Key Takeaways

- AI stock trading software enhances your trading by providing data-driven insights, automating analysis, and reducing emotional decision-making.

- When choosing a platform, you should consider its key features, accuracy, ease of use, supported assets, and the overall value it provides for its cost.

- Platforms like Intellectia.ai are designed for modern traders, offering a comprehensive suite of tools from AI-driven stock picks to automated technical analysis.

- Many platforms now offer AI assistants and no-code strategy builders, making advanced trading techniques accessible even if you are a beginner.

Introduction

Have you ever felt overwhelmed by the sheer volume of market data, wondering how you can possibly keep up, let alone find a real edge? You're not alone. Many traders find themselves reacting to market moves rather than anticipating them, often leading to missed opportunities and frustrating losses. This is where the power of ai stocks trading software comes in.

This technology shifts the paradigm. Instead of spending hours staring at charts and drowning in financial news, you can leverage sophisticated algorithms that do the heavy lifting for you. These tools analyze market sentiment, detect complex patterns, and generate trading signals with a level of speed and accuracy that's impossible to achieve manually.

The solution isn't to work harder; it's to trade smarter by equipping yourself with the right AI-powered tools.

Why Consider Using an AI Stock Trading Software?

In today's fast-paced markets, having an edge is more critical than ever. An AI stock trading app isn't just a fancy tool; it's a fundamental shift in how you can approach your trading strategy. By harnessing the power of artificial intelligence, you unlock capabilities that were once exclusive to large institutional firms.

First and foremost, AI excels at processing enormous amounts of data in real-time. Think about it: news headlines, social media sentiment, company financials, and technical indicators. An AI can analyze all these sources simultaneously to identify opportunities you might otherwise miss.

This leads to more informed and less emotional trading decisions. Fear and greed are powerful forces that can derail even the most well-thought-out plan. Since an AI operates purely on data and logic, it helps you stick to your strategy without emotional interference.

Furthermore, the best AI for stock research allows you to backtest your strategies against historical data with incredible speed. This means you can refine your approach and gain confidence in its effectiveness before risking a single dollar.

Whether you’re a day trader needing high-frequency signals or a swing trader looking for the next big move, an AI stock trading bot can be customized to monitor the markets for you, sending alerts so you never miss a critical entry or exit point.

Criteria to Select the Best AI Stock Trading Software

Choosing the right AI software for stock trading can feel daunting with so many options available. To find the best fit for your needs, you need to focus on a few key criteria. Start by evaluating the platform's core features. Does it offer what you need, such as an AI stock screener, real-time trading signals, or automated pattern recognition? Look for a tool that aligns with your specific trading style.

User experience is another crucial factor. A powerful tool is useless if it's too complicated to navigate. The best AI stock trading app will have an intuitive interface that makes it easy to access information, set up alerts, and execute your strategy. Many platforms offer free trials or demos, which are excellent opportunities to test the software's usability before committing. You can check out Intellectia.ai's trial to see how a user-friendly design can simplify complex data.

Finally, consider the cost and overall value. Subscription fees can vary widely, so it's important to understand what you're getting for your money. Some platforms charge extra for premium data or advanced features. Compare the pricing structures and weigh them against the potential return on your investment. A more expensive platform might be worth it if its predictive accuracy and feature set give you a significant advantage in the market.

Top AI Stock Trading Software to Consider in 2026

Navigating the world of AI trading software can be tough. To help you out, here is a breakdown of some of the top platforms available today, so you can find the one that best suits your goals.

| Platform | Key Features | Ideal User | Cost |

|---|---|---|---|

| Intellectia.ai | AI signals (swing & day trading), AI stock picker, AI agent, screener, chart pattern recognition. | Beginners and experienced traders looking for actionable, data-driven signals and a comprehensive toolset. | Starts at $14.95/month. |

| VantagePoint | Patented intermarket analysis, trend forecasting (1-3 days ahead), up to 87.4% accuracy. | Serious traders and investors who want predictive forecasts for stocks, forex, and ETFs. | High-end, requires a quote (typically several thousand dollars). |

| TrendSpider | Automated technical analysis, strategy backtesting (no-code), AI assistant (Sidekick), dynamic alerts. | Technical traders who want to automate their analysis and strategy testing. | Starts at $44/month. |

| StockHero | Pre-set trading bots, bot marketplace, paper trading, strategy designer. | Traders who want to fully automate their strategies with bots and connect to multiple brokerages. | Starts at $4.99/month (Free basic plan available). |

| Trade Ideas | AI-powered market scanner (Holly), simulated trading, real-time idea generation. | Active day traders who need a constant stream of high-potential trade ideas. | Starts at $118/month. |

Intellectia.ai

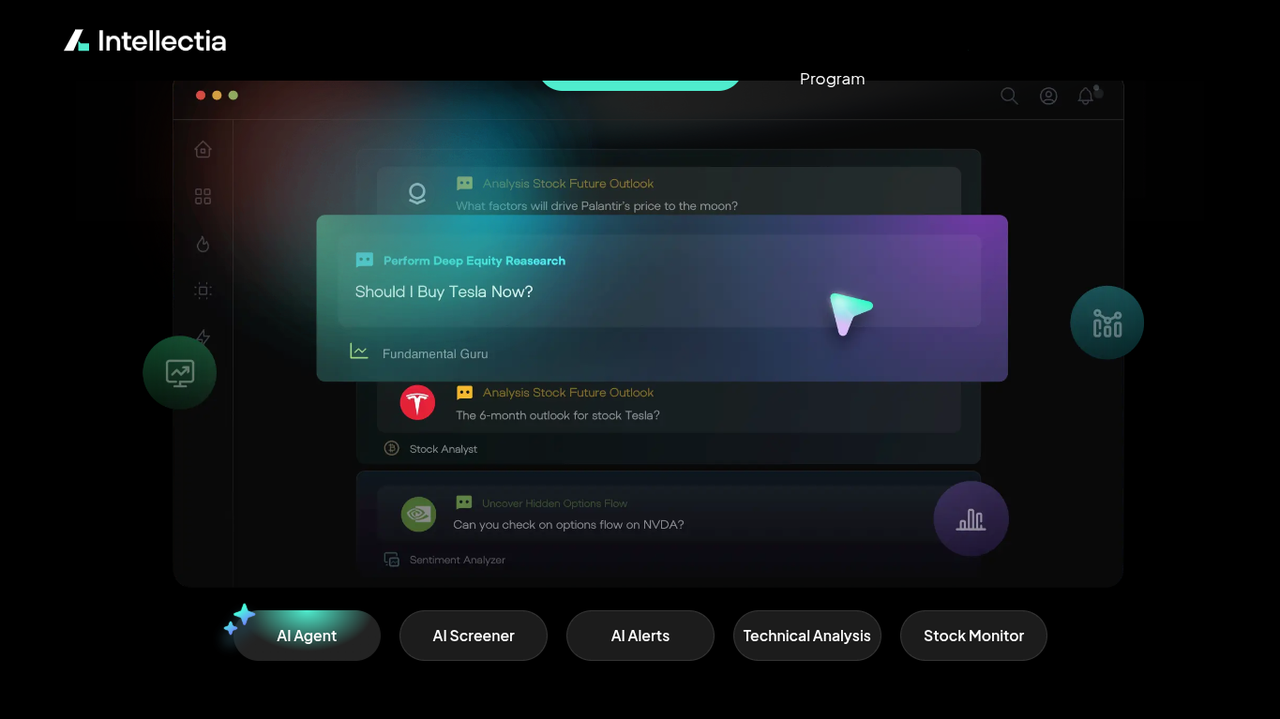

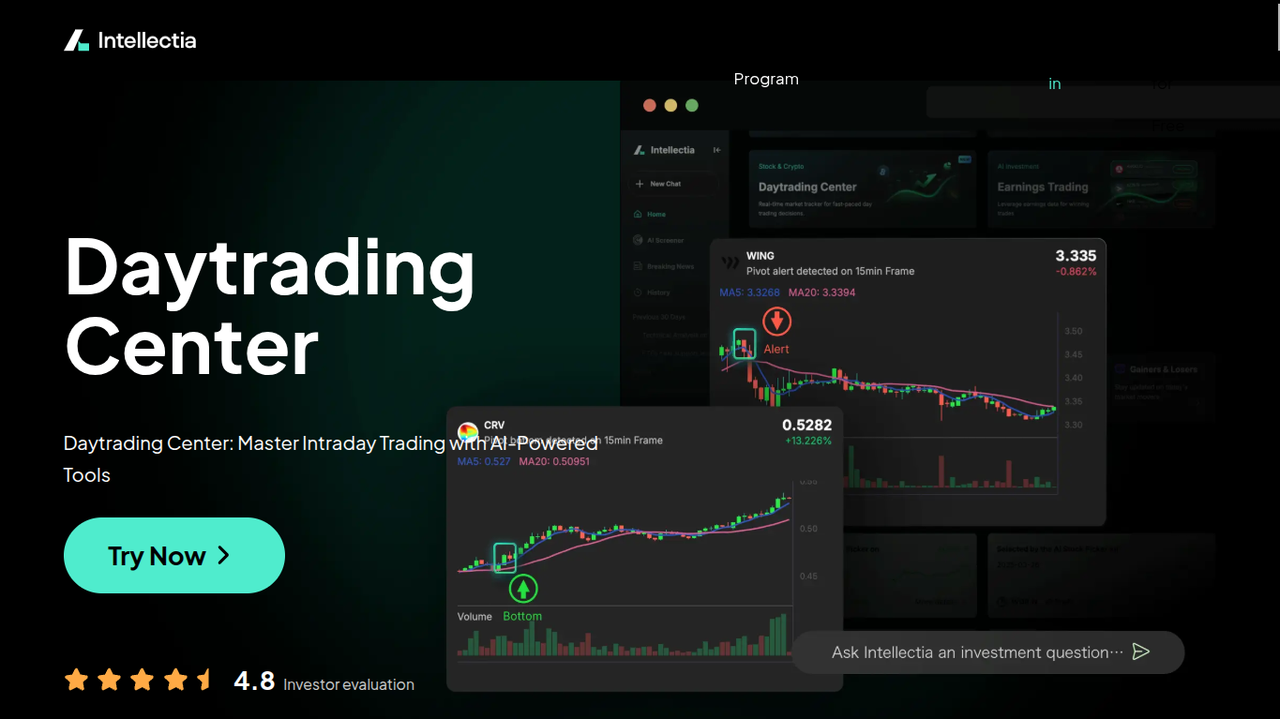

Intellectia.ai is designed to provide you with a distinct advantage by transforming complex AI analysis into clear, actionable trading opportunities. The platform focuses on delivering tangible results, not just raw data, making it an excellent `ai stock research` tool.

- Key Features: The platform offers a suite of powerful tools, including a daily AI Stock Picker with a backtested annualized return of over 200%, and Swing Trading signals that simplify when to buy, hold, or sell. Its conversational AI Agent can answer your financial questions, perform analysis, and even predict stock prices. You can also leverage the AI Screener for price movement forecasts and the automated Stock Chart Patterns feature to spot classic technical setups.

- Pros: Highly user-friendly, provides direct and easy-to-follow signals, covers both stocks and crypto, and offers a comprehensive set of features at an affordable price point. The AI-driven approach is integrated across all its tools, from the Daytrading Center to earnings predictions.

- Cons: Currently focused on US and Hong Kong stocks, with broader international coverage still in development.

Recommended Rating: 9.7/10

VantagePoint

VantagePoint stands out for its patented global intermarket analysis, which forecasts trends 1 to 3 days in advance with a claimed accuracy of up to 87.4%. It analyzes the hidden relationships between different markets to predict price movements, giving you a predictive edge rather than a reactive one.

- Key Features: Predictive technical indicators, market forecasts for over 2,300 assets, and patented trend-forecasting technology.

- Pros: High-accuracy forecasts can provide a significant trading advantage. The software is backed by decades of development.

- Cons: It comes with a very high price tag, making it inaccessible for most retail traders. It's also desktop software, which is less flexible than cloud-based platforms.

Recommended Rating: 8/10 (For professional traders with large capital)

TrendSpider

TrendSpider is built to automate the tedious work of technical analysis. It automatically draws trendlines, detects chart patterns, and helps you build, test, and refine trading strategies without writing a single line of code.

- Key Features: Automated pattern recognition, multi-timeframe analysis, a no-code strategy tester, and an AI assistant named Sidekick that can analyze charts and answer questions on command.

- Pros: Saves a tremendous amount of time on manual charting, powerful backtesting capabilities, and innovative AI features.

- Cons: The interface can have a learning curve for beginners, and the sheer number of features can be overwhelming at first.

Recommended Rating: 9/10 (For technical analysis automation)

StockHero

If you're looking for an ai stock trading bot, StockHero is a strong contender. This platform allows you to automate your trading strategies 24/7. You can either use pre-built bots from its marketplace or design your own with its intuitive strategy designer.

- Key Features: A marketplace of trading bots, a no-code bot creation tool, paper trading to test bots risk-free, and support for numerous major brokerages.

- Pros: Excellent for hands-off, automated trading. The bot marketplace makes it easy for beginners to get started. It's also very affordable.

- Cons: Your success is highly dependent on the quality of the bot and strategy you choose. It requires careful monitoring to ensure bots are performing as expected.

Recommended Rating: 8.5/10 (For bot-focused trading)

Trade Ideas

Trade Ideas is an AI-powered scanner designed for one purpose: to feed you high-potential trade opportunities all day long. Its flagship AI, "Holly," runs millions of simulations overnight to identify strategies with the highest probability of success for the next trading day.

- Key Features: AI-driven trade signals, real-time market scanning, backtesting capabilities, and simulated trading.

- Pros: Unparalleled in its ability to generate trade ideas in real-time. Great for active day traders who need to find momentum stocks quickly.

- Cons: It is one of the more expensive subscription services, and the platform can be complex for new users. Its focus is almost entirely on idea generation rather than portfolio management.

Recommended Rating: 8.5/10 (For day traders)

Conclusion

Choosing the right AI stock trading software is a critical step in elevating your trading game. These powerful tools can help you analyze the market, identify opportunities, and execute trades with a level of precision and discipline that is difficult to achieve on your own. From the automated analysis of TrendSpider to the predictive forecasts of VantagePoint, there is a platform out there to fit every trading style and budget.

Ultimately, the best tool is one that empowers you to make confident, informed decisions. For a solution that combines powerful, AI-generated signals with an intuitive interface and a comprehensive set of features, Intellectia.ai stands out.

Don't just follow the market—let AI help you anticipate it. Subscribe to Intellectia.ai to receive daily AI stock picks, advanced trading signals, and in-depth market analysis. Ready to take your trading to the next level? Sign up for Intellectia.ai today and start making smarter, AI-driven decisions!