Key Takeaways

The battle for the world's most valuable company has intensified, with Alphabet overtaking Apple in market capitalization while both trail behind Nvidia's commanding lead.

• Alphabet leads with $3.94T market cap vs Apple's $3.84T, driven by superior AI positioning and 67.50% annual growth compared to Apple's 7.22%

• Apple generates higher revenue ($416B vs $385B) but Alphabet shows better profitability with $228B gross profit and stronger five-year returns (29.45% vs 15.04%)

• AI strategies differ fundamentally: Apple focuses on privacy-first on-device processing while Alphabet leverages cloud-based Gemini for advanced capabilities

• Both face major regulatory challenges - Google must share search data with competitors by 2026, Apple confronts $7B class action and EU App Store pressure

• Alphabet appears better positioned for 2026 with projected $455B revenue growth and expanding cloud division, while Apple delays key AI features until 2026

The winner will ultimately depend on AI execution, regulatory outcomes, and maintaining consumer trust in an increasingly competitive landscape where technological innovation drives market valuation.

Alphabet has overtaken Apple as the most valuable business title holder recently. Alphabet closed with a market capitalization of $3.89 trillion, surpassing Apple's $3.85 trillion. The gap grew even wider as Alphabet reached $3.94 trillion while Apple settled at $3.84 trillion at a subsequent market close. But both tech giants still trail behind Nvidia, which currently holds the top position with a market value of $4.5 trillion.

The competition to become the world's most expensive company has reached unprecedented levels. The top 10 most valuable businesses now all command valuations above $1 trillion. Twelve of the largest companies worldwide have market caps of at least $1 trillion. Investors looking to buy Google in 2026 face an interesting decision, especially since Apple—once the undisputed heavyweight—shows signs of fatigue in a market that rewards constant reinvention. You'll find which of these tech behemoths might claim the crown as the most valuable business in 2026, and what factors could shape their trajectory in the coming years.

Company Profiles: Apple vs Alphabet in 2026

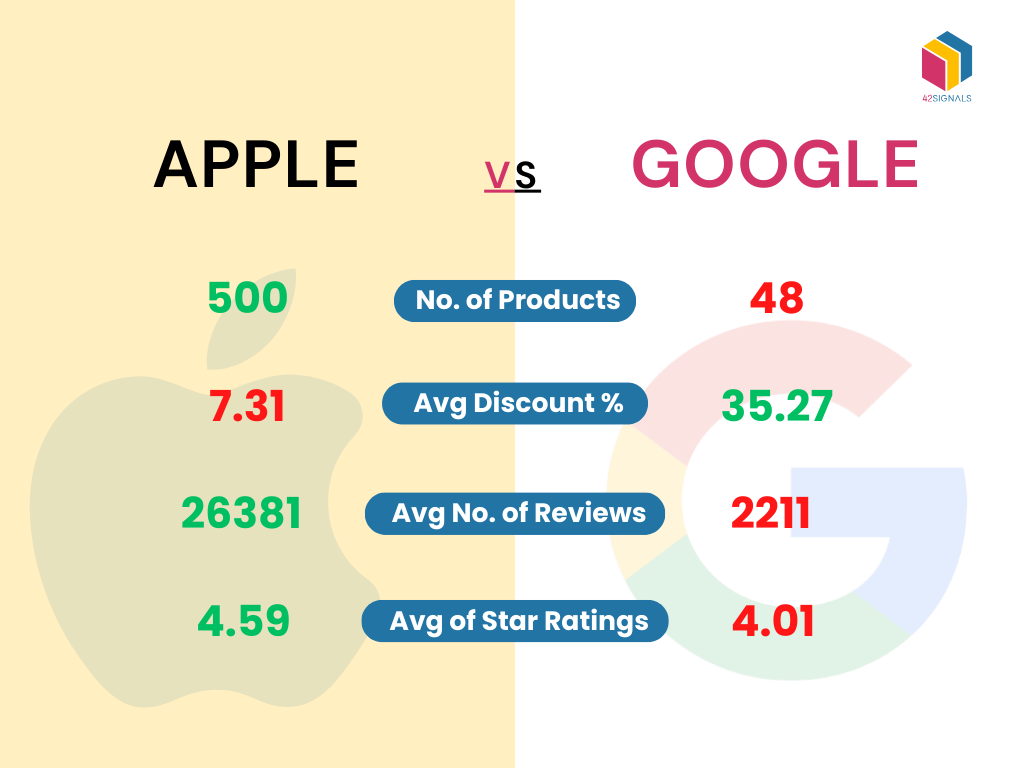

Image Source: 42Signals

The battle between tech titans for market dominance needs proper context about their foundations. Apple started its story in 1976 by focusing on personal computing before expanding to mobile devices and services. Alphabet came into existence in 2015 as Google's parent company. It kept the search giant's advertising-focused revenue model while venturing into various tech initiatives.

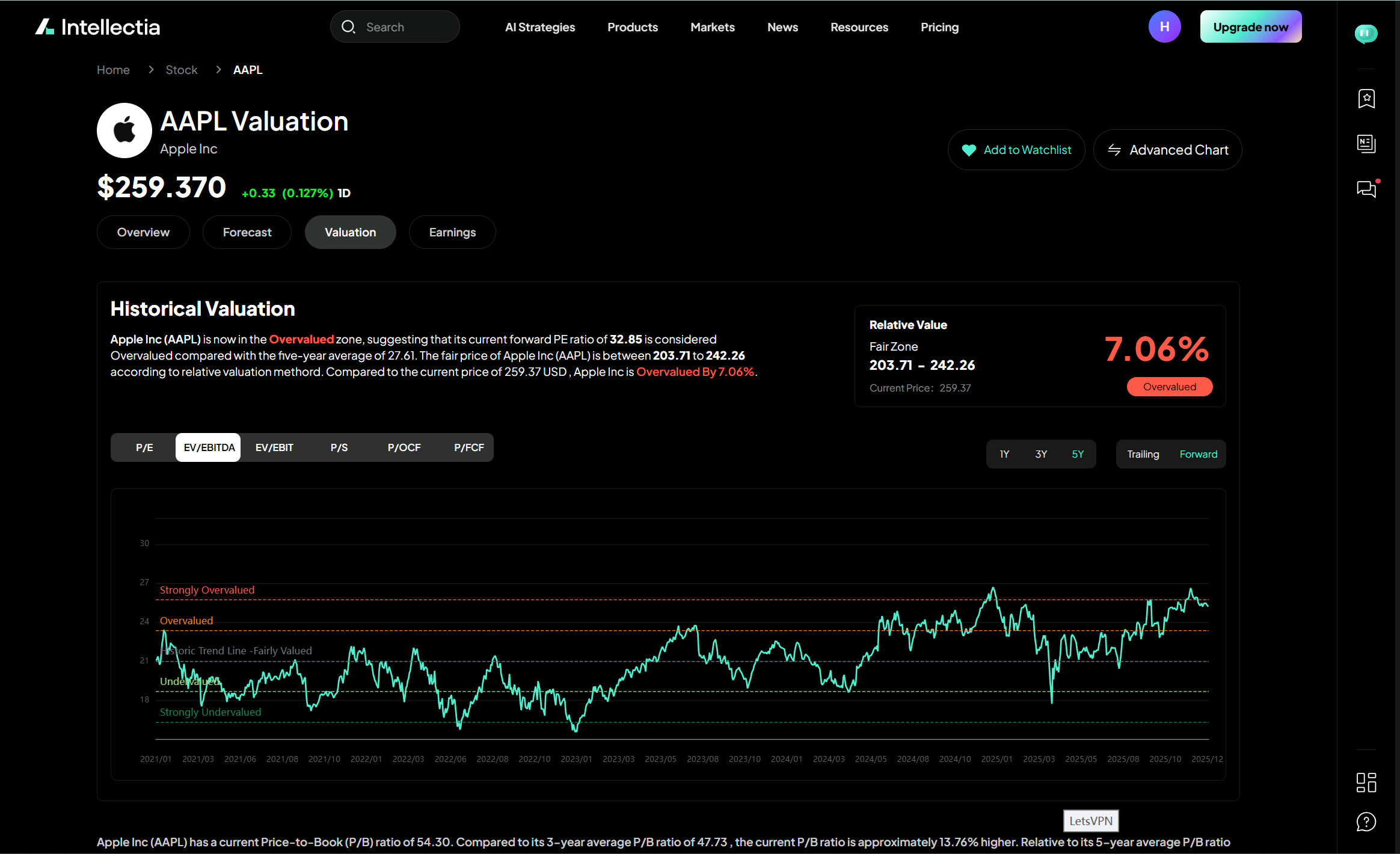

Alphabet's market capitalization has taken the lead. The company reached $3.98 trillion compared to Apple's $3.89 trillion. This change highlights shifting investor confidence. Alphabet's shares climbed about 1%, which pushed its valuation to $3.94 trillion, ahead of Apple's $3.84 trillion. Both companies still lag behind Nvidia's impressive $4.50 trillion valuation.

Apple shows strong operational performance despite its market cap decline. The company generated $416.16 billion in total revenue (TTM) while Alphabet reached $385.48 billion. Alphabet maintains better profitability metrics with $228.10 billion in gross profit compared to Apple's $195.20 billion. The company also achieved a net income of $124.25 billion, surpassing Apple's $112.01 billion.

Looking at five-year investment returns shows Alphabet's clear advantage. The company achieved a remarkable 29.45% five-year return, while Apple managed 15.04% during that time. This gap became more obvious when Alphabet surged 67.50% in the last year, making Apple's 7.22% growth look modest in comparison.

Market perception of each company's AI strategy explains this performance difference. Alphabet finished 2025 as a top performer on Wall Street after positioning its AI initiatives successfully. Apple's limited presence in the AI space has reduced investor excitement, even with its strong revenue performance.

Innovation and Product Ecosystem

Apple and Alphabet compete beyond just money - their different approaches to innovation shape their standing as top business rivals.

AI Development: Apple Intelligence vs Google Gemini

These tech giants show their different philosophies in how they handle AI. Apple Intelligence runs mostly on your device to protect privacy and security. Google's Gemini uses its massive cloud setup to do more complex tasks. While Gemini is better at creating content and accessing knowledge, Apple Intelligence works better with personal tasks. Gemini handles files and different types of input more flexibly, but Apple's photo editing tools work better for specific tasks.

Hardware vs Software Dominance

Apple controls everything by making both hardware and software, which creates a smooth experience across all devices. Google puts most of its effort into cloud services and AI platforms. Apple's custom chips work more efficiently even with lower specs, while Google focuses on making its Tensor chips smart with AI.

Service Ecosystem: iCloud, Apple TV+ vs YouTube, Google Cloud

Apple's services work perfectly together but don't play well with other platforms. iCloud is easy to use and has great support, but Google Cloud gives users better tools and works better with code. Google's services work fine on Apple devices, but Apple's services won't work on non-Apple devices.

Device Integration: iPhone vs Pixel and Android

iPhones work best when you use only Apple products. Android devices work better with other companies' products and let users customize more. The Pixel 10 uses AI throughout its system, while iPhones use AI to make specific features better.

Legal, Regulatory, and Public Perception

Regulatory challenges are shaping the competition for the most valuable business title. Apple and Google face unprecedented scrutiny from regulators worldwide.

Antitrust Lawsuits: DOJ vs Apple and Google

A landmark August 2024 ruling requires Google to share its search index with competitors by January 2026. Google might also need to sell its AdX exchange after losing the AdTech lawsuit. Apple deals with its own challenges - a $7 billion consumer class action trial and growing pressure from the European Union about App Store policies. The company's legal troubles grew when the DOJ's March 2024 lawsuit about smartphone market monopolization moved forward in June 2025.

Privacy and Data Handling Practices

Apple focuses on processing data directly on devices through its Privacy Nutrition Labels launched in 2020. Google's 2022 Data Safety Section aims to be clear about how it handles user information. Legal issues continue for both companies. Apple paid $95 million to settle a lawsuit about Siri recordings in 2024. Google faces legal challenges about collecting data even after users turned off tracking features.

Brand Loyalty and Consumer Trust Metrics

Recent studies show how user priorities have shifted. Trust in digital companies depends heavily on data transparency, with 44% of users saying it's their top concern. Users are more cautious now - 46% accept all cookies less often compared to three years ago. People feel increasingly uneasy about their data - 62% believe they've become "the product," and 59% don't like their information being used to train AI systems. These trust issues play a crucial role in determining which company stays at the top of global markets.

Future Outlook and Investment Potential

The race for the most valuable business title depends on growth initiatives and state-of-the-art momentum.

AI and Cloud Expansion Plans

Alphabet has made its cloud computing division a key growth driver, with Google Cloud revenue rising 34% in Q3 2025. The division now has a massive $155 billion backlog that shows a 46% year-over-year increase. Google Cloud revenue could reach $90 billion in 2026, up from $60 billion in 2025, according to analysts.

Apple has made an unexpected move to use Google's 1.2 trillion-parameter Gemini model at roughly $1 billion per year. This mutually beneficial alliance will help until Apple develops its own trillion-parameter system. The company's "more personal Siri" launch has been pushed to 2026 as a result.

Global Market Penetration Strategies

Waymo, Alphabet's autonomous driving unit, will expand to London in 2026 and seeks a standalone $110 billion valuation. Apple plans to introduce Apple Intelligence in China without Google's banned services, choosing to work with Alibaba for content filtering.

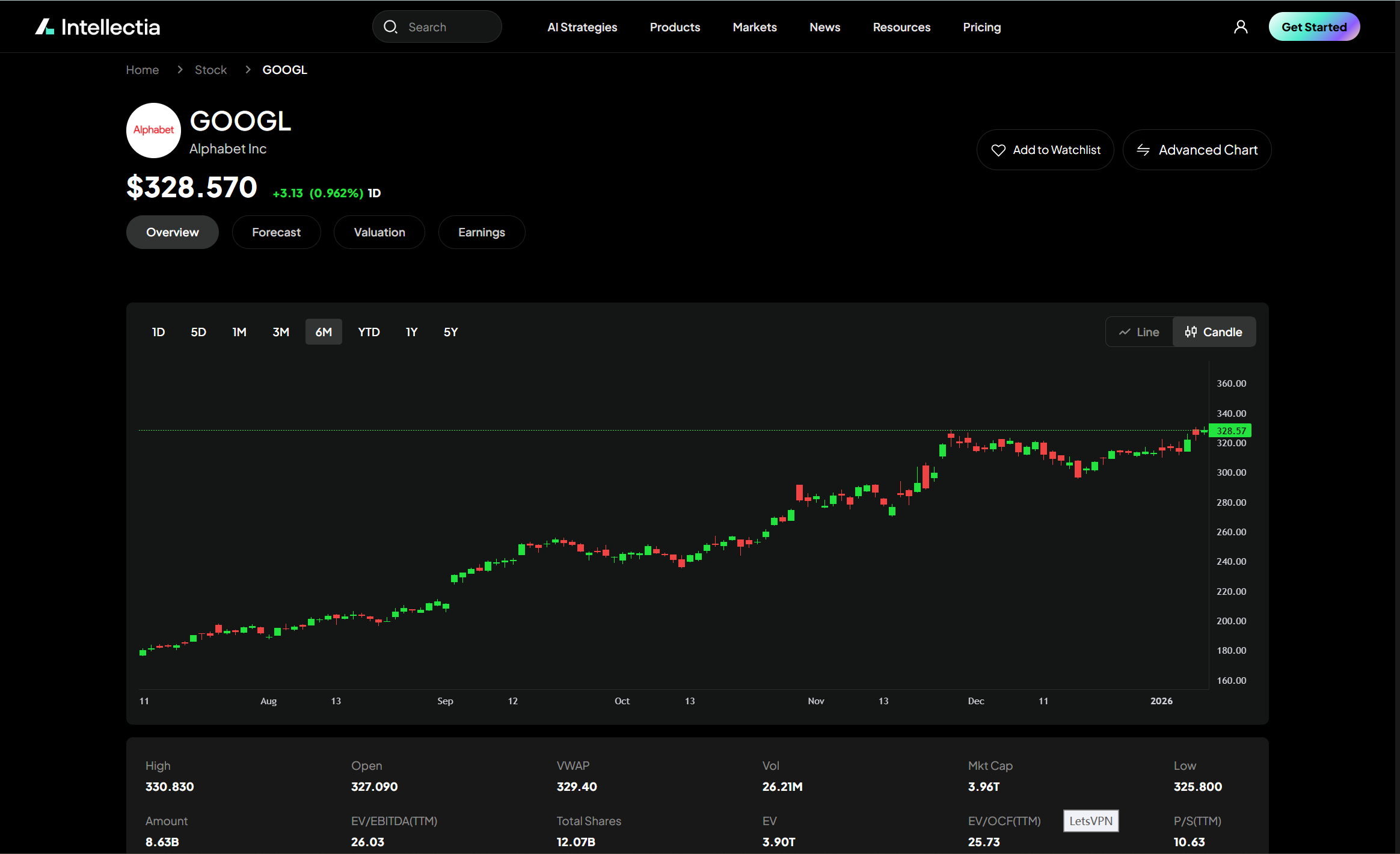

Stock Performance Trends: Should I Buy Google 2026?

Alphabet's shares jumped 65% in 2025. Wall Street analysts strongly recommend buying, with 50 Buy, 9 Overweight, and 12 Hold ratings. Their price targets range from $268 to $432, with a $334 median. The company's projected 2026 revenue is $455 billion, showing 14% growth.

Smart investors look beyond growth projections. High valuation premiums reflect market expectations, while rapid competitive changes make traditional analysis challenging. Many investors now use a Financial AI Agent to handle overwhelming data and eliminate emotional bias. This tool works like a dedicated financial advisor that offers precise analysis for stocks, ETFs, and cryptos, helping you remain competitive through smarter decisions.

What is the Most Expensive Company in 2026?

Nvidia currently leads with $4.3-4.6 trillion, while Alphabet follows at $3.88 trillion and Apple at $3.84 trillion. Alphabet might overtake Nvidia by year-end, according to some analysts. Market focus will likely move from AI hardware companies to businesses that effectively use AI to streamline processes.

Comparison Table

| Comparison Criteria | Apple | Alphabet |

| Current Market Cap | $3.84 trillion | $3.94 trillion |

| Total Revenue (TTM) | $416.16 billion | $385.48 billion |

| Gross Profit | $195.20 billion | $228.10 billion |

| Net Income | $112.01 billion | $124.25 billion |

| 5-Year Return | 15.04% | 29.45% |

| 1-Year Growth | 7.22% | 67.50% |

| AI Strategy | Device-based processing with privacy focus | Cloud-based with Gemini model |

| Core Strength | Hardware and software synergy | Cloud services and AI platforms |

| Ecosystem | Apple device exclusive with uninterrupted integration | Available across platforms |

| Major Legal Challenges | $7B consumer class action, App Store rules | Search sharing mandate, AdTech lawsuit |

| Cloud Strategy | Google partnership ($1B/year for Gemini) | Expanding cloud division (34% revenue growth) |

| 2026 Outlook | Siri enhancement delays | Expected $455B revenue (14% growth) |

Conclusion

Apple and Alphabet showcase a remarkable story of competing business philosophies in their battle for market supremacy. Apple managed to keep its lead for years through its integrated hardware-software ecosystem. Yet Alphabet's AI-first strategy helped it surpass Apple with a $3.94 trillion valuation compared to Apple's $3.84 trillion. Both companies still rank below Nvidia, which holds the top spot globally at $4.5 trillion.

The numbers paint an interesting picture. Apple pulls in more total revenue at $416.16 billion while Alphabet makes $385.48 billion. But Alphabet shows better profitability with higher gross profit and net income. The return on investments tells an even more striking story. Alphabet's five-year return stands at 29.45% compared to Apple's 15.04%. The gap widens further in one-year growth: 67.50% for Alphabet versus 7.22% for Apple.

Their different views on state-of-the-art technology explain this gap. Apple focuses on privacy with on-device processing through Apple Intelligence. Google takes a different path with cloud-based Gemini. Apple shines at vertical integration in its product ecosystem, while Alphabet gives users more cross-platform freedom. These core beliefs shape their service models, device strategies, and market positions.

Both giants face tough legal battles. Google must open its search index to competitors by January 2026. Apple deals with a $7 billion consumer class action trial and European pressure about App Store rules. These legal challenges will affect their growth and market value going forward.

As 2026 approaches, Alphabet seems ready for more growth with its expanding cloud plans and AI momentum. Investors might want to spread their money among several AI stocks to balance risk while staying exposed to this game-changing technology. Long-term portfolios need stable performers, but AI's high volatility creates chances for active traders. An AI Stock Picker helps capture daily price swings without the guesswork.

The competition for most valuable company remains tight. Nvidia leads now, but Alphabet keeps gaining ground. The winner depends on AI strategy execution, regulatory decisions, and public trust. These factors keep changing in this fast-paced tech world. Alphabet might have the edge now, but tech's unpredictable nature means the leader could change before 2026 ends.