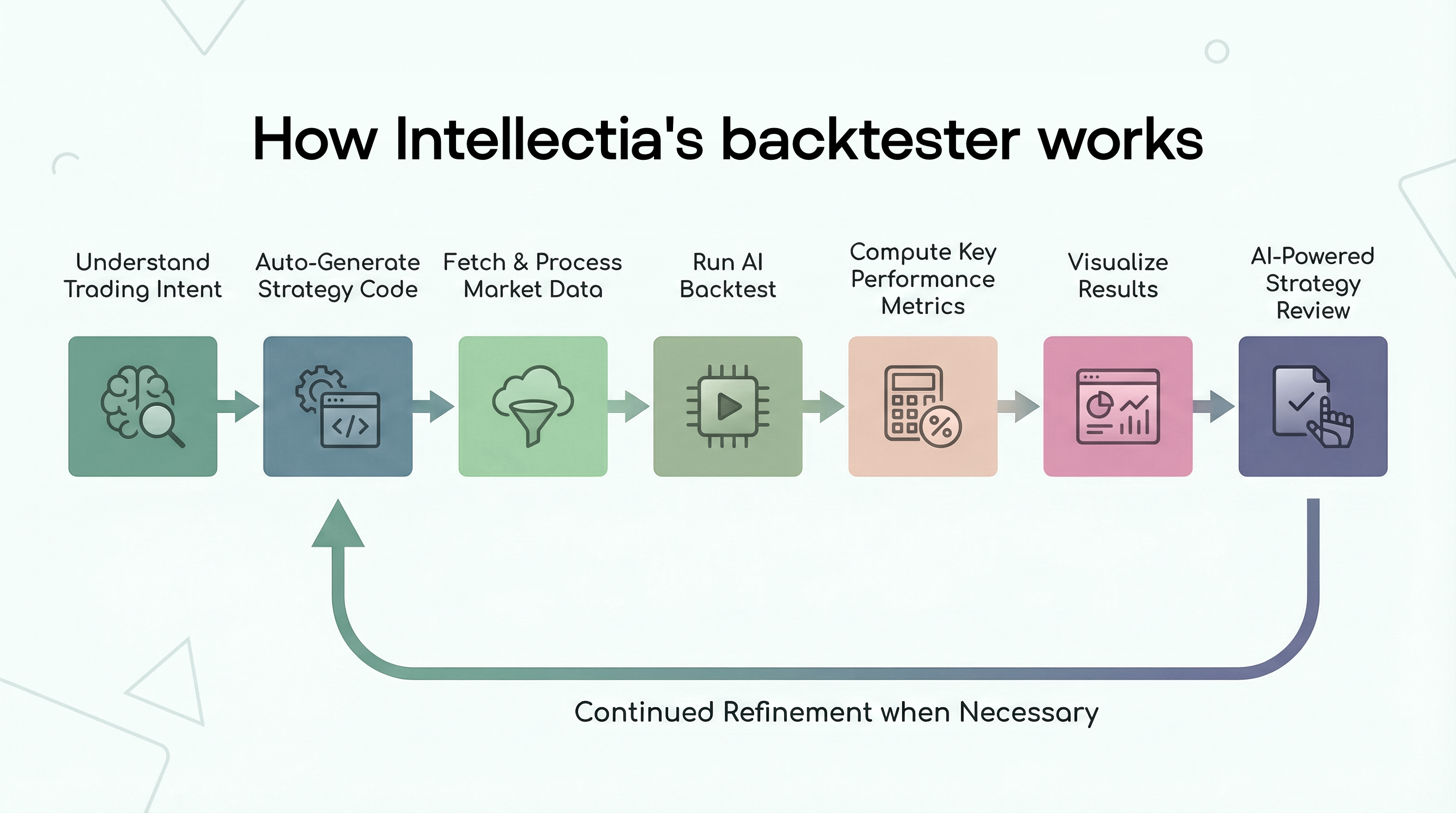

How Intellectia Backtest Agent Works

Intellectia Backtesting Playground is the world’s first fully AI-powered, commercial-grade strategy backtesting engine.

It lets you turn any trading idea into a rigorously tested quantitative strategy — using nothing but plain English. No code. No scripting. Zero technical setup. Just describe your hypothesis, our AI instantly:

- Translates it into a professional-grade quant model

- Backtests it across decades of data and every market regime

- Optimizes parameters with institutional precision

- Stress-tests and refines the strategy with advanced risk controls (drawdown limits, position sizing, volatility targeting, and more)

Validate ideas in minutes that used to take quant teams weeks. Find out whether your edge is truly real before you risk a single dollar.

This approach removes long standing technical barriers that once limited systematic trading to programmers and quantitative specialists. For the first time, traders with zero coding experience can freely create, test, and refine their own trading scenarios using plain text. Intellectia delivers a seamless research experience where users can move directly from idea to historical proof with nothing more than natural language.

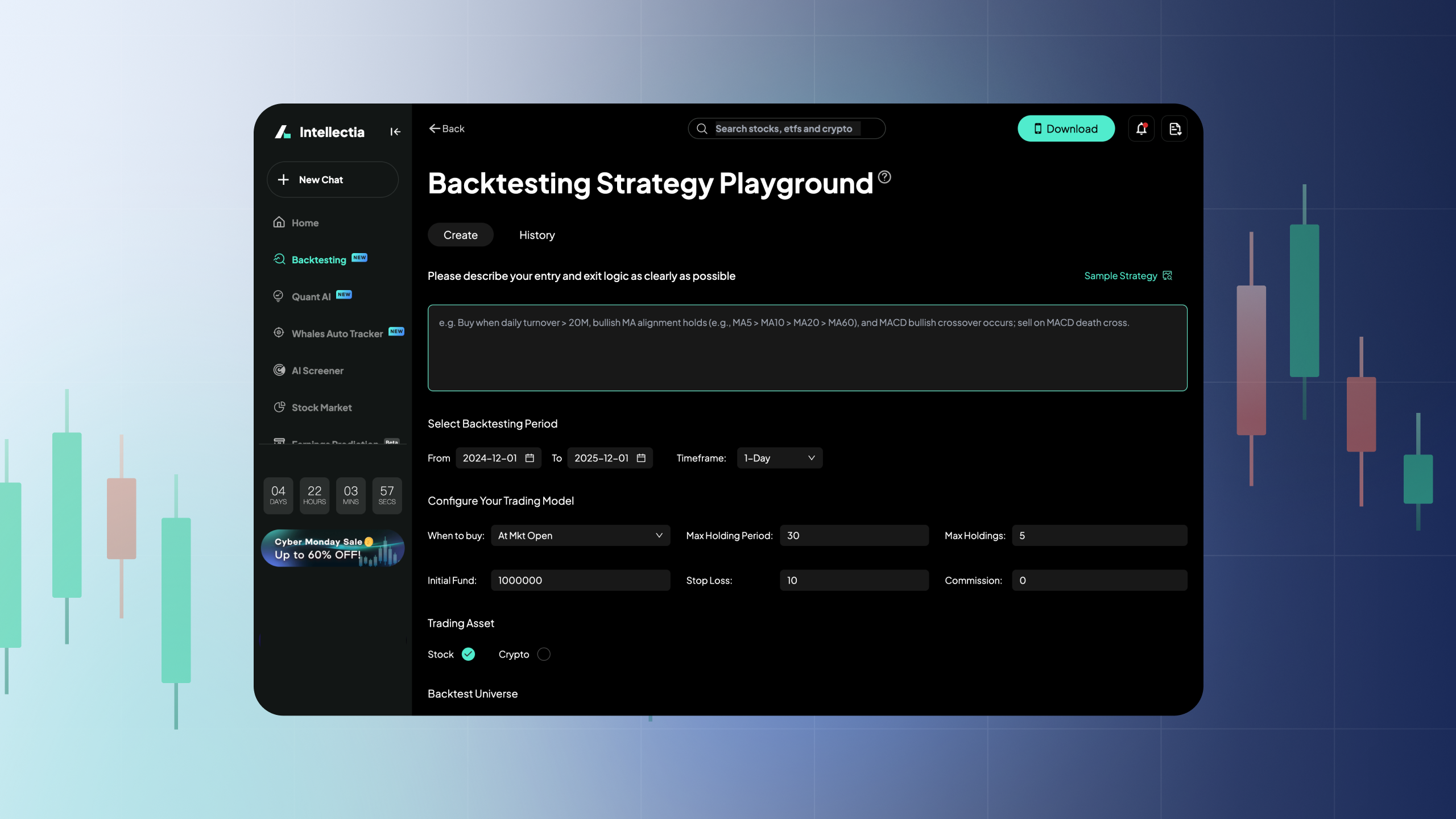

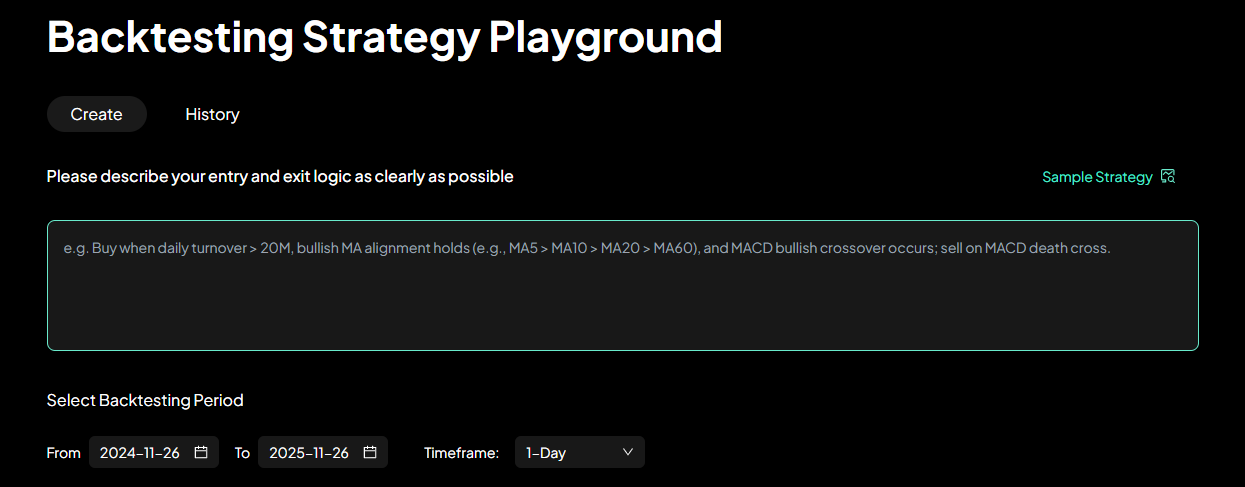

Setting Up the Strategy

Every backtest begins with defining your buy and sell logic. The Playground provides two dedicated input fields where you can describe your conditions in simple, readable language. For users unsure of how to start, the "Sample Strategy" option automatically loads a pre-configured example, allowing you to explore the workflow immediately.

After defining the logic, the next step is select the date range. The system supports a maximum of five years of historical data when the analysis uses daily or weekly intervals. It supports a maximum of one year of historical data when intraday intervals are used. This design maintains realistic data availability and ensures consistent testing behavior regardless of timeframe.

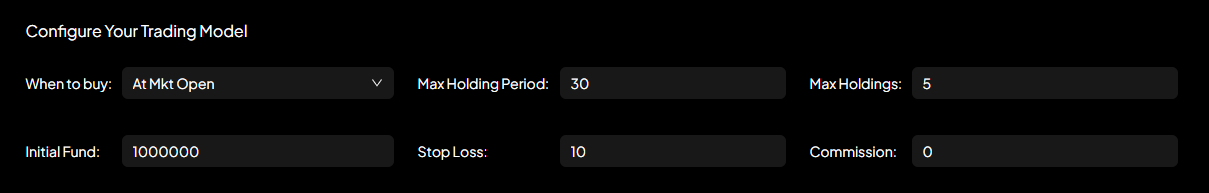

Configuring How the Strategy Trades

The Backtesting Playground provides several parameters that shape how a strategy executes in historical simulations. Each parameter influences the realism and behavior of the backtest in a different way.

- The system allows you to choose whether trades enter at the next day’s market open or at the current day’s market close. This setting determines the fill price and affects strategies that depend on end-of-day signals or overnight market movement.

- The maximum holding period can be set anywhere between one and nine hundred ninety nine days. A trade automatically exits when it reaches the limit. Setting the value to nine hundred ninety nine days removes this restriction and allows the position to remain open until the sell condition is triggered.

- The initial fund determines the starting portfolio size used during the simulation. This value helps align the results with real-world capital levels and makes the dollar-based outcomes easier to interpret.

- A stop loss can be applied to enforce an automatic exit when a position moves beyond a defined threshold. This setting provides an additional layer of risk control and helps reveal how the strategy behaves during periods of elevated volatility.

- A commission rate can be applied to every trade. Incorporating transaction costs shows how the strategy performs under realistic conditions and clarifies whether it remains profitable after accounting for trading expenses.

Choosing the Assets to Test

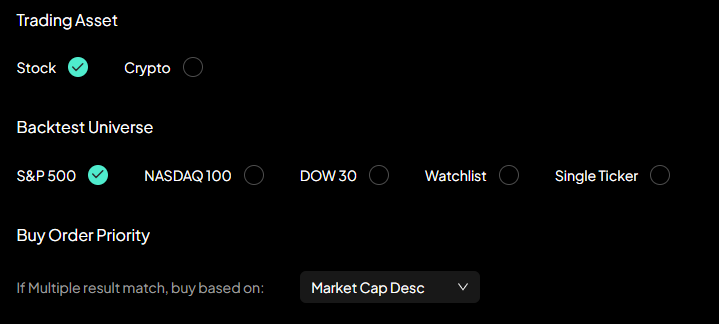

The Backtesting Playground supports both equity and cryptocurrency markets. Equity users can run strategies across the S&P 500, NASDAQ 100, DOW 30, individual tickers, or custom watchlists. Crypto users can test on universes such as the Top 100, Top 200, the full crypto list, watchlists, or single coins.

When testing multiple assets, the platform allows the user to sort the selected universe by market capitalization, price, recent percentage change, or trading volume. Sorting helps maintain a structured and repeatable methodology. For example, a user may want to consistently test the largest one hundred assets or the strongest performers during a defined period.

Running the Backtest

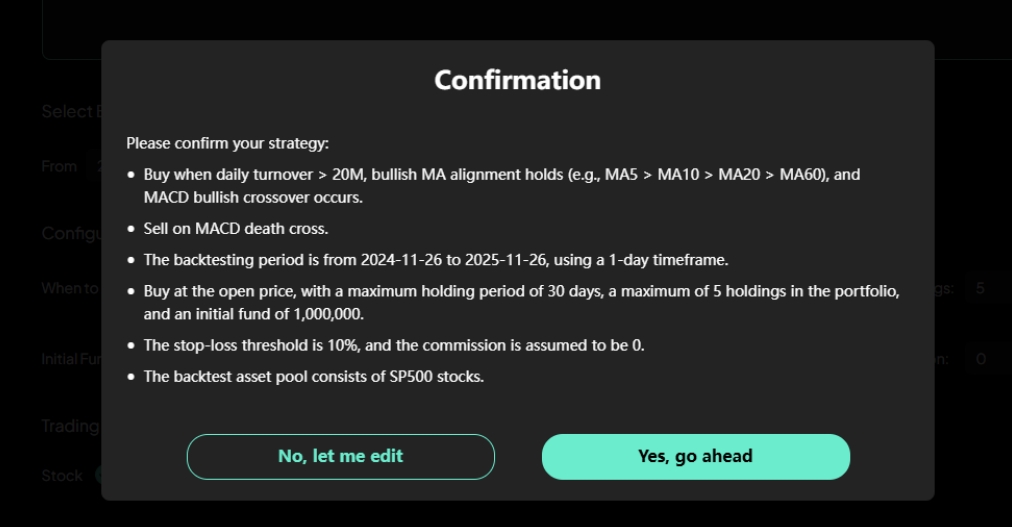

After the setup is complete, selecting "Run Backtest" initiates the analysis. A confirmation window appears reminding you that each test consumes one backtesting credit; all users receive three free credits to explore the system.

Once confirmed, the engine applies your rules to historical data, identifies buy signals, checks sell conditions, enforces holding-period constraints, and simulates execution based on your chosen entry timing. When processing is complete, the platform automatically directs you to the results.

Interpreting the Results

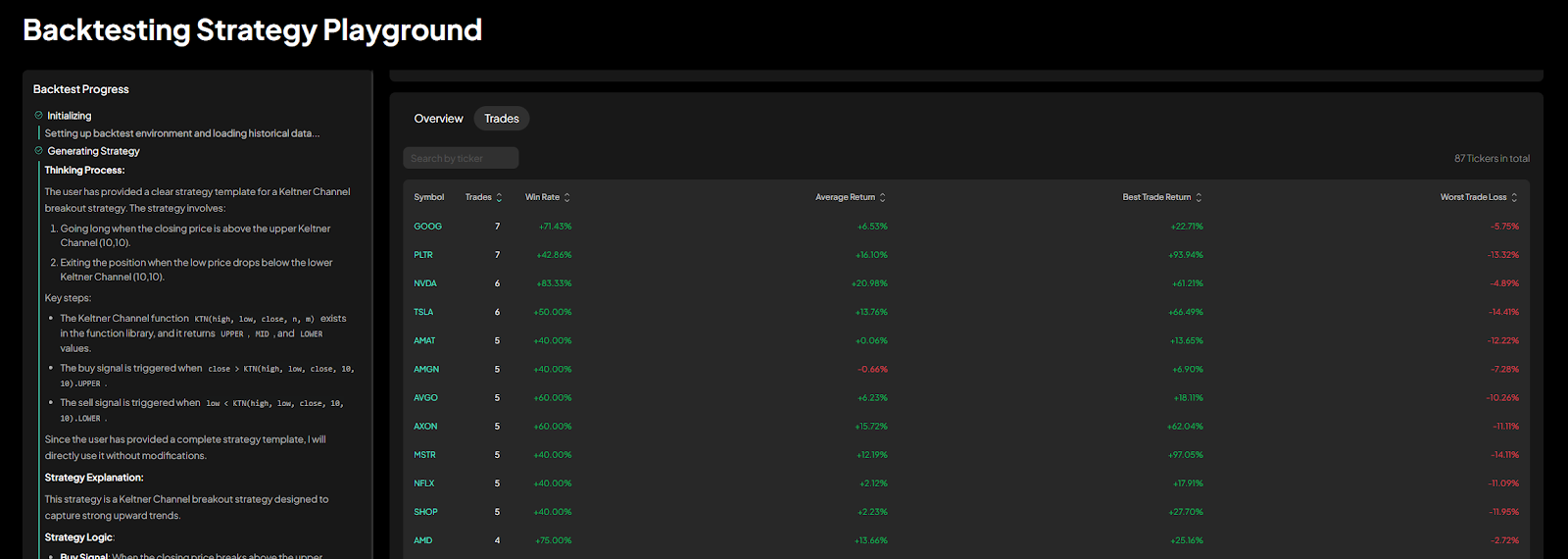

The results page provides a comprehensive view of your strategy's historical performance.

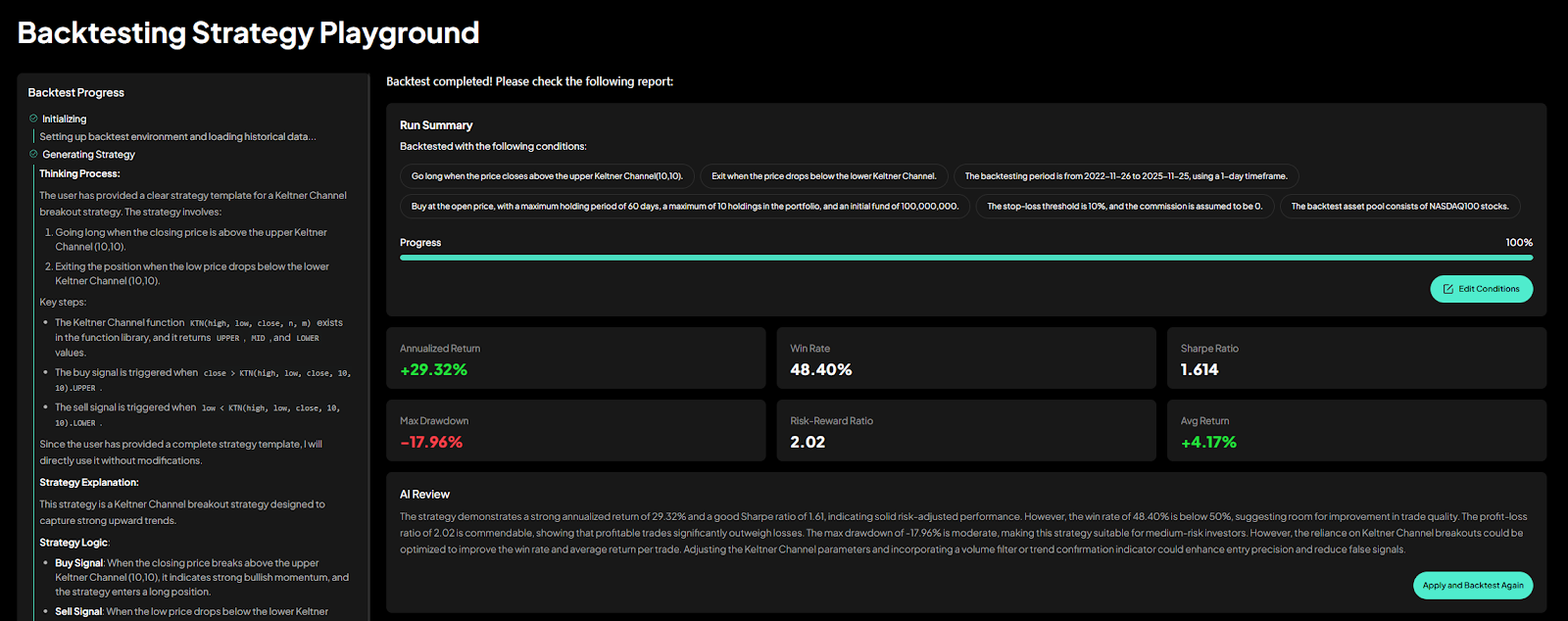

A summary section highlights key metrics such as annualized return, win rate, maximum drawdown, number of trades, average return per trade, and risk-adjusted indicators. These figures give you a quick sense of whether the strategy behaves consistently or shows signs of structural instability.

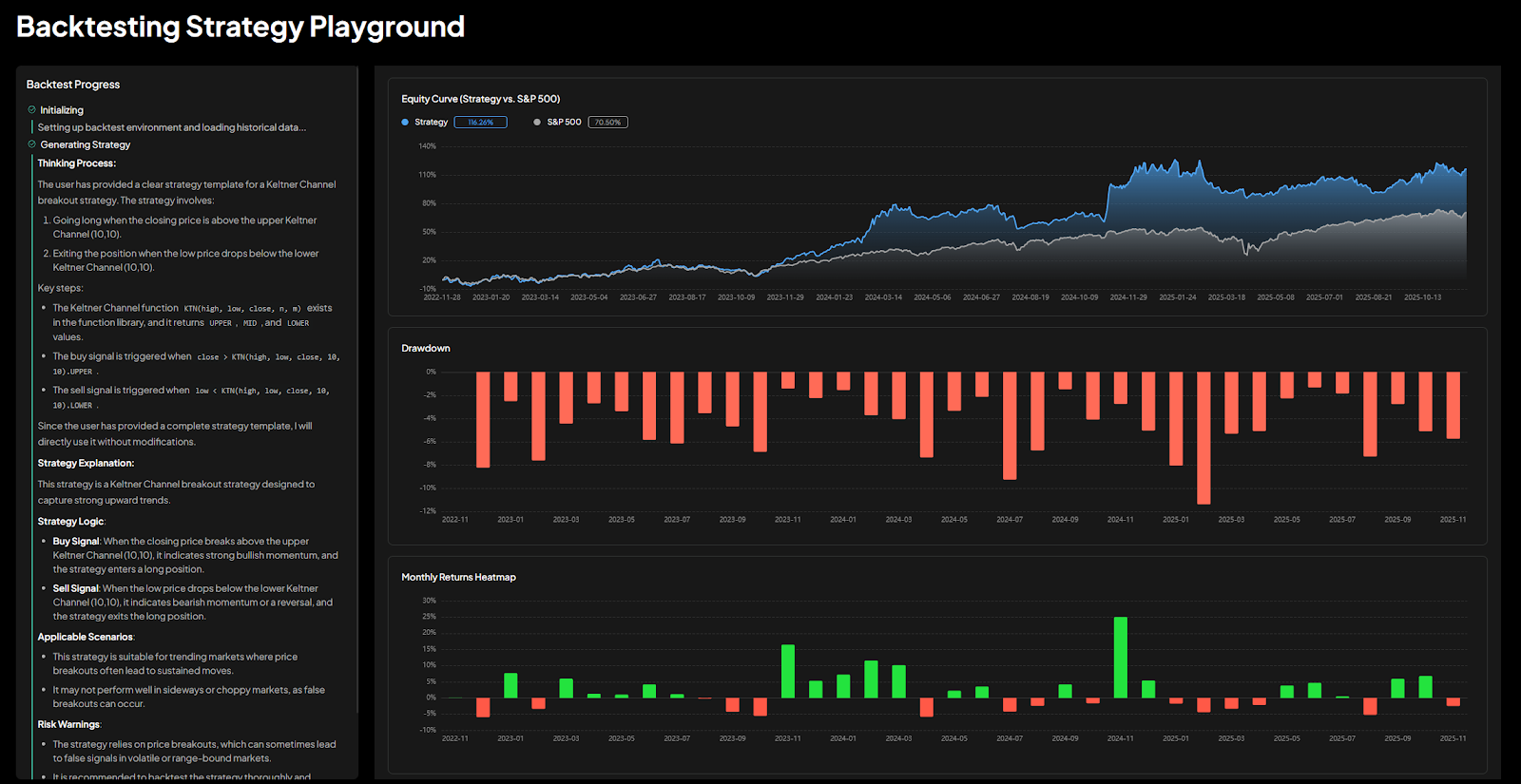

Below the summary, a portfolio equity curve illustrates how the strategy's value changed over time, while the drawdown chart shows the depth and duration of losses relative to previous peaks. A monthly return heatmap reveals periods of strength and weakness, and a return-distribution chart shows the shape of your trade outcomes, allowing you to quickly understand whether results are driven by a few large winners or a broad base of smaller gains.

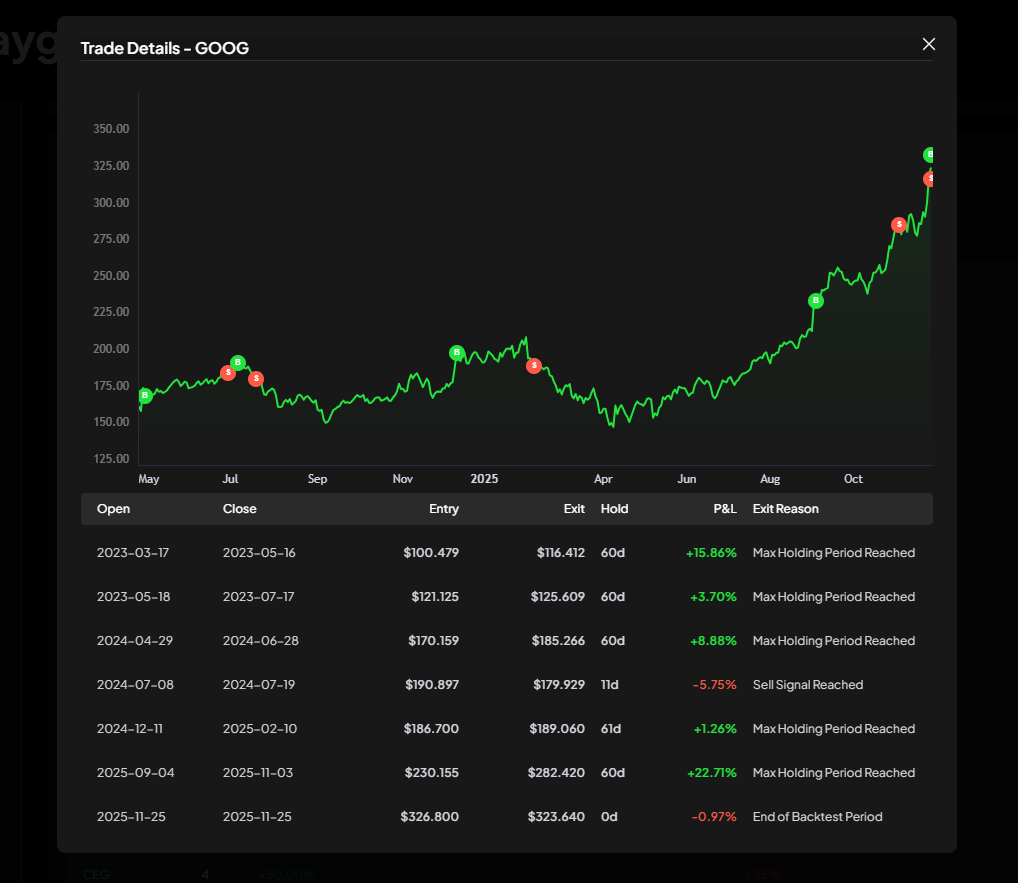

Reviewing Individual Trades

For deeper inspection, each tested ticker includes a detailed trade log. You can review entry and exit dates, trade durations, return percentages, and the system's reason for exiting a position. Each trade can also be viewed on a chart, with buy and sell markers placed directly on historical price action. This level of granularity helps uncover behavioral patterns that summary metrics alone may obscure.

A Framework for Continuous Improvement

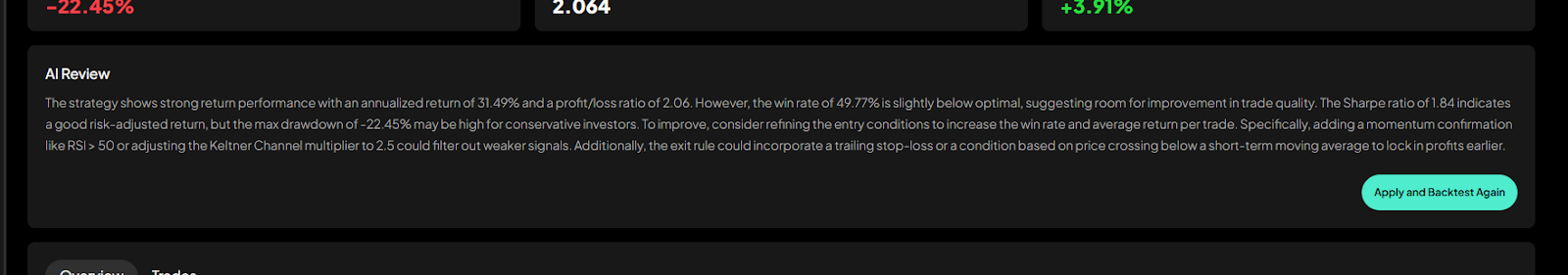

Intellectia includes an AI review that automatically evaluates the backtest once the results are generated. The system examines the strategy’s strengths, identifies weaknesses, and highlights adjustments that may improve performance. These insights appear directly below the core metrics and provide a concise interpretation of what the data suggests. If the user finds the recommendations helpful, the interface offers a single action button that applies the suggested changes. This workflow allows users to refine their strategies more efficiently and to iterate with clearer direction.

Final Thoughts

Effective strategy development requires repeated testing, careful evaluation, and a clear understanding of how rules behave across different market environments. The Backtesting Playground is designed to support this research process by providing transparent performance analytics, detailed trade breakdowns, and AI-driven insights that help investors move from raw ideas to evidence-based decisions. Whether the user is exploring a new concept or fine-tuning an established approach, Intellectia offers a structured environment that encourages disciplined analysis and continuous improvement. It is a practical framework for anyone seeking to refine trading logic through data rather than speculation.

Intellectia Backtesting Playground: where intuition meets institutional rigor, powered entirely by natural language.