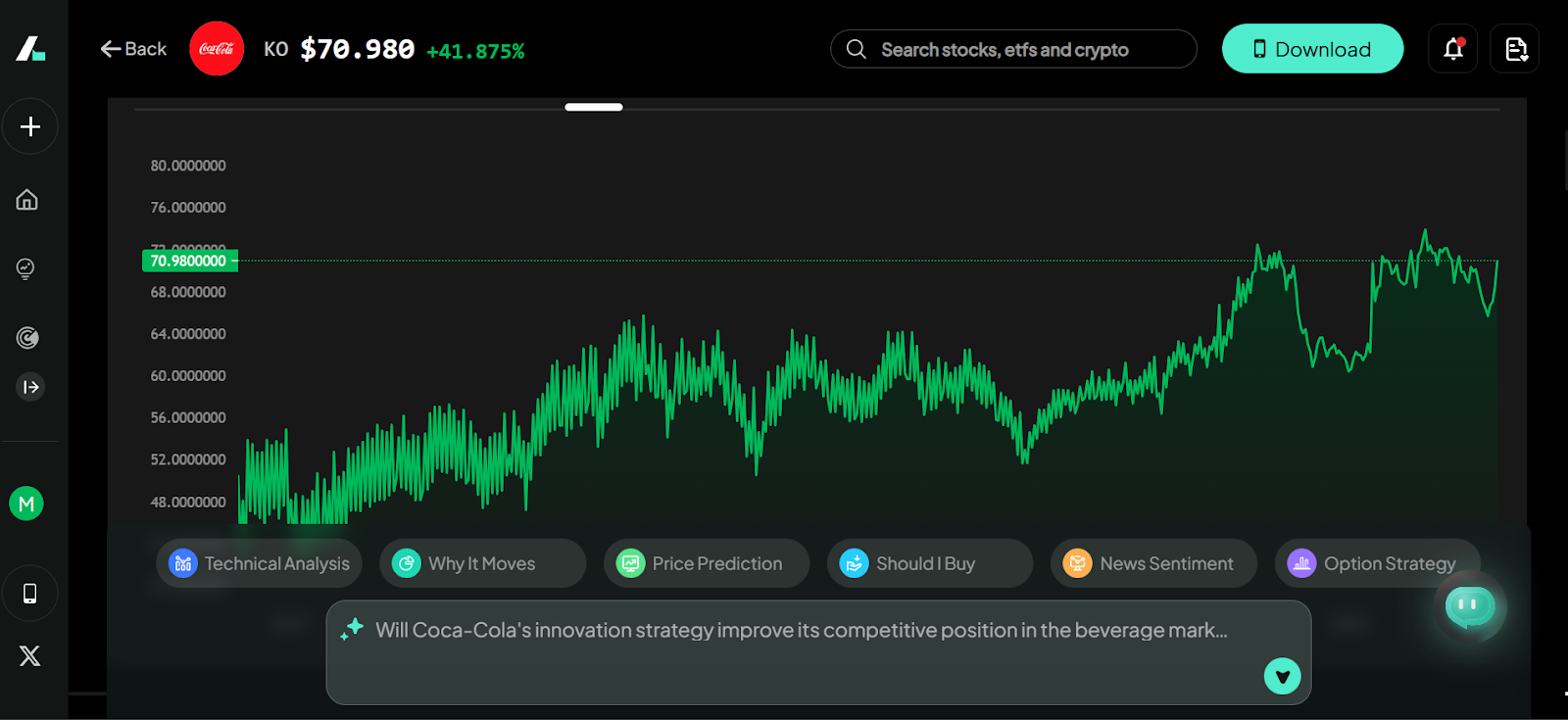

KO – The Coca-Cola Company

Coca-Cola is the unchallenged archetype when we mention blue-chip stocks with dividends. It has one of the most well-known brands in the world and a distribution network that is second to none. It can overcome the inflationary pressures due to its size and pricing strategies. While it operates in the slower-growth consumer staples sector, its consistent dividend growth and geographical reach make it a perfect defensive income play.

The unique strength here is its unparalleled global distribution network and brand name, which provide it with strong pricing power against inflation.

Coca-Cola should be part of your portfolio in case you want to focus on safe and trustworthy dividends and effective risk coverage in case of economic turmoil.

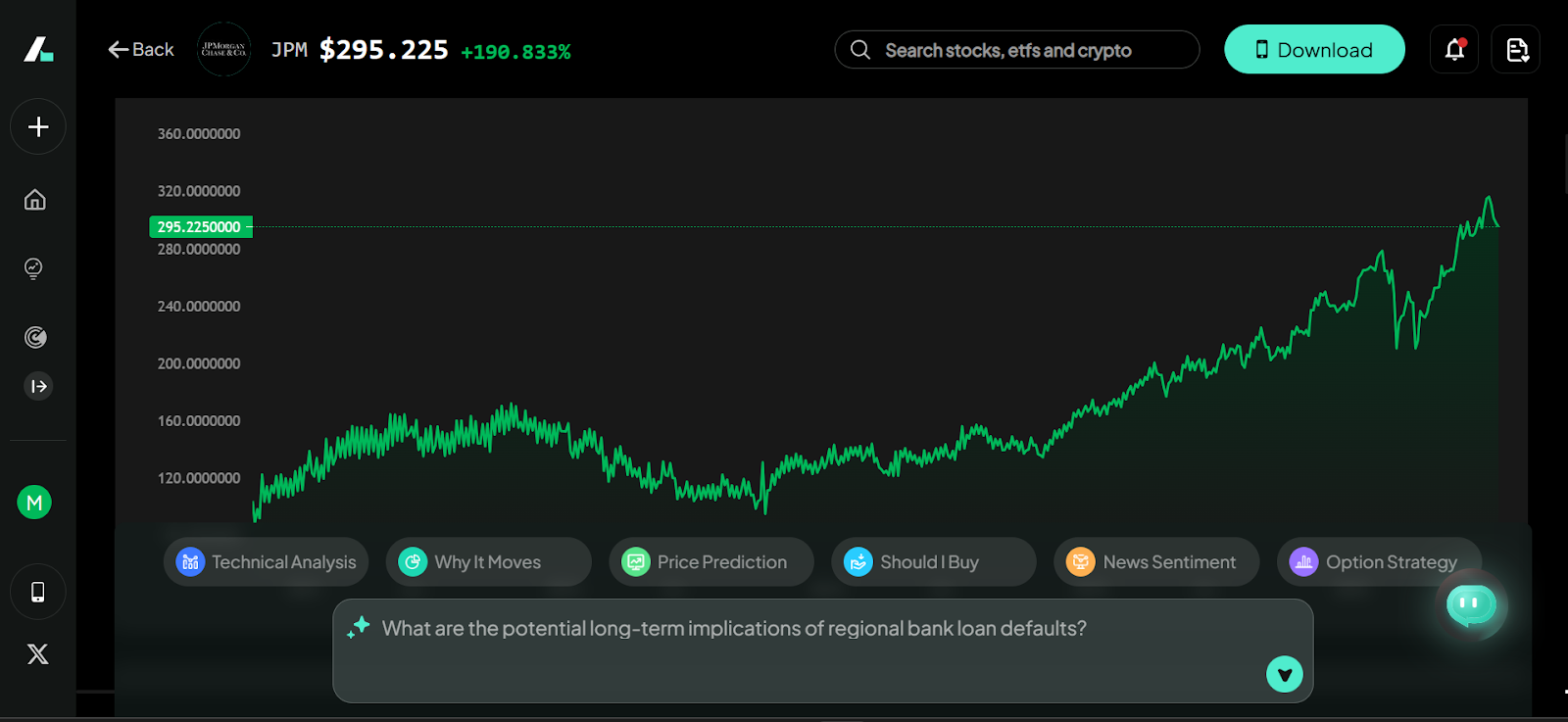

JPM – JPMorgan Chase & Co.

JPMorgan Chase is consistently regarded as the best-controlled bank in the United States and a substantial financial blue-chip share. Its sheer size and highly diversified business in consumer banking, investment banking, and asset management give it an enormous competitive advantage. When interest rates rise, JPM benefits directly from higher lending margins. More importantly, the bank has a good balance sheet, and its management has been conservative over the years, making it well-suited to any economic challenge.

The distinguishing feature here is that JPM is the leading financial institution in the US, directly benefiting from stable economic growth and increased rates.

In case you intend to gain exposure to the financial sector of a leading blue-chip firm enjoying high capital returns and increased interest rates, JPM is the apparent choice.

Investment Strategies for Blue-Chip Stocks

Using best blue-chip stocks effectively requires a strategy focused on patience, compounding, and innovative risk management.

Long-Term Holding

The inherent strength of blue chips is that they do not go away. Long-term holding should be your key strategy to maximize on dividend compounding and slow appreciation of capital.

Diversification

Although blue chips are safe by nature, you cannot invest all your money in a single stock or industry. Spread investments across sectors like tech, healthcare, and finance to balance risk.

Risk Assessment

Even the best blue-chip stocks can face temporary setbacks or price swings. This is where the modern AI tools can be useful. Do not trust your intuition or generic financial news. You can use the Intellectia.ai Agent to keep a constant watch on your holdings. This feature allows you to create custom alerts to track changes in volatility or key trading indicators, ensuring you are never taken by surprise and can act quickly based on data.

Use AI Trading Signals and Strategies

To take advantage of short-term declines and rises, you can supplement your long-term blue chip holdings with a shorter-term plan. As an example, the Swing Trading capabilities of Intellectia.ai can give you some data-driven indications that you can use to buy or sell a stock when a stock temporarily deviates from its value. This allows you to make more money while holding your core stable stocks, making your anchor holdings work harder for you.

Conclusion

Investing in blue-chip stocks isn’t about quick gains — it’s about compounding wealth through time-tested reliability. Our top five picks for 2026 — Apple, Microsoft, Johnson & Johnson, Coca-Cola, and JPMorgan — each offer a unique blend of growth, income, and resilience.

The next step is to develop an unquestionable advantage by obtaining institutional-level data and intelligence. Stop relying on outdated news and emotional decision-making. Register and subscribe to Intellectia.ai to receive the daily AI stock picks, real-time AI trading signals and strategies, and the market analysis you need to manage your blue chip portfolio with absolute confidence.